What should be the ideal startup presentation? (final part)

Everslide translated a detailed study from the DocSend project that answers the question “what should be the ideal start-up presentation?”. Number of slides, presentation content, design, etc.

The first part: megamozg.ru/company/everslide/blog/21554

What you need to know about the timing?

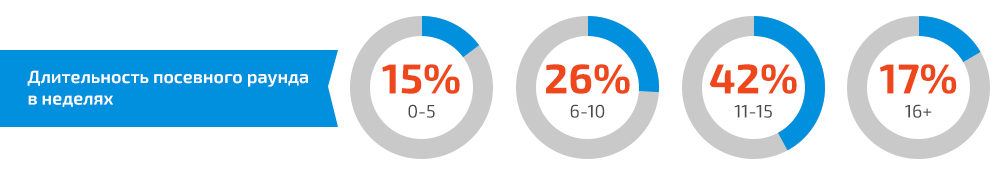

How long does it take to search for investment at the seed stage? According to the DocSend study, an average of 12.5 weeks. However, there are many deviations from this value. 20% of companies attracted investments of 20 weeks and longer, but the other 20% - 6 weeks and less. The longest period was 40 weeks.

')

Some companies gave up after 6.7 weeks of unsuccessful searches. Perhaps these companies are simply not patient - companies that have successfully found an investment said that the search for investments took longer than they expected. We asked study participants to evaluate the duration of the investment search period based on their expectations. On a scale of 1 to 5, where 3 was “expected,” and 5 was “sooo long,” the average was 3.6.

Of course, patience for startups is important, but it is also important to know when to retreat, revise a project, or close it to prevent losses. Three-quarters of companies that failed to attract investment, try again and the average time to restart 8.9 weeks - time for analyzing feedback and correcting errors.

Aim for quality, not quantity, investors

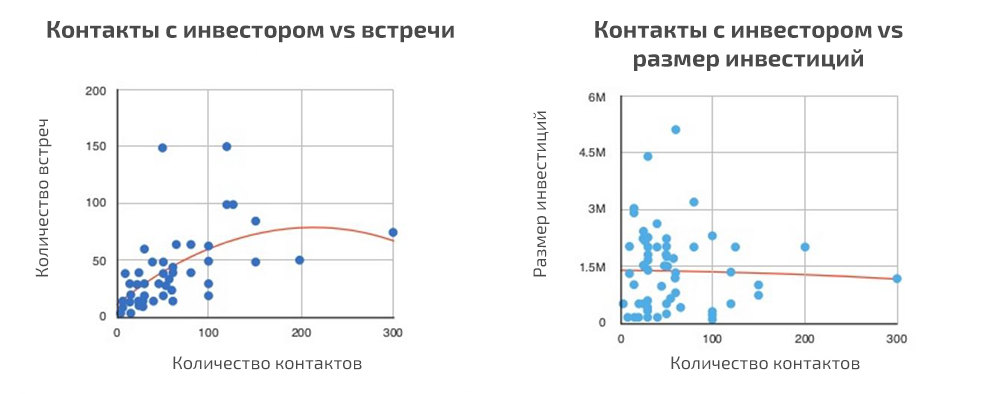

Many people think that the more contact with investors, the higher your chances of receiving money. Unfortunately, this is not the case. Of course, the more contacts, the more meetings you can have.

The more contacts you make, the more meetings you will have, but this is not a necessary condition for receiving money. Focus on the quality of the investors you selected for the meeting. The graph shows the dependence of the number of contacts and the size of attracted investments.

Note: in the above results, an entrepreneur could meet several times with one investor, which means there could be more meetings than investors.

What to do and when to give up?

Create a list of 30 investors who, in your opinion, will best appreciate your presentation. Many startups, from our analysis, contacted only 20-30 investors before the end of the round.

If none of this list has agreed to invest, it is possible that something is wrong with your presentation. Ask them about the reasons and make the appropriate changes before meeting with other investors. If you could not find an investor after 100 contacts, then you should seriously consider your project. Some companies found investors after 100 contacts, but this is very rare and time consuming.

How much and from whom to take?

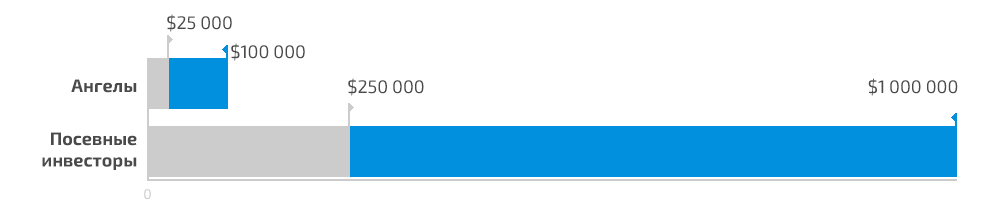

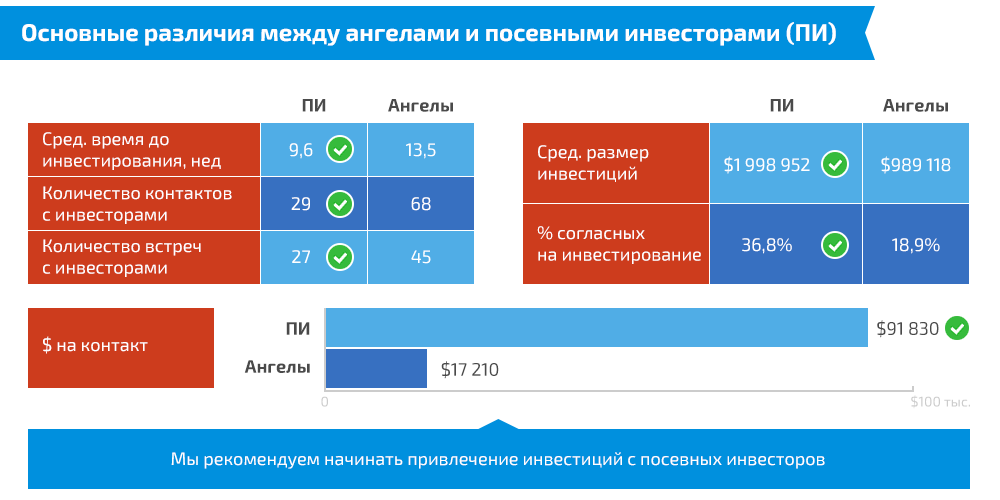

Earlier, we mentioned that the average size of attracted investments is $ 1.3 million, among the companies included in the study. However, the quantity and conditions varied greatly from how investments were attracted, from angels or from seed investors.

Investor angels are wealthy businessmen who invest from $ 25,000 to $ 100,000. Sowing investors are small venture capital funds that invest on a regular basis. These investors usually invest from $ 250 thousand to $ 1 million.

Angels vs Sowing Investors

A few key points:

+ Angels: Usually, angels are managers, so they may have a personal interest in your project. Since in one round you may have several angels, this gives you more support.

+ Sowing investors: These are professional investors who invest heavily, so they have a great financial interest in your success. You can count on additional investments in the future, if necessary.

- Angels: Angels have a busy life and unstable capital, so you cannot be guaranteed to rely on the regular flow of funds and support.

- Sowing investors: Investors may begin to control your project, but they may not be able to offer you the best solution to your questions. Also, such companies run several projects simultaneously, which makes it difficult for you to get their attention.

Rounds: Less, but better

Basically, an angel becomes a company manager more often than an investment fund. According to David S. Rose, an angel investor can finance about 1,500 startups each year, while an investment fund is about 50,000. This difference arises, in part, because the fund invests on average in each 400 start-up, and an angel - in each 40. These figures are approximate, but they show that if you want to attract the attention of an investment fund, your presentation should be outstanding and you should know the market "from and to".

According to DocSend, even though the angel becomes the leader of a startup more often, startups managed by investment funds work much more efficiently. If you can attract investments from an investment fund, then you can get twice as much money in a significantly shorter time. You will also need to contact only a much smaller number of investors.

Rounds "A" and sowing campaign

Rounds "A" is significantly less than sown. According to DocSend statistics, only every 9 sowing round goes into round “A”. Although, we still have not a lot of data, but we have already managed to collect some statistics about the differences between rounds "A" and sowing.

If you have the opportunity and need to find an investment of the round "A", it will be easier, take less time, more investment and you need fewer investors than in the sowing round.

Popular markets for financing

Business models that address consumer needs and other economic conditions are most successful in fundraising. Among the volatile mass of trends in the past 12 months, 4 types of companies that have had the greatest success in sowing investments are distinguished: consumer goods, B2B, marketplace (aggregators) and technological startups (hardware).

On average, aggregators received more investment in the sowing round. A successful aggregator is quite rare, but if successful, it surpasses Uber or Airbnb. Finding investment for start-up aggregators takes a lot of time and, despite the fact that companies are willing to finance such projects, it takes a lot of time to convince the investor that your project will be successful.

A reminder - seven tips

Finding investments for your startup may not be transparent and frustrating, especially when the future of your project is at stake. Use these tips to increase your chances of success.

- No more than 20 slides. Remember that the average viewing time is 3 min. 44 sec.

- Finding investments at the seed stage will take much longer than you think. Do not despair if there is no result for several months.

- Try searching among private investors, because they can give you funding for just a few meetings.

- More meetings don't mean more money. Focus on meeting investor quality. Quality, not quantity.

- It's easier for you to meet with 20-30 investors and much more difficult if there are hundreds of investors.

- Engage your presentation, bring it to perfection. Remember that the optional financial part is the most viewed.

- Do not include the terms of the transaction in the presentation, and inform in person. Conditions may vary from investor to investor.

Source: https://habr.com/ru/post/296756/

All Articles