Eight key questions from venture investors

Guest author Glenn Kelman ( Glenn Kelman ) is the CEO of Redfin , an online real estate business whose goal is to provide consumers with all the necessary information and services previously owned only by agents.

Previously, he co-founded Plumtree Software , which went public in 2002 and is now part of Oracle Corporation. Below he shares the important questions that investors asked him during the next round of raising funds.

')

For startups, Christmas usually comes in November. In September, partners return from vacations, and the offers are closed a few months later. Due to the financial crisis [original article published in 2009 - approx. perev.], capital raising had to be suspended until the end of the year, so November 2009 is likely to be particularly tense.

Redfin is one of the companies that have recently successfully completed another round of investment. This process [of attracting venture financing] has already changed our way of thinking so much that now we are not thinking about how to survive , but about how to become truly meaningful . Any startup can try itself in our role, regardless of whether it needs investment or not, if it tries to answer the basic questions that venture capitalists have asked us.

Venture capitalists are asking good questions. They [investors] are not related to the wrong decisions that you make, they are not touched by the deep meaning of your mission, moreover, they are less worried about the fact that in case of a slip you can go bankrupt. Investors are considering you in conjunction with other companies that they have already seen. They select everything valuable from different companies to create their ideal, profitable business mechanism. And since the stakes are high, in general, such a philosophical approach usually leads to certain actions.

Below is a list of questions posed by venture investors to Redfin representatives and forcing us to look at our business from the other side.

1. What is your mortal sin?

Roelof Botha, a venture capitalist for Sequoia, said that he is investing only in companies that allow their consumers to pamper themselves with one of the seven deadly sins. He lists them in one breath. “You do not need to create a product that people would like to use, you must create a product that they can’t stop using,” says Rolof.

2. Where is real money?

The attention of venture capitalists to the size of the market made us realize that half of our potential income is in the eight markets we have already entered. They asked us: “What's the point in rushing to enter the Orlando market if you haven’t even taken 1% of the market here in Silicon Valley?”

Good question. A startup that only earns real incomes for 18 months is similar to Val Kilmer in one of the scenes of the movie Fight, when his character had only 80 seconds to get bonds from an armored car. As the detective is amazed in the next scene of the film: “They [the criminals] didn’t pay attention to the small bills”. Here's how to work with the target market: to be not only greedy, but also disciplined. Time is short.

3. How is your unit economy calculated?

Financial statements for each month can not show how small business will look when it grows up. Of course, we must take into account all fixed costs, for example, how much we spend on engineers or the implementation of services. But it is more important to understand whether we receive more money from the client than we spend on his attraction and maintenance. Thus, to see whether a business will earn on a large scale, venture capitalists first want to understand how well it works in a small business.

For us, this meant that we had to explain how Redfin made a profit this summer from buying one house, taking into account the cost of each transaction: how much we spent on marketing to attract customers ($ 27); to get local data ($ 153); customer service ($ 2,906) and so on. We also calculated the share of annual income for each unique (within a month) visitor.

We knew the amount of our profit before, but had never performed an analysis of this indicator in the most convenient format for perception. It is important. Numbers do not tell you anything if they are not clear enough so that you can react on their basis; A midfielder with simple tactics can instantly react as the game progresses: he doesn't need to think about his actions. When we realized that this was a large number — the amount we spent building our customer service team — our focus changed. We became more interested in how well we formed this team and how successfully we invested money in its well-being.

4. What is the reason for this situation?

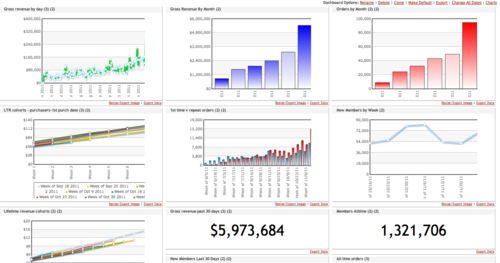

The presentation for investors consists mostly of growing graphs, two for each slide (so that growth looks more impressive). We believed that the only reaction that our presentation may cause is admiration. But Rolof asked us to designate for each of the graphs what is called “event-cause” in statistics, explaining the situation.

What changes in our business have led to higher incomes? We argued that the publication of feedback from agents led to an increase in conversion. But when we analyzed our indicators, it turned out that the event that actually influenced the increase in conversion occurred a month before - it was the appearance on the site of unlimited "virtual tours" on homes sold. Understanding the trends underlying one or another large-scale change helps you find out what really leads to business development. Without conducting such an analysis, we can assume that you are just lucky.

5. Why can't you grow faster?

The most important question asked by investors is what is stopping your company from growing faster. At first, I thought it was some kind of demand disguised as a rhetorical question, an attempt to make us promise more than we can really do. But when I became annoyed, David Sze, a spokesman for Greylock, said: "We are not asking you to lie." He really just wanted to know what the limiting factor was.

We squeezed out a few hesitant answers: "We have put profit, not growth, in priority." "We wanted to be realistic." Then Redfin’s Sasha Aickin from Redfin calmly pointed out the number of employees we were expecting and said that our limiting factor is probably how quickly we can hire first-class real estate professionals. We returned from that meeting and started thinking about expanding the hiring of specialists.

6. What are the factors that accelerate progress?

It's easy to grow 300% in the first year or two of your work, when you start from scratch and people only learn about your service. But the real giant is different from other companies in that it continues to grow at the same pace in the fourth, fifth year of its work and beyond. When Reid Hoffman looked at Redfin, his first question was whether our business has “accelerating factors” in which growth generates even more growth. For Amazon, the second stage of growth was accelerated by product reviews and an analysis of the personalized purchase history of the first users. For Facebook and Twitter, the growth factor is that the community itself constantly attracts new users. For companies like Zappos and, hopefully, Redfin, personal recommendations and stories about the level of our customer service will work. This approach led Redfin to focus on our most stable competitive advantages: not on the usability of the site as such, but on the data we receive from site visitors, and the enthusiastic feedback from those visitors who have become our customers.

7. What is the recipe for your “secret sauce”?

One of the godfathers of venture capital, as we were informed, is obsessed with the “secret sauce”. A man, obviously, didn’t put mayonnaise on his sandwich for 20 years. Therefore, in preparing for the meeting with him, we thought about all the technologies that could be implemented. I used to always believe that this is not a problem. Botanists like me believe that “at lunch, the main thing is meat, not sauce”; we just try to focus on the main problems and run faster than our competitors. From this position, even Google would have given up its market share to competitors if it had stopped creating new services for a couple of years. But while Redfin continues to grow steadily, allowing users to filter property searches by pool or parking, putting pressure on us to create something special helped us to reconsider our priorities, changing the rules of the game that we did not pay in the past. attention. We hope to come up with something really big in 2010.

8. How do you win?

Constant thoughts of world domination can ultimately lead to dizziness. I usually live my day, limiting my thinking to how to serve the next few customers or increase my income in the next few months. This means that although I must know the history of our victory by heart, an obsession that I am on the wrong path is increasingly appearing in my subconscious.

But the essence of the work of the CEO is to tell this story to everyone who will listen, each time making it better and better. If you attract venture capital, your story may sound very implausible and include things so illogical that it is even embarrassing to talk about them out loud. The rehearsal of the whole story will certainly reveal gaps in the plot.

Just try, for example, with a deadpan look, to say how Redfin goes to success: we get the most accurate data and created the best real estate website (possibly). We hire our own agents and pay them to focus not on sales, but on customer satisfaction (this is a bit strange, but, why not?). Clients appreciate this difference and massively dismiss their traditional agents, who sent them a bottle of wine every Christmas for 10 years, and thanks to this we process 20% of all valuable real estate transactions (it can not be!).

Can. It is difficult to express how strongly the resolution of all these issues helped Redfin to conquer all our hidden fears. Of course, we had previously guessed about these problems, but we existed in an experimental state, not recognizing this. We spent weeks thinking about what we had to do to achieve our intended success: choose a red pill , take shelter from the cold with the skin of TonTon (as Han Solo invented in Star Wars), hack Kobayashi Maru . In the history of the company there are only a few moments when she so consciously made her way. Like a recovering patient who survived everything that could only make him sick, we also intend to make the most of our reincarnation.

We asked Dmitry Kalaev , director of the acceleration programs of the IIDF, to comment on the material from the point of view of the Russian realities of investing in venture projects:

In my opinion, at different stages of investing different issues are priorities. For example, at the stage when there is no turnover and the product is in the process of development, the important questions are: who is in the team, what motivates them, why this team will “tear” the market. At all stages, the question “how big is the market” is important.

In fact, if the market is small, then there is no chance of building a large company. For example, for FRII the minimum acceptable level is a company with an income of 300 million rubles, which means that the market must be more than 1 billion rubles. At each stage it is important to specify the size of the market because competitors appear, there is an understanding that someone is "not our client". According to the experience of the Accelerator of IIDF, after the first sales, the real size of the market, which is considered not based on the Gartner size estimate, but on the basis of the ratio “average check to the number of available customers”, decreases in 99% of cases - it is important to constantly update this size!

At the stage where the IIDF Accelerator works, one of the important issues is the “unit economy”. Indeed, it’s usually impossible to get profit for a startup in the early years. all money is reinvested in development. BUT! It is very important that the company earns on each transaction: attracting a client costs 5 thousand, servicing 3 thousand, and a customer pays 10 thousand, and we earn 2 thousand on each transaction. In most cases, the picture when a client costs 10 thousand and pays 3 will never be interesting for an investor.

Well, at the company's scaling stage, the question “why you cannot grow faster” becomes really relevant - it is very important to find the limitations of rapid growth and come up with tools for multiple growth.

Announcement:

Announcement:On July 16, our seminar on the launch of new products in the field of information security will be held with the participation of experts from Group IB, the Office “K” of the Ministry of the Interior of the Russian Federation, the Central Bank of the Federal Security Service, Kaspersky Lab, Microsoft, Softline, Jet Infosystems and Acronis.

Beginning at 18:00. Participation is free, registration is required.

Source: https://habr.com/ru/post/292472/

All Articles