Square company has applied for an IPO. Jack Dorsey will be the head of two public companies - Twitter and Square

The manufacturer of payment devices Square has applied for an initial public offering on the New York Stock Exchange under the symbol "SQ". The company, founded by Jack Dorsey, the creator of Twitter, raised $ 590 million from venture capitalists, and The Wall Street Journal estimates it at $ 6 billion.

Square offers a platform for accepting bank cards on mobile devices. Payment terminals suitable for iOS and Android smartphones are used by street food vendors, taxi drivers and coffee shop owners. Square's plans for IPO became known in July 2015. The company used the US law on support for startups - according to this law, a company with annual revenues of up to $ 1 billion may not disclose details of its work to an IPO.

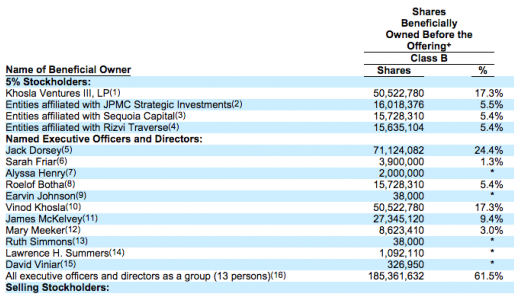

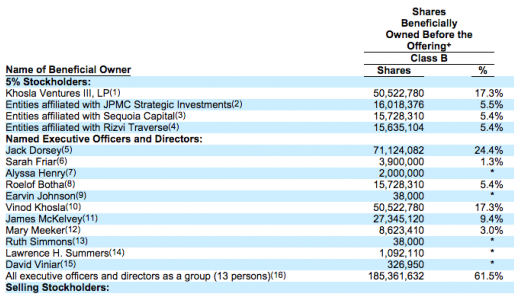

Square company is 24.4% owned by Jack Dorsey . He is currently the CEO of Square and Twitter at the same time, and after the initial public offering of Square shares, he will be the head of two public companies. For Square this is a risk, since Dorsey will have to sacrifice time in favor of either of the two companies.

')

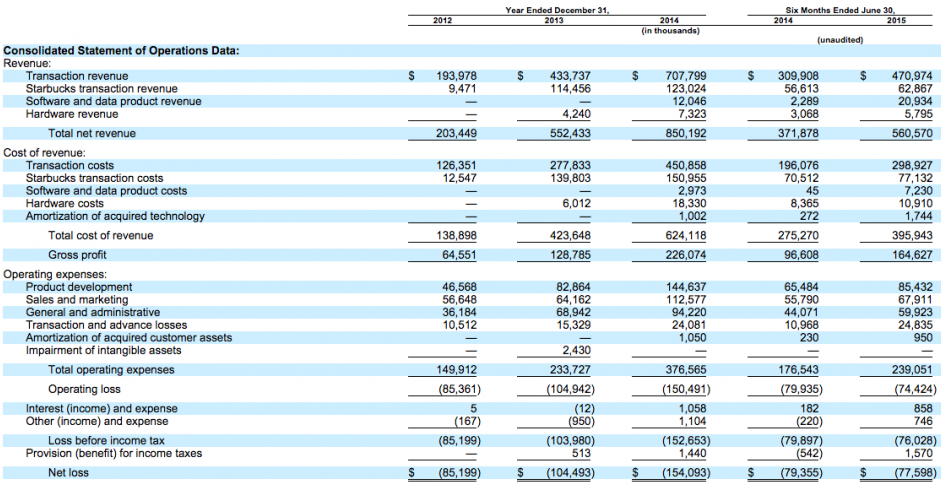

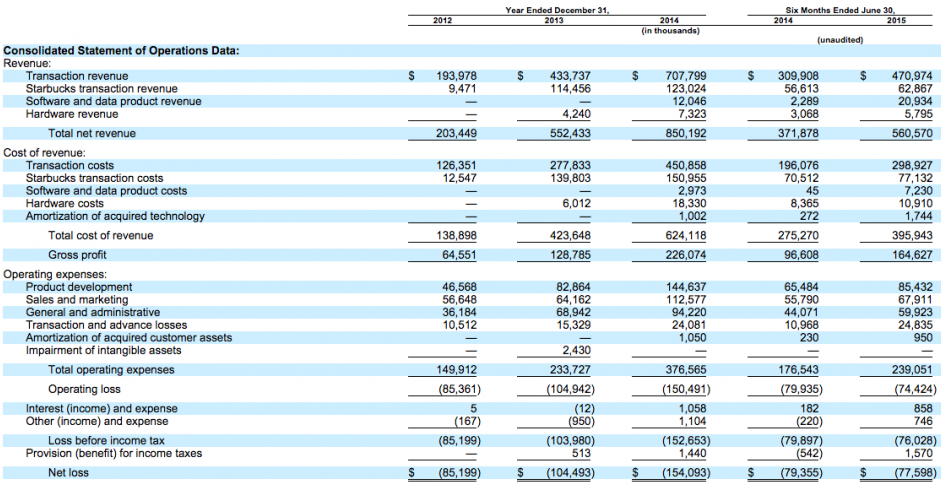

According to Square documents, net income to the company in 2014 amounted to $ 850 million. Net losses for the same period amounted to 154 million. In the first six months of 2015, net revenues amounted to $ 560.6 million, which is 51% more than this figure for the same period of 2014, and net losses amounted to 77% - the same result as last year.

Square offers a platform for accepting bank cards on mobile devices. Payment terminals suitable for iOS and Android smartphones are used by street food vendors, taxi drivers and coffee shop owners. Square's plans for IPO became known in July 2015. The company used the US law on support for startups - according to this law, a company with annual revenues of up to $ 1 billion may not disclose details of its work to an IPO.

Square company is 24.4% owned by Jack Dorsey . He is currently the CEO of Square and Twitter at the same time, and after the initial public offering of Square shares, he will be the head of two public companies. For Square this is a risk, since Dorsey will have to sacrifice time in favor of either of the two companies.

')

According to Square documents, net income to the company in 2014 amounted to $ 850 million. Net losses for the same period amounted to 154 million. In the first six months of 2015, net revenues amounted to $ 560.6 million, which is 51% more than this figure for the same period of 2014, and net losses amounted to 77% - the same result as last year.

Source: https://habr.com/ru/post/295376/

All Articles