Interest rates are no longer

Businessmen and techies like to fantasize about the future: how self-driving cars will change transportation, how logistics will be destroyed by drones, how bitcoins will force out sovereign currencies.

But, apart from technology: what will happen to the financial markets? Namely: what will happen to interest rates and capital returns in the next 50 years? What will the destruction of the old order of new technologies?

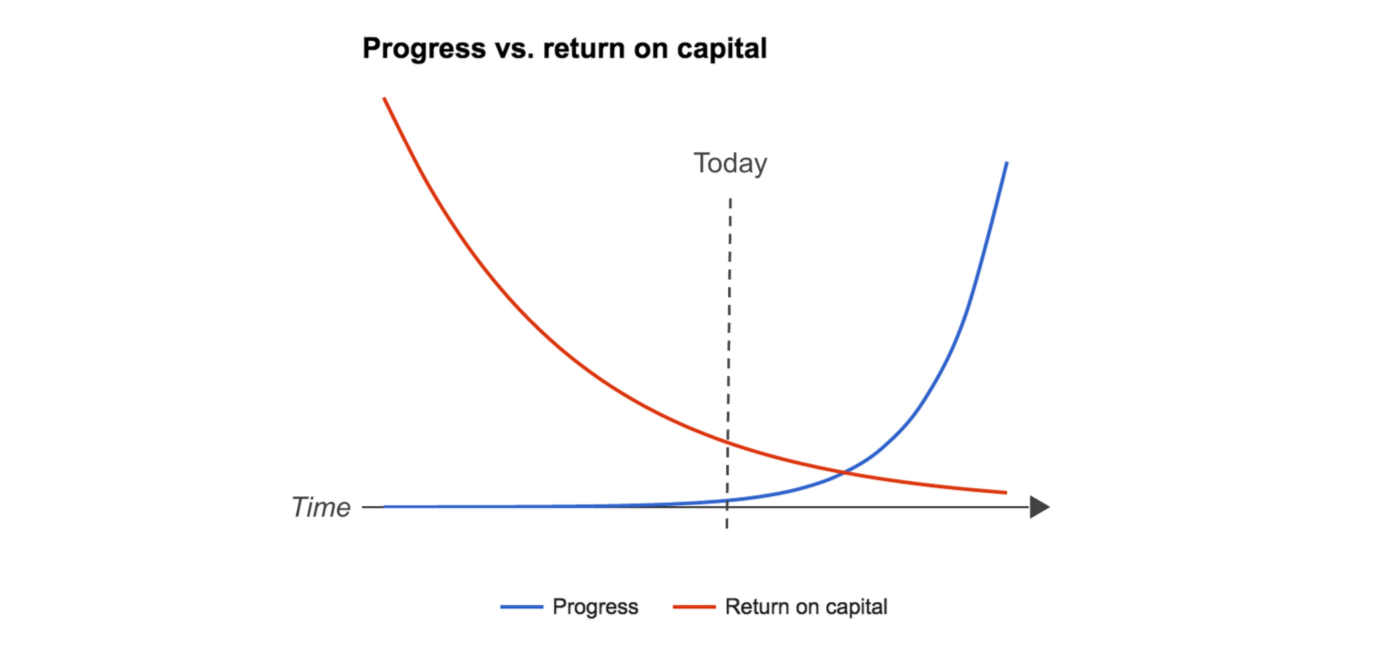

Today we can confidently prove that the return of capital (or the cost of capital - depending on which side you are from) tends to zero as technological progress grows.

')

Return on capital decreases with increasing technological progress.

Why?

Technology makes innovation cheaper by increasing the availability of capital

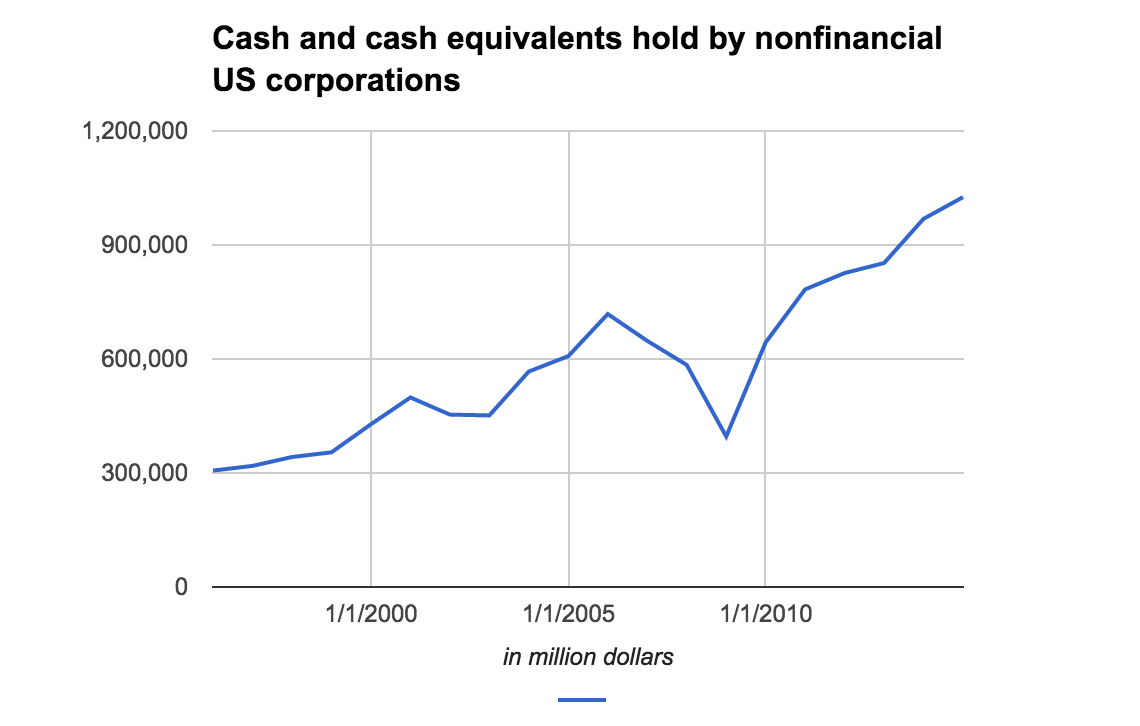

During the industrial revolution, it was impossible to start a business without solid capital. Innovations depended on "heavy" tangible assets (for example, mining or foundry) and therefore required substantial investments. Now everything is different. Innovation and the creation of companies have never been so cheap. As a result, the supply of capital is growing rapidly. Corporations eat a huge amount of cash. At the end of 2014, only non-financial companies in the United States had more than one trillion dollars in cash on their balance sheets.

The reason is simple: a lower demand for capital leads to higher availability, which, in turn, leads to a decrease in its profitability.

Balance of non-financial corporations of the USA, million dollars, according to the data of the US Federal Reserve for 1995 - 2014

Technology improves capital market efficiency and capital availability

In addition to the fact that capital is becoming more affordable, the effectiveness of its attraction is also growing due to information technology. The emergence of algorithmic trading and information technologies such as the Bloomberg ★ terminal in the 90s made open markets more efficient. Companies such as Angellist, Mattermark and Kickstarter are rapidly equalizing the information efficiency of the private equity market.

Arbitrage transactions ★ are fading away, and the possession of large capital does not create new opportunities in and of itself, which ultimately also leads to a decrease in capital return.

Return on assets in the US economy 1965 - 2010, according to the Deloitte Shift Index

The trend is noticeable today in many industries. A study of 20,000 organizations in the United States from 1965 to 2010 shows that the return of capital today is only a quarter of the level of 1965.

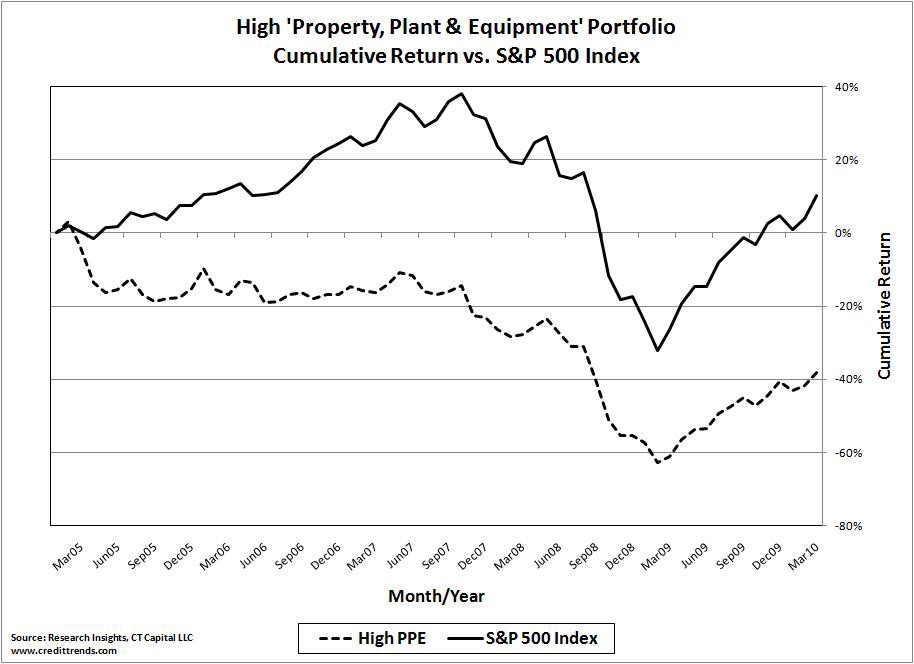

The decrease in profitability will be even more noticeable for capital-intensive industries.

Companies requiring large investments will face an even more noticeable decline in profitability. Capital-intensive products will be used (including jointly) more and more efficiently, which will lead to a decrease in demand for them. Car and bike sharing is just the beginning. In the foreseeable future, households will produce and distribute electricity among themselves. Companies can use common power, 3D printers, heavy machines. Increasing the efficiency of collective consumption of capital-intensive goods will release even more capital.

This trend has already affected the market value of companies with "heavy" assets. Yields in resource-intensive industries, such as mining and steel, have been significantly lower in recent decades than in light industry.

Comparison of heavy industry securities with the rest of the market, according to S & P500

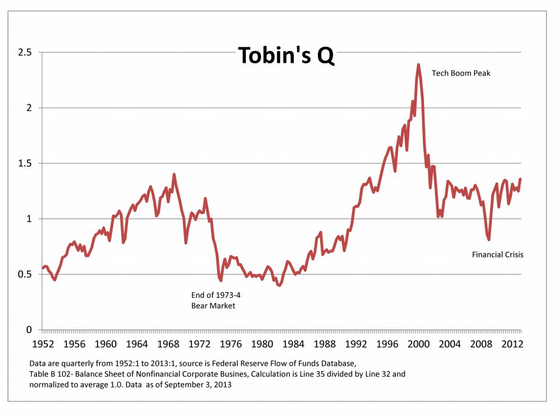

The dilemma of corporations with "heavy" assets also manifests itself in how we value companies. The share of tangible assets no longer affects the value of the company so much in a situation where the economy is based on intellectual property. A significant deviation of the book value of assets from the company's valuation (Tobin's Ratio ★ ) was previously perceived as an anomaly, but is now becoming the standard. Look at Google, Facebook, etc.

Tobin's ratio: the ratio of the company's market value to the replacement value of the company's assets, according to the US Federal Reserve

Be that as it may, the deviation of market value from book value is due not only to the flow of capital from “heavy” to “light” industries, but also to lower profitability per se. The reason for the current high estimates of the cost of technology companies (Uber, Pinterest, etc.) and the overall market growth are not so much the super optimistic expectations of the future revenues of these companies, as the realization of how little they will have to return to investors. This reduces the denominator by which we divide future cash flows, which gives a higher estimate of the company's value today.

Reducing the entry barrier will accelerate the decline in yield

Not the first year in all industries entrance barriers are reduced. In addition to reducing the capital required to start a business, lower returns work as a self-sustaining force, leading to even lower returns. Investors and corporations are looking for the latest "high-yield" opportunities, acting as the "invisible hand of the market", entering into industries where profitability is still attractive. "Free" are opportunities for investment with less capital return.

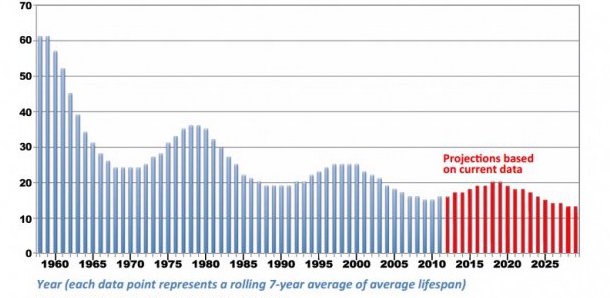

Reducing the entry barrier is already common in all industries. Half a century ago, the expected life of a Fortune 500 company was 75 years, and today it has dropped to less than 15 years.

Moving average for 7 years from the average life of the company. Richard Foster, "Creative Destruction"

What should an entrepreneur proceed from today?

- Increasing capital supply will simplify its attraction for entrepreneurs. In recent years, record amounts have flowed into private equity and venture capital. (The average venture fund has grown all the way since 1980, according to the National Venture Capital Association of the USA.)

- Funds of direct and risky investments will show a lower yield in comparison with historical values.

- Growing capital and constantly changing conditions will make it even more difficult to predict market bubbles. (Even today it is unclear: are we in a bubble or not?)

- Innovative development will only accelerate, which, on the one hand, will allow companies to easily invade the market, but on the other, it will complicate their position.

- With rare exceptions, markets will become less saturated with more small and medium companies.

To summarize, the best way to achieve high returns is to be an entrepreneur.

And never before have there been more suitable conditions for this. ∎

About the author: Paul Gebhardt is the executive director and founder of @bonusbox . A fan of data, an amateur cook, econometrics ★ with rich experience in the financial industry.

Source: https://habr.com/ru/post/292324/

All Articles