How to build a domestic market in a single firm: theory and practice

The main drawback of most firms is the lack of a domestic market. Where there is none, one can always face irrational use of resources, theft, idleness and negligence.

In this publication, we will talk about why the firm’s internal market is needed, and give some practical advice on how to build it.

')

My friend - let's call him Mr. W , in order to avoid advertising - has been creating information systems for business management for 15 years now. He has been brought to this field since long ago, when his previous occupation - the use of mathematical game theory to simulate the battles of military fighters and bombers - had ceased to be in demand.

For a long time I perceived his activity as a set of cunning tricks and useful improvements that allow me to gain some advantage over competitors.

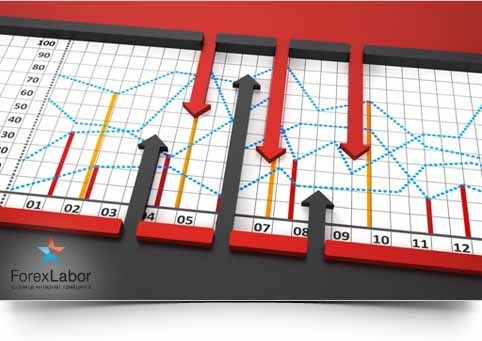

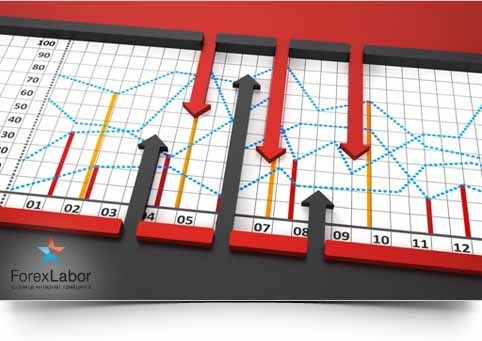

But here, time after time, the companies running its information systems began to “take off”. Already 6-12 months after the start of the system, each firm showed only positive cash flow and increased its sales at least 2 times. Salaries of employees also increased significantly. Then the company continued to grow dynamically, even in the conditions of a market downturn or economic crisis.

It became clear that such stable results cannot be explained by the simple effect of using cunning “lotions”, and I wanted to thoroughly understand everything and “derive a formula” for Mr. W.’s management systems. His own explanations using some kind of “terminal sets” and etc. were beyond my comprehension - after all, I'm just a simple and shy theoretical physicist who has been working in consulting for 18 years.

As a result, I confined myself to studying separately his managerial "chips" and came up with his own explanation, which can be formulated in the language of mere mortals. Of course, all the conclusions set forth below are based on a discussion of these issues with Mr. W, and are published with his consent.

As I happened to establish, the main "trick" of Mr. Y is that he understands the key reason for the inefficiency of firms, and eliminates it wherever possible.

Since the basic approach that Mr. W uses is to build free-market relations in a single firm, we first get a little deeper into the theoretical foundations of the nature of markets and the nature of firms. To this end, we will very briefly outline the system of views on markets and firms formulated by Ronald Coase ( Ronald Harry Coase , Nobel Prize in Economics in 1991).

Then, using the example of a company engaged in wholesale trade, we describe in detail how Mr. Y's management model is implemented in practice.

Immediately, I note that Mr. U builds its systems on the basis of 1C. However, this is not a principle requirement at all. Any modern digital technology that includes tools such as workflow, statuses, user roles, access rights, etc., will do.

In many economics textbooks, the benefits of trade are explained by the example of the exchange of nuts for apples between individuals located on the edge of the forest. This approach, of course, explains why trade is profitable, but it does not affect the factors that determine the scope of trade and the type of goods that are traded.

Creating markets is a business of entrepreneurs, and it has a long history. In medieval England, fairs and markets were organized by private individuals who received royal privilege. They not only provided facilities needed to hold a fair or market, but also were responsible for security (very important in such unsettled times with relatively weak governments) and ruled the court to resolve conflicts (fair court).

Over time, the role of traditional markets has diminished, new markets have emerged that have taken an equally important place in the modern economy, such as stock and commodity exchanges. Usually they are organized by groups of merchants (members of the exchange) who provide their own (or rented) premises for trading.

All exchanges regulate in detail the activities of those who trade in these markets (the time allotted for making transactions, possible objects of trade, the responsibility of the parties, the terms of agreements, etc.), and each of them provides a mechanism for resolving conflicts and applying sanctions against those violates the rules of the exchange.

It is extremely important that these exchanges, which economists often refer to as an example of a perfect market and perfect competition, are markets with detailed regulation of operations (and this is in addition to possible government regulation). It follows that the existence of something like perfect competition usually requires a complex system of rules and restrictions.

So why do we need such rigidly regulated structures, like, say, commodity exchanges, if no one forbids the exchange of goods at the edge of the forest?

It turns out that any exchange involves so-called transaction costs, and structures such as markets are needed to reduce transaction costs and, consequently, to increase trade volumes.

Ronald Coase defines transaction costs as follows:

"In order to carry out a market transaction, it is necessary to determine with whom it is desirable to conclude a deal, notify those who wish to conclude a deal about its terms, conduct preliminary negotiations, prepare a contract, collect information to make sure that the terms of the contract are fulfilled, and so Further".

In turn, Dalman (CJ Dahlman) has the following idea of transaction costs: it is “the costs of collecting and processing information, negotiating and making decisions, exercising control and being forced to fulfill the terms of the contract”.

The exchange relieves market participants, both sellers and buyers, from the majority of transaction costs, reducing their interaction to a simple exchange of signals, such as “Sell” or “Buy”. There is no need to repeat that this is achieved through the detailed regulation of all operations, the structuring and unification of trade processes and, of course, complete and timely information support of market participants.

Why are there firms? What are they needed for?

Recall how medieval handicraft production was organized. To make a carriage, a cartwright bought, say, iron from a blacksmith, a tree from a carpenter, cloth from weavers, etc. Everyone who directly or indirectly participated in the creation of the carriage acted as an independent business unit.

Why didn’t the caretaker create a firm or hire a blacksmith, carpenter and weaver into it? Obviously, for the caret owner in this way of doing business there were undoubted advantages.

Firstly, he bought semi-finished products only when he had an order for the manufacture of a carriage. Secondly, he could choose the best semi-finished product on the market at the best price. Thirdly, he did not have to pay a blacksmith, a carpenter and a weaver for forced downtime, when there were no orders for carriages. Fourthly, the cartwright had the opportunity to negotiate with each of the suppliers about exactly which semi-finished products he needs in each particular case. He also did not have to bear the costs of defective semi-finished products, which for one reason or another were made by his suppliers.

In other words, the cartwright enjoyed all the advantages that are characteristic of the free market and the price mechanism built into it. When production is directed by the movement of prices, it can be carried out generally outside of any organizations.

On the other hand, if Henry Ford tried to organize the production of cars in the same way, he would have to make every minute an incredible number of transactions, given the scale of production and the complexity of the car device compared to the carriage.

Each transaction would have been transaction costs for Henry Ford, and even if he were capable of making such an incredible number of transactions, his business would be extremely costly.

Thus, the emergence of firms was caused by the increase in scale and complexity of production processes, and was a form of adaptation to the problem of increasing transaction costs.

Outside the firm, production is subject to market price movements, and coordination is the result of successive exchange operations in the market. Inside the firm, these market transactions are eliminated, and the role of a complex market structure with all exchange operations is performed by the entrepreneur coordinator, who directs production. J.E. Robinson ( J. ) commented on this matter as follows: “we discover islands of conscious power in this ocean of unconscious cooperation.”

As Ronald Coase points out,

“The main reason for creating profitable firms should be that the price mechanism does not work without costs. The most obvious of the costs of "organizing" production with the help of the price mechanism is to find out what the corresponding prices are. The costs of this can be reduced thanks to the emergence of specialists who will sell this information, but they cannot be eliminated at all.

Consideration should also be given to the costs of negotiating and concluding a contract for each exchange transaction, which is inevitable in the market. Although in some markets, for example, on commodity exchanges, a technique has been developed to minimize these contract costs, but they have not been completely eliminated.

True, contracts cannot be eliminated even in the presence of a firm, but here they are much smaller: the production factor (or its owner) should not conclude a series of contracts with factors with which it cooperates within the firm, which would be necessary, of course, if this cooperation was a direct result of the price mechanism. ”

Among other things, Ronald Coase put forward a theorem that, in the absence of transaction costs, the most efficient use of resources is achieved precisely by applying the market price mechanism. And this happens regardless of external factors, including the legal regulation of economic relations.

A distinctive feature of the creation of firms is precisely the crowding out of the price mechanism for the use of resources, which is replaced by the transition to "manual" control. Within firms, with rare exceptions, there is no relationship between the buyer and the seller at each internal stage of production, trade or provision of services. Issues such as who, what and when should do, are decided at the discretion of entrepreneurs or their proxies - managers. This is the main drawback of firms, since, according to the Coase theorem, it does not guarantee the achievement of the most efficient use of economic resources.

The most important know-how on which Mr. Y's management systems are based is the re-creation of the market price mechanism within firms. Obviously, this became possible only through the use of modern information technologies.

Now let's move away from economic theory and formulate several basic principles on which Mr. W.’s management systems are built. We will show how all these principles can be implemented within a company engaged in wholesale trade.

The principle of interest correlation is that it should be beneficial for each employee of a company to do exactly what is beneficial for the firm (or its owners).

When it is possible to implement the principle of correlation of interests, there is no need to “manually” control the actions of employees or supervise them. In practice, this most often leads to the fact that so-called “middle managers” become unnecessary, and their roles are transformed.

The truth of life is that employees most often act solely in their own interests, not really thinking about the interests of the company. Where there is no correlation, you can always face theft, idleness and negligence. The system, built in accordance with the principle of correlation, motivates the staff to perform useful work, and at the same time makes any work that does not bring value to the company unprofitable.

It would seem that this principle is quite obvious, but its implementation represents one of the greatest difficulties in organizing the work of a company.

For example, it is widely believed that employees will work more efficiently if they tie up the earnings of each employee to the company's profits. But, as Wolfgang Pauli put it, “it’s not only wrong, it’s not even mistaken.”

There is no difficulty in declaring to employees that from now on each of them will receive a certain percentage of the firm’s profits. But this will not give any clue to what each of them should do differently in order to maximize the company's profits.

To clarify the situation, we recall the story of how Heisenberg once introduced Pauli to his new theory. In response, he received a letter in which a square was drawn marked "I can draw like Titian." Below in small handwriting it was attributed: “All that is missing is the details.”

The flow of single transactions is akin to the flow of single products in lean manufacturing technologies. The maximum total economic effect is achieved precisely when the result of each operation and transaction is maximized.

Since the main task is to create market mechanisms within the company, all the processes of interaction of employees with each other and with the outside world are presented as a sequence of numerous single transactions, both internal and external.

The stream of single transactions allows the maximum completeness to implement the principle of the correlation of the interests of the company and each employee. The employee is rewarded with a certain part of the profit from each transaction in which he participated (or bears the company's share of the loss from the transaction if it is unprofitable). This motivates employees to maximize the firm’s profit in each transaction.

All transactions must be structured in such a way that the result of the transaction (profit or loss) can be attributed precisely to that stage of the internal process of the company, on which it was achieved. This requires a detailed account of all costs incurred by the company at all previous stages of the process and related to this particular transaction, in order to correctly form domestic prices.

As a result, each employee is responsible (in the form of his earnings) for the profitability of only that part of the process in which he was directly involved. On the other hand, the employee does not receive a share of the total profit of the company if value added has not been created on his part of the process.

The cost of using resources affects the profitability of the firm, and should be taken into account when determining domestic prices, as well as the size of remuneration of employees responsible for the use of resources.

Rational use of resources is achieved in two ways:

It is curious that in Mr. U's systems, the charge for resources can take rather exotic forms. For example, in one of its client firms, a fixed amount is automatically deducted from the account of a call center employee as soon as he receives a call from a potential client. In this situation, each potential customer calling is considered as a valuable resource, and the call center employee pays for the opportunity to process the call and earn his part of the profit on a potential transaction. Is it worth explaining that every time, picking up the phone, the call center employee seeks to justify his costs?

A huge number of internal transactions carried out by employees of the company, should be free from all related transaction costs.

Just as a commodity exchange relieves market participants, both sellers and buyers, from the majority of transaction costs, reducing their interaction to a simple exchange of signals, such as “I sell” or “I buy,” internal exchange operations should be as simple as possible in the firm’s domestic market.

This is achieved through detailed regulation of all operations, structuring and unifying the processes of intra-company and foreign trade and, of course, full and timely information support for all participants in the process.

Thus, the formation of the internal market is always associated with proper reorganization of all internal processes of the company. At the same time, in accordance with the principles of the correlation of interests and the flow of single transactions, its added value is determined for each stage of the process, and thus all useless (not creating value) processes are discarded, and the accounting systems of information necessary for determining the costs associated with process, domestic prices and profits at the current stage of the process.

Also, of course, the process participants themselves must be identified so that those responsible for the outcome of each transaction can be tracked. This, in turn, if necessary, allows you to determine the person responsible for the subsequent transaction and track the execution time of the transaction and the entire process.

Modern digital technologies allow realizing all these tasks with the help of such tools as workflow, statuses, user roles, access rights, etc.

“If one has something, there will always be another who will want to take it away,” said Shakespeare.

The use of a valuable resource will be more effective if the person is guaranteed the undivided use of this resource in some long term. Competition for resources arises when many people are ready to lay claim to this resource. As a result, the value of buying a TV at a discount on a sale is greatly reduced if you have to take a turn to the store from 4 in the morning. Especially if it does not even guarantee a purchase.

Of course, it makes sense to maintain private ownership of resources only as long as the return on the use of the resource is really high. Mr Y illustrates this with the following example taken from one of his client companies.

In this company, which sells cardboard, the client is “given away” for 2 months to the private property of the seller who concluded the last transaction with him. During this time, all other sellers are prohibited from making transactions with this client.

It is curious that every Monday the computer “expropriates” from the owners of all customers who have not made transactions within 2 months, and “throws” the list of these customers on the free market. All the vendors of the company (I will note that only women work there) are waiting for this release, and they are beginning to frantically process these “draw” customers. , , .

, , . .

, , , .

, C, ( ) , , .

, , B, .

, 2 : , 15%.

– , , 3%. , .

, , .

, ( ) . , . , . , , .

(. Fair Value )— , ( «»).

№ 13 ( IFRS 13 ). , .

, , . , , , . , , . 2 – , , , 2 ( ) 1 .

LIFO FIFO , , . 1 , , ( ) .

, 1 /. , , 3 , 3 1 .

, , , .

, , , , , , , . , .

:

, (, , ). , (, , ) . , , , , .

, . , , , .

– . , , , , .

(, , , , ..), . , , .

/ :

, , , .

In this publication, we will talk about why the firm’s internal market is needed, and give some practical advice on how to build it.

')

My friend - let's call him Mr. W , in order to avoid advertising - has been creating information systems for business management for 15 years now. He has been brought to this field since long ago, when his previous occupation - the use of mathematical game theory to simulate the battles of military fighters and bombers - had ceased to be in demand.

For a long time I perceived his activity as a set of cunning tricks and useful improvements that allow me to gain some advantage over competitors.

But here, time after time, the companies running its information systems began to “take off”. Already 6-12 months after the start of the system, each firm showed only positive cash flow and increased its sales at least 2 times. Salaries of employees also increased significantly. Then the company continued to grow dynamically, even in the conditions of a market downturn or economic crisis.

It became clear that such stable results cannot be explained by the simple effect of using cunning “lotions”, and I wanted to thoroughly understand everything and “derive a formula” for Mr. W.’s management systems. His own explanations using some kind of “terminal sets” and etc. were beyond my comprehension - after all, I'm just a simple and shy theoretical physicist who has been working in consulting for 18 years.

As a result, I confined myself to studying separately his managerial "chips" and came up with his own explanation, which can be formulated in the language of mere mortals. Of course, all the conclusions set forth below are based on a discussion of these issues with Mr. W, and are published with his consent.

As I happened to establish, the main "trick" of Mr. Y is that he understands the key reason for the inefficiency of firms, and eliminates it wherever possible.

Since the basic approach that Mr. W uses is to build free-market relations in a single firm, we first get a little deeper into the theoretical foundations of the nature of markets and the nature of firms. To this end, we will very briefly outline the system of views on markets and firms formulated by Ronald Coase ( Ronald Harry Coase , Nobel Prize in Economics in 1991).

Then, using the example of a company engaged in wholesale trade, we describe in detail how Mr. Y's management model is implemented in practice.

Immediately, I note that Mr. U builds its systems on the basis of 1C. However, this is not a principle requirement at all. Any modern digital technology that includes tools such as workflow, statuses, user roles, access rights, etc., will do.

The nature of the markets

In many economics textbooks, the benefits of trade are explained by the example of the exchange of nuts for apples between individuals located on the edge of the forest. This approach, of course, explains why trade is profitable, but it does not affect the factors that determine the scope of trade and the type of goods that are traded.

Creating markets is a business of entrepreneurs, and it has a long history. In medieval England, fairs and markets were organized by private individuals who received royal privilege. They not only provided facilities needed to hold a fair or market, but also were responsible for security (very important in such unsettled times with relatively weak governments) and ruled the court to resolve conflicts (fair court).

Over time, the role of traditional markets has diminished, new markets have emerged that have taken an equally important place in the modern economy, such as stock and commodity exchanges. Usually they are organized by groups of merchants (members of the exchange) who provide their own (or rented) premises for trading.

All exchanges regulate in detail the activities of those who trade in these markets (the time allotted for making transactions, possible objects of trade, the responsibility of the parties, the terms of agreements, etc.), and each of them provides a mechanism for resolving conflicts and applying sanctions against those violates the rules of the exchange.

It is extremely important that these exchanges, which economists often refer to as an example of a perfect market and perfect competition, are markets with detailed regulation of operations (and this is in addition to possible government regulation). It follows that the existence of something like perfect competition usually requires a complex system of rules and restrictions.

So why do we need such rigidly regulated structures, like, say, commodity exchanges, if no one forbids the exchange of goods at the edge of the forest?

It turns out that any exchange involves so-called transaction costs, and structures such as markets are needed to reduce transaction costs and, consequently, to increase trade volumes.

Ronald Coase defines transaction costs as follows:

"In order to carry out a market transaction, it is necessary to determine with whom it is desirable to conclude a deal, notify those who wish to conclude a deal about its terms, conduct preliminary negotiations, prepare a contract, collect information to make sure that the terms of the contract are fulfilled, and so Further".

In turn, Dalman (CJ Dahlman) has the following idea of transaction costs: it is “the costs of collecting and processing information, negotiating and making decisions, exercising control and being forced to fulfill the terms of the contract”.

The exchange relieves market participants, both sellers and buyers, from the majority of transaction costs, reducing their interaction to a simple exchange of signals, such as “Sell” or “Buy”. There is no need to repeat that this is achieved through the detailed regulation of all operations, the structuring and unification of trade processes and, of course, complete and timely information support of market participants.

The nature of firms

Why are there firms? What are they needed for?

Recall how medieval handicraft production was organized. To make a carriage, a cartwright bought, say, iron from a blacksmith, a tree from a carpenter, cloth from weavers, etc. Everyone who directly or indirectly participated in the creation of the carriage acted as an independent business unit.

Why didn’t the caretaker create a firm or hire a blacksmith, carpenter and weaver into it? Obviously, for the caret owner in this way of doing business there were undoubted advantages.

Firstly, he bought semi-finished products only when he had an order for the manufacture of a carriage. Secondly, he could choose the best semi-finished product on the market at the best price. Thirdly, he did not have to pay a blacksmith, a carpenter and a weaver for forced downtime, when there were no orders for carriages. Fourthly, the cartwright had the opportunity to negotiate with each of the suppliers about exactly which semi-finished products he needs in each particular case. He also did not have to bear the costs of defective semi-finished products, which for one reason or another were made by his suppliers.

In other words, the cartwright enjoyed all the advantages that are characteristic of the free market and the price mechanism built into it. When production is directed by the movement of prices, it can be carried out generally outside of any organizations.

On the other hand, if Henry Ford tried to organize the production of cars in the same way, he would have to make every minute an incredible number of transactions, given the scale of production and the complexity of the car device compared to the carriage.

Each transaction would have been transaction costs for Henry Ford, and even if he were capable of making such an incredible number of transactions, his business would be extremely costly.

Thus, the emergence of firms was caused by the increase in scale and complexity of production processes, and was a form of adaptation to the problem of increasing transaction costs.

Outside the firm, production is subject to market price movements, and coordination is the result of successive exchange operations in the market. Inside the firm, these market transactions are eliminated, and the role of a complex market structure with all exchange operations is performed by the entrepreneur coordinator, who directs production. J.E. Robinson ( J. ) commented on this matter as follows: “we discover islands of conscious power in this ocean of unconscious cooperation.”

As Ronald Coase points out,

“The main reason for creating profitable firms should be that the price mechanism does not work without costs. The most obvious of the costs of "organizing" production with the help of the price mechanism is to find out what the corresponding prices are. The costs of this can be reduced thanks to the emergence of specialists who will sell this information, but they cannot be eliminated at all.

Consideration should also be given to the costs of negotiating and concluding a contract for each exchange transaction, which is inevitable in the market. Although in some markets, for example, on commodity exchanges, a technique has been developed to minimize these contract costs, but they have not been completely eliminated.

True, contracts cannot be eliminated even in the presence of a firm, but here they are much smaller: the production factor (or its owner) should not conclude a series of contracts with factors with which it cooperates within the firm, which would be necessary, of course, if this cooperation was a direct result of the price mechanism. ”

Coase's theorem

Among other things, Ronald Coase put forward a theorem that, in the absence of transaction costs, the most efficient use of resources is achieved precisely by applying the market price mechanism. And this happens regardless of external factors, including the legal regulation of economic relations.

A distinctive feature of the creation of firms is precisely the crowding out of the price mechanism for the use of resources, which is replaced by the transition to "manual" control. Within firms, with rare exceptions, there is no relationship between the buyer and the seller at each internal stage of production, trade or provision of services. Issues such as who, what and when should do, are decided at the discretion of entrepreneurs or their proxies - managers. This is the main drawback of firms, since, according to the Coase theorem, it does not guarantee the achievement of the most efficient use of economic resources.

The most important know-how on which Mr. Y's management systems are based is the re-creation of the market price mechanism within firms. Obviously, this became possible only through the use of modern information technologies.

Basic principles

Now let's move away from economic theory and formulate several basic principles on which Mr. W.’s management systems are built. We will show how all these principles can be implemented within a company engaged in wholesale trade.

Interest correlation

The principle of interest correlation is that it should be beneficial for each employee of a company to do exactly what is beneficial for the firm (or its owners).

When it is possible to implement the principle of correlation of interests, there is no need to “manually” control the actions of employees or supervise them. In practice, this most often leads to the fact that so-called “middle managers” become unnecessary, and their roles are transformed.

The truth of life is that employees most often act solely in their own interests, not really thinking about the interests of the company. Where there is no correlation, you can always face theft, idleness and negligence. The system, built in accordance with the principle of correlation, motivates the staff to perform useful work, and at the same time makes any work that does not bring value to the company unprofitable.

It would seem that this principle is quite obvious, but its implementation represents one of the greatest difficulties in organizing the work of a company.

For example, it is widely believed that employees will work more efficiently if they tie up the earnings of each employee to the company's profits. But, as Wolfgang Pauli put it, “it’s not only wrong, it’s not even mistaken.”

There is no difficulty in declaring to employees that from now on each of them will receive a certain percentage of the firm’s profits. But this will not give any clue to what each of them should do differently in order to maximize the company's profits.

To clarify the situation, we recall the story of how Heisenberg once introduced Pauli to his new theory. In response, he received a letter in which a square was drawn marked "I can draw like Titian." Below in small handwriting it was attributed: “All that is missing is the details.”

Single transaction flow

The flow of single transactions is akin to the flow of single products in lean manufacturing technologies. The maximum total economic effect is achieved precisely when the result of each operation and transaction is maximized.

Since the main task is to create market mechanisms within the company, all the processes of interaction of employees with each other and with the outside world are presented as a sequence of numerous single transactions, both internal and external.

The stream of single transactions allows the maximum completeness to implement the principle of the correlation of the interests of the company and each employee. The employee is rewarded with a certain part of the profit from each transaction in which he participated (or bears the company's share of the loss from the transaction if it is unprofitable). This motivates employees to maximize the firm’s profit in each transaction.

All transactions must be structured in such a way that the result of the transaction (profit or loss) can be attributed precisely to that stage of the internal process of the company, on which it was achieved. This requires a detailed account of all costs incurred by the company at all previous stages of the process and related to this particular transaction, in order to correctly form domestic prices.

As a result, each employee is responsible (in the form of his earnings) for the profitability of only that part of the process in which he was directly involved. On the other hand, the employee does not receive a share of the total profit of the company if value added has not been created on his part of the process.

Rational use of resources

The cost of using resources affects the profitability of the firm, and should be taken into account when determining domestic prices, as well as the size of remuneration of employees responsible for the use of resources.

Rational use of resources is achieved in two ways:

- by applying a pull mechanism that is suitable for continuous flows of resources. For example, if we are talking about production processes, then the purchase of raw materials and materials, the production of semi-finished products, etc. are carried out only when a signal arrives (or “order”) for their purchase or manufacture from the subsequent stages of the production process. In this case, inventories at each stage are formed in accordance with established internal standards;

- by establishing a fee (or remuneration) for the use (or provision) of scarce resources. This method is most useful in situations where, for example, the purchase of goods is carried out in large batches and takes a long time, or when the company has a need to raise additional funds. In the first case, a daily charge can be set for the remnants of goods in the warehouse, and in the second case - a reward for receiving advance payments from customers. Fees and remuneration for resources are set depending on the need for resources at a regulated internal rate.

It is curious that in Mr. U's systems, the charge for resources can take rather exotic forms. For example, in one of its client firms, a fixed amount is automatically deducted from the account of a call center employee as soon as he receives a call from a potential client. In this situation, each potential customer calling is considered as a valuable resource, and the call center employee pays for the opportunity to process the call and earn his part of the profit on a potential transaction. Is it worth explaining that every time, picking up the phone, the call center employee seeks to justify his costs?

Formation of the domestic market

A huge number of internal transactions carried out by employees of the company, should be free from all related transaction costs.

Just as a commodity exchange relieves market participants, both sellers and buyers, from the majority of transaction costs, reducing their interaction to a simple exchange of signals, such as “I sell” or “I buy,” internal exchange operations should be as simple as possible in the firm’s domestic market.

This is achieved through detailed regulation of all operations, structuring and unifying the processes of intra-company and foreign trade and, of course, full and timely information support for all participants in the process.

Thus, the formation of the internal market is always associated with proper reorganization of all internal processes of the company. At the same time, in accordance with the principles of the correlation of interests and the flow of single transactions, its added value is determined for each stage of the process, and thus all useless (not creating value) processes are discarded, and the accounting systems of information necessary for determining the costs associated with process, domestic prices and profits at the current stage of the process.

Also, of course, the process participants themselves must be identified so that those responsible for the outcome of each transaction can be tracked. This, in turn, if necessary, allows you to determine the person responsible for the subsequent transaction and track the execution time of the transaction and the entire process.

Modern digital technologies allow realizing all these tasks with the help of such tools as workflow, statuses, user roles, access rights, etc.

Principle of private property

“If one has something, there will always be another who will want to take it away,” said Shakespeare.

The use of a valuable resource will be more effective if the person is guaranteed the undivided use of this resource in some long term. Competition for resources arises when many people are ready to lay claim to this resource. As a result, the value of buying a TV at a discount on a sale is greatly reduced if you have to take a turn to the store from 4 in the morning. Especially if it does not even guarantee a purchase.

Of course, it makes sense to maintain private ownership of resources only as long as the return on the use of the resource is really high. Mr Y illustrates this with the following example taken from one of his client companies.

In this company, which sells cardboard, the client is “given away” for 2 months to the private property of the seller who concluded the last transaction with him. During this time, all other sellers are prohibited from making transactions with this client.

It is curious that every Monday the computer “expropriates” from the owners of all customers who have not made transactions within 2 months, and “throws” the list of these customers on the free market. All the vendors of the company (I will note that only women work there) are waiting for this release, and they are beginning to frantically process these “draw” customers. , , .

, , . .

, , , .

, C, ( ) , , .

, , B, .

, 2 : , 15%.

– , , 3%. , .

, , .

, ( ) . , . , . , , .

(. Fair Value )— , ( «»).

№ 13 ( IFRS 13 ). , .

, , . , , , . , , . 2 – , , , 2 ( ) 1 .

LIFO FIFO , , . 1 , , ( ) .

, 1 /. , , 3 , 3 1 .

:

, , , .

, , , , , , , . , .

Sellers

:

- . , ( ), ( ). ( ) (. ).

- , . , , .

- .

- ( , ). , (. ).

, (, , ). , (, , ) . , , , , .

, . , , , .

– . , , , , .

(, , , , ..), . , , .

/ :

- . , , , . ( ) , ( , , .).

- .

- , .

- . , . , , .

- . , , .

, , , .

Source: https://habr.com/ru/post/297566/

All Articles