You calculate the MRR incorrectly, and this is why

The life or death of a SaaS business is due to subscription income. To measure the growth or decline of this indicator, you probably focus on the all-powerful MRR (Monthly Recurring Revenue - recurring monthly income).

In preparing the article, we looked at examples of calculations of this metric from 50 SaaS-services. It turned out that every fifth company does not take into account individual cost items in the equation; two of the five include in the calculations the expected income from users of free or trial versions; The overwhelming majority misread the income from customers who have bought a quarterly or annual subscription.

')

Let's see what the MRR is, consider the errors and determine why the correct calculation of the indicator is important for business.

What is MRR?

MRR shows the planned amount of monthly income. Successful SaaS companies track MRR levels for two reasons:

a) Financial forecast and planning . Thanks to the subscription, the MRR is relatively stable and predictable. Knowing the recurring income for a long period, you can easily model the state of the business, make financial forecasts and make realistic plans for the company.

b) Growth measurement . It does not matter whether investors support you or the company develops on its own - the growth of MRR from month to month is very important. This is a key indicator of the success of SaaS-business, which makes it clear: you have already taken off or have not yet left the ground.

How to calculate MRR?

Calculating the metrics seems like a difficult task, so we split the process into three easy steps.

- Take customers of the analyzed month and place them in the first column of the table, each under a personal identifier (number, login).

- In the second column, enter the cost of a monthly subscription. If the client has paid the annual or quarterly plan, pre-divide the amount by the number of paid months.

- Sum the digits of the last column - this is the MRR.

An example . You have 10 clients who paid $ 10 / month, and 10 people who bought the pro version for $ 15 / month. Therefore MRR = (10 x 10) + (10 x 15) = $ 250.

It is more difficult to calculate MRR taking into account other metrics: outflow or the emergence of new customers, user transitions to expensive or cheap tariffs, etc. However, in its original form, the calculation of the MRR looks exactly as shown above.

Five mistakes that replace reality

1) Accounting for the full cost of annual, semi-annual, quarterly subscriptions when calculating the metrics for the month

Even if the client paid the full amount for a long subscription, divide it by the number of paid months.

Reason: MRR is primarily used to measure growth rates. You do not calculate the total income, but calculate how quickly and effectively a business grows. In addition, a similar error immediately discards the effect of other metrics on the MRR.

2) Deduction of overdue payments and transaction fees

For founders, it may be tempting to deduct these amounts - they believe that this will positively affect the accuracy of the calculations. However, the road to hell is paved with good intentions: such actions distort the true value of the indicator.

The fact is that overdue payments are in the "gray" zone. They float between losses due to customer churn and revenue from active subscriptions. The problem manifests itself at the end of the month, when the calculations show that the client exists and there is no payment. What to do? Highlight late payments in a separate group. So you accurately measure and reduce the amount of income that you lose every month due to this problem.

Subtracting the amount of transaction fees makes it difficult to obtain reliable data and hides the potential for optimization. Of course, you are unlikely to achieve a 0% commission, but try replacing a payment aggregator or connecting payment services directly.

3) Inclusion in the calculation of one-time payments

Such revenues (for example, payment of advice or modifications) are not repeated and are not taken into account when calculating the MRR. Otherwise, one-time payments will inflate the indicator and distort the overall financial picture.

4) Accounting for expected income from trial users

Doing this before customers switch to the paid version of the product is the biggest sin when calculating metrics in the SaaS business. By doing this, you are deceiving yourself: we all know that there is no 100% conversion.

5) Ignoring discounts

A blatant mistake - do not include the discounts provided. If the tariff plan costs $ 100, and the customer receives a 50% discount, take into account only $ 50. When you later cancel the discount, the MRR will increase to $ 100.

What to do to improve MRR?

Make sure your calculations are correct . If you use any service for calculating metrics, check that the calculations are correct. Some platforms (for example, Recurrly and Zuora) are subject to the errors listed.

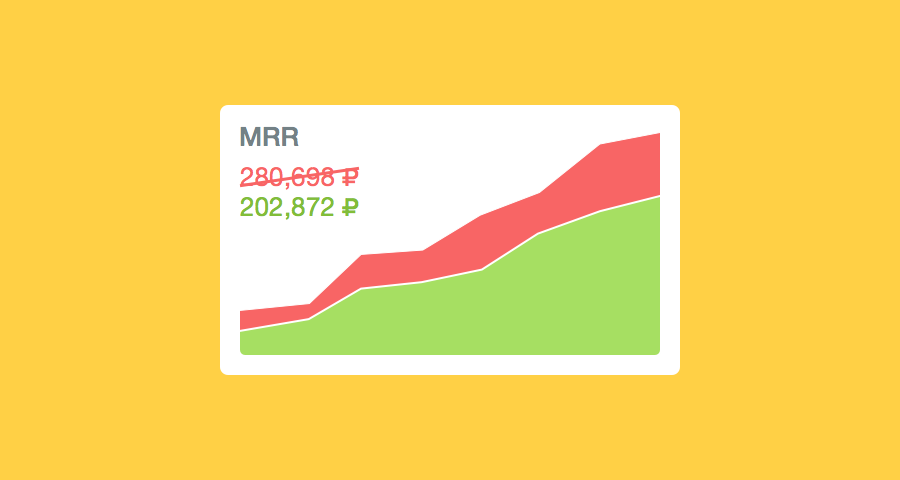

Graphic goal setting . MRR - growth rate metric. It is better to track it on the chart, where the daily change of the indicator is clearly visible both in the current and in the past months. To complete the picture and display the planned growth.

Take this a few minutes each work day. Then at the end of the month you will not be disappointed, and the sales department - an emergency mode of operation.

Although MRR is not part of GAAP (Generally Accepted Accounting Principles), IFRS (International Financial Reporting Standards - International Financial Reporting Standards), incorrect calculation of this indicator means that you lie to investors or, worse, get into a situation when an erroneous assessment of development becomes the basis of planning.

Source: https://habr.com/ru/post/295874/

All Articles