Inadequate startups - rule or exception

Source: Josh Kopelman

Maybe startups really "go crazy" - each in their own way? Someone loses an adequate perception of reality, along with profit and hope for a bright future, slipping into debt trap. This situation is more like the realities of our country, unfortunately.

And someone is rowing investment "shovel" and can not stop - as a gambler, who carries the whole evening. Such a start-up makes everyone play with him and does not pay attention to objections and arguments. Not getting what he wants, he goes berserk. This "style" of doing business, as it turns out, is increasingly common in the United States. Well, in Silicon Valley there are all the conditions for such an "game addiction" to reach its apogee.

')

In the context of the western investment climate, it has become easier than ever for technology startups to attract investments. According to one of the investors in Silicon Valley, many founders seriously complained that they managed to attract only $ 1 million of seed investments.

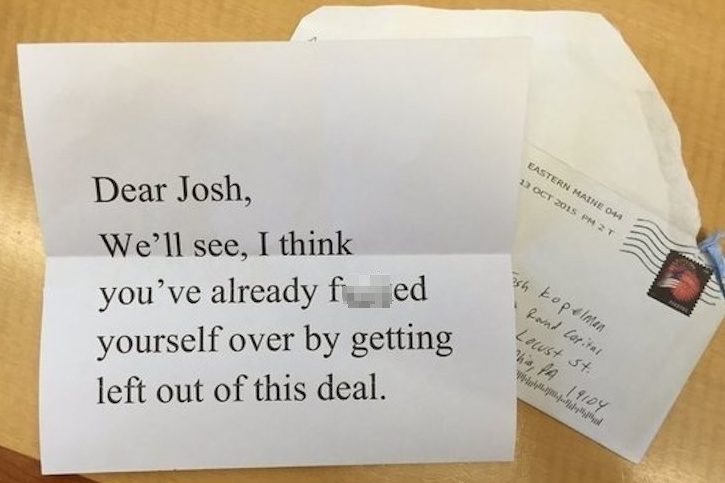

The edition of Business Insider on Friday told about how one start-up arranged an attraction of unprecedented arrogance. Josh Kopelman, partner of the Foundation First Round Capital, shared this story with the publication. By the way, he ranks fourth among the most successful venture capital investors in the Forbes rating .

On Twitter, Kopelman published a post (see the image at the beginning of the article) with a letter from the founder, who received another rejection. First Round Capital in the face of Josh Kopelman refused (apparently, repeatedly) to participate in the round of financing of an angry start-up. The content of the letter boils down to the fact that the start-up in an obscene form hints that by refusing to participate in the round, Kopelman "punished" himself and missed the class project.

Then it turned out that not only First Round Capital, but also the Menlo Ventures fund became the victim of a hunter for the “heads” of investors:

How many more investors have received such letters is unknown.

And, as if by the law of paired events, on October 24, on the website of the Firrma publication a material was published describing one of the aspects of communication between Russian founders and investors.

Alexander Chachava, Managing Partner of the LETA Capital Fund, on his Facebook page cites a case from personal business practice. He completes the post naked irony, hinting at bizarre stereotypes and, to put it mildly, strange methods of negotiating with US investors.

Source: https://habr.com/ru/post/295688/

All Articles