Bank in your pocket: 9 trends in mobile payments and banking

The report contains the results of a survey of 15,000 mobile device users from 15 countries of the world. The main topic of the report was a steady increase in the popularity of mobile banking and mobile commerce. 69% of users of mobile devices use online banking, 66% make certain types of transactions. It should be noted that the popularity of "mobile money" varies considerably from country to country.

According to MEF, in the broad sense “mobile payments” can mean such activities as payment using a mobile device in a store, online payments on websites, money transfers from one account to another (P2P), buying digital content, paying online services at the point of delivery, payments using mobile wallets.

')

The study also shows that contactless payments in offline stores still occupy a minimal share in the volume of mobile commerce. With the launch of Samsung Pay, Android Pay and Apple Pay, which recently announced its plans for large-scale expansion, there is no doubt that the situation will change soon.

New technologies and NFC growth

Developed markets today are characterized by high penetration of mobile devices and developed infrastructure. This allows us to develop and complicate the use of “mobile money”, both between individuals and between consumers and financial institutions. An example of such new technologies is NFC sensors in smartphones, which allow paying in offline stores using a mobile device as a contactless bank card.

Convenience and speed are the main drivers for most developed markets, although there is no universal payment solution that would suit any user to solve any problems. For example, payment tools that allow you to pay for digital content that does not have a physical carrier (the so-called carrier billing) are the most suitable solution for those who do not have bank cards, as well as a convenient way to make purchases in mobile applications.

Speaking about NFC technology, it is impossible not to mention how retailers use mobile payments together with other important elements of e-commerce - loyalty, special offers and rewards , so as not to lose their position in the market. For example, the Starbucks mobile app processes more than eight million transactions per week and has about 16 million registered users. With each purchase made using the application, points are credited to the customer’s account, which can be exchanged for drinks and other bonuses. This increases loyalty of loyal customers and attracts new supporters of the brand.

Mobile Champions - Africa and Asia

In the markets where mobile payments are leading, the picture is very different. In dozens of countries in Africa and Asia, services such as Mpesa and Fundamo (providers of payment services and microfinance for subscribers of a mobile operator) have unleashed a mobile revolution. Although most of the population of these countries have not yet begun to use banking services, they actively use phones with enhanced functionality to access mobile money services and pay for physical goods, bills, remittances or access to digital goods and services.

The use of mobile payment services as the main method of making transactions in these countries allowed them to “overtake” even developed economies. The growing popularity of smartphones in these countries has created additional opportunities for the development of mobile payments. For example, 80% of respondents in Indonesia, 85% of respondents in Nigeria, and 93% of respondents in Kenya confirmed that they are active users of mobile banking.

It should be noted that the dominance of mobile money slows down the development of the banking system and retail trade in several regions of Asia and Africa.

Having understood the many possibilities of using mobile payments, MEF chose the nine key trends and drivers that are currently setting the tone for the entire M-commerce industry and will greatly influence it in the future.

I. Payments using smartphones in offline stores, so small today, have great prospects in the future.

12% of users made at least one contactless payment over the past six months:

- 4% using NFC technology;

- 7% through a mobile POS terminal at the point of sale;

- 5% made payments with a mobile loyalty card (Starbucks, etc.).

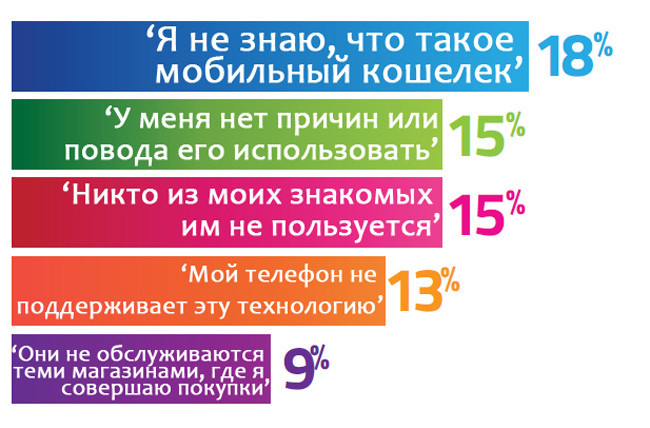

Ii. Consumers still do not know why they need mobile e-wallets.

The study reflects the bewilderment of society and, as a result, indifference to mobile wallets. 18% do not know what it is, 15% do not see sense in it, and as many more as none of their acquaintances use.

Iii. Social networks are the future of e-commerce.

The impact of social networks on the use of mobile devices can not be overemphasized. 24% of mobile phone users and 15% of smartphone owners actively use social networks in the process of online shopping.

Iv. Mobile payments are hampered by user mistrust.

34% of consumers put safety first among their concerns. 11% “do not trust the security of mobile payments”, 9% are afraid to indicate too much personal information, 8% say that mobile systems are absolutely unprotected, and 6% do not trust e-commerce companies at all.

V. Mobile applications - a new opportunity for shopping.

56% of respondents prefer to make purchases through the application, rather than through a mobile site. Since consumers spend most of their time in instant messenger applications, some experts suggest that in the future they may become a new online sales channel. Some of these services already have the function of making financial transactions. Such messaging applications like Line in the Asia-Pacific region allow users to connect a bank card to the messenger and make money transfers to friends, as well as shopping in some stores.

Vi. "Second screen" - the path to the heart of the buyer.

94% use two or more "screens" in the process of Internet surfing, most of which (42%), for example, watch TV. In addition, 32% use the “second screen” to search for additional information about the purchase. Read more about the specifics of multi-screen sales - in the analytical material “ Multi-screen World. Cross-platform shopping .

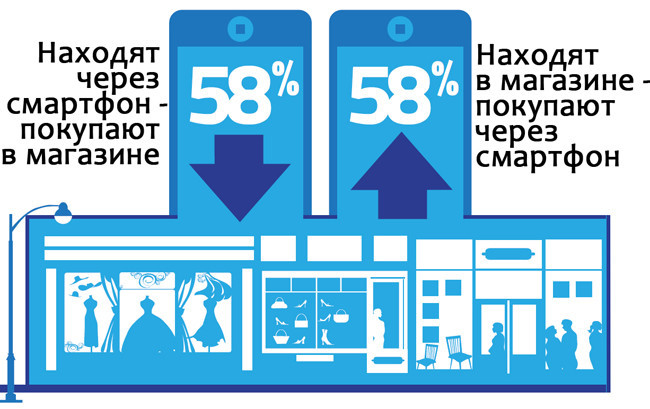

VII. From online to offline and back.

58% of users at least once found the product online via a smartphone, and then purchased it in an offline store. Approximately the same number of respondents, on the contrary, get acquainted with the assortment offline, then to place an order on the Internet. About this trend, the press center PayOnline wrote in 2013 .

Viii. The place of the bank is in your pocket.

69% of mobile users interact with their bank account through their mobile device. The most popular feature is the bank balance check. At the same time, the popularity of more complex financial transactions is growing: 18% transfer money from one account to another, 16% transfer money to friends, 9% apply for a loan.

Ix. In the first place - simplicity and convenience.

Mobile payments attract 32% of users at a high rate of shopping speed. Payment providers understand the need of users for speed and convenience - and strive to make services as friendly as possible.

One of the most interesting solutions is fingerprint identification. For many, this is the best opportunity to make a payment in one action. Apple devices already support this option to pay for iTunes - and this is just the beginning.

In the summer of 2014, the TouchID API became available, which allowed developers to implement this technology in their applications. At the moment, this feature is more used to unlock the phone, rather than to make payments. However, with the advent of Apple Pay, the rapid rise in the popularity of authentication through biometric data is perhaps inevitable.

So in the Mobile Ecosystem Forum see the future of M-commerce. The material has been prepared for publication by the authors of the PayOnline electronic payment system .

Source: https://habr.com/ru/post/295534/

All Articles