Effective recovery of MFIs overdue with SaaS Credit

The activities of microfinance organizations have a number of features that significantly distinguish it from bank lending. One of the key features is the high level of non-return risks. This is primarily due to the ease of obtaining a loan and a fairly loyal approach to the assessment of borrowers. In addition, in most cases there is no loan security for microcredit. Such an approach is necessary for the existence and competitive activity of an MFI, but its by-product becomes a large number of problem loans. This means that it is necessary to solve the problem of their return. SaaS Credit , a business automation system for microfinance organizations, equipped with a well-designed collector module, can help.

What is SaaS Credit?

')

SaaS Credit is a cloud-based business automation system for microfinance organizations. The system is based on an integrated approach that provides for the automation of all MFI business processes. Including implemented a solution to ensure the acceptance of applications and the issuance of loans via the Internet, or, in other words, to actually create a business to issue loans online. Thanks to its deployment in the cloud, the system replaces the entire IT infrastructure, regardless of the territorial distribution of offices and points of credit, as well as regardless of the location of the borrower.

The software complex itself has a modular structure, which allows the microfinance organization to use the functions necessary for it. Including in the system there is an advanced collection module, which greatly simplifies the work of MFOs to recover bad debts.

Features of the SaaS Credit Collection Module

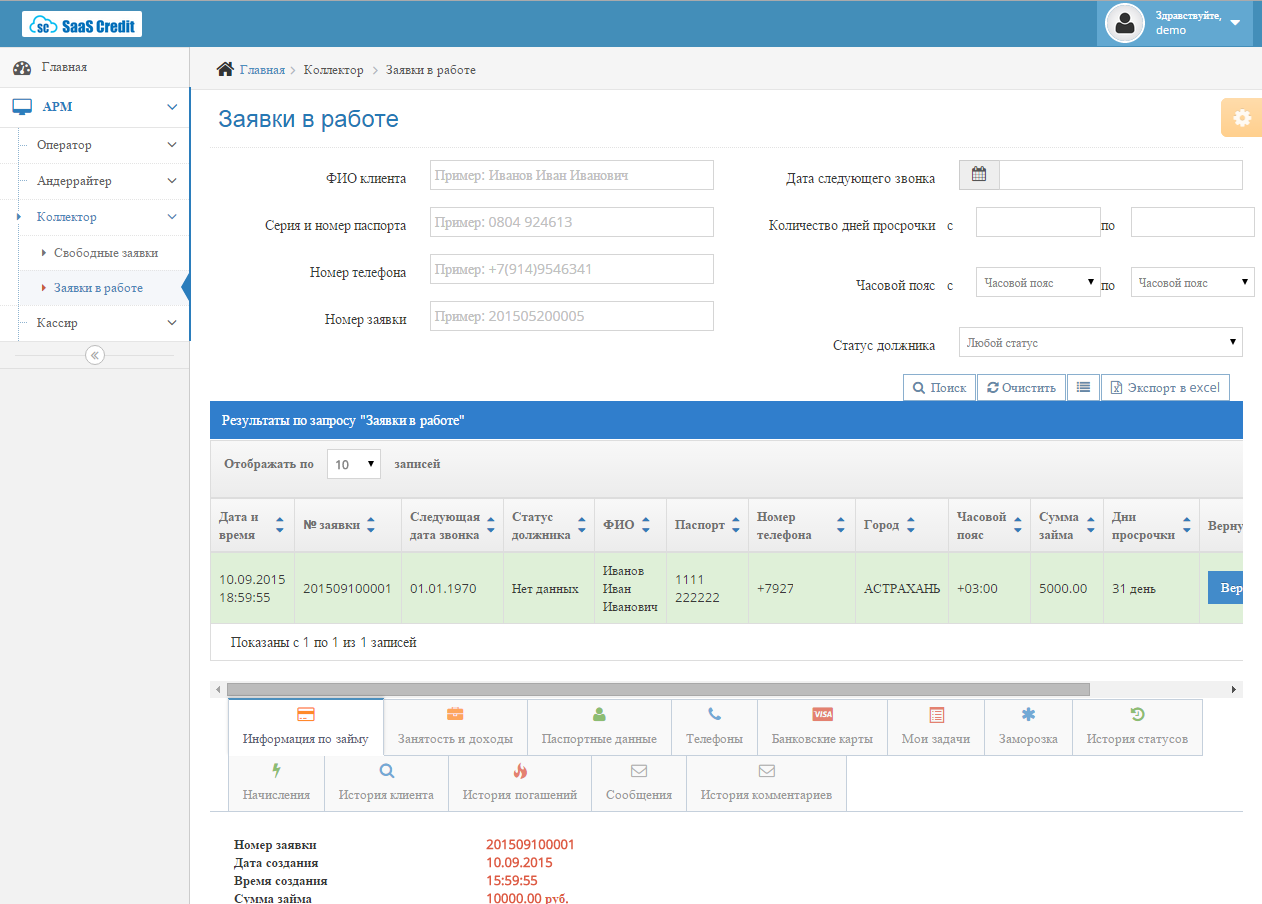

SaaS Credit business automation system collector module is designed to conduct work on the collection of overdue debts. The module has extensive functionality, which significantly simplifies the work of collectors. The system allows you to use flexible settings. Including you can set the following parameters:

• The number of days of delay in repayment, after which the loan debt is transferred for collection.

• The number of days overdue, after which the loan is automatically frozen.

• Automatic distribution of the problem of debt among employees of the collection service;

• Distribution of loans among the staff of the collection service in manual mode.

SaaS Credit allows you to effectively organize the work of a large number of employees. Overdue loans between employees can be distributed not only automatically, but also in manual mode. At the same time, all events in the process of collection of overdue debts are stored in history, which is maintained for each loan individually.

The system has a number of functions that simplify the work of the collector and make it more efficient. At the stage of negotiating with the borrower, the collector has the opportunity to set himself a reminder. Also, the borrower can be assigned certain statuses, depending on how the interaction is promoted. In addition, the employee of the collection service has the ability to suspend the accrual of interest and interest (together or separately) for problem loans. Due to this, one employee can accompany a large number of loans, while ensuring high efficiency of recovery work.

Owners or managers of microfinance organizations, the SaaS Credit collection module, offers a convenient way to monitor the work of the collection service for overdue debts. There is a built-in performance evaluation system for each employee.

Cloud complex SaaS Credit is actively developing, which opens up more and more new opportunities for users. This also applies to the collector module. At the moment, the developers are testing an IP-telephony system that will allow phone calls to borrowers directly from the interface of the SaaS Credit software package in a “pipeline” mode.

What is SaaS Credit?

')

SaaS Credit is a cloud-based business automation system for microfinance organizations. The system is based on an integrated approach that provides for the automation of all MFI business processes. Including implemented a solution to ensure the acceptance of applications and the issuance of loans via the Internet, or, in other words, to actually create a business to issue loans online. Thanks to its deployment in the cloud, the system replaces the entire IT infrastructure, regardless of the territorial distribution of offices and points of credit, as well as regardless of the location of the borrower.

The software complex itself has a modular structure, which allows the microfinance organization to use the functions necessary for it. Including in the system there is an advanced collection module, which greatly simplifies the work of MFOs to recover bad debts.

Features of the SaaS Credit Collection Module

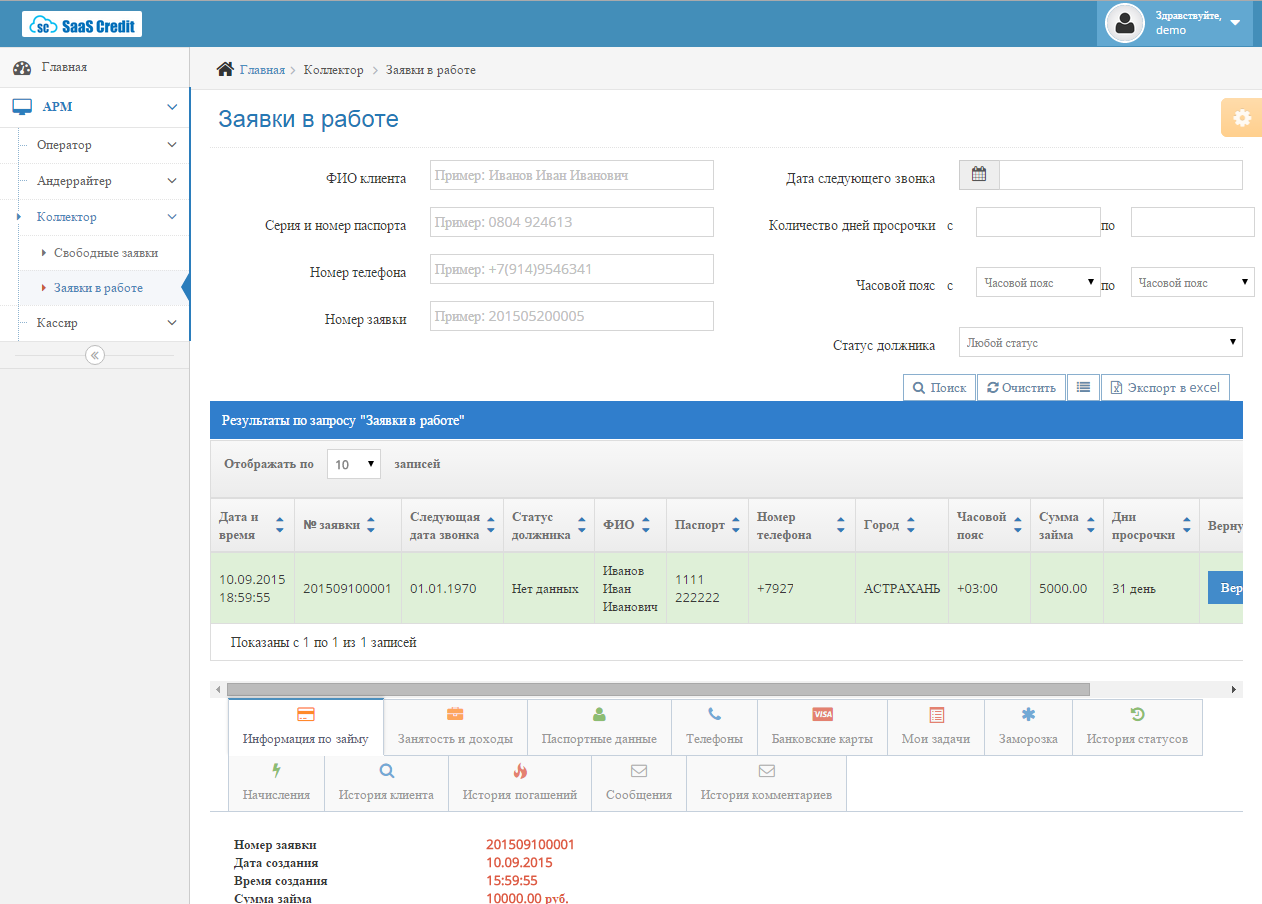

SaaS Credit business automation system collector module is designed to conduct work on the collection of overdue debts. The module has extensive functionality, which significantly simplifies the work of collectors. The system allows you to use flexible settings. Including you can set the following parameters:

• The number of days of delay in repayment, after which the loan debt is transferred for collection.

• The number of days overdue, after which the loan is automatically frozen.

• Automatic distribution of the problem of debt among employees of the collection service;

• Distribution of loans among the staff of the collection service in manual mode.

SaaS Credit allows you to effectively organize the work of a large number of employees. Overdue loans between employees can be distributed not only automatically, but also in manual mode. At the same time, all events in the process of collection of overdue debts are stored in history, which is maintained for each loan individually.

The system has a number of functions that simplify the work of the collector and make it more efficient. At the stage of negotiating with the borrower, the collector has the opportunity to set himself a reminder. Also, the borrower can be assigned certain statuses, depending on how the interaction is promoted. In addition, the employee of the collection service has the ability to suspend the accrual of interest and interest (together or separately) for problem loans. Due to this, one employee can accompany a large number of loans, while ensuring high efficiency of recovery work.

Owners or managers of microfinance organizations, the SaaS Credit collection module, offers a convenient way to monitor the work of the collection service for overdue debts. There is a built-in performance evaluation system for each employee.

Cloud complex SaaS Credit is actively developing, which opens up more and more new opportunities for users. This also applies to the collector module. At the moment, the developers are testing an IP-telephony system that will allow phone calls to borrowers directly from the interface of the SaaS Credit software package in a “pipeline” mode.

Source: https://habr.com/ru/post/295782/

All Articles