7 ways to get rid of all the excess and get more pleasure from life (part 1)

And you agree that the path to success, happiness and self-realization is not through increasing income, consumption and entertainment, but through getting rid of chaos and distractions that make it difficult to focus on what really matters? Consider 7 ways to help make life easier and more productive .

“Art is the exclusion of the unnecessary.”

- Pablo Picasso

')

1. Reduce the number of daily decisions

Classical economic theory claims that consumers like to have a choice. The more options, the better, economists often say.

Of course, the ability to choose a product or service from a wide range on the market is not in itself all that bad. However, in terms of behavioral economics and psychology, frequent decision making is not easy for people. Having to make choices too often can lead to thoughtless and frivolous decisions. This is due to the so-called decision-making fatigue.

A particularly interesting example of such fatigue is the sentencing of a prisoner by a judge and the judicial commission on the release of parole. During the day they have to deal with many similar cases. According to published data from the New York Times: “At the beginning of the day, prisoners spend 70% of their working time on parole cases, while at the end of the day this figure is only 10%.” From this we can conclude that the prisoner has 60% more chance of being released early if his case is considered, for example, at 8:50 in the morning, and not at 16:30 in the evening.

The phenomenon of decision-making fatigue affects not only minor, insignificant decisions, but often vital ones as well. The members of the judicial commission make a decision that radically changes the fate of the prisoner. At the same time, they inevitably deprive the right to the early release of other convicts who really deserve it.

But is it really that the number of decisions we make every day is so large that it can lead to fatigue? According to Wonsink and Sobal, economists at Cornell University in the United States, an average person makes about 227 decisions about food every day.

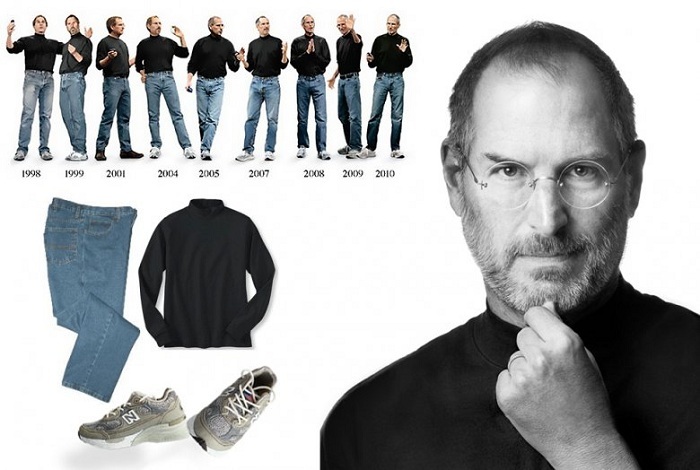

Steve Jobs was clearly a supporter of this principle. Remember his usual look: a black turtleneck, blue jeans and sneakers from New Balance.

Why did the founder of Apple always wear the same boring clothes? He simply understood that his brain was capable of making a limited number of decisions per day. He did not want to waste his mental abilities, choosing what to wear - he had to make the most important decisions to start the most expensive company in the world.

An effective way to reduce the number of decisions is a strict daily routine. A large number of decisions that cause fatigue, we take in the first few hours after sleep. Get up or get the alarm again? What to eat for breakfast? Do jogging or read an interesting book? How to allocate time for all classes? What should you focus on?

Strict adherence in the morning and following certain habits will help minimize decision fatigue and work more efficiently.

Here is a rough schedule for the morning:

- 5:30 - rise;

- from 5:30 to 6:15 - do exercises;

- from 6:15 to 6:30 - take a shower and get dressed;

- from 6:30 to 6:45 - have breakfast;

- from 7:00 - start doing the most important thing.

With such a strict schedule you will get rid of the need to make a number of decisions. In the evening, think about what you really need to do in the morning. It will save your time and energy - you do not have to decide in the morning what else you need to work on. To top it all: try not to check your email in the morning.

2. Reduce your expenses

At first glance, this seems obvious. But you can’t even imagine how peace of mind can be achieved by learning how to manage your finances.

Americans practically do not adhere to this principle. Their personal savings account for about 3-5% of their income, while the Chinese have a much higher figure of 25-50%.

People make decisions about cash based on what is called mental finance in behavioral economics. For example, at the beginning of the month you make a budget, including food, transportation, and clothing.

Suppose food expenses were to be $ 100 per month, and you spent only $ 50. The most rational solution would be to set aside the remaining $ 50 in a savings account.

However, the results of various studies have shown that most people do not do that. Instead, they are ready to spend them on anything, for example, to go to an expensive restaurant.

Making a monthly budget is a great idea. But at the same time, it is necessary to set as a rule to save the remaining money from all items of expenditure to a savings account.

Invest only in what guarantees long-term progress and development , gives joy and satisfaction.

3. Reduce your debts

A certain part of the debt can be justified as an investment in economic prospects, for example, a loan for education (by the way, it is quite possible to save on education ). However, credit card and real estate debts are of great concern. For example, in America since 2010, real estate debts account for the lion’s share of loans.

Why are debts so fast growing? According to Nerd Wallet, the US financial news agency, "over the past 12 years, the rising cost of living has outpaced income growth among the population."

Nerd Wallet also states that "consumers significantly underestimate or underestimate information about their debts." Thus, as of 2013, in the United States, actual credit card debts were 150% more than the credit balances declared to borrowers.

Few things can cause the same stress and loss of sleep as unpaid loans.

Continuation - here .

PS We recommend another useful article on the work on yourself - How to neutralize the natural mechanisms of survival in preparing for tests .

The author of the translation is Vyacheslav Davidenko, the founder of the TESTutor company.

Source: https://habr.com/ru/post/298376/

All Articles