Investments: How to convince an investor and get financing

Stanford course CS183B: How to start a startup . Started in 2012 under the leadership of Peter Thiel. In the fall of 2014, a new series of lectures by leading entrepreneurs and Y Combinator experts took place:

Second part of the course

- Kirsty Nate and Carolynn Levy: Legal Basis for Startup Launch ;

- Kirsty Nate and Carolynn Levy: The Basics of Attracting Investments ;

- Kirstie Nate and Carolynn Levy: Employee Basics ;

- Tyler Bosmen: Where to start and how to communicate with customers .

First part of the course

- Sam Altman and Dustin Moskovitz: How and why to create a startup?

- Sam Altman: How to form a start-up team and culture?

- Paul Graham: Illogical startup ;

- Adora Cheung: Product and Honesty Curve ;

- Adora Cheung: The rapid growth of a startup ;

- Peter Thiel: Competition - the lot of losers ;

- Peter Thiel: How to build a monopoly?

- Alex Schulz: An introduction to growth hacking [ 1 , 2 , 3 ];

- Kevin Hale: Subtleties in working with user experience [ 1 , 2 ];

- Stanley Tang and Walker Williams: Start small ;

- Justin Kahn: How to work with specialized media?

- Andressen, Conway and Conrad: What an investor needs ;

- Andressen, Conway and Conrad: Seed investment ;

- Andressen, Conway and Conrad: How to work with an investor ;

- Brian Cesky and Alfred Lin: What is the secret of company culture?

- Ben Silberman and the Collison Brothers: Nontrivial aspects of teamwork [ 1 , 2 ];

- Aaron Levy: Developing B2B Products ;

- Reed Hoffman: On Leadership and Managers ;

- Reed Hoffman: On the leaders and their qualities ;

- Keith Rabois: Project Management ;

- Keith Rabua: Startup Development ;

- Ben Horowitz: Dismissal, promotion and reassignment ;

- Ben Horowitz: Career advice, westing and options ;

- Emmett Shire: How to conduct interviews with users;

- Emmett Shire: How to talk to users in Twitch ;

- Hossein Rahman: How hardware products are designed in Jawbone;

- Hossein Rahman: The Design Process at Jawbone.

Sam Altman: Talk about how to raise money. Michael Sable will talk about how to prepare for a meeting with investors, and then Casar will show us how to communicate with these people.

')

Casar: This is nothing special. We will tell only the most basic, but before that I would like to say that in YC we pay not so much attention to this. First of all, this is due to the fact that the best way to prepare a good presentation is to improve your company.

Your task is to show that you have achieved certain results and you have a great product. Investors want to see successful founders in front of them. The main thing you need to remember: improve your company, and then make a presentation will be much easier.

We will break our story into three parts. Michael will talk about how to prepare for a meeting with investors. Then we will model this meeting and see what it is. After that, we briefly summarize.

Michael: My name is Michael Sible. I am a partner of YC. I created two companies. The first is Justin.tv, which was acquired by Amazon. The second is Socialcam, bought by Autodesk. I want to make out in detail the process of preparing for a meeting with investors and dispel some myths. Very often, the founders say they do not know how to explain to investors what they are doing, and how to ask them for money. In fact, this is exactly what the founders should do.

My story consists of four parts. First, I will talk about the 30-second presentation. You should always keep it in your head. It should consist of the best that is in your company. With it, you can work wonders. It doesn't matter if you want to get money from people or not - it should always be with you. Secondly, I will talk about the two-minute presentation. It is designed for people interested in your company or your product: these could be investors, your future employees or other people who want to know a little more about your company. Note that I am not talking about longer presentations.

Many prepare a speech of 10, 30 or 60 minutes. This is all nonsense. You have enough two minutes to tell all that you need. I often tell the founders: the more you say, the more likely you are to say something that others don’t like. Better to say less.

Thirdly, I will talk about when it is better to start raising money, because, in my opinion, many of the founders do not know. And at the end I will briefly tell you how to arrange a meeting with an investor.

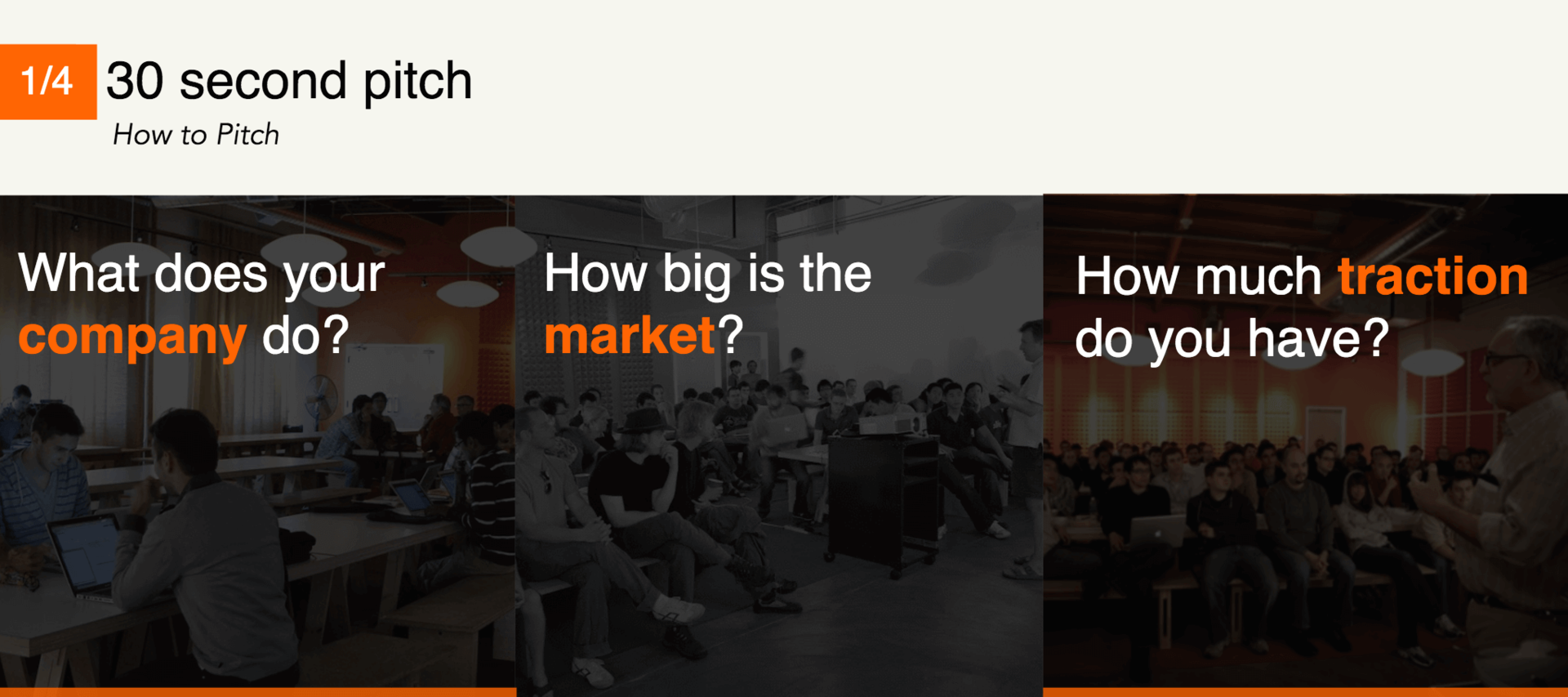

The structure of the 30-second presentation is extremely simple. You should be able to talk about your company at a calm pace. This presentation consists of three sentences. The first is what your company does. As a rule, no one can articulate it clearly. It should be as simple and clear as possible.

At the same time, you should take into account that I know nothing about your company. Nothing at all. Usually we ask the founders to imagine that they are speaking to their mother. If you cannot tell your mom or dad in one sentence what you are doing, then this sentence needs to be redone.

For example, you can say, “Hi, we are Airbnb, and we can help you rent an extra room in your house.” That's all. Needless to say, “We are Airbnb, and we work in the real estate market.” I don't even know what that means! To understand, I will need more time. Try to use simple words.

In the second sentence, you must indicate the volume of the market in which you operate. It does not hurt to spend a few hours to learn more about your market. Find out how big it is. Investors want to hear that you are in a multi-billion dollar market. Determine it is not so difficult.

For example, the founders of Airbnb could talk about the size of the hotel services markets, holiday properties, or online hotel bookings. All data can be obtained through Google. In such a situation, the investor will think: “So, if the market is so large, then this company could be worth several billion dollars. It can not be missed. So, the second sentence - what is the volume of your market.

The third sentence is what your results are. Ideally, this proposal should sound like this: “We launched the project in January, and the company's performance increases every month by 30%. We have such sales, such income, so many users. ” It's simple. If you are just preparing to launch and cannot tell you about your successes, you must convince the investor that your company is growing rapidly: “Our team started work in January. In March, we launched a beta version. In April, launched the finished product.

Convince investors that you are moving very fast. You are not a corporation in which it is difficult to change anything. You are a startup that is rapidly changing and learning from your mistakes. Three sentences are all you need to tell in 30 seconds. Based on them, you can already talk more about your company. Everyone should understand from these three sentences what you do. You have no idea how valuable it is to be able to explain in 30 seconds what you are doing.

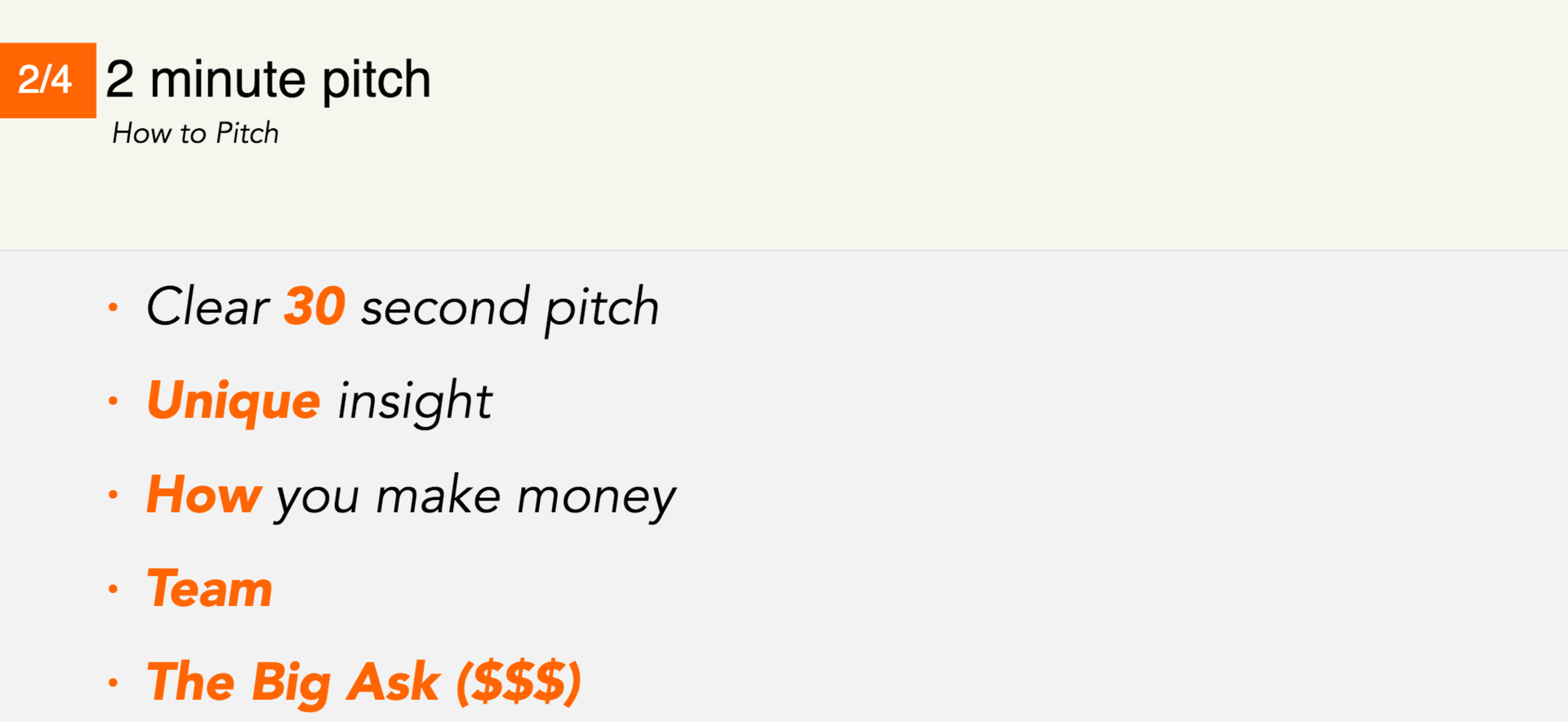

Now a few words about the two-minute presentation. Before you is a man whom you must convince of something. Perhaps you want to ask him for money. In this case, four more components are added to the 30-second presentation. They should also be as brief as possible. The first is your uniqueness. An investor may ask you: “What is your secret? What is your competitive advantage? What is your peculiarity? ”When you start talking about the uniqueness of the company, you have a chance to tell everyone what other players in your market do not know or do not fully understand.

This is where the moment of truth comes for investors. You have to put together everything that will help you eliminate your competitors, or express the idea with which your business started. Your goal is to surprise everyone. You will immediately understand whether you have succeeded or not. It is advisable to formulate your idea in two sentences, so that you can quickly move on to the next one. So, if I look at you with surprise and I cannot say a word, it means that you have succeeded. If I sit and think: “I know this” - nothing happened with you. Think carefully about how you will tell about it. In a two-minute presentation, these two sentences are exactly why you came to listen. Therefore, these phrases should not be complicated, like everything we are talking about here today.

After that you talk about how you are going to make money. Everyone knows their business model. However, I often see how the founders avoid this question. They believe that if they start talking about advertising, they will be told: "This is stupid." Do not be afraid of it. Tell me how it is! If you're going to make money from advertising, say so.

By the way, Facebook and Google receive huge advertising revenue. If the basis of your income is direct sales, tell us about them. If you distribute paid apps, that's fine too. Just say it. For this one sentence is enough. No need to skip it in your story. Some founders do not understand this and start saying ambiguously: “We will advertise your product. Perhaps we will use virtual goods - we will find out how this is done. Perhaps, then perhaps this. "

Now you are just talking rubbish. You just told everyone that you have no idea how you will make money. I was ready to put a tick in front of this item, but now I have to draw a big question mark. Say that you will earn as well as everyone else, and move on. This is absolutely normal. No one will put pressure on you and in three years will not say that you have not earned anything in this or that way. It is much better to talk about everything briefly and clearly than to remember all the possible ways to increase income.

The following is the command. I think everything is clear here. If your team has achieved impressive results, do not hide it. Everyone would like to say: "We founded PayPal." Or: "We founded Amazon." It would be even better if you somehow increased the income of your investors. If not, please do not list the personal rewards of your team members, your academic degrees, and so on. No one is interested.

We want to know how many founders you have: it is desirable to have from two to four. We want to know how many engineers are among them, and how many are businessmen: it is desirable that there be 50 to 50, or more engineers. We want to know how long you've known each other.

You will not succeed if you met three days ago at a meeting of the founders. Ideally, you should be friends or colleagues for at least six months. We want to hear that you will be busy full-time and that you are interested in the success of the company. This is a big plus. And we want to know how you met. That's all.

All this can be easily put in two sentences. The best option is to tell about your achievements. In a conversation with an investor, it is advisable to talk about the successes that brought someone money. Do not try to impress if you do not have specific data. The more you talk about your shortcomings, the worse they will look.

The last sentence is your request. Here you need to know for sure whether you are going to raise funds or not. I usually say that at this point you need to know whether you are raising funds in the form of a convertible loan or using the SAFE tool. You need to know what the capitalization of this tool is. You need to know how much money you will ask. You should know what the minimum amount should be on the check you write.

If you do not know this, investors will consider that you are not serious about this meeting or have not prepared for it. If up to this point you should not have used specific terms, here you cannot just say: "We need some money." You must use the appropriate concepts. If you do not know them - Google to help. You quickly figure it out for yourself. This is where your presentation ends, and you give the floor to the other party.

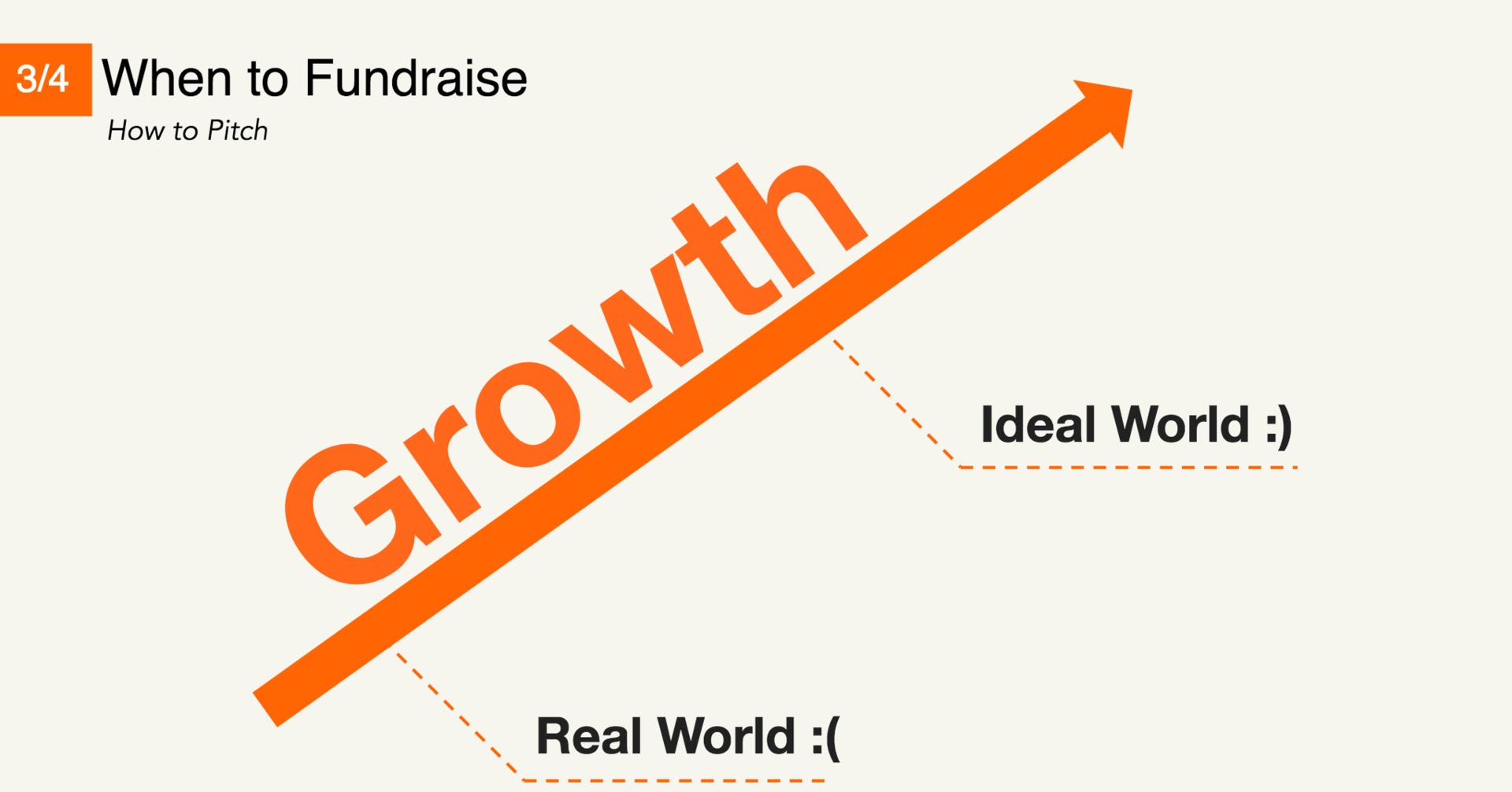

Now, about when to raise money. This is also very important. Usually, the founders show the growth schedule of their company. Investors prefer to invest in a project that has achieved certain results. It is almost always better to attract money when you have achieved great success. However, you may be in a situation where you have just launched your project. Your task is to radically change the balance of power.

You must clearly understand that if you come to ask investors for money, then you are in a less favorable position. How should events develop so that you find yourself in a better position? Because only in this situation it is worth starting to attract funds. First, how do you know that you are in a better position? If investors offer to invest their money in you, it means that you win. This suggests that you have chosen the best time to raise funds. If investors do not offer you their money, then tell us how many people know about your startup. Maybe you do not want everyone to know about you. If you tell everyone about your startup - either in the press, or through your friends or other startupers - this is a good start.

Secondly, do you have a plan to launch and develop your project, which does not require a large amount of funds? 95% of the startups I work with can bring their product to the market, while having very little money. Never show an investor that everything depends on him.

Never say: "We can not start anything without money." Always try to be in a better position. You have to say: “Our company has results. We all left the main work and dedicate all our working time to this project. And this is paying off. If you want to join us, you are welcome. If not, there are plenty of business angels around who are ready to share their money with us. ” It is with this attitude that one should approach the matter.

You must behave confidently. If you need money at an early stage, be prepared for what you get less. Always be ready to show that you have a reliable team that is moving quickly towards your goal. This is the only way you can gain an advantage if you do not have specific results. If you have not yet launched the product, but you can show that in one or two months you have done the work that usually takes six months, and if you have a team whose members have left work and are ready to invest all their strength in the development of the project, then you You can partially regain this advantage. You will not be able to return it completely until you launch your product and show a certain growth.

And finally, how to arrange a meeting with the investor. In fact, this is very simple, but I am amazed at how many companies do not understand this. First, another entrepreneur or your past investor should acquaint you with the investor. It is always better to start with this. If one of the investors who have not invested their money in you, offers to introduce you, it is better to refuse. It may be dangerous. So first you must be well represented. No need to pester investors with cold calls. You should not take them by surprise. The authority of the person who is going to introduce you to the investor can seriously affect whether the investor agrees to come to your meeting or not.

Secondly, think "in parallel." For many people I work with, the process of raising funds is progressing very slowly. With one person they meet this week. Then plan on meeting with another next week. Another one they need to meet in three weeks. If you decide to raise funds, the process should be completed as soon as possible. This is a sprint, not a marathon. Therefore, it is best to schedule all your meetings in one week, and this is not easy.

However, there is one trick. After you are well presented, investors send you a letter, and you can answer them like this: “We want to meet, but in the next two weeks we have a lot of work. Can we meet in three weeks? ”And so you tell everyone. So everyone is planning to meet with you in three weeks. So it will be better for investors, because at this time they have not so many planned activities.

So it will be better for you, because all your meetings will be held in one week. In addition, you kind of say: “We are not chasing money. We are working. We can meet in three weeks, but now we are very busy. " Investors will love this. So this method is one of the most effective. Another important note: one of your team members must take on all the fundraising tasks. This should not be done by the whole company, because it will distract from the work.

Announcement:

Announcement:January 19 will be held #poSEEDelki with IIDF (Krasnodar, ul. Krasnoarmeyskaya 55/1).

The format involves communication with like-minded people for good.

We select the actual topic, listen to the expert report and discuss it all together.

Program and registration here .

Source: https://habr.com/ru/post/297744/

All Articles