Promising Startup: An Analysis of the Situation by Mark Custer

Note Trans.: In this article, Mark Saster, a venture capitalist and investment partner at Upfront Ventures, talks about the MakeSpace project, which he supported.

Mark talks about how Clayton Christensen’s ideas about disruptive innovations can be put into practice and what directions of development of modern technology businesses from his point of view may be the most successful and financially sustainable.

')

Amazon. This name has become a household name. It has become synonymous with other Internet companies, for which the French have invented the scornful term "les GAFA", which includes the acronym Google-Apple-Facebook-Amazon and emphasizes the superiority of American companies on the Web.

Try to imagine that you have not heard anything about Amazon, and company representatives go to meetings with venture capitalists and tell you that they are going to turn the market of commerce, starting with books, and then gradually moving to selling electronics, clothes, toys and so on. It is unlikely that they would receive a warm welcome from investors - until one day they would not show them how orders from the Amazon site deliver drones.

Amazon symbolizes companies that change the balance in the market without making much noise out of it. They break through due to well-established supplies, supplies, inventory management and storage, customer support, merchandising, cross-selling and, ultimately, better prices and significant market coverage.

It’s hard to imagine all this until you see how such a business works in full force, overtaking retailers who spend money on rent, and because of this, either raise prices for products or reduce their profits.

That is why Amazon’s market capitalization is $ 200 billion.

In the same way as I was struck by the obvious dominance of this retail monster in the US e-commerce market today, I was puzzled by the idea of creating the MakeSpace project. The goal of Sam [Rosen] was to create a technology company that provides opportunities for storing tangible items in the "cloud" and building a large-scale business with which it will be very difficult to compete.

I had several investment friends who instantly saw a parallel between these two concepts, but others scratched their heads and said: “How can a company engaged in storing material objects, even if using the term cloud, be truly technological?”

Let's start from the beginning.

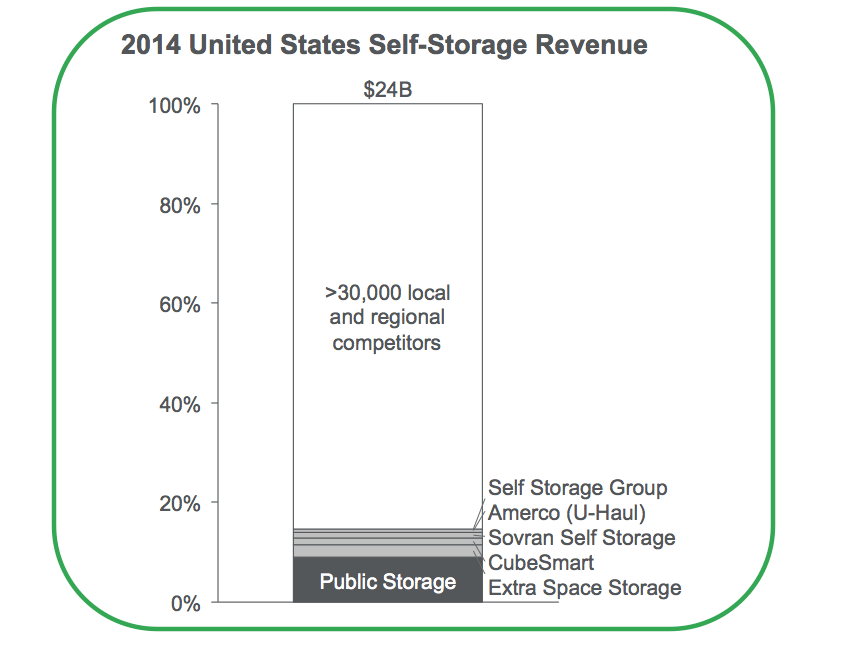

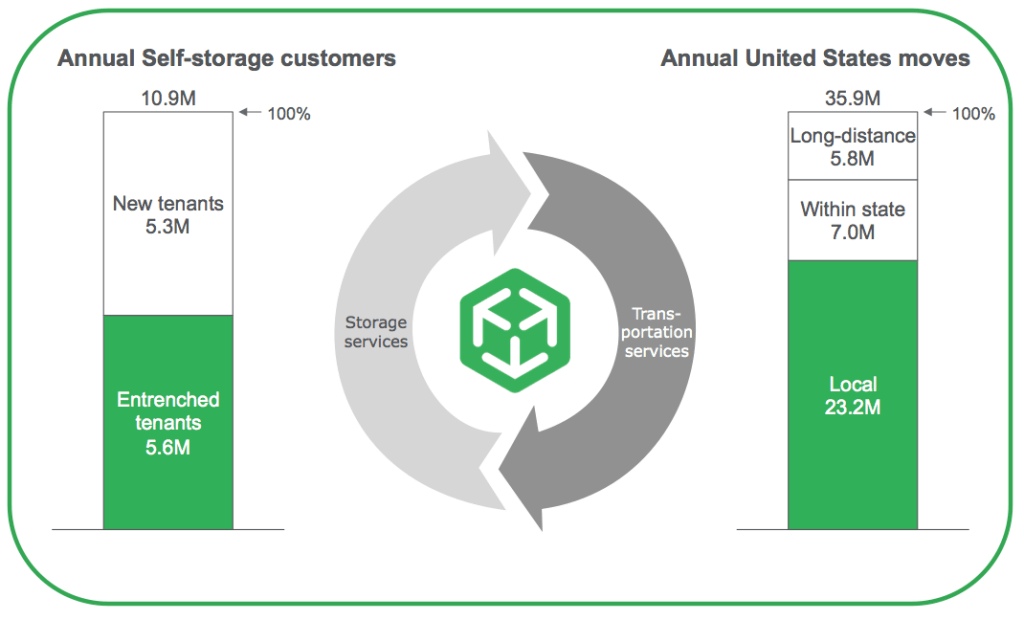

In the United States alone, the warehouse market, which is completely divided into segments, where the leading player is a company that controls 10% of the total market, attracts $ 24 billion in annual revenue. And, let's say, today these companies do not equip their business with any technologies.

I have not met a single person who would be completely satisfied with the services of the company providing him with storage space. No one. Most people who are not very knowledgeable about this industry assume that individual storage is used exclusively in densely populated cities like New York. In fact, the share of New York is only 3% of the total US market, and areas such as Dallas in Texas, by contrast, are among the top five areas where this service is most in demand.

Stores are used in many [economic] markets for a wide variety of purposes that you don’t even suspect. This business has acquired significant dimensions not only in Dallas, but also in San Diego, Phoenix and Sacramento, as well as in Boston, Chicago, Washington and, of course, in San Francisco.

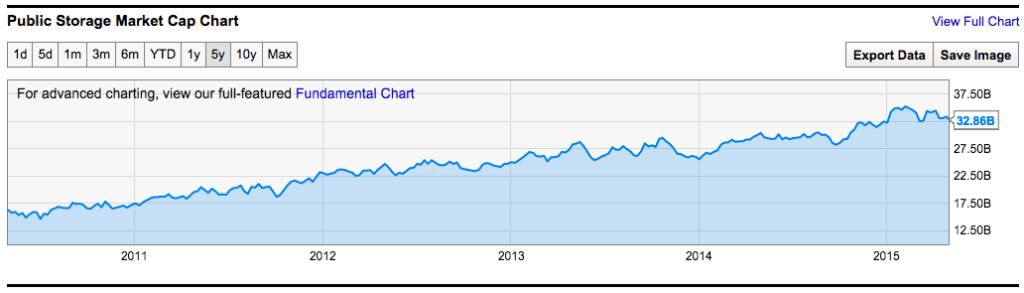

How much are these outdated businesses estimated? One of the largest US warehouses costs $ 35 billion, and the cost of a few smaller ones is also estimated at billions.

Nor are they equipped with any modern technology. They do not use innovation at all. Warehouses are perceived as real estate investments, and your skis, bicycles and winter clothes become their inhabitants.

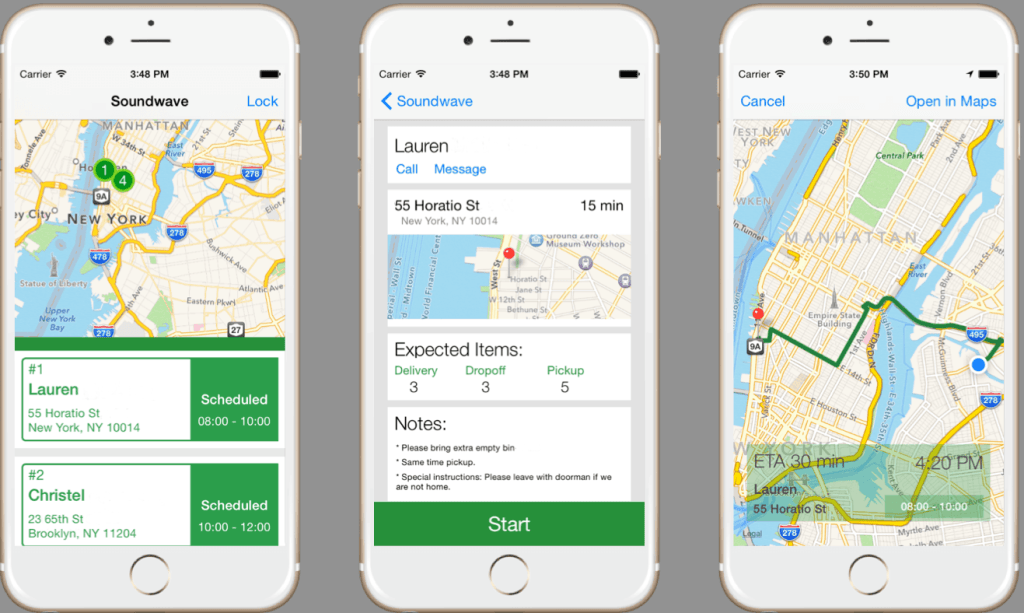

MakeSpace set out to update the entire storage process completely. We ship the boxes to your home, you pack them, and we take them back for free. We take a photo of your things from a bird's-eye view and provide you with a convenient application for reliable tracking of valuables distributed in labeled containers.

If you need a separate container at a certain time, you need to leave a notification for 24 hours. Thus, all your belongings will arrive to you on time: a tuxedo - just in time for the wedding ceremony, skis - before leaving for rest, and winter clothing will be returned to the warehouse in the spring.

The value proposition is pretty understandable. Most customers will not go a few miles to the warehouse: they stop their choice primarily on small local companies. However, today's advantage - owning real estate - tomorrow may be a big hindrance.

That is why Blockbuster Video rental shops are eagerly waiting for any company with centralized vaults, price advantages and logistical opportunities to rent their outdated premises. This is the classic “innovator dilemma,” and we know how this ends. I have no doubt that multibillion-dollar startups with higher quality products and low prices will upset the existing balance of power in this market.

And that's the thing. The main reason we, consumers, make repeated purchases on Amazon.com, is in price and service. It is much easier and more convenient to order goods delivered to your home in one day, while being able to choose among a large assortment, make purchases at low prices and not experience difficulties in case of return of goods. This is a no brainer.

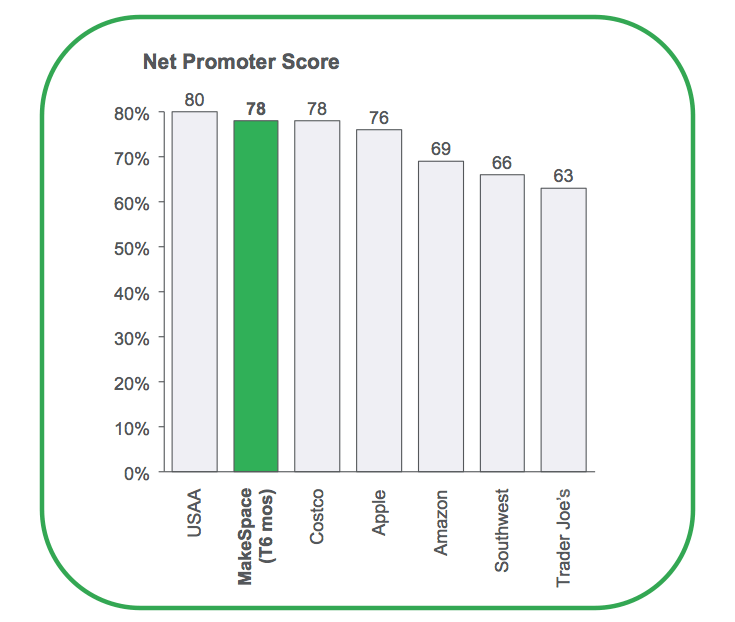

What do consumers think about MakeSpace 18 months after launching a project in New York?

It's very simple: if you provide excellent customer experience in an area that is potentially interesting to users, but which they are now ignoring due to the lack of convenient solutions, you will be able to form an exceptional customer loyalty to your brand.

When we talk about “disruptive innovations” in the sense embodied in Clayton Christensen ’s magnificent book “The Innovator's Dilemma” , we mean that “undermining” almost always occurs due to cheaper prices, which, in turn, often leads to an increase in of the market. This is what led me to the following conclusion: all large Internet companies are “deflationary” . This made me invest primarily in MakeSpace.

Below I put the financial chart ...

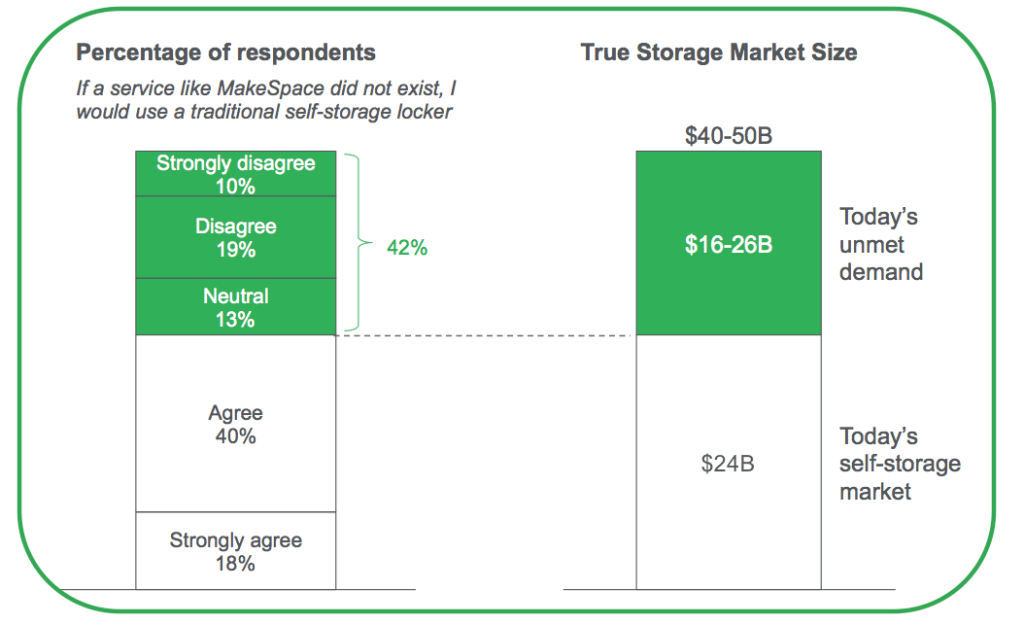

42% of today's customers simply would not want to store their belongings in a traditional warehouse complex. These are young city dwellers who do not have the time, means and desire to drag around with their belongings somewhere on the outskirts of the city to put them in a 6 × 6 container, and 60 days later have no idea what they left there, and how it all You can easily return back. And if you think that 42% of our customers are a large market share, look what happens when we reduce costs, disperse our businesses throughout the country and increase brand awareness.

Do these archaic companies, like dinosaurs, survive? Of course yes. They know that they will not be able to bypass startups in innovation, so they began to carry out advertising campaigns in New York, saying: "do not trust your things to the cloud storage." Ha. How much do they need to worry?

In just the first year of operation in New York, MakeSpace has attracted more than 2% of its target market's customers with almost zero budgets for marketing and attracting customers. The modern self-storage market (as opposed to Blockbuster Video) has a long enough history to take advantage of this and realize that today's assets may be a stone on the neck tomorrow.

Since we arrived at a payback of about 5 months ago, taking into account the costs of attracting users, our ratio of lifetime customer value (LTV) to the amount of costs of attracting users (CAC) is already more than 4.5 (and continues to increase as by CAC, and due to the increase in LTV), we will have many opportunities for growth as soon as we decide to focus on capitalization.

“But Mark!” You will say. - Well, let's say I get an advantage due to the centralization of the service. But can you say that MakeSpace is a technology company? Is that really true? ”

Much more technological than you might think - that is why the money received from our last round of raising capital went to build a technological infrastructure that will allow us to differ dramatically from the clone companies that have begun to emerge in this area. Some of them literally stole images from our site, our price lists and copied the format of communication with customers - as if this is the only thing that is needed to succeed. Try now to copy the Amazon frontend!

On the development of which areas did the capital attracted by us go? These are driver routing systems, scheduling, inventory management and tracking systems, warehouse management systems, photo automation, customer service applications, and front-end solutions we are used to, such as an application for tracking things.

We have an excellent team of drivers in New York, Washington, Chicago, who daily deliver things to local warehouses, while choosing the most optimal and low-cost routes using our technologies. But, as you understand, we also made these technologies available for third-party companies operating in areas not mastered by our own drivers. In addition, we implemented integration with UPS for a product called MakeSpace Air.

We are creating a national business and a recognized brand within the bulk segmented market, which is hated by many. I know that the market for the storage of goods for many is very unattractive, but in terms of the potential for the emergence of disruptive innovations, this area is just heaven on earth.

And finally, another thought. Imagine a solution by which people’s things from all over the country are kept centrally and securely. Imagine a company that owns its own cars and engages third-party drivers. Imagine a business that offers relatively low-cost solutions, but with a revenue stream like a SaaS platform. By putting all these elements together, you can imagine the direction of our movement in the future. We believe that we will be able to expand our overall existing market from 50 to 75 billion dollars in the United States alone.

I believe that the future belongs to the teams that create technology companies around material objects. Such enterprises are more difficult to develop, but if they succeed, they will be able to provide higher reliability of cash flow compared to startups that create popular consumer applications.

And we intend to compete with dinosaur enterprises without technical equipment and enterprises - “cash cows”, which should be armed, because in our face they will see barbarians at their gates.

Source: https://habr.com/ru/post/292748/

All Articles