Money in the economy is not enough? Why?

If we talk specifically about the economy of our country, then in fact there are two points of view:

- Our economy has always lacked money for reforms all the time.

- More money (to give, print, issue, etc.) can not be as soon as inflation increases. And one of the main tasks of the government (first of all) is to prevent inflation from rising.

')

Further the first point of view will be justified. And that's why.

Let us use an analogy for the beginning. Many economists call money - a lubricant for the economy. Those. The economy is like a mechanism in which its gears constantly need lubrication. There will be no lubrication - the mechanism will jam.

And if money performed only the function of lubrication, and only lubricated the production and consumption of goods and services (that is, they would be used solely as a measure of cost and means of payment in the real sector of the economy), then it would be easier to determine their required amount.

So, economists, for example, know the following formula:

M = (C-B + P-VP) / V;

Where M - the required amount of lubricant, to blame, money in circulation;

C - the sum of the prices of goods and services sold with payment immediately;

B - the sum of the prices of goods and services sold on credit;

P - received payments (from transactions of previous periods);

VP - tests of various kinds;

V is the velocity of money.

Framed, counted, “typed” - the gears are spinning. But, alas, money is not only a lubricant, it is also a commodity that is “lubricated” by the financial sector, above all the production and trade in goods and services, above all the stock market.

1. Money is a commodity

There is a special market for money as a commodity - this is the currency market. And if someone thinks that in this market foreign currency is bought / sold only in order to make cross-border transactions and, of course, to save a little in reserve, then he is mistaken.

The total volume of trade in the foreign exchange market of the whole world is approximately 50 times higher than the total volume of the world turnover of goods and services. In Russia, of course, these numbers are not so different. But even here, with an average monthly volume of imports of $ 20-25 billion on Forex, only transactions with the calculation of tomorrow (in a ruble-dollar pair) up to $ 5 billion are made per day. Those. up to 150 billion dollars a month. At least 6 times the volume of imports. And these are transactions that bring a rather big profit (do everyone remember Soros?), And our lubricant (money from turnover) is constantly leaking to this market.

Continuing the analogy - the engine controller of your car began to trade with other cars with oil available in the engine. And from this you profit went, but is it good from this trade to your motor?

We state. The foreign exchange market is largely speculative and a significant portion of the money supply is constantly drawn on it .

For reference: the total money supply in the Russian Federation (M2 unit) is about 30 trillion. rubles.

2. Money and stock market

In money, turnover is expressed and money is used not only to pay for goods and services, but also in the trading of financial instruments. In other words, besides the market for goods and services, there is also a securities market. And the turnover on it also requires its own portion of money.

Of course, on the one hand stocks, bonds, etc. financial instruments are a means (must be a means) of attracting investment in the real economy. Those. It can be said a cure for a lack of money in circulation. But let's see how much of this "medicine" there is in the world. Is it too much? We type in the search for "stock market capitalization" and get - the capitalization of the share market in the Russian Federation in recent years is at the level of 23 trillion. rubles, which is 30% of Russia's GDP. They say this is not enough. Maybe for something a little. But in order to take on part of the money supply is not so little, if we recall the value of the money supply in the Russian Federation - about 30 trillion. rubles. Comparable numbers.

However, the stock market like no other has a global character. The world's largest New York Stock Exchange has a market capitalization of 17 trillion dollars, already dollars naturally. The capitalization of the 10 largest stock exchanges in the world is about 45 trillion. dollars. And there are derivatives.

You could even say, THERE ARE MORE DERIVATIVES (these are derivative securities on securities). They were released on a fantastic amount of about 1.5 quadrillion dollars (quadrillion is a million billion). The global volume of the derivatives market is about 700 trillion dollars, while the sum of all the GDP of all countries of the world is 10 times less.

In fact, derivatives have become quasi-money, issued entirely by several of the largest private banks in the world. But these "quasi-money" also traded for ordinary money. And their turnover (and the fluctuations of this turnover, too!) Serve the money too. Central banks are not able to regulate or even predict the volume of the derivatives market. They are just beginning to learn this market at least to control.

In this analysis, the term "quasi-money" is used without any negative overtones. The fact that derivatives are a useful tool, primarily for risk management, is as if there is no doubt. Here are just a lot of this tool. And it goes, part of the money from the circulation of goods and services cannot but go to the stock market.

3. The reason for the deficiency number three: loan interest

To illustrate its action, consider such a model example. It is known (to whom it is not known to believe that this is so) that most of the money is released into circulation by commercial banks at the expense of the so-called money multiplier.

For clarity, we assume that all money is issued only by commercial banks, i.e. issued to businesses on credit. Suppose a loan at some time issued 1000 units of money at 10% per annum. For a period of 1 year. Let, for simplicity, the production cycle of our model economy is also a year. Then a year later, when it comes time to return the loan, banks will need to return 1,100 units. But in economics, only 1,000 units! Where to get another 100 units? There are only three basic options:

1. Someone must certainly go broke and give his 100 units to others (encouraging competition).

2. Good and wise banks will issue new loans amounting to 1,100 units for another year (and then another).

3. Banks part (but of course only a part) of their profits (obtained at the expense of loan interest) invest in the real economy.

In the first two options, there is a deficit of 100 units, which is closed either through bankruptcies or through new loans. In the latter version - also a deficit, but for a smaller amount. By the way, a curious particular consequence of this example. If all banks are state-owned and they direct all their profits to finance state budget spending, there will be no money shortage in the economy at the expense of loan interest. Those. in such a system consisting only of state-owned banks, the loan interest would no longer play the negative role of a vacuum cleaner sucking money from the real sector.

I in no way call for the nationalization of the banking system. But such a conclusion nevertheless suggests.

At first glance, the system that constantly withdraws some of the money from circulation is only a lending rate. The currency and stock markets in some of the current dynamics can be viewed as systems that simultaneously take money from the real sector and return it too.

But, this is if they do not grow. And these markets are constantly and very rapidly growing. Accordingly, for servicing the turnover in these markets it is constantly required more and more money that we take ... but from the same turnover of goods and services. And about the investment. In order to invest something (return to the economy) you need to first “earn” something (steal, win, take somewhere in general), in other words, you must first take this money from the real economy. Well, it is clear that you can only return what you took, or less (any investors do not forget about themselves, too).

Accumulations

If someone does not know the population in our country is rich. According to the assessment of the Dean of the Faculty of Economics of Moscow State University, Auzan A., in the hands of the population, 31 trillion. rubles. Of course, some of this money is about 17 trillion. rubles is in bank accounts and thus does not disappear from circulation. Where are the rest? Apparently anywhere (in stockings, under mattresses, in bank cells, translated into foreign currency) - but they are withdrawn from circulation. Let me remind you again, the total money in circulation (unit M2) is also about 30 trillion. rubles.

All this taken together takes a considerable part of the money from the circulation of goods and services. And what is no less significant - no one can exactly calculate or predict how much money flows there.

Let's look at the problem from the other side.

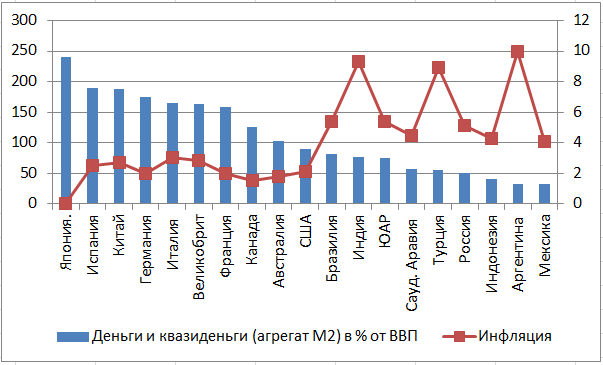

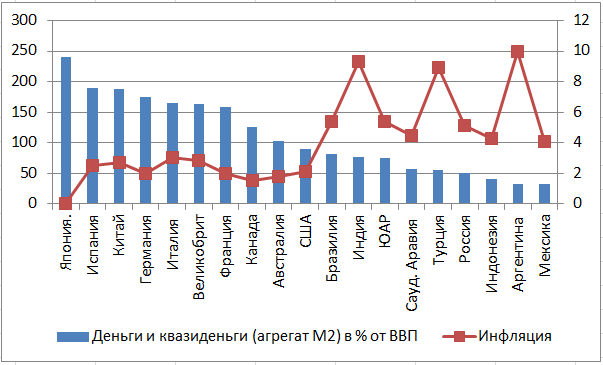

In economics, the term monetization is known. It is the ratio of the amount of money in the economy (the so-called money supply or aggregate M2) to GDP (gross domestic product).

In the Russian Federation, this ratio in recent years is constantly growing and is now around 50%.

And, for example, in Japan it is 170%, in China 180%, in the EU countries, on average, about 100%. Even in India, it is 85%. And we have only 50%. Is it a little lubrication? Is that why Chinese economy is growing much faster than our economy?

And inflation? How to be with her? If you issue more money, won't inflation grow proportionally? With a clear conscience, I will say - since I do not pretend to the position of Chairman of the Central Bank, I have the right to say - I don’t know.

But look at the statistics.

The volume of money supply in the Russian Federation from 2009 to 2015 increased by about 2.7 times.

The volume of GDP, expressed in purchasing power parity, during the same time increased by about 1.3 times, and if at constant prices in 1990, then by 1.15 times. For some reason, it seems to me that the latter figure more accurately reflects the actual growth in the production of goods and services.

Thus, the growth of money supply was 2.3 times greater (2.3 = 2.7 / 1.15) growth in the production of goods and services.

And if the entire increase in the money supply went on the growth of inflation, then the average inflation in these years would have to be more than 15% each year. I write more because, in addition to the growth of the money supply, there are still many non-monetary factors of inflation growth, say the growth of tariffs of natural monopolies.

At the same time, according to official data, inflation in these years fluctuated in the range of 8-12%. Those. was below the “calculated” minimum value.

And there are statistics and this kind. In all countries where the monetization ratio is 100 percent or more - inflation does not exceed 2-3% or there is deflation in general (which of course is also bad). But wherever inflation is 10 percent or more, wherever central banks and governments are waging an irreconcilable struggle — the coefficient of monetization, as in Russia, is noticeably less than 100%. And I did not see any exceptions to this rule. Very indicative pattern.

In conclusion about crises and economic cycles. It is known (well, this is something that everyone knows for sure) that periods of economic growth alternate with periods of recession. For the purposes of monetary analysis, this periodicity is primarily important in the following circumstance.

During periods of growth, an increase in the amount of loans is observed. Money becomes "easy." They are easy and take a loan, and relatively easy to earn. There is no shortage of money during these periods. On the contrary, there is an excessive supply, which inflates different bubbles (in the stock market, in the real estate market, etc.). Money in these periods pulls the economy up. But the reasons for their scarcity do not disappear anywhere, and inevitably another crisis occurs, which, as a rule, leads to an avalanche effect: less money - less goods - less demand - even less money, etc. And unfortunately, it is always possible to interrupt this circle only by overcoming the tendency to increase the shortage of money. And nothing else.

Let's sum up.

1. There are no economic theories that allow one to determine more or less reliably how much money the economy needs, first of all the real sector of the economy needs. This is largely due to the large volatile and unpredictable financial market.

2. Growing currency and stock markets are dragging off ever-increasing amounts of money.

3. The data on monetization of the economy directly indicate that our economy does not have enough money.

I can supplement these macroeconomic considerations with observations from life. The lack of money in particular is expressed in the fact that we see what is called a seller’s market in the credit market. Banks are now less and less willing to give loans to small and medium businesses. They are not interested. It comes to ridiculous (personal practice), they say well, we are ready to give you a loan, but there must be absolutely liquid collateral. For example, if you put a deposit in our bank for the amount of the loan, which would be the official security for the loan, then we would give the loan. And if earlier a loan under a deposit was such a demanded circuit engineering, now it’s not shy to offer it as a real loan deal. And some managers of large state-owned banks directly state that it is not necessary to credit small and medium businesses at all.

Of course, an amateur can argue about the terms. And to call the above processes not a shortage of money, but otherwise. But the essence of this does not change: without enough money in circulation, the economy does not work. And the tools designed to help the real economy, in particular, the currency and stock markets, the banking sector - take more than they give money into circulation.

I call this the lack of money and the property inherently (internally) inherent in the modern financial system.

- Our economy has always lacked money for reforms all the time.

- More money (to give, print, issue, etc.) can not be as soon as inflation increases. And one of the main tasks of the government (first of all) is to prevent inflation from rising.

')

Further the first point of view will be justified. And that's why.

Let us use an analogy for the beginning. Many economists call money - a lubricant for the economy. Those. The economy is like a mechanism in which its gears constantly need lubrication. There will be no lubrication - the mechanism will jam.

And if money performed only the function of lubrication, and only lubricated the production and consumption of goods and services (that is, they would be used solely as a measure of cost and means of payment in the real sector of the economy), then it would be easier to determine their required amount.

So, economists, for example, know the following formula:

M = (C-B + P-VP) / V;

Where M - the required amount of lubricant, to blame, money in circulation;

C - the sum of the prices of goods and services sold with payment immediately;

B - the sum of the prices of goods and services sold on credit;

P - received payments (from transactions of previous periods);

VP - tests of various kinds;

V is the velocity of money.

Framed, counted, “typed” - the gears are spinning. But, alas, money is not only a lubricant, it is also a commodity that is “lubricated” by the financial sector, above all the production and trade in goods and services, above all the stock market.

1. Money is a commodity

There is a special market for money as a commodity - this is the currency market. And if someone thinks that in this market foreign currency is bought / sold only in order to make cross-border transactions and, of course, to save a little in reserve, then he is mistaken.

The total volume of trade in the foreign exchange market of the whole world is approximately 50 times higher than the total volume of the world turnover of goods and services. In Russia, of course, these numbers are not so different. But even here, with an average monthly volume of imports of $ 20-25 billion on Forex, only transactions with the calculation of tomorrow (in a ruble-dollar pair) up to $ 5 billion are made per day. Those. up to 150 billion dollars a month. At least 6 times the volume of imports. And these are transactions that bring a rather big profit (do everyone remember Soros?), And our lubricant (money from turnover) is constantly leaking to this market.

Continuing the analogy - the engine controller of your car began to trade with other cars with oil available in the engine. And from this you profit went, but is it good from this trade to your motor?

We state. The foreign exchange market is largely speculative and a significant portion of the money supply is constantly drawn on it .

For reference: the total money supply in the Russian Federation (M2 unit) is about 30 trillion. rubles.

2. Money and stock market

In money, turnover is expressed and money is used not only to pay for goods and services, but also in the trading of financial instruments. In other words, besides the market for goods and services, there is also a securities market. And the turnover on it also requires its own portion of money.

Of course, on the one hand stocks, bonds, etc. financial instruments are a means (must be a means) of attracting investment in the real economy. Those. It can be said a cure for a lack of money in circulation. But let's see how much of this "medicine" there is in the world. Is it too much? We type in the search for "stock market capitalization" and get - the capitalization of the share market in the Russian Federation in recent years is at the level of 23 trillion. rubles, which is 30% of Russia's GDP. They say this is not enough. Maybe for something a little. But in order to take on part of the money supply is not so little, if we recall the value of the money supply in the Russian Federation - about 30 trillion. rubles. Comparable numbers.

However, the stock market like no other has a global character. The world's largest New York Stock Exchange has a market capitalization of 17 trillion dollars, already dollars naturally. The capitalization of the 10 largest stock exchanges in the world is about 45 trillion. dollars. And there are derivatives.

You could even say, THERE ARE MORE DERIVATIVES (these are derivative securities on securities). They were released on a fantastic amount of about 1.5 quadrillion dollars (quadrillion is a million billion). The global volume of the derivatives market is about 700 trillion dollars, while the sum of all the GDP of all countries of the world is 10 times less.

In fact, derivatives have become quasi-money, issued entirely by several of the largest private banks in the world. But these "quasi-money" also traded for ordinary money. And their turnover (and the fluctuations of this turnover, too!) Serve the money too. Central banks are not able to regulate or even predict the volume of the derivatives market. They are just beginning to learn this market at least to control.

In this analysis, the term "quasi-money" is used without any negative overtones. The fact that derivatives are a useful tool, primarily for risk management, is as if there is no doubt. Here are just a lot of this tool. And it goes, part of the money from the circulation of goods and services cannot but go to the stock market.

3. The reason for the deficiency number three: loan interest

To illustrate its action, consider such a model example. It is known (to whom it is not known to believe that this is so) that most of the money is released into circulation by commercial banks at the expense of the so-called money multiplier.

For clarity, we assume that all money is issued only by commercial banks, i.e. issued to businesses on credit. Suppose a loan at some time issued 1000 units of money at 10% per annum. For a period of 1 year. Let, for simplicity, the production cycle of our model economy is also a year. Then a year later, when it comes time to return the loan, banks will need to return 1,100 units. But in economics, only 1,000 units! Where to get another 100 units? There are only three basic options:

1. Someone must certainly go broke and give his 100 units to others (encouraging competition).

2. Good and wise banks will issue new loans amounting to 1,100 units for another year (and then another).

3. Banks part (but of course only a part) of their profits (obtained at the expense of loan interest) invest in the real economy.

In the first two options, there is a deficit of 100 units, which is closed either through bankruptcies or through new loans. In the latter version - also a deficit, but for a smaller amount. By the way, a curious particular consequence of this example. If all banks are state-owned and they direct all their profits to finance state budget spending, there will be no money shortage in the economy at the expense of loan interest. Those. in such a system consisting only of state-owned banks, the loan interest would no longer play the negative role of a vacuum cleaner sucking money from the real sector.

I in no way call for the nationalization of the banking system. But such a conclusion nevertheless suggests.

At first glance, the system that constantly withdraws some of the money from circulation is only a lending rate. The currency and stock markets in some of the current dynamics can be viewed as systems that simultaneously take money from the real sector and return it too.

But, this is if they do not grow. And these markets are constantly and very rapidly growing. Accordingly, for servicing the turnover in these markets it is constantly required more and more money that we take ... but from the same turnover of goods and services. And about the investment. In order to invest something (return to the economy) you need to first “earn” something (steal, win, take somewhere in general), in other words, you must first take this money from the real economy. Well, it is clear that you can only return what you took, or less (any investors do not forget about themselves, too).

Accumulations

If someone does not know the population in our country is rich. According to the assessment of the Dean of the Faculty of Economics of Moscow State University, Auzan A., in the hands of the population, 31 trillion. rubles. Of course, some of this money is about 17 trillion. rubles is in bank accounts and thus does not disappear from circulation. Where are the rest? Apparently anywhere (in stockings, under mattresses, in bank cells, translated into foreign currency) - but they are withdrawn from circulation. Let me remind you again, the total money in circulation (unit M2) is also about 30 trillion. rubles.

All this taken together takes a considerable part of the money from the circulation of goods and services. And what is no less significant - no one can exactly calculate or predict how much money flows there.

Let's look at the problem from the other side.

In economics, the term monetization is known. It is the ratio of the amount of money in the economy (the so-called money supply or aggregate M2) to GDP (gross domestic product).

In the Russian Federation, this ratio in recent years is constantly growing and is now around 50%.

And, for example, in Japan it is 170%, in China 180%, in the EU countries, on average, about 100%. Even in India, it is 85%. And we have only 50%. Is it a little lubrication? Is that why Chinese economy is growing much faster than our economy?

And inflation? How to be with her? If you issue more money, won't inflation grow proportionally? With a clear conscience, I will say - since I do not pretend to the position of Chairman of the Central Bank, I have the right to say - I don’t know.

But look at the statistics.

The volume of money supply in the Russian Federation from 2009 to 2015 increased by about 2.7 times.

The volume of GDP, expressed in purchasing power parity, during the same time increased by about 1.3 times, and if at constant prices in 1990, then by 1.15 times. For some reason, it seems to me that the latter figure more accurately reflects the actual growth in the production of goods and services.

Thus, the growth of money supply was 2.3 times greater (2.3 = 2.7 / 1.15) growth in the production of goods and services.

And if the entire increase in the money supply went on the growth of inflation, then the average inflation in these years would have to be more than 15% each year. I write more because, in addition to the growth of the money supply, there are still many non-monetary factors of inflation growth, say the growth of tariffs of natural monopolies.

At the same time, according to official data, inflation in these years fluctuated in the range of 8-12%. Those. was below the “calculated” minimum value.

And there are statistics and this kind. In all countries where the monetization ratio is 100 percent or more - inflation does not exceed 2-3% or there is deflation in general (which of course is also bad). But wherever inflation is 10 percent or more, wherever central banks and governments are waging an irreconcilable struggle — the coefficient of monetization, as in Russia, is noticeably less than 100%. And I did not see any exceptions to this rule. Very indicative pattern.

In conclusion about crises and economic cycles. It is known (well, this is something that everyone knows for sure) that periods of economic growth alternate with periods of recession. For the purposes of monetary analysis, this periodicity is primarily important in the following circumstance.

During periods of growth, an increase in the amount of loans is observed. Money becomes "easy." They are easy and take a loan, and relatively easy to earn. There is no shortage of money during these periods. On the contrary, there is an excessive supply, which inflates different bubbles (in the stock market, in the real estate market, etc.). Money in these periods pulls the economy up. But the reasons for their scarcity do not disappear anywhere, and inevitably another crisis occurs, which, as a rule, leads to an avalanche effect: less money - less goods - less demand - even less money, etc. And unfortunately, it is always possible to interrupt this circle only by overcoming the tendency to increase the shortage of money. And nothing else.

Let's sum up.

1. There are no economic theories that allow one to determine more or less reliably how much money the economy needs, first of all the real sector of the economy needs. This is largely due to the large volatile and unpredictable financial market.

2. Growing currency and stock markets are dragging off ever-increasing amounts of money.

3. The data on monetization of the economy directly indicate that our economy does not have enough money.

I can supplement these macroeconomic considerations with observations from life. The lack of money in particular is expressed in the fact that we see what is called a seller’s market in the credit market. Banks are now less and less willing to give loans to small and medium businesses. They are not interested. It comes to ridiculous (personal practice), they say well, we are ready to give you a loan, but there must be absolutely liquid collateral. For example, if you put a deposit in our bank for the amount of the loan, which would be the official security for the loan, then we would give the loan. And if earlier a loan under a deposit was such a demanded circuit engineering, now it’s not shy to offer it as a real loan deal. And some managers of large state-owned banks directly state that it is not necessary to credit small and medium businesses at all.

Of course, an amateur can argue about the terms. And to call the above processes not a shortage of money, but otherwise. But the essence of this does not change: without enough money in circulation, the economy does not work. And the tools designed to help the real economy, in particular, the currency and stock markets, the banking sector - take more than they give money into circulation.

I call this the lack of money and the property inherently (internally) inherent in the modern financial system.

Source: https://habr.com/ru/post/297212/

All Articles