Cloud computing market exceeds expectations (Part 1)

Even a general increase in start-ups began to go "no" in Silicon Valley, but Amazon, Microsoft and Google all as one report on the excellent profits for the last quarter, and they are making big bets on cloud computing.

What exactly do these companies sell? Who is the buyer? And why is Amazon, a company that was not in the technology industry just a decade ago, now beats all competitors?

')

Here's how things are with the cloud business.

Why is everyone chasing cloud computing

The most important concept in the field of cloud computing is “large scale”.

To support their websites and services, Amazon, Microsoft and Google have built a wide computing infrastructure. The data centers of these companies are much larger and more efficient than any server room or data center that most other companies can build or support.

And now the giants are handing over some of these capacities to developers and companies around the world. A developer or company can simply pay with a credit card and get access to unlimited computing power.

This means that the software can operate on a much larger scale, for less money and with a higher level of availability and performance. And no one needs to worry about the content of the data center.

At first glance, all the major players offer the same basic set of services for developers.

Amazon, Google, Microsoft, and most other cloud players offer two different cloud layers:

- Infrastructure as a Service, or “IaaS”, allows you to configure virtual servers and storage systems in someone else's data center. This is the most basic layer.

- Platform as a Service, or "PaaS" - is a set of tools and services that facilitate the developers of the process of creating applications and relieve from worries about the servers with which they work.

(There is a third layer, “Software as a Service” or SaaS, which works with application software such as Salesforce sales and marketing products or competing Microsoft Office 365 and Google At Work products. All of these are cloud products, but usually when it comes to "cloud computing", people do not mean just them.)

The main action strategy for all cloud computing providers is to make these clouds suitable for both independent developers and large companies.

Developers can start by using a single application, but as their business grows, the need to use the cloud grows.

The more clients a cloud platform gets, the more servers it can afford to add. The more servers, the greater the savings due to growth, so that the company can offer customers lower prices for more reliable and enterprise-friendly features. The lower prices and better products, the more customers and users who want to go to the cloud.

Amazon calls this the "virtuous cycle."

Amazon first began to develop cloud services ...

... and this is exactly what gives him a competitive advantage.

Amazon's web services are the most popular, taking their origins from the 2006 experiment approved by Jeff Bezos and becoming part of a company that will generate at least $ 7 billion in revenue this year.

"This is a script in the spirit of the tape" The field of his dreams, "- said Ed Anderson (Ed Anderson), vice president of cloud services research at Gartner. "They created a product, and they all came down on it."

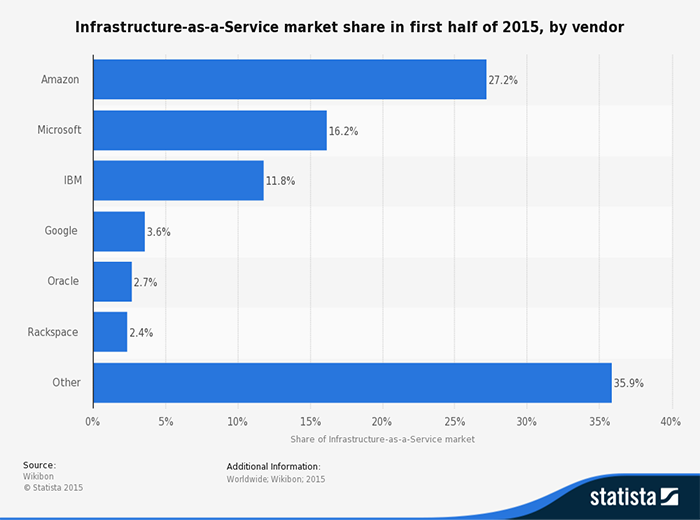

This chart from Statista (which uses Wikibon statistics) shows Amazon’s dominance in IaaS:

When AWS was just launched, clients were offered a set of core infrastructure services: The Elastic Compute Cloud (EC2) for virtual servers. A little later, Amazon Simple Storage Service (or S3) was added to store data.

Initially, Amazon Web Services was primarily used by small developers as a cheap way to test different things or manage a simple web site.

But many of those customers (including Netflix, Airbnb, and later Slack) went from managing small experimental applications on Amazon Web Services to what made AWS the core of their growing business.

“Amazon’s early take-off was due to developers who were creating cool new applications,” said Forrester Research chief analyst Dave Bartoletti.

This trend has begun Amazon's virtuous cycle. With the revenue that first customers brought, Amazon was able to invest in more functions for enterprises and provide better quality services that could work with large applications, going beyond start-ups and experiments.

Today, large companies such as Comcast, Capital One, and even the Central Intelligence Agency of the United States are Amazon Web Services clients using services for at least some of their computing infrastructure.

A long lead by Amazon is a major success factor. Since Amazon’s virtuous cycle lasts longer than anyone else, the company has the advantage of offering a wider range of features and scale than its competitors.

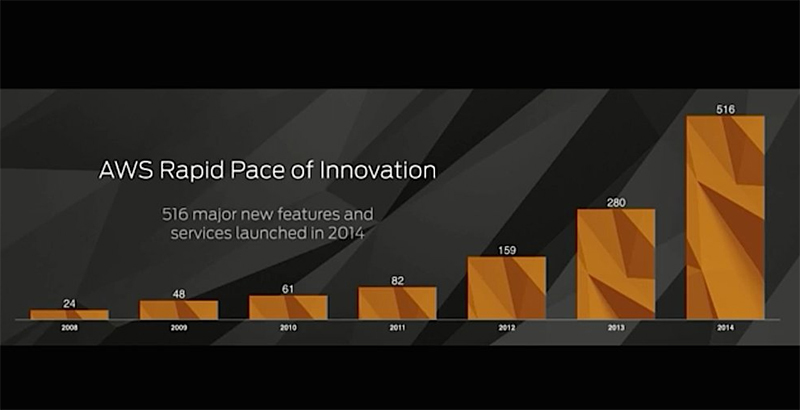

Amazon Chart showing that only in 2014, 516 new features were added to Amazon Web Services:

This means that Amazon Web Services has become the same standard in cloud computing as IBM used to be in data centers.

“Everyone tacitly agreed that choosing Amazon is a safe bet,” says Anderson.

Today, Amazon Web Services is a business valued at $ 7 billion and is expected to grow to 50 billion by 2020. Amazon Web Services offers as much computing power as the other 14 players on the market combined (according to recent estimates Gartner).

Microsoft and its epic strategy

You would think that in the face of tough competition from the technology industry, giants would quickly reach the Amazon level.

But no. Microsoft has been working on cloud concepts since the mid-2000s, but has not presented its Azure creation (AWS main competitor) to the world until 2010.

Microsoft (and other corporate software giants) first viewed the cloud as a novelty or a fad, and then as a threat. If customers turned to Amazon Web Services, they would not need the same number of copies of Microsoft software such as Windows Server and SQL Server, which are multibillion-dollar products used in information centers of most companies.

Microsoft has since managed to turn its weakness into strength. Cloud computing has now become one of Microsoft’s major profit growth factors, and Wall Street is happy to accept that.

When Azure was first launched, it was called Windows Azure, and it provided a platform-as-a-service (PaaS) layer, which makes it easier for developers to build their applications. Since its launch in 2010, Azure has grown and already includes lower-level infrastructure services that have made Amazon so popular.

Satya Nadella, as the head of Microsoft’s cloud services business, led Azure through these transformations. His success in this case was partly due to the fact that in 2014 he was appointed CEO of the company. Azure is now becoming a top priority for Microsoft, focusing on how closely it is connected to Windows Server and other enterprise products that are already used by many of Microsoft’s largest customers.

Microsoft's main advantage is not technology, but rather its know-how and established customer base.

Microsoft Azure is optimized for applications created in the .NET Runtime Environment, which has been the Microsoft standard for programming under Windows for the past 15 years or so. It's easy for an enterprise to move Windows applications to the Azure cloud compared to competing products.

Plus, many of Microsoft’s largest customers have so-called “Enterprise Agreements,” that is, contracts in which they receive steep discounts on Microsoft software from the company. Microsoft can manipulate these agreements in such a way that customers have an incentive to try out Azure.

“The growth was largely due to how well Microsoft used their [Business Accords] as leverage and tools,” said Anderson, an analyst at Gartner.

If we talk about technology, then with the arrival of Nadella, Microsoft swallowed its pride and began to support those technologies on Azure that they previously tried to crush, including the free Linux operating system - software that developers simply adore and which was once called the former general Microsoft CEO Steve Ballmer (Steve Ballmer) "cancer" and "communism."

This re-discovery of open source code has led many developers to fall in love with Microsoft.

“The reason Microsoft’s success is that the company has found a response from developers,” says Bartoletti.

Microsoft still lags behind Amazon. Microsoft is not sharing statistics about Azure, but the total revenue from the company's cloud services, including Azure and the Office 365 application suite, should be $ 6.3 billion this year.

Microsoft claims Azure is growing fast, and Garthner analyst believes it is growing faster than Amazon Web Services.

Recently, Microsoft CEO Satya Nadella called the confrontation of cloud services "Seattle races" between Amazon and Microsoft, as well as many smaller players.

To learn about Google cloud services, read the second part of the article.

Source: https://habr.com/ru/post/296174/

All Articles