Analysis of the IIDF projects

Analyzed the projects that have received investment of IIDF . Description of projects, see the article on the Megamind or on the IIDF website . He divided the projects by regions (correct, if not right), analyzed the trends, the conclusions at the end of the article. The overall picture is shown in the figure:

Separation of projects by regions:

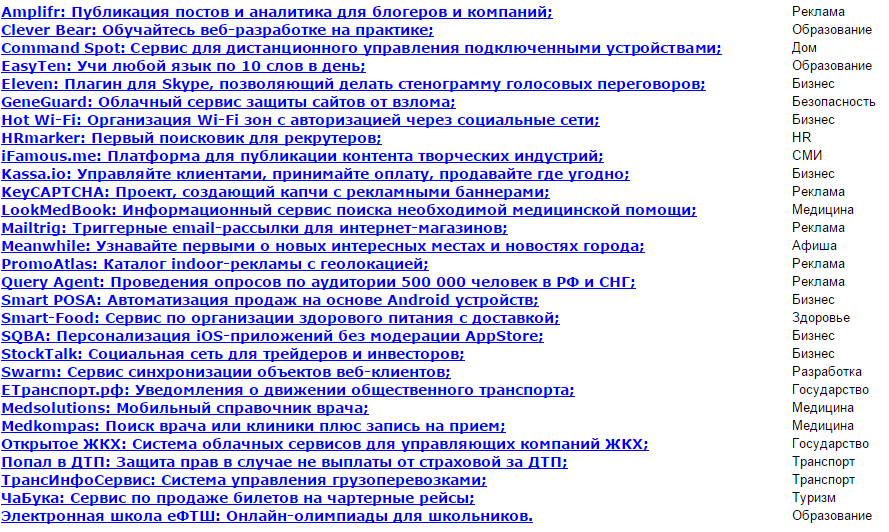

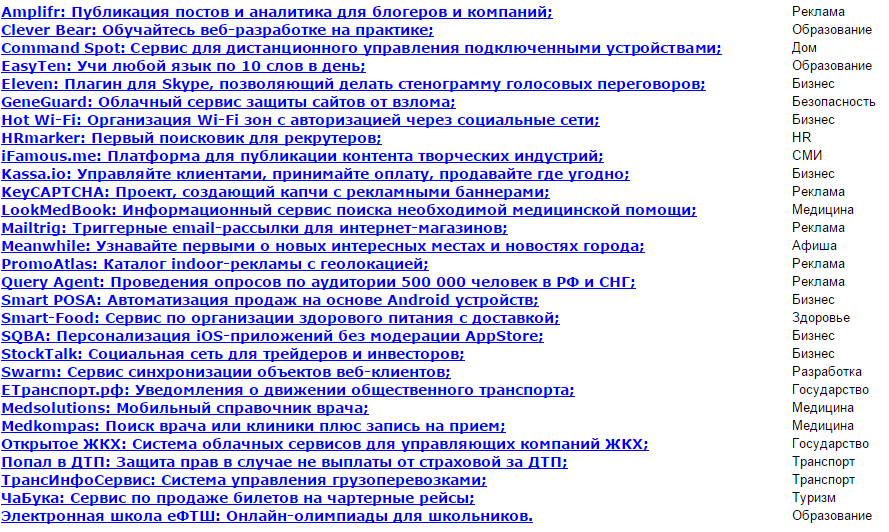

Baseline - Projects, with affixed areas:

Data based insights:

PS: The source data for the article (Excel file) - here

Separation of projects by regions:

Baseline - Projects, with affixed areas:

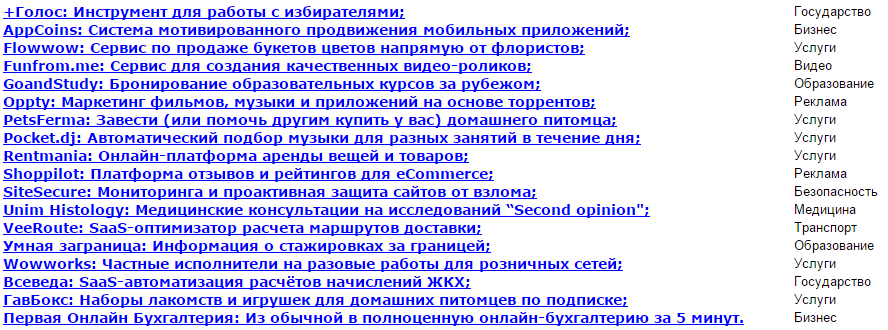

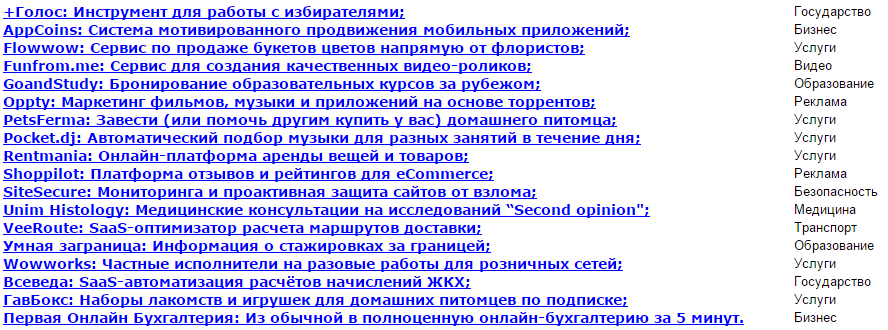

First set

Second set

Third set

Fourth set

Fifth set

Sixth set

Data based insights:

- In all sets, the number of projects serving the business is disproportionately large. Is B2B selling easier than B2C?

- The next for the leader of the region is the “Education, Advertising, Transport” troika. These are projects where you are accustomed to pay a lot and clearly see the benefits of a new service. Is there room for new projects in these markets?

- A sufficient number of niche projects in the field of services to individuals. But the market for each of them is small. It is rather a small business, and not startups in the classic sense. Do they have at least some chances of getting investments after the sowing stage to enter the world market?

- Almost zero presence of projects that are in trend in the "West" - Big Data, Internet of Things, information security, drones, augmented reality, technological (in hardware) projects. Slightly better with Mobile, Shared Economy, aggregators. Will global trends reach Russia in a couple of years or is there simply no local market & specialists for these areas?

- At a stable level, the number of B2G / C2G projects related to interaction with the state is kept. IIDF, as a state foundation, is actively promoting these projects. However, without the constant (dishonest?) Use of administrative resources, such projects are doomed. There are small chances of receiving investments for entering foreign markets, since outside of the Russian Federation they are not needed.

PS: The source data for the article (Excel file) - here

')

Source: https://habr.com/ru/post/295494/

All Articles