Scam attack on internet business: 5 monsters under the bed of an internet merchant

The damage from online card fraud exceeded 1 billion euros in Europe in 2013. Every year fraudsters find new ways to steal payment information, causing damage to both the cardholder and the Internet site, where the billing information was used by the attacker. In WayForPay, they decided to share five problems for online businesses that may arise when accepting payment on a stolen card and if they are overly protected against fraudulent transactions.

Chargeback or chargeback (from the English chargeback) is the return of the amount of the paid purchase back to the bank card as a result of a special procedure to challenge the transaction. In the case of fraudulent transactions, the chargeback is triggered if the buyer did not consent to the transaction and the payment was made with the stolen payment information. It is fraud with stolen cards that is the main reason for initiation of chargebacks.

The refund amount is borne by the seller, since he accepted payment by stolen card. Chardbeck can be challenged, but according to international practice, only about 21% of all cases filed were successfully protested by sellers. In fact, the seller reimburses the cost of the goods / services paid by the card, and also loses the product or service provided by the fraudster.

')

When processing online payments, standard filtering of all risky transactions is provided. Each payment goes through a filter. For example, in the system it can be seen that the user has always paid by card only in Ukraine. If the processing operator determines that a customer is trying to pay with a card, for example, in France (which is not typical for this customer), then the payment will be marked as risky. It will be assumed that the buyer has stolen payment information and is trying to pay with a card in another country. On the one hand, such work with risk payments is undoubtedly capable of preventing a fraudulent operation, but at the same time it can reject the purchase of a real cardholder.

The rejection of all risky transactions is equivalent to the fact that you simply forbid your customers to make purchases on your website. For example, the client of the site for the sale of airline tickets, which previously made purchases from one country decided to buy a ticket while in another country. As a result, according to the geographical anti-fraud filter, the client’s operation will be rejected, as it will be considered risky.

In the anti-fraud WayForPay system , more than 100 filters are checked for payment, plus a team of risk analysts with maximum accuracy analyzes and determines the level of riskiness of the transaction. At the same time, the cardholder does not suffer, which for some reason may make payments that do not correspond to the standard bank settings.

Antifraud system can be used both when accepting payments on the website via WayForPay , as well as as a separate protection system against fraudulent transactions, in combination with the existing Internet acquiring.

As a consequence of the previous clause “on refusing a customer to purchase”, customers cannot pay for the purchase due to suspicions of fraud. As a result, the business loses part of its profits. Each 5 payment can be regarded as risky, but on average only two transactions per 1000 payments will really be an attempt by the fraudster to pay with stolen payment information. Indicators for each type of business are different, depending on the level of riskiness. Each business can pre-calculate their losses when rejecting all suspicious payments.

Financial losses can also be attributed to losses in the value of a product or service, if, nevertheless, payment by a stolen card was missed by an online merchant.

The reputation of the brand may suffer as if the online merchant accepts payment by a stolen card, or if the payment to the cardholder is blocked as risky.

In addition to the amount of chargeback compensation, the seller may incur fines. According to the rules of payment systems Visa and MasterCard, the share of chargebacks should not exceed 1-2%. Otherwise, in addition to fines, the Internet entrepreneur faces closure of the trading account and a ban on accepting online payments with Visa and MasterCard.

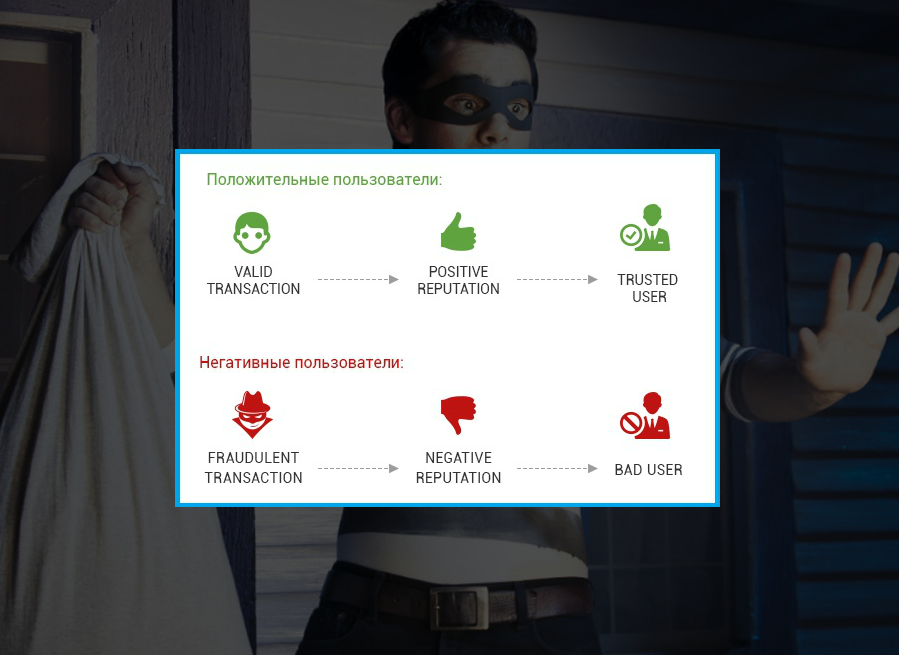

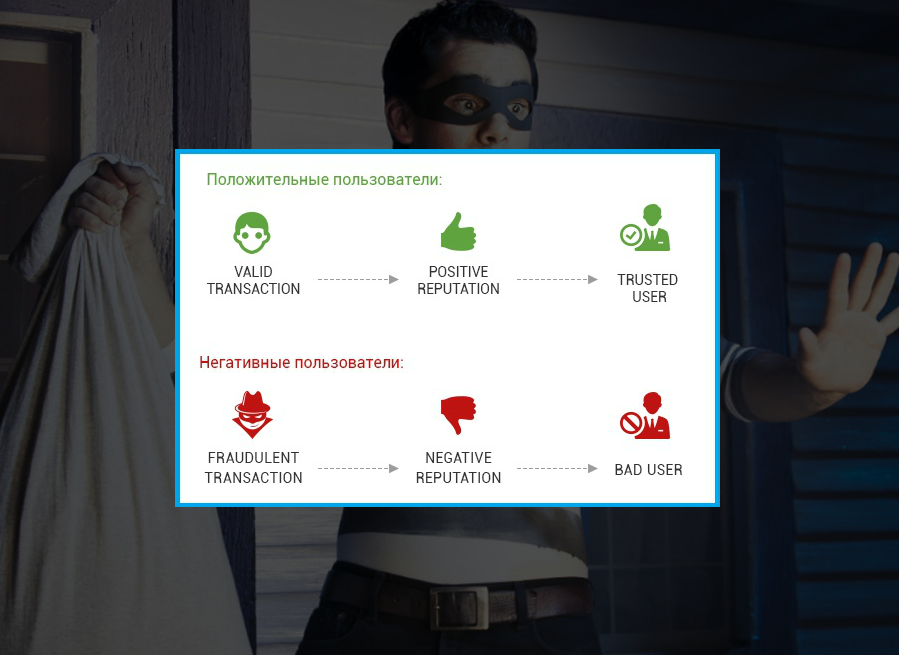

Not enough attention to fraudulent transactions, as well as the automatic rejection of all suspicious payments can create a number of business problems. Proper management of risky transactions allows you to cut off scammers' attempts to pay for a product or service on your site and skip to pay, by some parameters, a suspicious, but thoroughly verified transaction of your client - without losing profit.

Therefore, the availability of high-quality antifraud system with a partner for receiving online payments is already a necessity for a successful Internet business.

Chardbeck

Chargeback or chargeback (from the English chargeback) is the return of the amount of the paid purchase back to the bank card as a result of a special procedure to challenge the transaction. In the case of fraudulent transactions, the chargeback is triggered if the buyer did not consent to the transaction and the payment was made with the stolen payment information. It is fraud with stolen cards that is the main reason for initiation of chargebacks.

The refund amount is borne by the seller, since he accepted payment by stolen card. Chardbeck can be challenged, but according to international practice, only about 21% of all cases filed were successfully protested by sellers. In fact, the seller reimburses the cost of the goods / services paid by the card, and also loses the product or service provided by the fraudster.

')

Refusal to buy

When processing online payments, standard filtering of all risky transactions is provided. Each payment goes through a filter. For example, in the system it can be seen that the user has always paid by card only in Ukraine. If the processing operator determines that a customer is trying to pay with a card, for example, in France (which is not typical for this customer), then the payment will be marked as risky. It will be assumed that the buyer has stolen payment information and is trying to pay with a card in another country. On the one hand, such work with risk payments is undoubtedly capable of preventing a fraudulent operation, but at the same time it can reject the purchase of a real cardholder.

The rejection of all risky transactions is equivalent to the fact that you simply forbid your customers to make purchases on your website. For example, the client of the site for the sale of airline tickets, which previously made purchases from one country decided to buy a ticket while in another country. As a result, according to the geographical anti-fraud filter, the client’s operation will be rejected, as it will be considered risky.

In the anti-fraud WayForPay system , more than 100 filters are checked for payment, plus a team of risk analysts with maximum accuracy analyzes and determines the level of riskiness of the transaction. At the same time, the cardholder does not suffer, which for some reason may make payments that do not correspond to the standard bank settings.

Antifraud system can be used both when accepting payments on the website via WayForPay , as well as as a separate protection system against fraudulent transactions, in combination with the existing Internet acquiring.

Loss of profit

As a consequence of the previous clause “on refusing a customer to purchase”, customers cannot pay for the purchase due to suspicions of fraud. As a result, the business loses part of its profits. Each 5 payment can be regarded as risky, but on average only two transactions per 1000 payments will really be an attempt by the fraudster to pay with stolen payment information. Indicators for each type of business are different, depending on the level of riskiness. Each business can pre-calculate their losses when rejecting all suspicious payments.

Financial losses can also be attributed to losses in the value of a product or service, if, nevertheless, payment by a stolen card was missed by an online merchant.

Reputation suffers

The reputation of the brand may suffer as if the online merchant accepts payment by a stolen card, or if the payment to the cardholder is blocked as risky.

Fines

In addition to the amount of chargeback compensation, the seller may incur fines. According to the rules of payment systems Visa and MasterCard, the share of chargebacks should not exceed 1-2%. Otherwise, in addition to fines, the Internet entrepreneur faces closure of the trading account and a ban on accepting online payments with Visa and MasterCard.

Not enough attention to fraudulent transactions, as well as the automatic rejection of all suspicious payments can create a number of business problems. Proper management of risky transactions allows you to cut off scammers' attempts to pay for a product or service on your site and skip to pay, by some parameters, a suspicious, but thoroughly verified transaction of your client - without losing profit.

Therefore, the availability of high-quality antifraud system with a partner for receiving online payments is already a necessity for a successful Internet business.

Source: https://habr.com/ru/post/292870/

All Articles