A 62-year-old trader manipulated securities quotes on Twitter: his tweets “dropped” shares by 16-28%. Damage totaled $ 1.6 million

A 62-year-old trader from Scotland in 2013 used fake Twitter accounts to post a “duck” about the authorities checking the two companies. As a result, shares of companies fell by 16-28%, the trader bought them and later sold them, making a profit, and the damage to investors amounted to 1.6 million dollars.

The British Stock Exchange trader, James Craig, in 2013 posted on Twitter messages about Audience and Sarepta Therapeutics with fake accounts similar to well-known research companies. The gist of the message was that the federal authorities began checking against companies.

Shares Audience Inc. fell by 28%, after which the Nasdaq stopped trading in them. Shares of Sarepta Therapeutics fell by 16%. The goal of Craig was to buy shares after the price cuts and then sell them after the securities were returned to their usual indicators. The US Securities and Exchange Commission estimated the damage caused by price manipulation at $ 1.6 million.

')

James Craig, a 62-year-old resident of Scotland, is charged with fraud.

Messages in social networks often changed the value of shares on the market. American billionaire Karl Aykan May 18, 2015 raised Apple shares by 1.1%, increasing the value of the company by 8.35 billion dollars. This happened thanks to a tweet with reference to an open letter from an investor to Apple CEO Tim Cook. Aykan said the company's value should approach $ 240 per share.

Karl aikan

In March 2015, Ilon Mask raised shares of his company and earned nine hundred million dollars in ten minutes by publishing one tweet with a length of one hundred and fifteen characters. In the message Mask spoke about the new product Tesla, which is not an electric car.

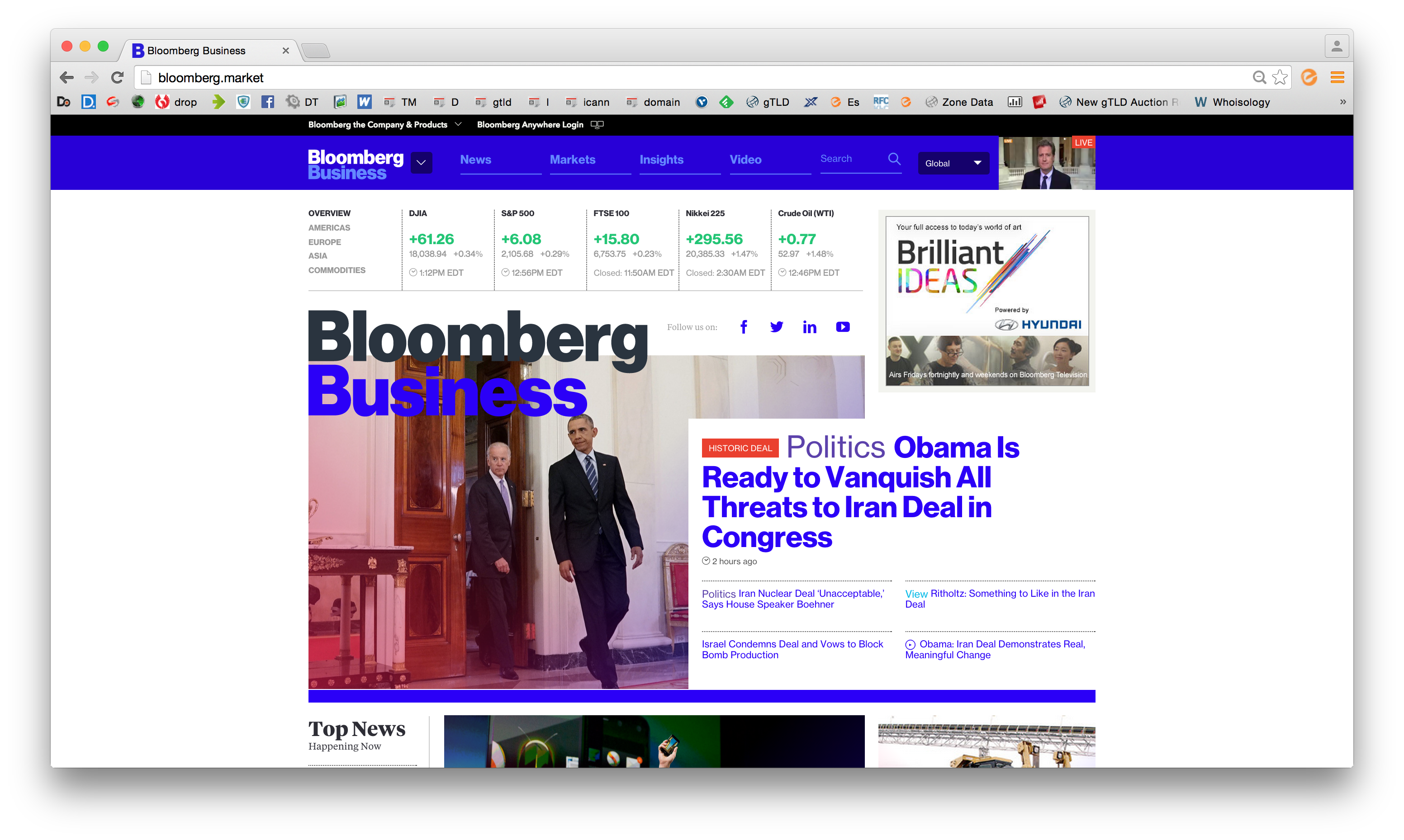

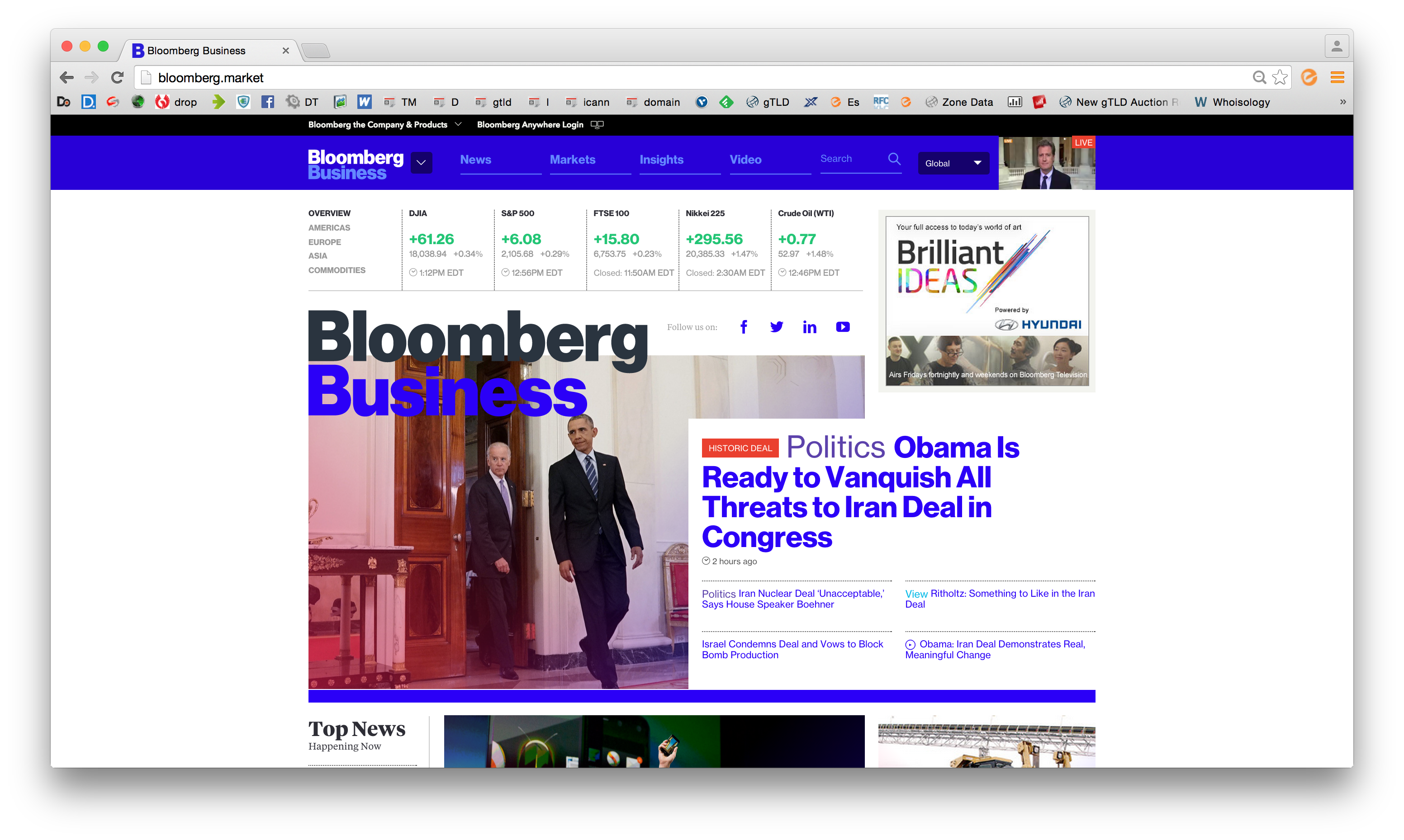

Twitter shares in July 2015 soared by 8% after publishing information on the Bloomberg Market website about the company's takeover for thirty one billion dollars. Twitter's capitalization increased by two billion dollars.

Information quickly spread in social networks. Investors believed in the reality of the news.

The site, externally similar to the site of one of the leading providers of financial information Bloomberg, was a fake. All links from the news page led to this bloomberg.com page.

The British Stock Exchange trader, James Craig, in 2013 posted on Twitter messages about Audience and Sarepta Therapeutics with fake accounts similar to well-known research companies. The gist of the message was that the federal authorities began checking against companies.

Shares Audience Inc. fell by 28%, after which the Nasdaq stopped trading in them. Shares of Sarepta Therapeutics fell by 16%. The goal of Craig was to buy shares after the price cuts and then sell them after the securities were returned to their usual indicators. The US Securities and Exchange Commission estimated the damage caused by price manipulation at $ 1.6 million.

')

James Craig, a 62-year-old resident of Scotland, is charged with fraud.

Messages in social networks often changed the value of shares on the market. American billionaire Karl Aykan May 18, 2015 raised Apple shares by 1.1%, increasing the value of the company by 8.35 billion dollars. This happened thanks to a tweet with reference to an open letter from an investor to Apple CEO Tim Cook. Aykan said the company's value should approach $ 240 per share.

Karl aikan

In March 2015, Ilon Mask raised shares of his company and earned nine hundred million dollars in ten minutes by publishing one tweet with a length of one hundred and fifteen characters. In the message Mask spoke about the new product Tesla, which is not an electric car.

Twitter shares in July 2015 soared by 8% after publishing information on the Bloomberg Market website about the company's takeover for thirty one billion dollars. Twitter's capitalization increased by two billion dollars.

Information quickly spread in social networks. Investors believed in the reality of the news.

The site, externally similar to the site of one of the leading providers of financial information Bloomberg, was a fake. All links from the news page led to this bloomberg.com page.

Source: https://habr.com/ru/post/296110/

All Articles