6 convenient mobile banks for business

Overview of mobile banks for business from " I love IP "

At the beginning of the year we published a rating of the best banks for business . Since then, several banks have lost their licenses, and new players have appeared on the market. Today we have selected six banks that have convenient mobile applications for entrepreneurs.

Additionally, for each bank, we calculated the cost per year. It includes a fee for opening a current account, connecting an Internet bank, monthly maintenance and sending ten payments.

')

We hope this article will help you choose the appropriate bank for your business.

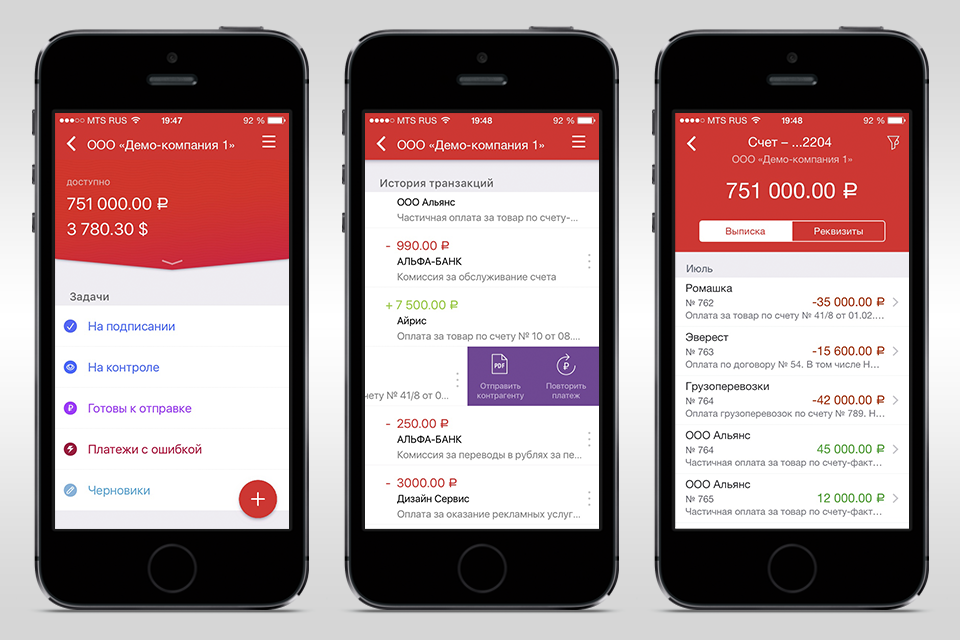

Alfa Bank

Mobile Bank Alfa Business Mobile works on iPhone, iPad, smartphones and Android tablets. You can use the application immediately after connecting the Internet bank (the login and password are the same). In the free version, you can view the account balance, get statements and information about the bank. To send payments, you must activate the Mobile Payment service (59 rubles per month).

In October, Alfa-Bank fully updated Alfa-Business Mobile. Now on the main screen there is a list of tasks. These are the payments to be signed or sent, as well as errors and drafts.

In the tape you can see the entire history of operations, including payments that are scheduled for transfer. (This is money that came into the bank's correspondent account, but has not yet been credited to the settlement account.)

To pay the invoice to the counterparty, you can repeat the payment from the tape or fill it with new details. Another useful feature is sending PDFs of executed bills via email.

Cost per year - 14,778 rubles.

Opening an account - 0

Connecting Alpha Business Online - 990 rubles.

Monthly service at the “Startup” tariff - 1090 rubles. (13 080 rubles per year)

Up to 5 payments via Internet banking per month - free of charge

Alpha Business Mobile - 59 rubles. per month (708 rubles per year)

Download in the App Store , Google Play (there is a demo version)

Bank Point

Bank Point is a new service from the creators of Bank24.ru. He appeared at the end of 2014 after the license was revoked from the bank and his team moved to Otkritie FG. Now Point is a separate branch of one of the largest private financial groups in Russia.

Mobile Bank Points works on iPhone, iPad, smartphones and tablets based on Android. In addition to features such as viewing available balance or account transactions, in the application you can create a payment by photo and invoice the counterparty. There is analytics on customers, suppliers and costs, as well as the ability to check the TIN partner.

Cost per year - 15,000 rubles.

Opening an account - 0

Internet Bank Connection - 0

Monthly service at the “To Beginning” tariff - 1250 rubles. (15 000 rub.)

Up to 5 payments via Internet banking per month - free of charge

Download in the App Store , Google Play (there is a demo version)

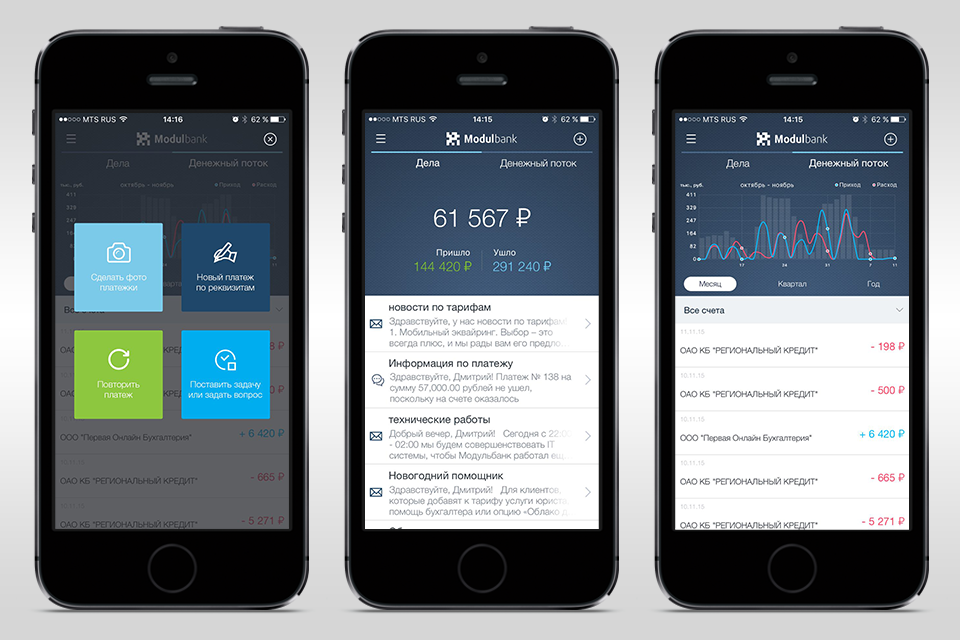

Modulbank

Modulbank is a new service for entrepreneurs based on Regional Credit Bank. Modulbank has a tariff without a monthly fee, so it is best suited for start-up entrepreneurs.

Mobile Bank works on iPhone, iPad, smartphones and Android tablets. In the application, you can view the account balance and transaction history, send payments, manage accounts and cards. There is a chat for quick communication with an assistant, an accountant and a lawyer (connect separately).

Cost per year - 900 rubles.

Opening an account - 0

Internet Bank Connection - 0

Monthly service at the “Starting” tariff - 0

The cost of one payment order - 90 rubles.

Download on the App Store , Google Play

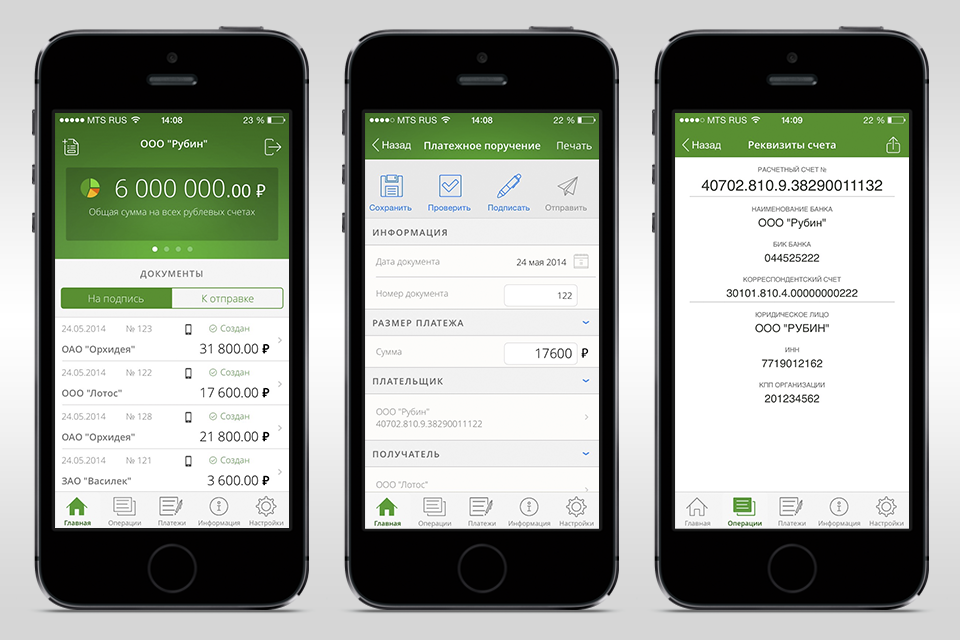

Sberbank

The Sberbank Business Online application works only on iPhone and iPad. The mobile bank has all the necessary functions: viewing the balance, transaction history, creating payments using templates (counterparties who have already made payments).

Cost per year - 19 650 rubles.

Opening an account - 2400 rubles.

Internet bank connection - 960 rubles.

Release of the electronic key - 990 rubles.

Monthly account maintenance - 600 rubles. (per year - 7200 rub.)

Monthly Internet banking service - 650 rubles. (per year - 7800 rub.)

The cost of one payment order - 30 rubles.

Download in the App Store (there is a demo version)

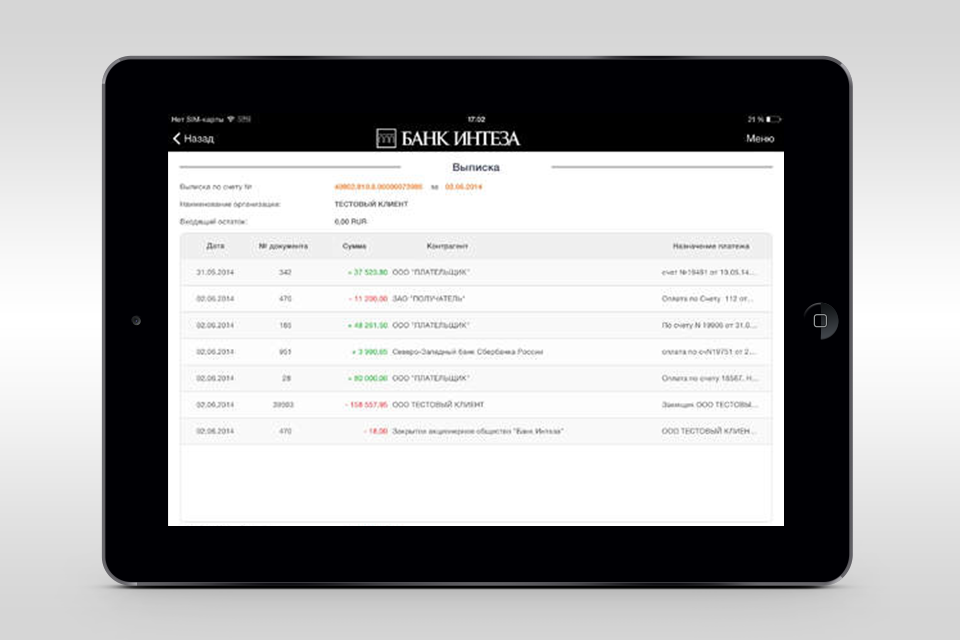

Bank of Intesa

Banca Intesa mobile client works only on iPads and Android tablets. In the application, you can view the available balance, account statements, as well as create payments using templates and free details.

Cost per year - 9945 rubles.

Opening an account - 1700 rubles.

Internet bank connection - 450 rubles.

USB key release - 375 rubles.

Monthly account maintenance - 0

Monthly Internet Banking service - 600 rub. (per year - 7200 rub.)

The cost of one payment order - 22 rubles.

Download in the App Store , Google Play (there is a demo version)

Raiffeisenbank

ELBRUS Mobile works on iPhone, iPad, Android smartphones and tablets. There is only a paid version, 190 rubles. per month.

In the application, you can view the available balance, transaction log, send account details via e-mail and SMS, create payments using templates.

Cost per year - 12,840 rubles.

Opening an account - 0

Internet bank connection - 0 rub.

Monthly service at the tariff "Start" - 880 rubles.

Mobile Bank Elbrus Mobile - 190 rubles. per month (2280 rubles)

Up to 3 payments via online banking per month - free of charge

Download in the App Store , Google Play (there is a demo version)

Mobile applications for business are still at the Bank of Moscow, Promsvyazbank and UBRD. But they can only view transactions, without sending payments.

* * *

If you are planning to become an entrepreneur and want to open a current account in Modulbank, we will prepare all the documents for free. Read more about the action on our website .

Source: https://habr.com/ru/post/296272/

All Articles