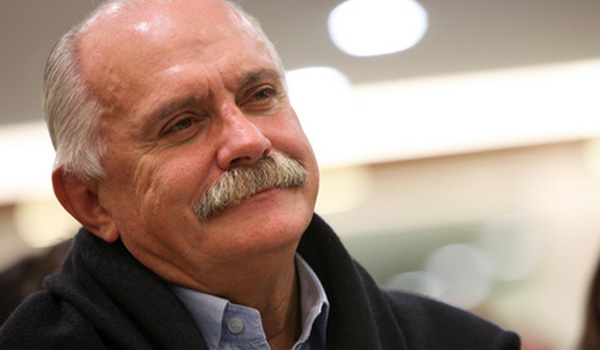

"Internet tax" Nikita Mikhalkov can still be entered

The Russian Authors' Society, headed by Sergey Fedotov, is not going to abandon the project to introduce a “global license” for content on the Web, RBC writes . At the same time, the idea of a “tax on the Internet”, first proposed by director Nikita Mikhalkov, the founder of the Russian Union of Rights Holders, was not accepted by market participants or profile ministries.

Now the Russian Union of Rights Holders (RSP) has united with the Russian Authors' Society (RAO) and the All-Russian Intellectual Property Organization (WIPO). The united structure is called the trade union of cultural workers "Russian Authors' Society" (MPC RW). Recall that the idea of a "tax on the Internet" implied the spread of a "global license" to all "music and phonograms, audiovisual works and works of literature" posted on the Web.

At the same time, Internet users could get access to all the named content in exchange for a monthly subscription fee, or “author's fee”. The authors of the idea of "tax on the Internet" found it difficult to determine the procedure for collecting such a fee, as well as to name the person responsible for the implementation of the idea.

')

Now the head of the MPC of RAO, Sergey Fedotov, claims that the global license is a “revolutionary proposal” that they simply did not understand. In many ways, the rejection of this idea, according to Fedotov, was due to "biased publications in the press." RAO plans to continue working on this project further. “Whether the proposal for a global license will be adopted in a modernized form or there will be another mechanism, while it’s too early to say. But he will be chosen one way or another, ”said Fedotov. is he

RAO plans to continue developing the national intellectual property registry. According to Fedotov, the registry should be developed by a “state-accredited collective management organization [copyright]”. Funds for the implementation of this project are planned to be allocated from the money received from the sale of real estate by a subsidiary of Service-Operation Company JSC.

Source: https://habr.com/ru/post/294274/

All Articles