The phenomenon of virtual communication via messengers is only gaining momentum

When Facebook swallowed up WhatsApp for $ 22 billion as a result of a deal in 2014, the media simply exploded from speculation, what was the reason for this very expensive acquisition. Then WhatsApp could boast an army of 400 million active users. Now, 21 months after the takeover announcement, this number jumped to 900 million. With a growth rate of 24 million users per month, WhatsApp became just a user growth engine.

Interesting plot twist:

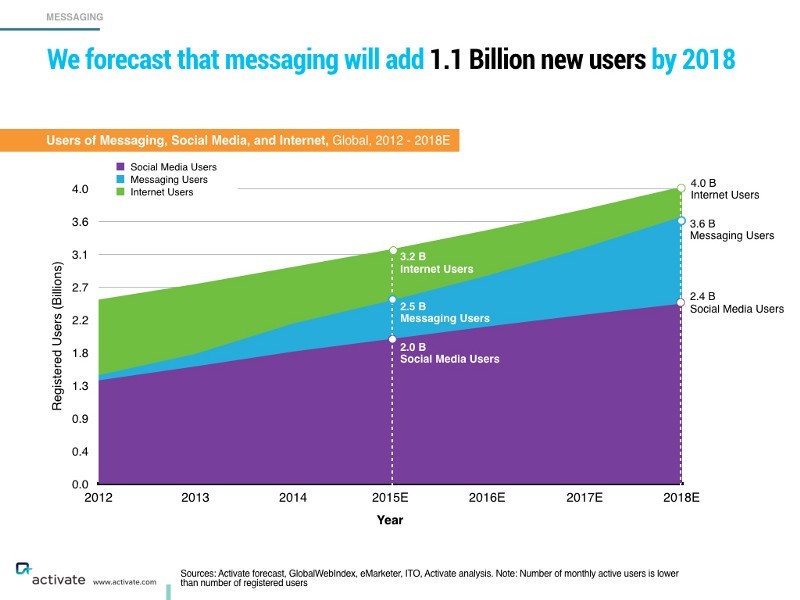

900 million active WhatsApp users every month are even less than half of the users who send messages on our planet. Today, 2.5 billion people worldwide use messaging applications, which means that such applications are used by 25% more people than social networks (if we talk about registered users). More surprisingly, the growth of messaging has just begun, and by 2018 an increase in the number of users is expected to reach 1.1 billion. The conclusion here is: messaging is much more ubiquitous than what the WhatsApp statistics indicate.

')

Means of messaging is already more popular than social networks, and their growth will not stop in the near future.

The section on messaging in my presentation for Activate Tech & Media Outlook 2016 is the result of a deep analysis that took place over two months. Creating this section, I had to dig deep to find answers to those questions that would determine the specifics of these opportunities. Where did these 2.5 billion users come from? Where else is 1.1 billion to come in the future? What will they prefer - WhatsApp or its competitors? How is the number of users converted into profit growth? The results of this analysis turned out to be more unambiguous than any of our team could have imagined. Our most unexpected discoveries were the following:

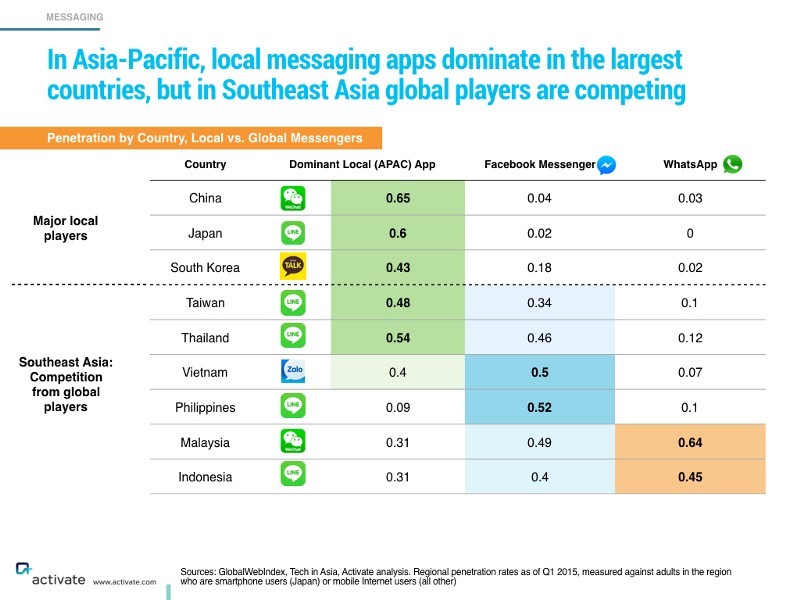

1. While messengers from China, Japan and South Korea have the largest number of users, Facebook Messenger and WhatsApp are preparing for action in Southeast Asia.

The whole world will not be able to cover. Large Asian markets are already crowded with local players, satisfying the size of the market. WeChat dominates among Chinese instant messengers, with a monthly total of 600 million active users and 65% of application entries from Chinese territory. Similarly, the Japanese instant messenger LINE reports about 211 million monthly active users and 60% of logins from Japan. In South Korea, a similar situation - there is dominated by KakaoTalk.

In Southeast Asia, the situation is slightly different. In Vietnam, the Philippines, Malaysia and Indonesia, Facebook Messenger and WhatsApp took the lead despite the geographical proximity of these countries to the main players in the Asia-Pacific region. The Japanese instant messenger LINE still dominates in Taiwan and Thailand, but in fact the gap between LINE and Facebook is not that big and continues to shrink.

Facebook Messenger and WhatsApp are ahead of major Asian players in Southeast Asia.

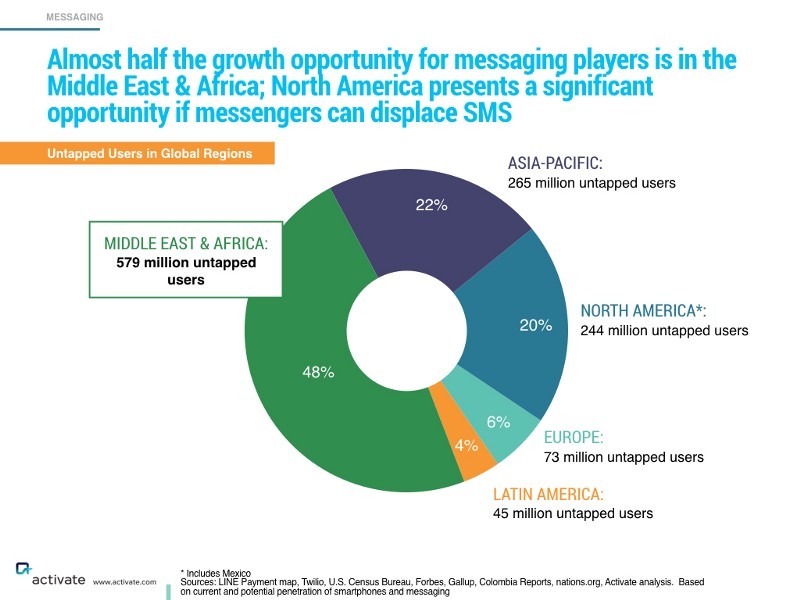

2. The most significant growth market for instant messengers is the Middle East and Africa, where Facebook Messenger and WhatsApp also have an advantage.

Nearly half of the growth in the number of users by messengers is provided by the Middle East and Africa. The penetration rate of smartphones in the region is traditionally low (21%), while in other regions these figures vary between 70-81%. Since smartphones are becoming increasingly popular in the Middle East and Africa, the number of users needing cheap and convenient messaging tools is growing. Among all those who currently have access to smartphones in this region, WhatsApp has a penetration rate of 65%, and Facebook Messenger comes second with a figure of 42%. Apparently, these applications will become popular among new smartphone users in this region.

The penetration rate of smartphones in the Middle East and African countries is gaining momentum, and with it the popularity of instant messengers is increasing.

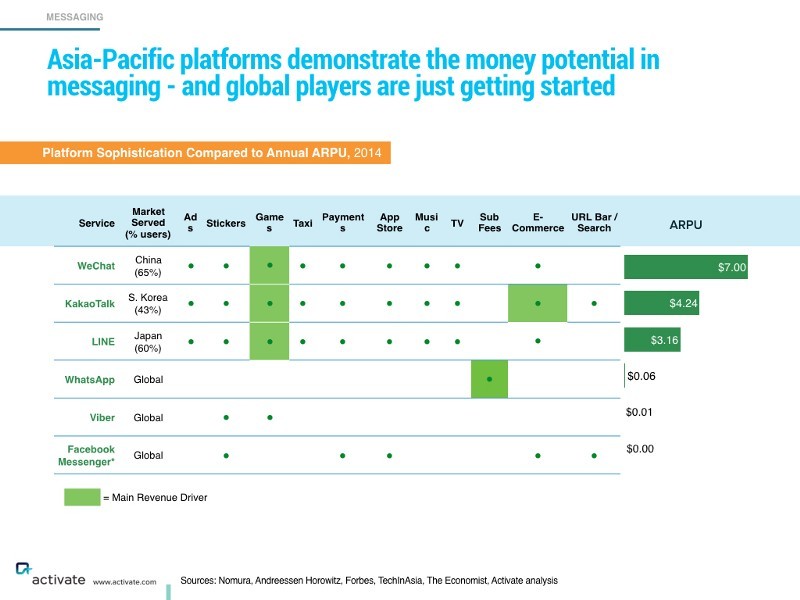

3. The growth in the number of users is converted into revenue through additional services that are add-ons to messaging platforms.

Major players in Asia - WeChat, LINE and KakaoTalk - have already begun to increase profits by running applications and services on top of messaging platforms. Almost everything a smartphone user would do in the original application can now be done in the messenger: play games, order a taxi, make money transfers, listen to music, watch TV shows, buy goods online, and so on.

The average income per user is very high for those instant messengers who offer all these services: $ 7.00 for WeChat, $ 4.24 for KakaoTalk and $ 3.16 for LINE. The main income comes from games, as well as from e-commerce (especially for KakaoTalk). For comparison, WhatsApp earns $ 0.06 per user, and this money comes exclusively from the monthly fee. The advantage of the represented layers of the platform is huge, and now that Facebook Messenger has launched an application store and a virtual assistant “M” inside its service, it seems that the key to a considerable profit from the messengers has been found.

Local players in the Asia-Pacific region quickly found a way to streamline their income from their services.

Source: https://habr.com/ru/post/296880/

All Articles