Business case. Marvel's wonderful resurrection (part 1)

Recently I was offered to write a case for one company, but I was forced to refuse a profitable offer, since I had never written them before. But the situation hurt me, so I decided to learn this business. Today I am publishing my first prototype. It is written on the basis of an idea drawn from the Harvard Business School website.

Recently I was offered to write a case for one company, but I was forced to refuse a profitable offer, since I had never written them before. But the situation hurt me, so I decided to learn this business. Today I am publishing my first prototype. It is written on the basis of an idea drawn from the Harvard Business School website.In general, the case study method (Case study, Case method) is a method of situational analysis, a teaching technique that uses a description of real economic, social and business situations. For a long time, occupies a key position in management education. The method was first applied at the Harvard Business School (Harvard Business School) in 1924.

Short description

In December 1996, Marvel Comics, one of the oldest comic book publisher companies, filed for bankruptcy. Team Marvel Entertainment LLC, formerly Marvel Enterprises and Toy Biz, Inc. (American entertainment company formed from the merger of Marvel Entertainment Group, Inc. and Toy Biz, Inc. in 1998), known for its universe of super-heroes, including Spider-Man, Hulk, X-Men and Iron Man, Must reconsider its marketing strategy. How did Marvel manage to go from bankruptcy to selling Disney for $ 4 billion? Was the revival of Marvel just an accident? What marketing strategies have allowed Marvel to replicate their success? How did you have to change your business model?

')

Setting

Geography: United States.

Field of activity: art, entertainment, publishing.

Number of employees: about 200.

Problem

The success of Marvel throughout its existence is explained by a number of incredibly talented authors and artists who took the company to the first place. Such employees even invented the so-called “Marvel method”, which consists in the fact that the author invents the plot, the artist draws it and thinks out subtle details of the plot, dialogues and even characters, and then the author completes the process of final polishing of the plot and dialogues.

In the same way, most of its failures can be safely attributed to management failures. In the 1980s, as a result of the editorial debate, some of the “star” authors of Marvel went to competitors DC, which served as a kind of beginning of the end of Marvel Comics. In 1986, the company was sold to the mediocre media company New World Entertainment, which produced B-class films, and in January 1989, Ronald Perelman , a corporate raider known for his hostile takeover of Revlon and arrivals at Salomon Brothers, bought Marvel for $ 82.5 million, spending only $ 10.5 million of own funds. With his reputation and the habit of leveraged-buyout (buying companies on credit), Perelman thought Marvel was undervalued, and, according to the old scheme, decided to quickly eliminate unprofitable lines of business and optimize operations.

In the first year under Perelman’s management, Marvel’s net profit rose from $ 2.4 million to $ 5.4 million, while revenues increased from $ 68.8 to $ 81.8 million. Then in 1991, Perelman sold 40% of the shares during the initial public offering, which brought in $ 70 million, $ 30 million of which was spent on debt payments, while the rest were used as a “special dividend”. At the same time, he issues a series of “junk” bonds, for sale from which a number of companies were bought.

In Russian Wikipedia, a point of view is suggested in which “Perelman helped bring Marvel back to life,” but the English is more accurate , describing Marvel’s subsequent bankruptcy as the result of the machinations and mistakes of Ronald Perelman.While his first steps to managing Marvel seemed successful, he gave impetus to four strategic shifts that most likely led to Marvel's financial collapse.

- Firstly, he tried to accelerate the growth of revenue by increasing the price of comic books several times, which is a rather obvious mistake, given the history of the emergence of comics as a genre. The initial popularity of comics came during the depression of the 1930s, when they appeared as a cheap form of entertainment for children of the poor.

- Secondly, Perelman initiated a rapid increase in the comics' nomenclature in an attempt to capture most of the market and reduce the cost of their production, and therefore the quality of the company's products decreased.

- Thirdly, he blamed Marvel Comics distributors for sales and committed a series of actions that caused significant damage to both distributors and retailers.

- Fourth, he embarked on a series of late acquisitions aimed at creating an entire entertainment Marvel empire, which led to a distraction from the company's main business and erosion of balance.

The first two mistakes came from Marvel’s hopes of making money on speculative collectors' madness, increasing the number of monthly editions from 45 to 1403 in some months, and a sharp increase in price from $ 1.25 to $ 4 for some issues (the previous owner of Marvel, three years before the sale, raised prices from $ 0.65 to $ 1). As a result, expensive and poorly written and illustrated comics have flooded the market. At this time, Marvel’s manic desire to earn money, led by Perelman, led to a modification of the entire industry. Marvel-inspired makers published premium comics with fancy covers and additional material. Often, comic books were sold already signed by authors and illustrators.

Some experimented, which led to curious cases where one release could appear with 13 different covers. In the short term, this strategy brought financial success, and the price of Marvel shares peaked in November 1994 at $ 34.25 per share. However, prosperity did not last long, frustrated collectors appreciated the influence of the laws of supply and demand, not finding either high quality or rarity in new comics. Thus, the speculative bubble burst and sales in the following year fell by 19% across all distribution channels. And comic book fans felt cheated by Marvel.

As a result of overproduction, as well as the specifics of the distribution of comic books, more than half of the stores selling comics went out of business, and the head of Marvel, while accusing of lowering sales of the largest distributors of Capital City Distribution and Diamond Comic Distributors, bought Hero's World, which soon became the sole distributor of Marvel Comics. In response, most other major publishers have signed exclusive deals with Diamond, forcing many others to simply go out of business. Having realized the mistake, Marvel withdrew from the distribution business and signed a similar contract, thereby leaving Diamond the sole distributor of the four largest market players - Marvel, DC, Dark Horse and Image Comics.

Non-core acquisitions also contributed to the destruction of the company. Trying to stimulate business growth through acquisitions, Ronald Perelman decided to diversify the company. Fleer, the second largest producer of sports and entertainment cards, was bought in July 1992 for $ 286 million, and in March 1995, Skybox Trading Card Company for $ 150 million. After the Marvel bankruptcy, these companies were sold for a purely symbolic amount of $ 26 million in aggregate . In March 1993, Perelman acquired a 46% stake in Toy Biz, which develops and sells children's toys, in exchange for an exclusive, perpetual, and royalty-free license to use all Marvel heroes.

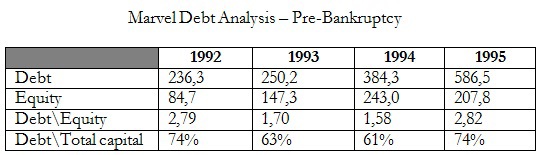

Also among the acquisitions were Panini Group (stickers), half of the Welsh Publishing Group (Barbie and Simpsons), Malibu Publishing (Planet of the Apes). Marvel Software was planned to enter the growing software market and joint venture with Planet Hollywood to create a series of themed restaurants. All of these deals were financed with large amounts of debt and an increase in the significant Marvel debt burden. Pay attention to the steady growth of debt with a huge surge in 1995.

Of the above acquisitions, the agreement with Toy Biz looks particularly rash. Let me remind you that Marvel received only 46% of the shares in exchange for exclusive rights to the toy products of all its characters.

Although Toy Biz made only figures, the agreement covered any toys, and therefore Marvel had to break all previous agreements with other manufacturers, which in no way replaced the loss from royalties, as Toy Biz made toys for free. In the end, Marvel lost an important source of income. Paradoxically, Toy Biz ultimately became the company that helped Marvel out of its subsequent bankruptcy.

Despite financial problems, Marvel did achieve its goal of becoming a diversified company, and the acquisitions helped to mask financial problems and gloss over the decline in comic sales. Although diversification theoretically protects part of the business from recession, Marvel lost $ 48.5 million in 1995, mainly due to losses in the publishing segment. The denial of the problems lasted until 1996, when the company declared bankruptcy, using chapter 11 of the US Bankruptcy Code.

Generally speaking, the financial situation of Marvel significantly undermined the period from late 1992 to late 1995. Total expenses rose to 419%, inventory turnover decreased by 26%, daily sales rose 37%, and total reserves rose to 406%. It is even more dramatic that the accounts payable increased by 603% over this period, which certainly led to a lengthening of the payment cycle. At the beginning of the period, one could assume that Ronald Perelman simply did not see the current problems, but by the end of 1995 he certainly knew that the company had big problems, and that was a year before the bankruptcy.

In the next part of the case, the details of the bankruptcy procedure will be described. Do not switch.

UPD

Business case. Marvel's wonderful resurrection (part 2) .

Business case. Marvel's wonderful resurrection (part 3)

Source: https://habr.com/ru/post/291942/

All Articles