The volume of the venture capital investment market in Russia has decreased by almost 2 times

Photo: Vedomosti

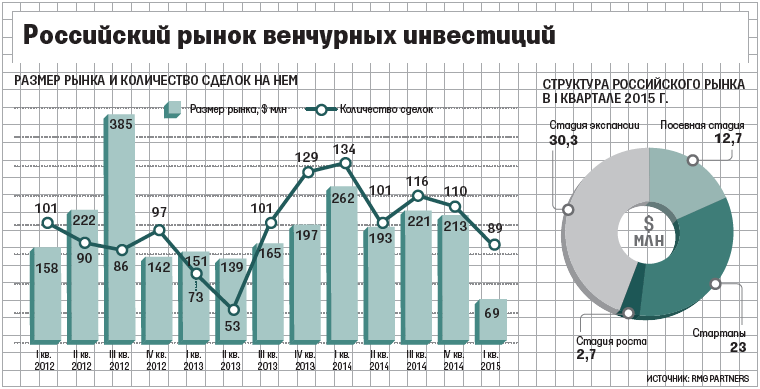

In the first quarter of 2015, the volume of transactions in the Russian venture capital market amounted to $ 68.7 million. Thus, the domestic venture capital investment market has almost halved, rolling back to the 2012 level, Vedomosti reports.

In the first three months of this year, 89 transactions were made in Russia, of which 52 transactions were conducted with the participation of government funds and corporations. Private funds, as far as can be judged, are not too willing to invest in domestic startups, preferring to invest in foreign companies. However, in this situation there is a way out - communities of business angels, where quite a large number of transactions are conducted at the very early and early stages.

Source: RMG Partners

')

As for the first quarter of 2015, during this time there has not been a single exit from the investment. The reason for this, according to RMG experts, is the devaluation and volatility of the ruble exchange rate. In the third and fourth quarters of last year, assets were sold on the market, after which the value of unsold assets fell. In addition, investors who planned to leave the portfolio unchanged, refused to simply take profits or losses, starting to negotiate the sale of their business. For example, in January-March such famous projects as LinguaLeo, Life-Pay, Utinet, Sotmarket, Contact, Payonline were put up for sale.

Also, in the first quarter of 2015, not a single transaction to attract investment in mature companies was recorded. At the same time, during this time, the amount of investment in projects at the stage of business expansion or at the startup stage increased 2-fold.

According to RMG Partners partner Arseny Dabbaha, the situation will not improve by the end of the year. “We will observe single exits from projects that were most likely planned well in advance,” he comments on market dynamics. Now the ratio of public and private money is almost equal, but not by increasing public investment, but by reducing private investment.

Roman Kosyachkov, Deputy General Director and Managing Director of RVC, believes that at the beginning of 2015, the venture capital market is showing a trend similar to the first half of last year. Plus, the situation is adjusted to reduce the availability of private capital - this is influenced by a not too positive macroeconomic situation. At the end of 2015, RVC does not expect positive dynamics of the Russian venture capital market. However, due to participation in investing in state development institutions, most likely there will not be a significant drop in the domestic venture capital market either.

The managing partner of Almaz Capital, Alexander Galitsky, claims that now domestic projects have begun to focus on foreign investment.

As for the work of the Internet Initiatives Development Fund, its director, Maxim Steigerwald, talks about the previous level of investment in domestic startups. There are now more than 170 projects in the IIDF portfolio.

Source: https://habr.com/ru/post/293722/

All Articles