Individual investment account: brokers' answers to questions about tax deduction, investment programs and income from securities

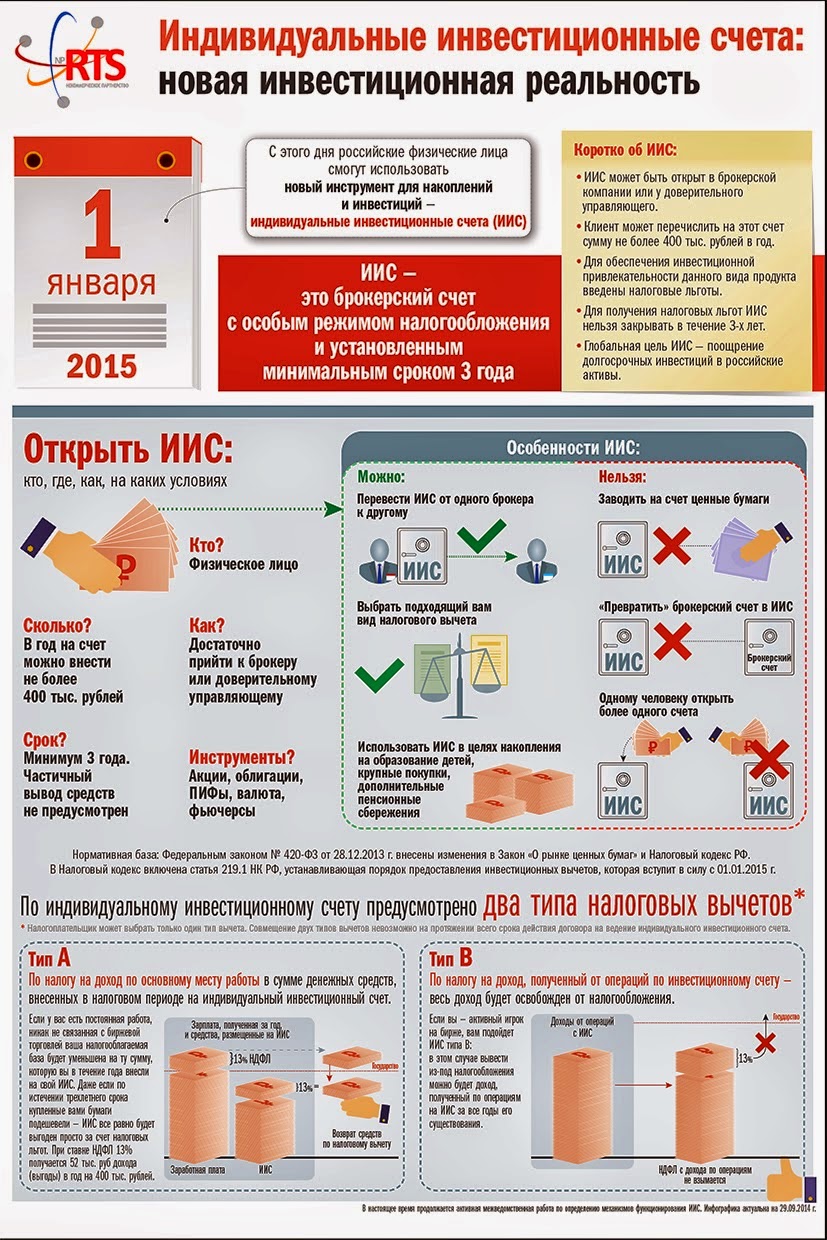

From January 1, 2015, an Individual Investment Account (IIS) is in effect in Russia - a special type of investment account that is subject to tax incentives. With the help of this tool, the Moscow Exchange will receive the money necessary for the development of the Russian securities market, and citizens will receive tax deductions and the opportunity to earn money.

I decided to use this tool for savings, but it turned out to be difficult to choose a broker: the conditions of IIS are different, and they do not give definite answers to some questions. Not a single Russian citizen has yet received a tax deduction for IIS - “early birds” will receive the first 13% of their funds only in January 2016. I interviewed several brokers, asked them the most tricky questions, including the opportunity to get a deduction on IIS while receiving a deduction for the purchase of an apartment.

Learn more about the basic principles of the individual investment account and brokers answers to thirteen questions - under the cut.

Tax breaks

When you open an account, you choose the options for benefits:

- tax deduction in the amount of 13% of the deposited funds (maximum - 52,000 rubles per year);

- absence of taxes on funds earned on the securities market.

')

To open an individual investment account 10,000 rubles is enough. After receiving the tax deduction to a separate bank account, you can deposit it back to the IIS in order to receive a deduction for this amount in the next year.

In the event of an account being closed before its expiration date, it will be necessary to return funds received from the state or unpaid to it.

How to earn?

Security

The funds that you invest and for which the broker purchases securities are stored in these securities. If the broker does not become - securities will remain yours.

For myself, I plan to choose the safest strategy with the minimum income - the purchase of government bonds at 9% per annum.

Remember: if a broker places a part of the funds on a deposit, the deposit insurance system does not cover them - there will be no coverage in the amount of up to 1.4 million rubles.

1. From what moment does the countdown of the validity period of an individual investment account begin: from the moment of opening an account or from the moment funds are received in the account?

2. What ready investment strategies for IIS does the bank offer? What is the expected return?

3. Is it possible to independently select a portfolio of securities when opening an IMS? Is it possible to change the structure of the portfolio after some time? How often can you change the structure of the portfolio?

4. What part of the funds deposited on the ICS will work on the securities market?

5. How long do you pay income from securities transactions, coupon payments and dividends? At the end of the action of IIS or upon receipt?

6. Where are these payments credited? Directly to the ASC or they can be immediately paid to another of my account?

7. What you need to do to get a tax deduction. What documents and when it is necessary to provide the IFTS for deduction? It is enough to provide them once or every year of the existence of IIS?

8. Is it possible to get a tax deduction through your bank, under any simplified system, without contacting the tax inspectorate at the place of residence?

9. Where does the tax deduction go? (On open IIS or on any of my accounts? Is there a choice?).

10. If the money earned on securities comes to IIS, will the deduction be made from the whole amount (deposits + earned money), or only from deposits?

11. If I am not satisfied with the quality of service, what is the procedure for transferring an existing IIS to another bank (without closing an account)?

12. If the amount of taxes paid by a citizen for a year is less than 52 thousand rubles, will he receive less than 52 thousand rubles with the amount of funds paid for the year 400,000 rubles? Will unpaid taxes be paid for the first year in the next, second year?

13. Does the IIS benefit affect other benefits and personal income tax deductions?

If I deduct a tax deduction from IIS at the same time and use other NDFL benefits (tax deduction when buying an apartment), will I get both benefits in full? The maximum for the apartment (260 000 rubles based on the cost of real estate 2 million rubles.) And at the same time the maximum on IIS (52 000 rubles from the calculation of the amount of contributions 400 tons of rubles).

They have not yet responded to the requests: Sberbank, Gazprombank.

I decided to use this tool for savings, but it turned out to be difficult to choose a broker: the conditions of IIS are different, and they do not give definite answers to some questions. Not a single Russian citizen has yet received a tax deduction for IIS - “early birds” will receive the first 13% of their funds only in January 2016. I interviewed several brokers, asked them the most tricky questions, including the opportunity to get a deduction on IIS while receiving a deduction for the purchase of an apartment.

Learn more about the basic principles of the individual investment account and brokers answers to thirteen questions - under the cut.

Tax breaks

When you open an account, you choose the options for benefits:

- tax deduction in the amount of 13% of the deposited funds (maximum - 52,000 rubles per year);

- absence of taxes on funds earned on the securities market.

')

To open an individual investment account 10,000 rubles is enough. After receiving the tax deduction to a separate bank account, you can deposit it back to the IIS in order to receive a deduction for this amount in the next year.

In the event of an account being closed before its expiration date, it will be necessary to return funds received from the state or unpaid to it.

How to earn?

- Get a tax deduction of 13% on investment.

- Get income from securities.

Security

The funds that you invest and for which the broker purchases securities are stored in these securities. If the broker does not become - securities will remain yours.

For myself, I plan to choose the safest strategy with the minimum income - the purchase of government bonds at 9% per annum.

Remember: if a broker places a part of the funds on a deposit, the deposit insurance system does not cover them - there will be no coverage in the amount of up to 1.4 million rubles.

General issues

1. From what moment does the countdown of the validity period of an individual investment account begin: from the moment of opening an account or from the moment funds are received in the account?

Alfa Capital AM

Since the receipt of funds in the account.

Brokerage House Opening

Since the opening of the account.

BCS Premier

Since opening

Life Capital

Since the opening of the account.

Finam

Since the opening of the account.

2. What ready investment strategies for IIS does the bank offer? What is the expected return?

Alfa Capital Management Company

The management company Alfa Capital offers three strategies - Points of Growth, Our Future and New Horizons. Read more here - www.alfaiis.ru

Brokerage House "Discovery"

open-broker.ru/lp/individual-investment-account/?utm_source=site_bdo&utm_medium=banner&utm_content=lp&utm_campaign=individual-investment-account and go down to the products

BCS Premier

We offer flexible solutions tailored to your needs. If we consider the most popular conservative strategies (deposit type), then these are portfolios consisting of:

-of federal loan bonds (OFZ), the current rate on OFZ about 10-11% per annum;

- Of the bonds of the largest banks (top 10) and top Russian companies, here the current rate is 13-14.5% per annum.

Life Capital

About the recommended options can be found on the page of the site, I attach the link market.life-capital.ru/iis .

Finam

Under the link www.comon.ru/robot all TradeCentr strategies are available. Next to the adapted for the Individual investment account there is a sign “Available on IIS”.

3. Is it possible to independently select a portfolio of securities when opening an IMS? Is it possible to change the structure of the portfolio after some time? How often can you change the structure of the portfolio?

Alfa Capital Management Company

Self-selection of a portfolio is not possible. The composition of the portfolio is determined by the portfolio manager of UK Alfa Capital. The structure of the portfolio varies depending on the economic situation in the country and in the world.

Brokerage House "Discovery"

Yes, for this purpose TP was created. Independent management of open-broker.ru/ru/pricing-plans/self-management.

Yes, change is possible. Change the portfolio, if you are on TP Self-management can even be several times a day.

BCS Premier

Independent selection of papers is possible. Since the portfolio consists of liquid securities, it is possible to revise it at any time when such a need arises.

Life Capital

What papers to buy the decision for you, the choice big. As for the changes, this is also possible at your discretion, since working on an IMS account involves various trading strategies.

Finam

If you connect your IIS to the auto-follow on strategy, it is possible to change the structure of the portfolio, but it is not recommended. You can not connect the account to the follow-up, but receive signals according to the strategy and work independently, relying on the signals of the managers.

4. What part of the funds deposited on the ICS will work on the securities market?

Alfa Capital Management Company

50% of the portfolio is the investment part, 50% is a deposit in Alfa-Bank JSC

Brokerage House "Discovery"

Depending on the choice of tariff and product. In self-management, you make decisions yourself. In the model portfolio - 80%, in trust - at the discretion of the manager.

BCS Premier

From 0% to 100% (i.e. money can be kept in cash, it can be in securities, in any proportion, depending on the situation and necessity);

Life Capital

In essence, an IIS account is a normal brokerage account that allows you to work in the stock market. Therefore, almost all funds will be used by you to work with securities and financial instruments.

Finam

Ivan, it depends on your preferences. You can trade the entire amount of funds deposited or trade.

Income from securities

5. How long do you pay income from securities transactions, coupon payments and dividends? At the end of the action of IIS or upon receipt?

Alfa Capital Management Company

All revenues from operations within IIS are accumulated on IIS. Partial conclusion d.s. and securities during the term of the agreement on the maintenance of IIS is impossible. Those. the opportunity to use the income received from operations in the framework of IIS, as well as received coupons and dividends, will appear only after termination of the contract for opening and maintaining IIS, if the assets are not transferred to another IIS of the same client.

Brokerage House "Discovery"

Upon receipt.

BCS Premier

Revenues from securities transactions are credited on the day the transaction is completed. Coupons and dividends come when they are paid by the issuer of a security, for example, bonds have known dates, usually 2 times a year.

Life Capital

Payment of dividends and coupons holds companies whose shares and bonds you own, the dates are known in advance, but depend on the companies themselves.

Finam

Upon receipt.

6. Where are these payments credited? Directly to the ASC or they can be immediately paid to another of my account?

Alfa Capital Management Company

Directly on IIS. See p.4

Brokerage House "Discovery"

On IIS, but payment of dividends and coupons to a bank account is possible.

BCS Premier

Both options are possible, you need to choose at the time of registration

Life Capital

All but dividends will be credited to IIS.

Finam

At your request.

Tax deduction

7. What you need to do to get a tax deduction. What documents and when it is necessary to provide the IFTS for deduction? It is enough to provide them once or every year of the existence of IIS?

Alfa Capital Management Company

There are two types of deductions - deduction for contribution and deduction for income. The deduction of the contribution can be received at the end of the tax period in which funds were credited to the IIS. To do this, the client submits a tax return to the tax authority at the place of permanent registration (personally, by mail, through a personal account on the FTS website). The declaration must be accompanied by documents confirming the receipt of income subject to taxation at a rate of 13% in the relevant tax period (for example, 2-NDFL), documents confirming the fact of transfer of d.s. on IIS as well as an application for tax refund indicating the bank details of the client. The deduction on income is provided to the client upon termination of the contract for maintaining IIS, if the assets are not transferred to another IIS opened to the client. The deduction is provided by the tax agent (prof. Participant). In order to receive the deduction, the client must submit a certificate from the tax inspectorate stating that he did not use the tax deduction for contributions on the IIS during the whole period of the existence of the IIS.

If the above conditions are met, the Professional Participant acting as a tax agent will not withhold personal income tax upon payment of funds.

Brokerage House "Discovery"

In the attachment memo "How to get a tax deduction for IIS"

BCS Premier

To receive the deduction, you must submit a tax return to the Federal Tax Service before April 30 of the year following the reporting form 3-NDFL with the following documents: 1) documents confirming receipt of income subject to personal income tax (at a rate of 13%) in the relevant tax period , 2) documents confirming the transfer of funds to the account (IIS). 3) application for tax refund indicating the bank details of the taxpayer

Life Capital

To return the personal income tax you must submit an application to the tax at the place of registration. Documents required for the treatment of the following:

- A copy of the IIS Treaty (applications for accession to the Regulations);

- Copies of payment documents for the transfer of funds in IIS;

- Copy of the passport;

- Tax declaration 3-NDFL;

- Certificate of employment 2-NDFL (if there are other sources of income, you can submit certificates 2-NDFL from all sources of income);

- Bank details for crediting funds.

A personal income tax refund can be made several times, for example, annually, if you have been in the last year of replenishing your IIA account.

Finam

Type A: To receive a tax deduction in the amount of money deposited by the taxpayer in the tax period to an individual investment account, you must submit in person or send to the tax office by mail a tax return in form 3-NDFL at the end of the tax period (until April 30, following the reporting year). Attach documents confirming receipt of income taxed at a rate of 13% in the relevant tax period, documents confirming the fact of crediting funds to an individual investment account (Article 219.1 p. 3 of the RF Tax Code), a tax return statement indicating the tax return details of the taxpayer. At the closure of IIS before three years, all amounts of income tax return received from the budget should be returned to the budget.

Type B: Upon termination of an individual investment account contract, after a minimum of three years from the moment of opening the account, the taxpayer provides the broker with a certificate from the tax inspectorate stating that the taxpayer did not use tax deductions for contributions to IIA during the life of the IIA. In this case, the broker, who acts as a tax agent, will not withhold income tax when paying out the funds. Important: When closing an account earlier than three years, a personal income tax is charged on a positive financial result as per a normal brokerage account.

8. Is it possible to get a tax deduction through your bank, under any simplified system, without contacting the tax inspectorate at the place of residence?

Alfa Capital Management Company

Currently no.

Brokerage House "Discovery"

Not

BCS Premier

Through the bank can not be issued

Life Capital

At the beginning of next year, it is planned to launch a service that will significantly simplify the procedure for filing documents for tax refund.

Finam

There is no such possibility.

9. Where does the tax deduction go? (On open IIS or on any of my accounts? Is there a choice?).

Alfa Capital Management Company

"Tax deduction" is the amount that reduces the amount of income from which the tax is paid, so that the tax deduction does not go anywhere.

If we are talking about the deduction of the contribution, the state does not return the deduction, but the overpaid tax in connection with the tax deduction provided. Refunds are made on the basis of the client's application to any account at the details specified in the application.

Brokerage House "Discovery"

Only to your personal bank account. You can only choose a bank to open this account.

BCS Premier

Only to a bank account opened in your name

Life Capital

See the answer to question 7.

Finam

To a bank account.

10. If the money earned on securities comes to IIS, will the deduction be made from the whole amount (deposits + earned money), or only from deposits?

Alfa Capital Management Company

The deduction of the contribution - in the amount of den. funds deposited on IIS.

Deduction for income - in the amount of a positive financial result for operations in the framework of IIS.

Brokerage House "Discovery"

Only with made. Contributed is the amount received from the bank account of the owner of IIS. All the rest is income.

BCS Premier

Only with contributions, i.e. from the amounts that you transferred to the IIS (of course, it can be funds returned by the FTS and coupons that were credited to your bank account)

Life Capital

The return of personal income tax is carried out only from the amount paid.

Finam

The deduction of the contribution (type A) can be obtained only from the amount of money contributed

Exceptional situations

11. If I am not satisfied with the quality of service, what is the procedure for transferring an existing IIS to another bank (without closing an account)?

Alfa Capital Management Company

The client can terminate the contract for maintaining IIS with one prof. the participant with the transfer of all assets recorded on the IIS to another professional participant. With this date, the validity of the IIS is not interrupted.

Brokerage House "Discovery"

The company in which you want to transfer IIS is engaged in transfer.

BCS Premier

You can transfer securities only when transferring IIS from one broker to another, for this you need to open IIS in another bank and within 30 days make a transfer to a new IIS

Life Capital

You will start the procedure of transferring the IIS to another broker, you will need to submit an order to the company, where to open an account and to the company, where you plan to switch to the service.

Finam

Procedure for transferring an IIS from another broker to Finam: A client closes an account and within 30 days opens an account with Finam. In this case, the tax rebate is not lost. The procedures may differ from other brokers.

12. If the amount of taxes paid by a citizen for a year is less than 52 thousand rubles, will he receive less than 52 thousand rubles with the amount of funds paid for the year 400,000 rubles? Will unpaid taxes be paid for the first year in the next, second year?

Alfa Capital Management Company

The deduction applies to income from which the tax was paid at a rate of 13%. Thus, if the amount of income in the tax period was less than 400 thousand rubles, and the contribution to IIS in the same tax period was 400 thousand rubles, then the return will be equal to the amount of income X 13%. The balance of the investment tax deduction cannot be transferred to the next tax period.

Brokerage House "Discovery"

He will receive exactly as much as he paid the tax this year, even if he contributed 400,000. No.

BCS Premier

If the amount of taxes paid is less than 52 tr. for a year, even if the amount on IIS is 400 tr., the citizen will be refunded the amount not more than the amount of taxes paid by him, however all income received by the citizen, for which he pays income tax, is taken into account, including, for example, work on part-time, etc .; Is it possible to transfer an underpaid tax deduction for subsequent periods (as in the case of a property deduction, unfortunately it is not clear exactly, since this is not clearly stated in the law, perhaps later on this issue there will be clarifications)

Life Capital

Tax refund will be equal to the paid without the possibility of transfer.

Finam

The client can receive no more than the amount that was paid to the tax during the year at a rate of 13%, with the exception of dividends.

13. Does the IIS benefit affect other benefits and personal income tax deductions?

If I deduct a tax deduction from IIS at the same time and use other NDFL benefits (tax deduction when buying an apartment), will I get both benefits in full? The maximum for the apartment (260 000 rubles based on the cost of real estate 2 million rubles.) And at the same time the maximum on IIS (52 000 rubles from the calculation of the amount of contributions 400 tons of rubles).

Alfa Capital Management Company

Yes, it does. The total amount of deductions may not exceed the amount of income received. It should also be borne in mind that the property tax deduction can be transferred to the following tax periods, but the investment tax cannot.

Brokerage House "Discovery"

Formally, nothing prevents you from getting it, but for more detailed information it is better to contact the tax authority. For other non-IIS-related deductions, we do not have information.

BCS Premier

It does, if the amounts of the annually paid tax allow, then both benefits can be obtained in full, if not, then, for example, a property deduction can be partially transferred to the next year, then another year, etc. Property deduction can be claimed at any time within 3 years after the purchase of an apartment and received in parts until it is completely selected.

Life Capital

These payments are summed up, but remember that you are making a refund of previously paid personal income tax.

Finam

The benefit of IIS does not affect other benefits. If the amount to be returned is sufficient, then you can get both deductions.

They have not yet responded to the requests: Sberbank, Gazprombank.

Source: https://habr.com/ru/post/293214/

All Articles