Research: Runet 2014-2015

The Federal Agency for Press and Mass Communications has conducted a study on the Russian Internet industry. How the Runet’s audience has changed, the online advertising and e-commerce market, how many Russian users write on social networks, and what significant events in the Russian IT business have happened over the past year - read under the cut.

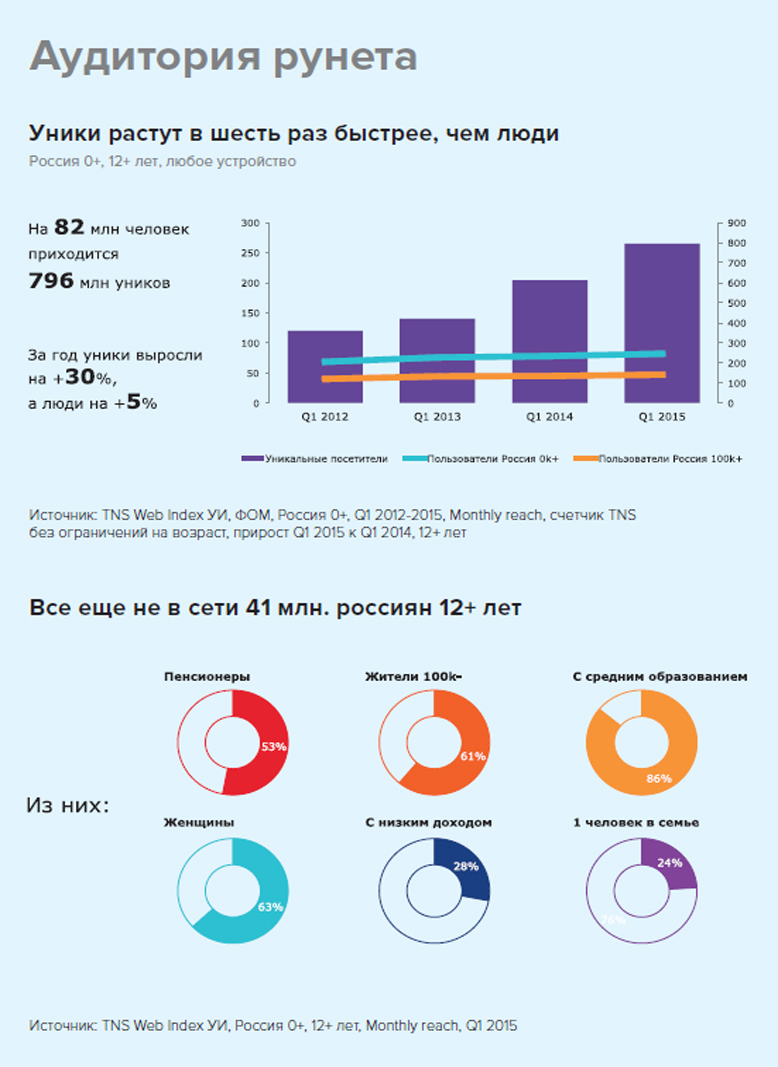

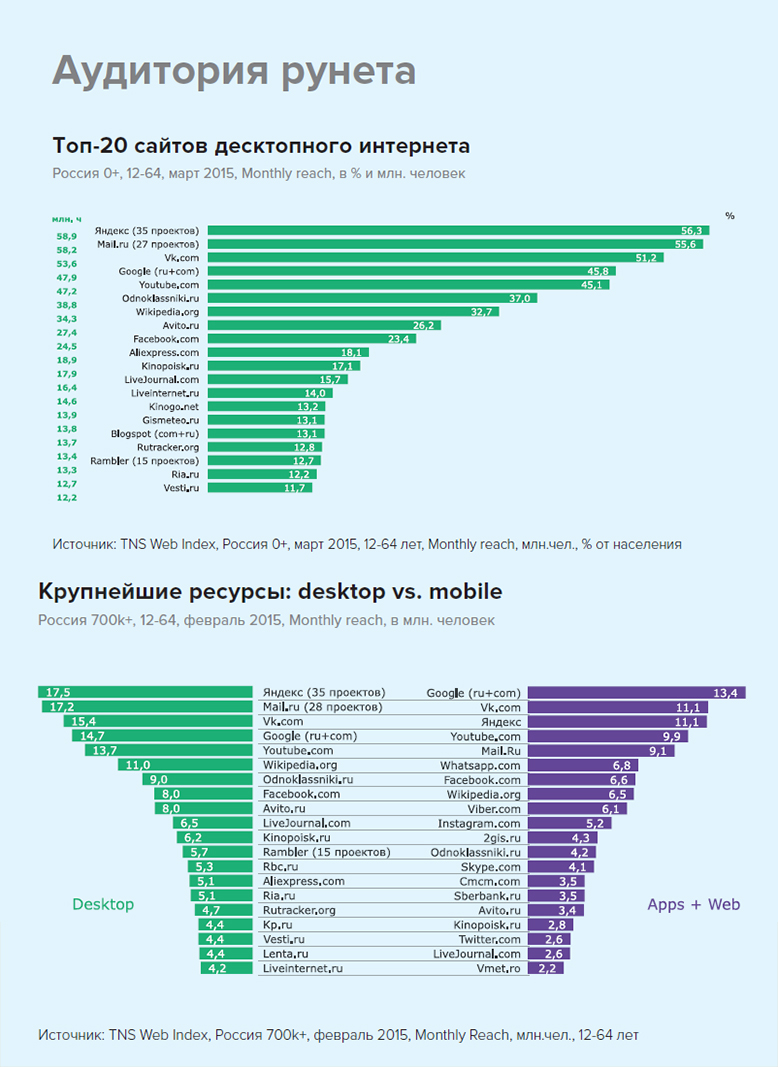

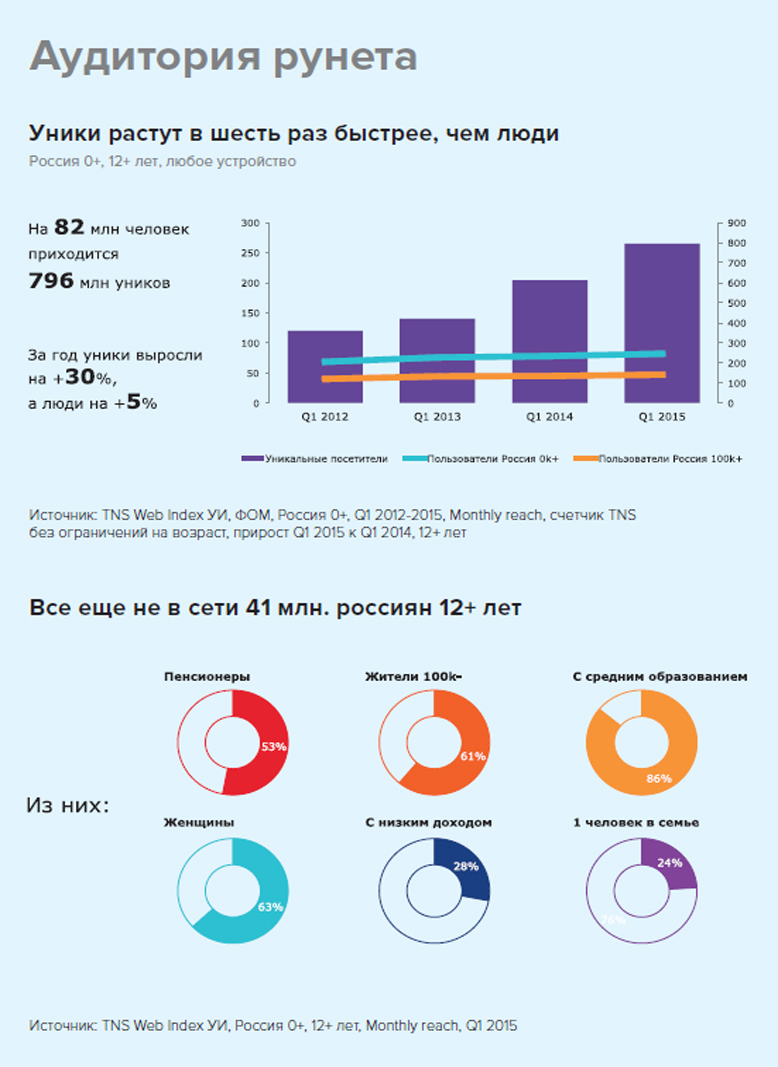

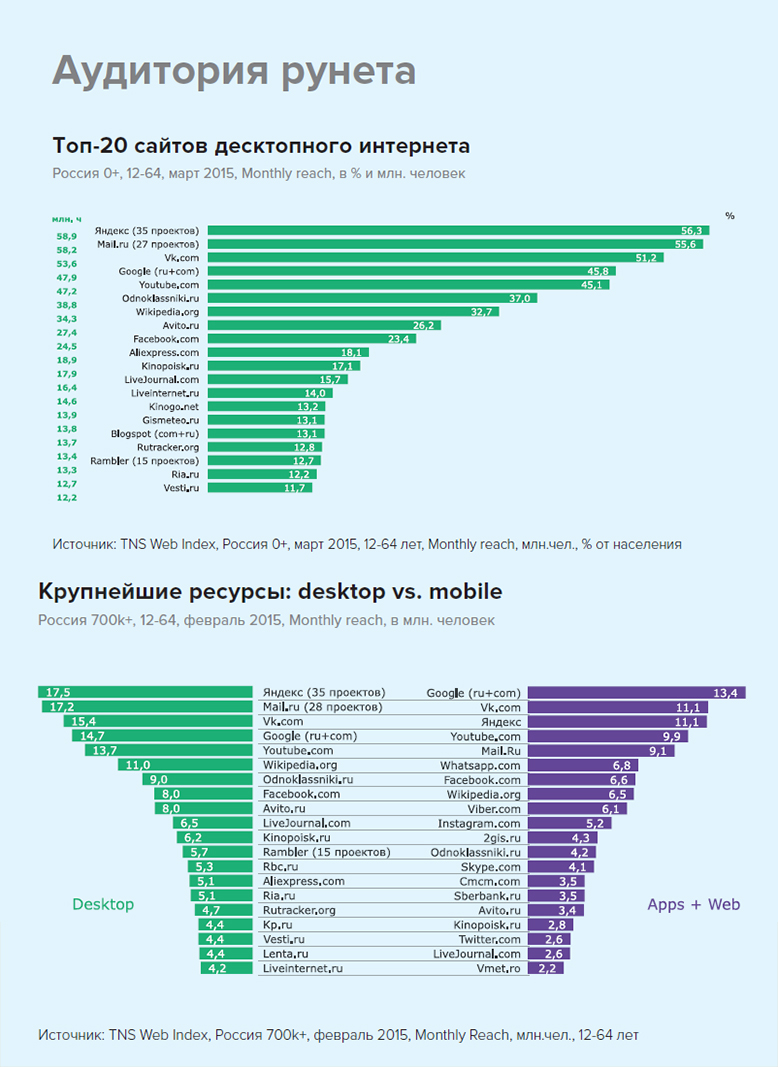

More than half of the country's population go online — 73.8 million users in Russia. Every day, 60.8 million people go online.

The penetration of the Internet among adult users by 2020 can be up to 82%, while maintaining growth rates.

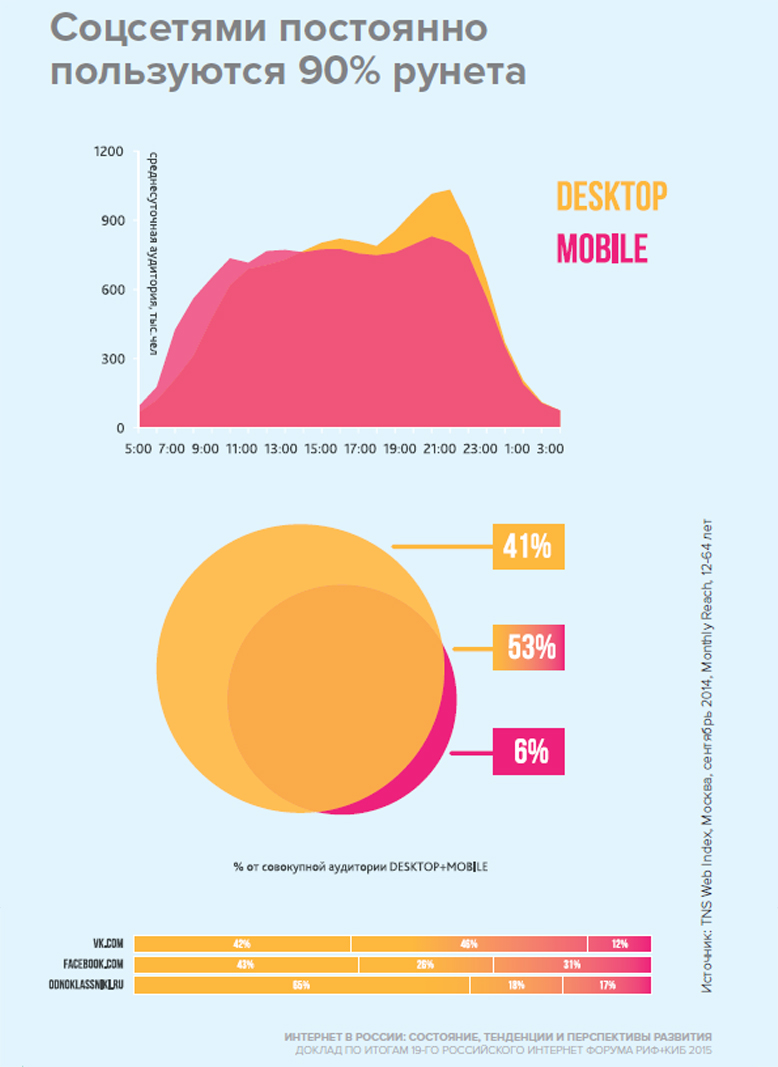

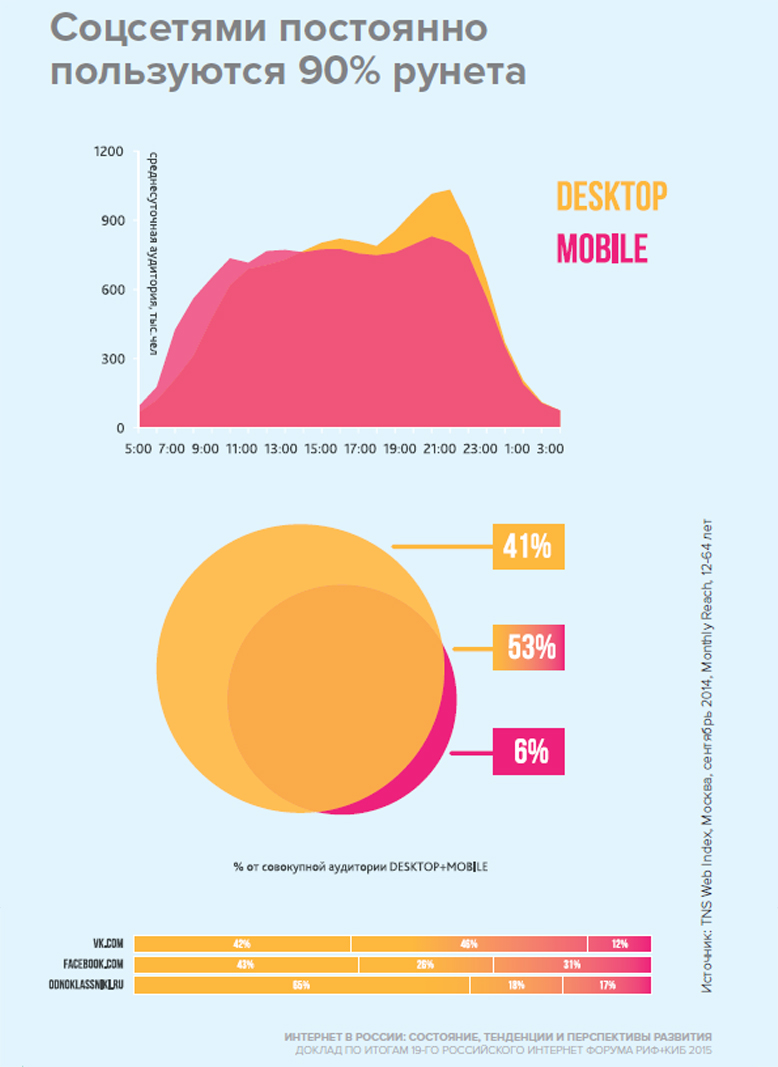

The share of mobile traffic has grown one and a half times, the mobile Internet audience has grown by a third - now half of the citizens use it 9% of the audience is online only from mobile devices. On average, users spend 126 minutes a day on the Internet, 86 minutes from mobile devices.

')

In Russia - 25 million online shoppers. 55% of users make purchases in Russian stores, 31% - in foreign online stores. In 2015, an increase in the number of online orders and a decline in the fourth quarter are forecast. 63% of online shoppers pay online for purchases.

Twitter has up to two million active Russian accounts, which give up to fourteen million tweets per day. Eight hundred Livejournal active authors produce three hundred thousand entries per day, seventeen million posts publish fifty-five million Vk.com accounts. From one to two million popular Facebook accounts publish four to five million posts daily. In Odnoklassniki peschuchivayut one hundred thousand thematic groups with sixty million subscribers. In Instagram, seven and a half Russian-language accounts publish from one to two million records. Up to fifty million messages per day are created in the Russian-speaking segment of the Internet.

The advertising market of the Runet in 2014 reached 84.6 billion rubles, but slowed down the growth rates due to the fall in the display advertising market. Media advertising in 2014 brought 19.1 billion rubles, contextual advertising - 65.5 billion rubles, social media marketing brought 7.3 billion rubles and grew by 17%. The video advertising market was estimated at 4.8 billion, of which 2.1 billion accounted for online cinemas.

The deterioration of the economic situation in the second half of 2014 led to a reduction in the advertising market and a decrease in the growth rate of video advertising in the network. The revenue received from subscriptions and paid movie views, while continuing to maintain high growth rates - this is due to the proliferation of smart-TV with online cinema applications.

Revenues of the video market, received by the advertising model, amounted to 1.67 billion rubles, and according to the paid model - 0.93 billion. Users began to pay more: the share of income from their payments increased from 22% in 2013 to 36% in 2014.

89% of Russia's largest advertisers use mobile advertising, giving an average of 26% of their budgets to it.

In September 2014, Mail.ru Group announced the purchase of the remaining 48.01% stake in VKontakte for $ 1.47 billion and became the sole shareholder of the social network.

Yandex made several major purchases in 2014-2015, including Auto.ru , which was immediately dismissed by the editor, Film Search and AdFox . The company acquired the MultiShip logistics services aggregator, a startup with the technology of collecting geodata of a smartphone with low energy costs KitLocate6, the Any Void application development studio, and several other startups and services.

The law “On Personal Data” entered into force on September 1, 2015, a number of foreign companies last year announced their readiness to transfer data from Russian users to physical servers in the country. Measures to protect confidentiality reduce the investment attractiveness and efficiency of new advertising models on the Internet and the cross-border nature of cloud services, the researchers note. In September, it became known that Roskomnadzor is not able to verify the implementation of the law by foreign companies.

Major Chinese players came to Russia, including JD.com and Alibaba. Only about ten Chinese software and hardware developers have entered the Russian market in the last year.

Based on AdIndex.

Lecture hall

More than half of the country's population go online — 73.8 million users in Russia. Every day, 60.8 million people go online.

The penetration of the Internet among adult users by 2020 can be up to 82%, while maintaining growth rates.

The share of mobile traffic has grown one and a half times, the mobile Internet audience has grown by a third - now half of the citizens use it 9% of the audience is online only from mobile devices. On average, users spend 126 minutes a day on the Internet, 86 minutes from mobile devices.

')

E-commerce

In Russia - 25 million online shoppers. 55% of users make purchases in Russian stores, 31% - in foreign online stores. In 2015, an increase in the number of online orders and a decline in the fourth quarter are forecast. 63% of online shoppers pay online for purchases.

Social networks

Twitter has up to two million active Russian accounts, which give up to fourteen million tweets per day. Eight hundred Livejournal active authors produce three hundred thousand entries per day, seventeen million posts publish fifty-five million Vk.com accounts. From one to two million popular Facebook accounts publish four to five million posts daily. In Odnoklassniki peschuchivayut one hundred thousand thematic groups with sixty million subscribers. In Instagram, seven and a half Russian-language accounts publish from one to two million records. Up to fifty million messages per day are created in the Russian-speaking segment of the Internet.

Internet advertising

The advertising market of the Runet in 2014 reached 84.6 billion rubles, but slowed down the growth rates due to the fall in the display advertising market. Media advertising in 2014 brought 19.1 billion rubles, contextual advertising - 65.5 billion rubles, social media marketing brought 7.3 billion rubles and grew by 17%. The video advertising market was estimated at 4.8 billion, of which 2.1 billion accounted for online cinemas.

The deterioration of the economic situation in the second half of 2014 led to a reduction in the advertising market and a decrease in the growth rate of video advertising in the network. The revenue received from subscriptions and paid movie views, while continuing to maintain high growth rates - this is due to the proliferation of smart-TV with online cinema applications.

Revenues of the video market, received by the advertising model, amounted to 1.67 billion rubles, and according to the paid model - 0.93 billion. Users began to pay more: the share of income from their payments increased from 22% in 2013 to 36% in 2014.

89% of Russia's largest advertisers use mobile advertising, giving an average of 26% of their budgets to it.

Legislation and business

In September 2014, Mail.ru Group announced the purchase of the remaining 48.01% stake in VKontakte for $ 1.47 billion and became the sole shareholder of the social network.

Yandex made several major purchases in 2014-2015, including Auto.ru , which was immediately dismissed by the editor, Film Search and AdFox . The company acquired the MultiShip logistics services aggregator, a startup with the technology of collecting geodata of a smartphone with low energy costs KitLocate6, the Any Void application development studio, and several other startups and services.

The law “On Personal Data” entered into force on September 1, 2015, a number of foreign companies last year announced their readiness to transfer data from Russian users to physical servers in the country. Measures to protect confidentiality reduce the investment attractiveness and efficiency of new advertising models on the Internet and the cross-border nature of cloud services, the researchers note. In September, it became known that Roskomnadzor is not able to verify the implementation of the law by foreign companies.

Major Chinese players came to Russia, including JD.com and Alibaba. Only about ten Chinese software and hardware developers have entered the Russian market in the last year.

Based on AdIndex.

Source: https://habr.com/ru/post/294884/

All Articles