Venture Capital Prospects 2016

GVA LaunchGurus translated for you this intriguing article by Mark Custer, partner of Upfront Ventures, about the prospects for venture capital in 2016. The expert spoke about current trends in the behavior of market players and about future changes in venture capital investment.

Mark Saster:

At the moment there is a lot of uncertainty about the state of the private, fast-growing technology and venture capital markets underlying them. On the one hand, innovations are now on an unprecedented rise due to such opportunities as high speed of communication, growth in the number of smartphones, promotion of commerce through social networks and the fact that we can make a purchase on Amazon, Apple, Google or PayPal with one click.

')

In 2012, I wrote an article entitled “The Dawn of Venture Capital ”, where I already described these trends, and in 2014 I published the presentation “ Why venture capital is the most attractive ”, where new data were presented on many of our past analytical studies.

Let's rewind three years ahead, and what will we see on the horizon of 2016? It will already be more like the sunset of venture capital, in the sense of the decline of days of rational behavior in this area. There is no one to blame for this recklessness - it’s just that the laws of the market operate, and history doesn’t teach us anything. The boom-bust cycle. The coolest companies appeared in the last stagnant period, and we all see how they have succeeded - Facebook, Twitter, Tesla and others. Prior to this, Google, Salesforce and LinkedIn appeared among others.

Technology innovations enrich venture capital with new companies and contributions — this is a reward for having investment partnerships rediscovered our asset class. Who is to blame? These partnerships? Venture capital? Or the flow of new entrepreneurs and pseudo-entrepreneurs seeking glory and wealth? Neither of those nor others. It is like accusing the press of continuous reports of Donald Trump, and then, at the sight of the Donald Trump rating at the debate, it’s surprising that the press pays him so much attention. The market is the market.

The modern private technology market is definitely in the bubble. According to Wikipedia, the bubble is

“Trading in securities at prices significantly different from the fair price”.

The objections that, they say: “This time, start-ups bring real incomes”, or that “the market value grows, it means this is not a bubble” - is not convincing. And the definition of “price that is significantly different from the fair price” sounds quite convincing. The market gave us what investment guru Michael Moritz defined as " second-rate unicorns (startups worth more than $ 1 billion)." As gracefully said.

The definition of a "bubble" from Investopedia :

“A jump in prices, more than justified by non-market factors, and usually appearing in a certain sector. It is usually followed by a fall in prices after the start of an active sale of financial instruments. ”

Jump in prices. More than justified. Usually in a particular sector. Let's take a closer look.

Last week, I spoke at the annual conference of Cendana , dedicated to venture capital and investment partnerships. Cendana founder Michael Kim was one of the first to notice changes in venture capital, which led to the emergence of seed investment stages, and financed many of the best projects in the area. It is always an honor to meet such illustrious colleagues. Under the link you can download my presentation from the summit.

Final venture outlook 2016 from Mark Suster

If the “market” stimulates price increases beyond the real value of the asset, then new players appear on the market who are not so rational in assessing actual prices — a number of non-venture funds, including corporate investors, hedge funds, and crowdsourcing. Please note that I do not condone what is happening in the industry - in the field of venture capital. I just want to emphasize that the rise in prices is closely linked to outsiders. The graph below shows that 78% of the rounds of financing of 80 companies worth as much as a billion dollars were conducted by non-venture investors.

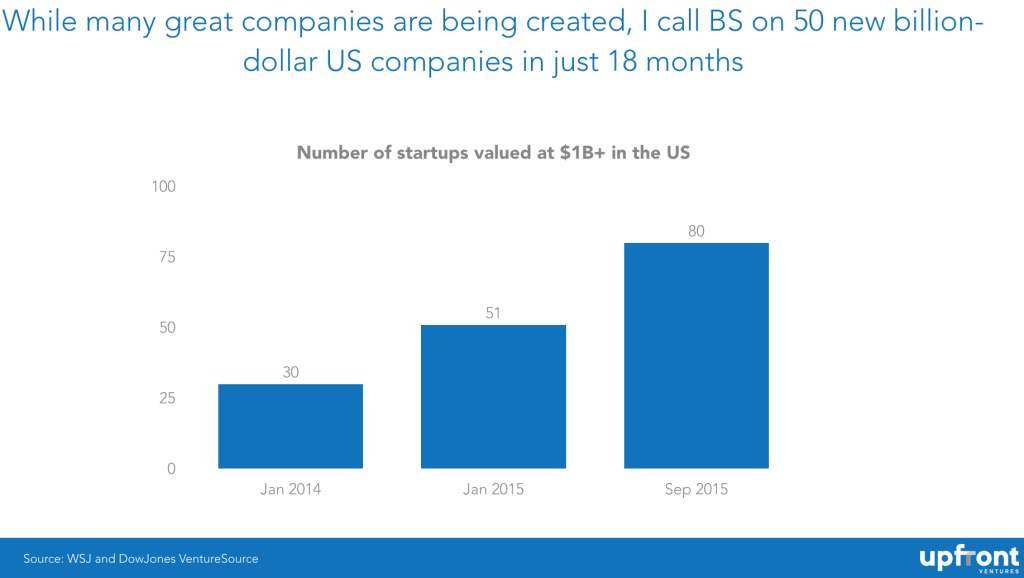

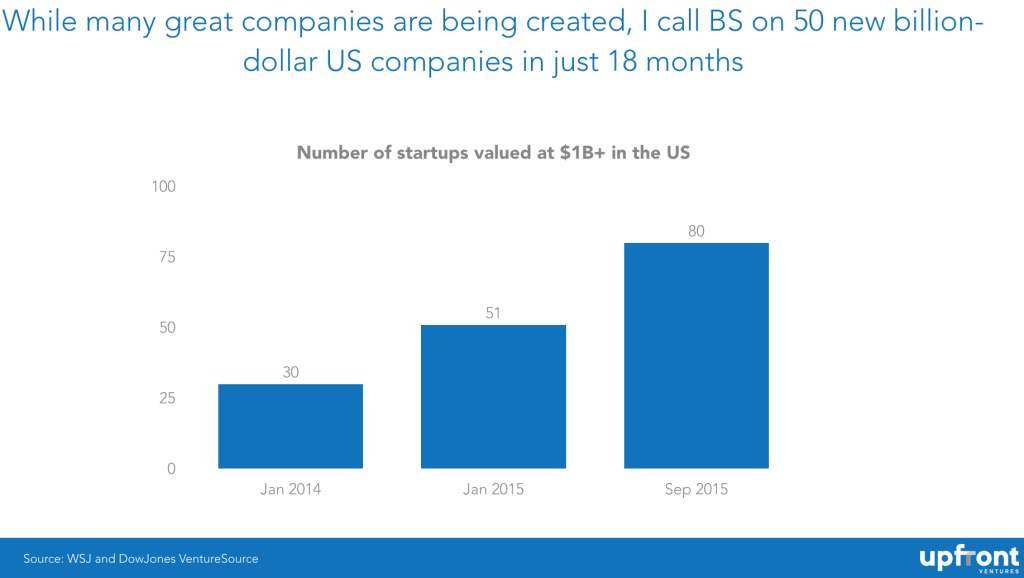

Although there are many excellent companies, I strongly doubt that the world has 50 new companies worth a billion within 18 months.

Startups valued at billion and more in the US

Startups valued at billion and more in the US

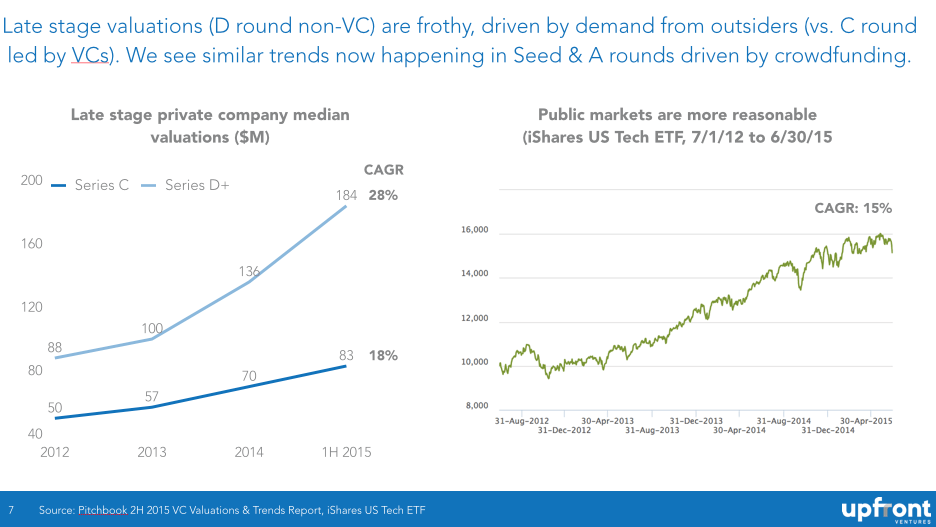

So that you better understand how quickly we created a “second-rate start-ups market” (as Michael Moritz calls it): over the past year and a half, in the US alone, the number of private companies involved in new technologies and estimated at over a billion (which is already considered high by some ) has grown from 30 to over 80. Either we got magic beans and elixirs, or we rushed with our calculations. Below is a graph showing the average valuation of private companies in the late stages of development compared to traditional rounds of financing for the development of a company, conducted by venture funds, and also compared to open markets.

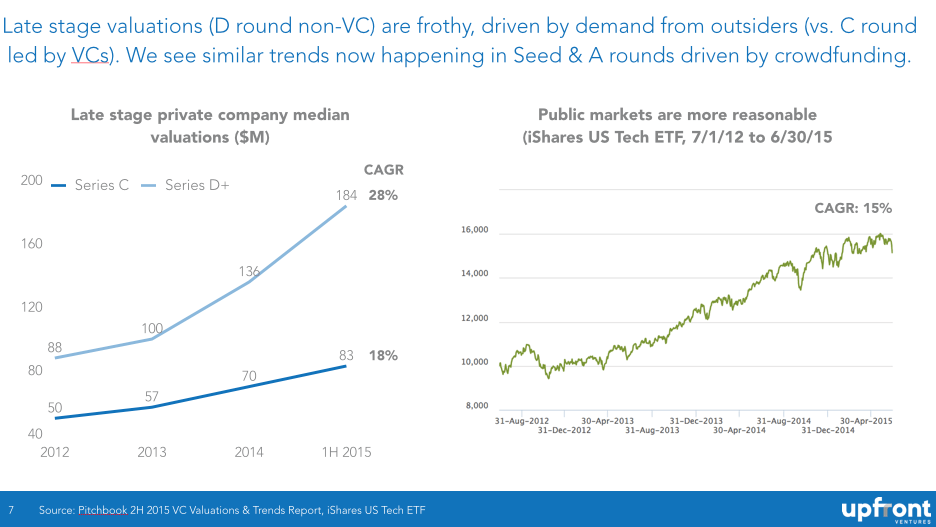

Estimates of companies in the later stages (Round D, non-venture capital) are superficial and dictated by the need of outsiders (compared to Round C conducted by venture funds). We can observe similar trends during the sowing rounds A and B, conducted with the help of crowdfunding.

Average rating, private companies in the late stages of development (SMT) Open markets are more adequate (US Tech ETF stocks from 1/7/12 to 30/6/15)

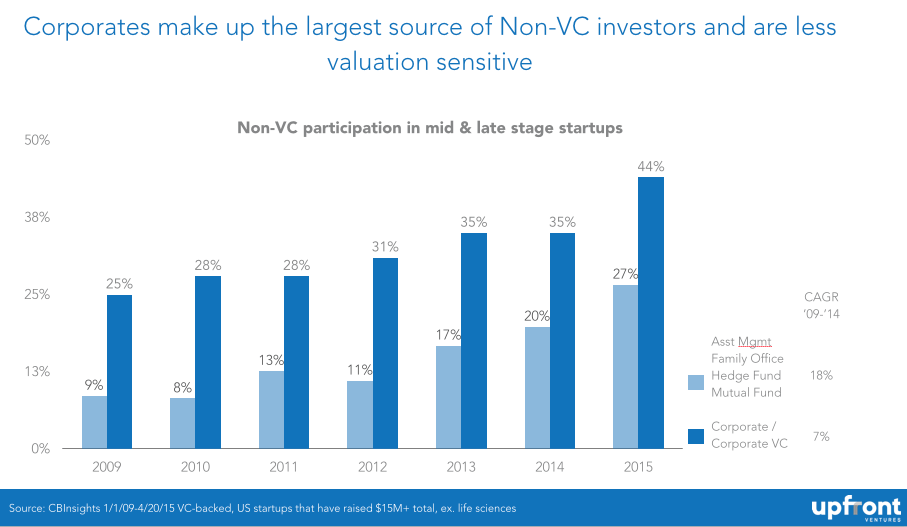

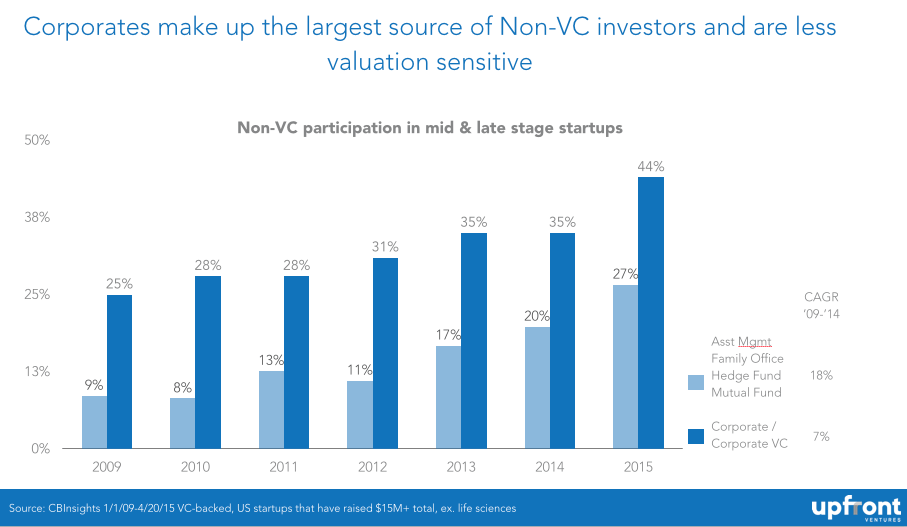

And after it is revealed what factors contributed to the increase in members of the club of second-rate startups, it is possible to track the money that leads to a small number of sources. First, corporate investors, including Google, Rakuten, Alibaba, Comcast, and others, have increased their investment in enterprises, and they are often not guided by the same profit motives (and thus, not the same pricing mechanisms) as traditional investors. This is not a denouncing statement or accusation against corporate investors - it’s just to be recognized that there are often strategic reasons for investments other than those usually caused by the actions of a financial investor.

Corporations make up the majority of unprincipled investors and pay less attention to valuations.

Non-venture presence in start-ups at intermediate and late stages of development

Perhaps the most interesting is the actions of mutual funds and hedge funds to penetrate the market of private capital. As I wrote in the post “Structural Changes in the Venture Capital Industry , private technology companies postpone initial public offerings, and thus private investors in the technology sector earn more before the actual placement of shares, and public investors feel the need to respond to this.

And what is the reaction?

Mature funds poured money into companies that seemed to them to be closest competitors to already public companies, and one knowledgeable person described this action as a simple "preliminary buying up of the placed shares in order to become owners of the shares after the companies become public."

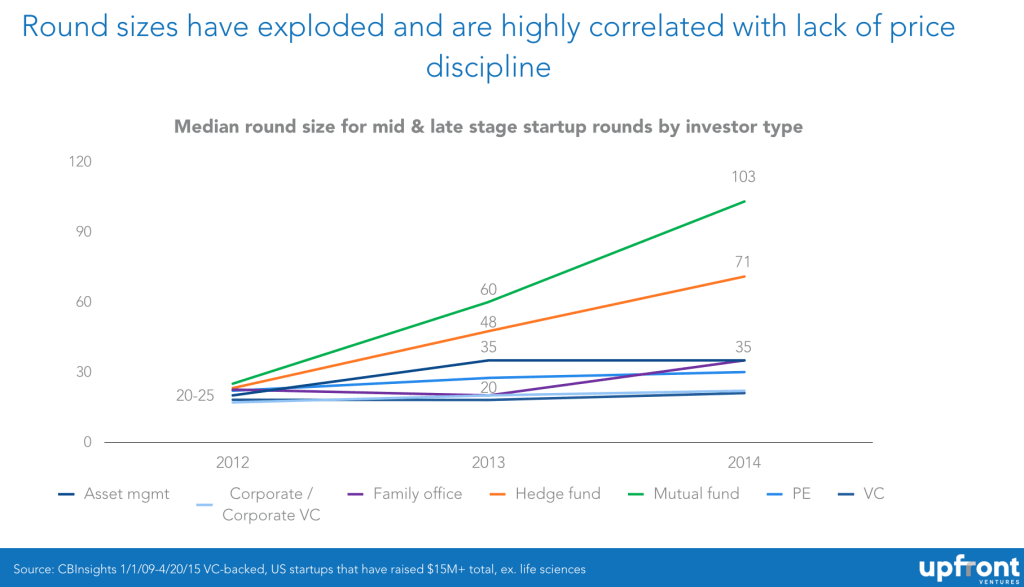

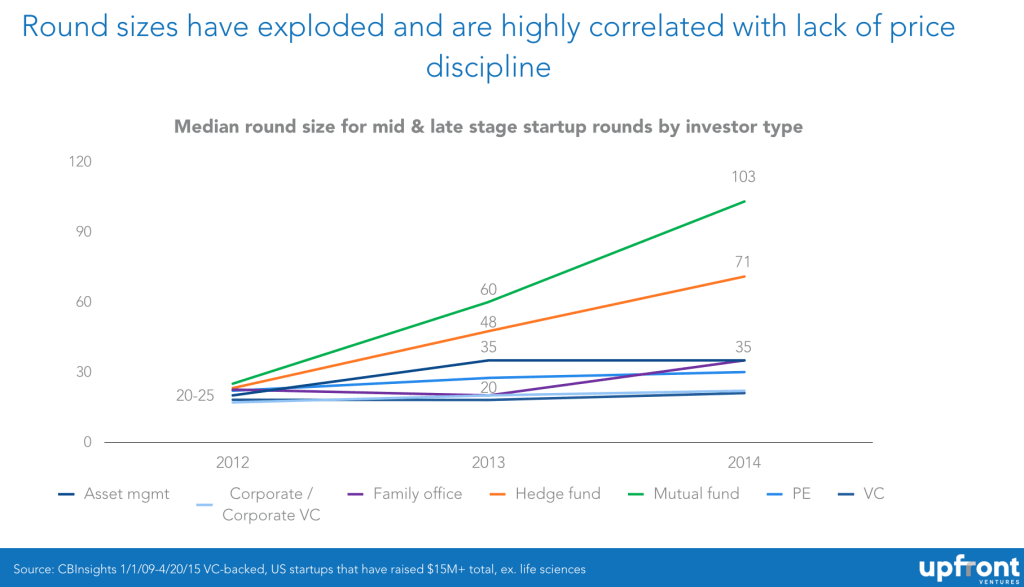

The sizes of the rounds have reached unprecedented values, which is directly related to the lack of discipline in pricing.

Average size of rounds for start-ups at an intermediate and late stage of development by types of investors

In just two years, the average size of a round involving mutual funds has more than tripled, and the same phenomenon has been observed in hedge funds. Therefore, we can say that a huge amount of money revolves around ecosystems in the later stages of development. This is good for entrepreneurs in the field of rapidly developing technologies - isn't it? Is not it? Not so simple. It turns out that companies will have their doomsday. They will have to either place their shares, or they will be bought by large companies that are probably public themselves. Everything should be back to square one.

Investors in open markets are not such fools as private investors are trying to expose. Of course, they embed protection mechanisms in their financial operations, which allows them to protect themselves from losses during the initial public offering, if the price is lower than the price paid by them. So is the price they pay today for a company worth more than a billion so reasonable? Is it really worth more than a billion dollars, or as Michael Moritz puts it, are we again creating second-rate unicorns?

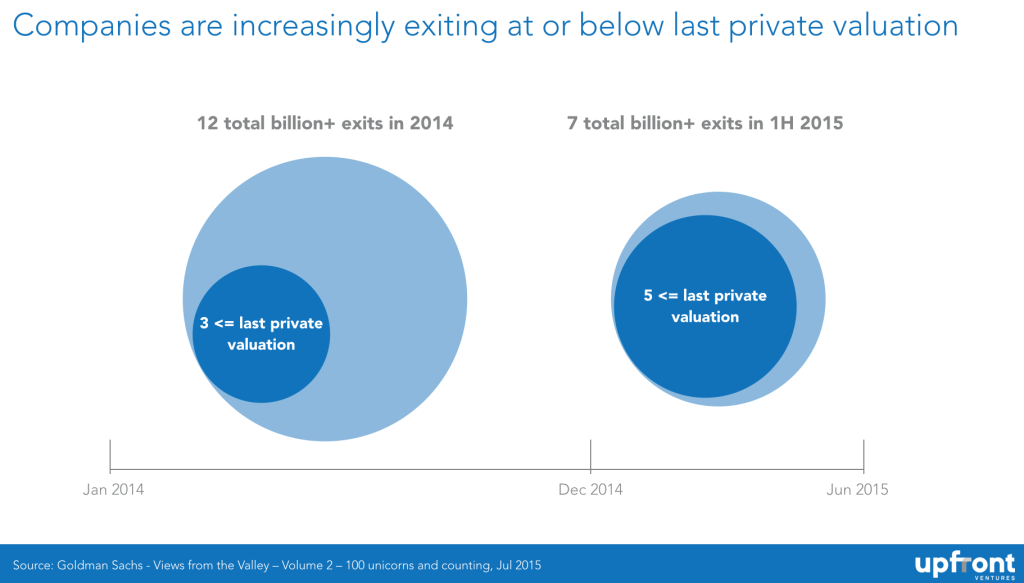

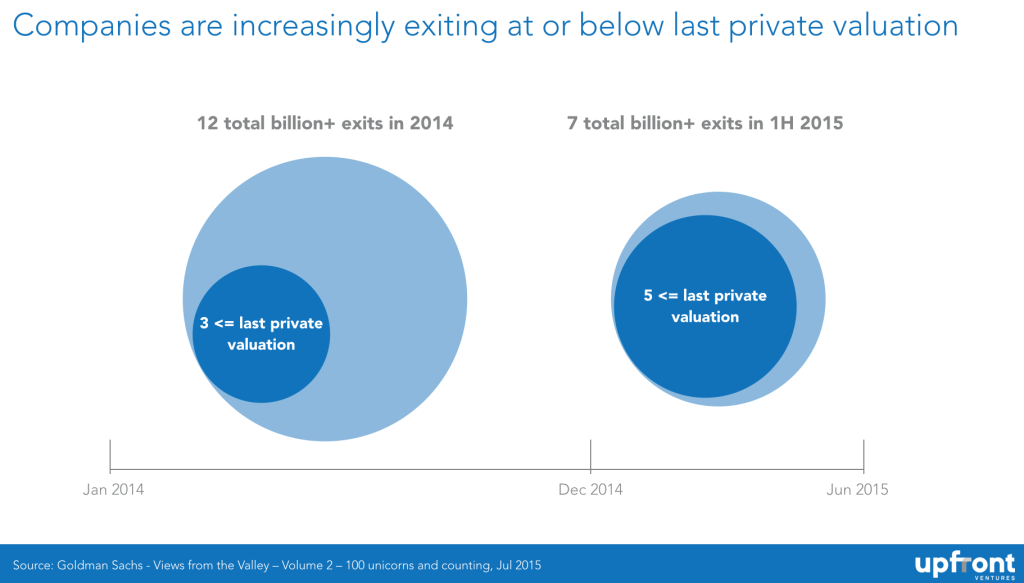

Increasingly, companies sell at a price equal to or lower than their value according to the latest estimate.

12 deals for the sale of shares worth more than 12 billion in 2012

7 deals for the sale of shares worth more than 7 billion in the first half of 2015

As usual - the market gives us hints. In 3 out of 12 cases, investors sold their shares at a price lower than their value as estimated in the previous round. 25% of sales at a reduced price? Sorry sight. But a year later, in 2015, 5 out of 7 sales were made at a reduced price. I myself count: this is already 71% of transactions.

And it’s hard to make any predictions for 2016 without recognizing the role that crowdsourcing is starting to play in the start-up market. Over the last 2 years, we have seen an influx of high-tech companies funded through crowdsourcing platforms. Those who read this article, of course, know that AngelList is an undoubted leader and a platform worthy of all respect, but many new platforms have reached the world level. Financing through them only in the last 2 years has reached unprecedented heights, and increased from 400 million to 2.6 billion dollars.

Meanwhile, on the other side of the market - CAGR crowdfunding over the past 2 years has reached 153%

The total amount of funds raised through crowdfunding worldwide

Of course, at first glance this sounds implausible, I myself read a lot of figurative statements about how dead venture capital is, and that it will soon be replaced by a gang of altruistic former founders who are sprinkling investment rain on startups. The reality is more subtle.

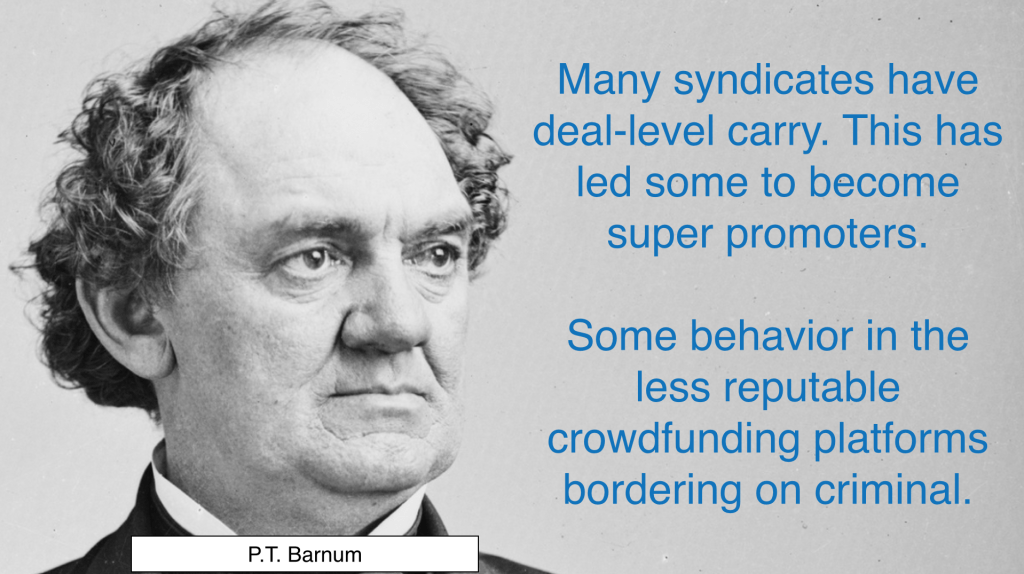

To begin with, conditions that are not offered to entrepreneurs with a convertible loan are much worse than the conditions offered by seed and venture funds, which companies evaluate, but only recently entrepreneurs have started talking about this. Although this is trivial compared to the beginning of large-scale cheating inexperienced investors. I openly warned about this for several years every time when it came to crowdfunding, but now the selling has become so obvious that even the Securities and Exchange Commission (SEC) should look at the activities of crowdfunding platforms.

I get a lot of letters from caring strangers who describe a particular startup and urge to make money as soon as possible, “before it's too late”, and at the same time convincing investors that they can enter the transaction only if they replenish the undersigned fund. I have often seen transactions recommended by the platform, where even the most necessary information is not given, the study of which would restrain, I think, the desire to invest.

Why not? The platform is often charged fees. The platform does not bear the costs of maintaining the investment position. And what many do not understand is the fact that many syndicates work according to the scheme of deal by deal. For the investor, this means that if the deal he made is closed (and another 49 transactions are covered), then the syndicate management can still make a lot of money on these 50 transactions, since he / she does not suffer losses due to other failed transactions. . Therefore, investment partnerships do not allow venture funds to work under the deal by deal scheme.

Founders of companies will pay for this short crowdfunding boom. In conditions when “every transaction is advantageous” and the money flows like a river, they will receive their money through intermediary financing, but when the market inevitably makes its own adjustments - who will carry out the subsequent financing of these companies stranded? I understand that the final chords have not yet sounded, but they will.

What is my forecast for 2016?

1. I think that in 2016 the market of private technology companies will cool down, but I predict this for 2 years already, that's why the hell knows it. Although I know that markets are overvalued, but one in the field is not a warrior one player cannot change market prices. That is why the scandal in the bar 38 Bin was just a diversion. I will continue to invest in the early stages of companies that fundamentally change some aspects of the industry over an adequate period of time (8-12 + years). Soon, only cats will be born, and if it is not a bubble, the money does not come immediately.

2. We will continue to observe excessive funding in the late stages of the development of companies, until the shroud does not subside, and then according to my predictions, sensible non-venture investors will return to their direct responsibilities, and again look for profits in other areas, and we - those , who understands something in venture funds, we will continue to go about our business.

3. The growth of crowdfunding as an equivalent alternative to venture capital will not decrease. Too much (relative to its value) of capital will be channeled into this channel until the next recession, when many inexperienced investors go bankrupt, or until the SEC (Securities and Exchange Commission) begins to carry questionable platforms or investors on these platforms. I suspect that this will happen after 2016, when retail investors are tired of waiting for easy money in the technology market.

4. In the meantime, technical progress will continue to develop no matter how many startups are evaluated there. Technology will continue to profoundly influence society and industry, and snatch off more and more pieces of the economic pie. And I suspect that for a long time venture capital will play a decisive role in supporting great entrepreneurs.

I would like to thank my colleague Kevin Zhen for his tireless work in tracking the trends of intermediary financing on behalf of Upfront Ventures. His work is invaluable, and if you follow his twitter, you will learn many useful things.

Mark Saster is an Upfront Ventures partner. He joined the company in 2007, after 8 years already collaborated with Upfront Ventures as an entrepreneur “on two fronts”. Prior to joining Upfront, Mark held the position of Vice President of Production Management at Salesforce.com, after the company was bought by Koral, where he in turn was one of the founders and CEO. Prior to Koral, Mark ran his own BuildOnline- European software company (SaaS), which was later bought out by the SWORD group. Mark is always looking for enthusiastic entrepreneurs to invest in projects in the early stages of technology development. His areas of interest include digital content and distribution, AdTech, consumer Internet technologies, and SaaS companies; Mark has impressive experience in this sector, given that he has already founded and sold two companies. Follow the link to read his articles in his blog "Two Sides of the Table " ("On two chairs").

The original article can be read on the link in the blog AlwaysOn.

Mark Saster:

At the moment there is a lot of uncertainty about the state of the private, fast-growing technology and venture capital markets underlying them. On the one hand, innovations are now on an unprecedented rise due to such opportunities as high speed of communication, growth in the number of smartphones, promotion of commerce through social networks and the fact that we can make a purchase on Amazon, Apple, Google or PayPal with one click.

')

In 2012, I wrote an article entitled “The Dawn of Venture Capital ”, where I already described these trends, and in 2014 I published the presentation “ Why venture capital is the most attractive ”, where new data were presented on many of our past analytical studies.

Let's rewind three years ahead, and what will we see on the horizon of 2016? It will already be more like the sunset of venture capital, in the sense of the decline of days of rational behavior in this area. There is no one to blame for this recklessness - it’s just that the laws of the market operate, and history doesn’t teach us anything. The boom-bust cycle. The coolest companies appeared in the last stagnant period, and we all see how they have succeeded - Facebook, Twitter, Tesla and others. Prior to this, Google, Salesforce and LinkedIn appeared among others.

Technology innovations enrich venture capital with new companies and contributions — this is a reward for having investment partnerships rediscovered our asset class. Who is to blame? These partnerships? Venture capital? Or the flow of new entrepreneurs and pseudo-entrepreneurs seeking glory and wealth? Neither of those nor others. It is like accusing the press of continuous reports of Donald Trump, and then, at the sight of the Donald Trump rating at the debate, it’s surprising that the press pays him so much attention. The market is the market.

The modern private technology market is definitely in the bubble. According to Wikipedia, the bubble is

“Trading in securities at prices significantly different from the fair price”.

The objections that, they say: “This time, start-ups bring real incomes”, or that “the market value grows, it means this is not a bubble” - is not convincing. And the definition of “price that is significantly different from the fair price” sounds quite convincing. The market gave us what investment guru Michael Moritz defined as " second-rate unicorns (startups worth more than $ 1 billion)." As gracefully said.

The definition of a "bubble" from Investopedia :

“A jump in prices, more than justified by non-market factors, and usually appearing in a certain sector. It is usually followed by a fall in prices after the start of an active sale of financial instruments. ”

Jump in prices. More than justified. Usually in a particular sector. Let's take a closer look.

Last week, I spoke at the annual conference of Cendana , dedicated to venture capital and investment partnerships. Cendana founder Michael Kim was one of the first to notice changes in venture capital, which led to the emergence of seed investment stages, and financed many of the best projects in the area. It is always an honor to meet such illustrious colleagues. Under the link you can download my presentation from the summit.

Final venture outlook 2016 from Mark Suster

If the “market” stimulates price increases beyond the real value of the asset, then new players appear on the market who are not so rational in assessing actual prices — a number of non-venture funds, including corporate investors, hedge funds, and crowdsourcing. Please note that I do not condone what is happening in the industry - in the field of venture capital. I just want to emphasize that the rise in prices is closely linked to outsiders. The graph below shows that 78% of the rounds of financing of 80 companies worth as much as a billion dollars were conducted by non-venture investors.

Although there are many excellent companies, I strongly doubt that the world has 50 new companies worth a billion within 18 months.

Startups valued at billion and more in the US

Startups valued at billion and more in the USSo that you better understand how quickly we created a “second-rate start-ups market” (as Michael Moritz calls it): over the past year and a half, in the US alone, the number of private companies involved in new technologies and estimated at over a billion (which is already considered high by some ) has grown from 30 to over 80. Either we got magic beans and elixirs, or we rushed with our calculations. Below is a graph showing the average valuation of private companies in the late stages of development compared to traditional rounds of financing for the development of a company, conducted by venture funds, and also compared to open markets.

Estimates of companies in the later stages (Round D, non-venture capital) are superficial and dictated by the need of outsiders (compared to Round C conducted by venture funds). We can observe similar trends during the sowing rounds A and B, conducted with the help of crowdfunding.

Average rating, private companies in the late stages of development (SMT) Open markets are more adequate (US Tech ETF stocks from 1/7/12 to 30/6/15)

And after it is revealed what factors contributed to the increase in members of the club of second-rate startups, it is possible to track the money that leads to a small number of sources. First, corporate investors, including Google, Rakuten, Alibaba, Comcast, and others, have increased their investment in enterprises, and they are often not guided by the same profit motives (and thus, not the same pricing mechanisms) as traditional investors. This is not a denouncing statement or accusation against corporate investors - it’s just to be recognized that there are often strategic reasons for investments other than those usually caused by the actions of a financial investor.

Corporations make up the majority of unprincipled investors and pay less attention to valuations.

Non-venture presence in start-ups at intermediate and late stages of development

Perhaps the most interesting is the actions of mutual funds and hedge funds to penetrate the market of private capital. As I wrote in the post “Structural Changes in the Venture Capital Industry , private technology companies postpone initial public offerings, and thus private investors in the technology sector earn more before the actual placement of shares, and public investors feel the need to respond to this.

And what is the reaction?

Mature funds poured money into companies that seemed to them to be closest competitors to already public companies, and one knowledgeable person described this action as a simple "preliminary buying up of the placed shares in order to become owners of the shares after the companies become public."

The sizes of the rounds have reached unprecedented values, which is directly related to the lack of discipline in pricing.

Average size of rounds for start-ups at an intermediate and late stage of development by types of investors

In just two years, the average size of a round involving mutual funds has more than tripled, and the same phenomenon has been observed in hedge funds. Therefore, we can say that a huge amount of money revolves around ecosystems in the later stages of development. This is good for entrepreneurs in the field of rapidly developing technologies - isn't it? Is not it? Not so simple. It turns out that companies will have their doomsday. They will have to either place their shares, or they will be bought by large companies that are probably public themselves. Everything should be back to square one.

Investors in open markets are not such fools as private investors are trying to expose. Of course, they embed protection mechanisms in their financial operations, which allows them to protect themselves from losses during the initial public offering, if the price is lower than the price paid by them. So is the price they pay today for a company worth more than a billion so reasonable? Is it really worth more than a billion dollars, or as Michael Moritz puts it, are we again creating second-rate unicorns?

Increasingly, companies sell at a price equal to or lower than their value according to the latest estimate.

12 deals for the sale of shares worth more than 12 billion in 2012

7 deals for the sale of shares worth more than 7 billion in the first half of 2015

As usual - the market gives us hints. In 3 out of 12 cases, investors sold their shares at a price lower than their value as estimated in the previous round. 25% of sales at a reduced price? Sorry sight. But a year later, in 2015, 5 out of 7 sales were made at a reduced price. I myself count: this is already 71% of transactions.

And it’s hard to make any predictions for 2016 without recognizing the role that crowdsourcing is starting to play in the start-up market. Over the last 2 years, we have seen an influx of high-tech companies funded through crowdsourcing platforms. Those who read this article, of course, know that AngelList is an undoubted leader and a platform worthy of all respect, but many new platforms have reached the world level. Financing through them only in the last 2 years has reached unprecedented heights, and increased from 400 million to 2.6 billion dollars.

Meanwhile, on the other side of the market - CAGR crowdfunding over the past 2 years has reached 153%

The total amount of funds raised through crowdfunding worldwide

Of course, at first glance this sounds implausible, I myself read a lot of figurative statements about how dead venture capital is, and that it will soon be replaced by a gang of altruistic former founders who are sprinkling investment rain on startups. The reality is more subtle.

To begin with, conditions that are not offered to entrepreneurs with a convertible loan are much worse than the conditions offered by seed and venture funds, which companies evaluate, but only recently entrepreneurs have started talking about this. Although this is trivial compared to the beginning of large-scale cheating inexperienced investors. I openly warned about this for several years every time when it came to crowdfunding, but now the selling has become so obvious that even the Securities and Exchange Commission (SEC) should look at the activities of crowdfunding platforms.

I get a lot of letters from caring strangers who describe a particular startup and urge to make money as soon as possible, “before it's too late”, and at the same time convincing investors that they can enter the transaction only if they replenish the undersigned fund. I have often seen transactions recommended by the platform, where even the most necessary information is not given, the study of which would restrain, I think, the desire to invest.

Why not? The platform is often charged fees. The platform does not bear the costs of maintaining the investment position. And what many do not understand is the fact that many syndicates work according to the scheme of deal by deal. For the investor, this means that if the deal he made is closed (and another 49 transactions are covered), then the syndicate management can still make a lot of money on these 50 transactions, since he / she does not suffer losses due to other failed transactions. . Therefore, investment partnerships do not allow venture funds to work under the deal by deal scheme.

Founders of companies will pay for this short crowdfunding boom. In conditions when “every transaction is advantageous” and the money flows like a river, they will receive their money through intermediary financing, but when the market inevitably makes its own adjustments - who will carry out the subsequent financing of these companies stranded? I understand that the final chords have not yet sounded, but they will.

What is my forecast for 2016?

1. I think that in 2016 the market of private technology companies will cool down, but I predict this for 2 years already, that's why the hell knows it. Although I know that markets are overvalued, but one in the field is not a warrior one player cannot change market prices. That is why the scandal in the bar 38 Bin was just a diversion. I will continue to invest in the early stages of companies that fundamentally change some aspects of the industry over an adequate period of time (8-12 + years). Soon, only cats will be born, and if it is not a bubble, the money does not come immediately.

2. We will continue to observe excessive funding in the late stages of the development of companies, until the shroud does not subside, and then according to my predictions, sensible non-venture investors will return to their direct responsibilities, and again look for profits in other areas, and we - those , who understands something in venture funds, we will continue to go about our business.

3. The growth of crowdfunding as an equivalent alternative to venture capital will not decrease. Too much (relative to its value) of capital will be channeled into this channel until the next recession, when many inexperienced investors go bankrupt, or until the SEC (Securities and Exchange Commission) begins to carry questionable platforms or investors on these platforms. I suspect that this will happen after 2016, when retail investors are tired of waiting for easy money in the technology market.

4. In the meantime, technical progress will continue to develop no matter how many startups are evaluated there. Technology will continue to profoundly influence society and industry, and snatch off more and more pieces of the economic pie. And I suspect that for a long time venture capital will play a decisive role in supporting great entrepreneurs.

I would like to thank my colleague Kevin Zhen for his tireless work in tracking the trends of intermediary financing on behalf of Upfront Ventures. His work is invaluable, and if you follow his twitter, you will learn many useful things.

Mark Saster is an Upfront Ventures partner. He joined the company in 2007, after 8 years already collaborated with Upfront Ventures as an entrepreneur “on two fronts”. Prior to joining Upfront, Mark held the position of Vice President of Production Management at Salesforce.com, after the company was bought by Koral, where he in turn was one of the founders and CEO. Prior to Koral, Mark ran his own BuildOnline- European software company (SaaS), which was later bought out by the SWORD group. Mark is always looking for enthusiastic entrepreneurs to invest in projects in the early stages of technology development. His areas of interest include digital content and distribution, AdTech, consumer Internet technologies, and SaaS companies; Mark has impressive experience in this sector, given that he has already founded and sold two companies. Follow the link to read his articles in his blog "Two Sides of the Table " ("On two chairs").

The original article can be read on the link in the blog AlwaysOn.

Source: https://habr.com/ru/post/296106/

All Articles