Pricing psychology: 10 strategies and 29 tactics

Welcome! This is a long list of pricing strategies that take into account psychological factors.

It doesn't matter if you are launching a new product, selling something on eBay, or making a deal to sell a house — you will learn to set prices that maximize your profits.

Content

The article is divided into four parts, each of which contains a set of tactics and strategies.

')

Step 1: Set a price

Strategy: Set attractive prices

- Tactic 1: Reduce the number on the left by one

Strategy: Use an appropriate level of ease of perception

- Tactic 2: Round off the mind

- Tactic 3: Choose numbers with fewer syllables

Step 2: Influencing Customer Perceptions

Strategy: Rephrase Your Offer

- Tactic 4: Separate the cost of the product from the cost of delivery

- Tactic 5: Offer payment by installments

- Tactic 6: Mention daily payment amount

Strategy: Indicate the profitability of the purchase

- Tactic 7: Place the cost of the goods in the lower left corner

- Tactic 8: Use fine print

- Tactic 9: If possible, remove the separators

- Tactic 10: Use the right words

- Tactic 11: Be precise when setting high prices.

Strategy: Maximize Estimated Cost

- Tactic 12: Set High and Accurate Face Value

- Tactic 13: Set a high "random" price

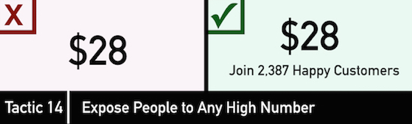

- Tactic 14: Set Any Big Number

- Tactic 15: Increase the cost of the previous version of the product

Strategy: Focus on the difference between estimated and actual prices.

- Tactic 16: Visually present a comparison with a higher price.

- Tactic 17: Offer a "bait product"

Step 3: Push customer to make a purchase

Strategy: Reduce the "pain of payment"

- Tactic 18: Remove Dollar Icon

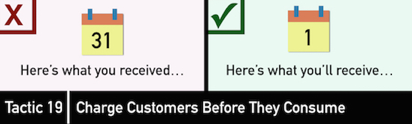

- Tactic 19: Charge before product use

- Tactic 20: Supply Your Product with Others

- Tactic 21: Shift time focus

- Tactic 22: Create a new payment instrument

Strategy: Use discounts wisely

- Tactic 23: Follow Rule 100

- Tactic 24: Explain the reason for the discount

- Tactic 25: Do not use discounts with exact numbers

Step 4: Maximize Your Income

Strategy: Make price increases imperceptible

- Tactic 26: Increase prices more often (and unnoticed)

- Tactic 27: Reduce Product Size

Strategy: Do not use dangerous pricing strategies

- Tactic 28: Do not use the substitution method

- Tactic 29: Be Careful With Dynamic Pricing

Step 1: Set a price

Large companies have an advantage. They can afford to carry out the best price studies (for example, decombination analysis) in order to determine the optimal cost of their product. Small companies are denied such privileges.

Fortunately, it is here that knowledge of psychology comes to the rescue.

According to research on the processes of perception and human behavior, some prices are more effective than others. Even if you do not find the most suitable option, you can make small but significant changes in order to achieve maximum efficiency from the established price. And all this is absolutely free.

In this section, you will learn how people perceive numerical values (and, accordingly, how to choose the right numbers for their price).

Similar articles:

- 7 Tips for Determining the Value of Your SaaS Product - Scott Gerber

- Scalable SaaS sales models - everything starts with pricing - Shteli Efti

- How to determine the cost of your software - Jim Geisman

- Tips on the Impact of Effective Pricing - Mick Hollison

Strategy: Set attractive prices

In the past couple of decades, marketers have tried to set attractive prices — prices ending at 9, 99, or 95.

And the results speak for themselves. Take a look at sales from Gumroad :

When people see such a positive effect, they immediately begin to sign nines to their prices. But there is another important element: the number on the left.

Tactic 1: Reduce the number on the left by one

Attractive prices give a greater effect when changing the numbers on the left. The difference of one cent between $ 3.80 and $ 3.79 will not play a role. But the difference of one cent between $ 3.00 and $ 2.99 is of great importance.

Why is the number on the left so important? What matters here is how our brain processes numerical values.

The human brain processes the numbers so quickly (and we are not aware of this) that we determine the size of the number before we finish reading it. Thomas and Morvitz (2005) explain this as follows:

“... in assessing the value of 2.99, the process of its processing begins as soon as our eyes find the number 2. Therefore, the processed value of $ 2.99 fixes attention to the figure on the left (that is, $ 2) and it seems much less than the value of $ 3.00 (p. 55).

Additional advice: You can select a new first digit, if you visually reduce the size of the digits, indicating the number of cents.

Strategy: Use an appropriate level of ease of perception

When determining which numbers will be written on the price tag, you should also consider the “accessibility perception”.

Accessibility perception - the ease with which we absorb information.

We can make certain conclusions about the price, based on the simplicity of perception (that is, on whether it is easy or hard for it to be “read”). This section will teach you to pick numbers with the appropriate level of perception availability.

Tactic 2: Round off the mind

One aspect to consider is the degree of price accuracy. Rounded prices (for example, $ 100) are easily perceived, while non-rounded values (for example, $ 98.76) are perceived more difficult.

Can the choice of a particular price increase the level of sales? Scientists believe that it can.

Vadhva and Zhang (2015) found that rounded prices — because they are perceived easily — will be more effective in the case of emotional purchases. When the buyer can quickly read the price, it seems “quite appropriate.”

In addition, scientists have proven that the opposite is true. The buyer should do more mental work while reading the non-rounded price. Therefore, such prices, apparently, are more suitable for rational purchases.

Despite the clarity of the statements, I have to clarify something.

Even if the purchase is emotional, over-rounded values should be avoided when rounding the price (for example, $ 100, $ 5,000). It will seem to people that these prices are deliberately high, as if they were taken from the ceiling ( Yanishevsky and Wee, 2008 ).

When should rounding be applied? This principle helps to determine whether to add a few cents to the current price.

If the purchase is made on emotions, you should get rid of cents.

If the purchase is a rational acquisition, it is worth adding a few cents.

Tactic 3: Choose numbers with fewer syllables

Our brains use more resources to process longer phonetics in terms of price (which gives rise to the effect of ease of perception). Once we use more mental resources, we make a false conclusion that prices should be higher.

This aspect is even more important. People will assume that the price is lower if it contains fewer syllables.

But Nick! When I look at the price, I do not say it out loud. I just read it.

Same. And according to the research ... it doesn't matter. When you read what is written on the price tag, the brain unconsciously processes the spoken version of this price ( Dehen, 1992 ). You don't even need to mentally reproduce this price — in any case, your brain will process it.

Still in doubt? Coulter, Choi and Monroe (2012) found a direct link between the number of syllables and the perceived size of the price. Even if two prices have the same number of characters (for example, $ 27.82 and $ 28.16), people perceive the price with a large number of syllables as higher.

Step 2: Influencing Customer Perceptions

“All our knowledge is born in our perception”

–Leonardo da Vinci

There is nothing unequivocal in the world. Everything we know is generated by our perception. By and large, price is just what we perceive, no more, no less.

And it will play into your hands. There are no established standards that would determine whether this price is high or low: it all depends on perception.

In this section, you will learn about several strategies that allow you to change people's perceptions. You will learn how to make the price seem even lower (without changing its value).

Similar articles:

- Experiments with prices that you might not have known, but of which you can learn something - Pip Laya

- Making up the effective price list - Brian Eisenberg

- What the buyer thinks about - Terry Lyn

- What does a compelling list price look like? - David Mot

Strategy: Rephrase Your Offer

As I told in the video, you can influence how the buyer stays with your price. When people compare your price with an approximate, you can influence them by adding an even lower price for comparison.

Why add even lower price for comparison? This strategy takes advantage of the fact that our brain is too lazy to process numerical values. Adaval and Monroe (2002) explain it this way:

“... information about the cost of the product is recorded in our memory not as concrete numbers, but rather as more general notions about quantities (for example,“ low ”,“ high ”). Thus, the value of the price is influenced by its original environment when the buyer tries to restore it later in his memory ”(p. 585).

Given these memory features, you can influence how people will remember your cost. How? It is only necessary to reformulate your sentence, using a smaller numerical value. Setting such a low value will cause the buyer to memorize a lower value.

Below are a few methods that may be suitable for this.

Tactic 4: Separate the cost of the product from the cost of delivery

If you are engaged in online trading, then you should separate the cost of the product itself from the delivery charge.

Using the “time beat of price” (that is, breaking the total cost into several components), you focus the buyer's attention on the base price, not on the actual cost of the goods ( Morvitz, Greenleaf and Johnson, 1998 ).

When people compare your price with an approximate, they probably will take into account the base price.

Hossen and Morgan (2006) tested this hypothesis at auctions held on eBay. They put up music CDs for auctions and analyzed various bidding structures.

- At some auctions, a low starting price was offered with additional delivery charges (for example, $ 0.01 per item and $ 3.99 for delivery).

- For others, a high starting price was offered without shipping charges (for example, $ 4 with free shipping).

As a result, auctions with a low starting price (plus payment for delivery) attracted more participants and brought in more revenue. By the way, Clark and Ward (2002) obtained similar results at auctions, where Pokemon cards were sold.

Tactic 5: Offer payment by installments

Similarly, when you offer to pay for goods in small parts (not the full amount at once), you rivet the attention of buyers to a low price.

Suppose you are offering to subscribe to an online course for $ 499. Giving the opportunity to pay it periodically (for example, 5 times $ 99), you thereby change the course of the comparison process. Buyers are likely to compare the amount of a single payment ($ 99) with the total amount paid by a competitor (for example, $ 500) - the difference is huge and it makes your offer more attractive.

But don't get me wrong, people are not so stupid. They know that comparing $ 99 and $ 500 is not quite right.

Fortunately, it does not matter. Since people usually compare the estimated prices subconsciously ( Mouzumdar and Sinha, 2005 ), the amount of your payment will most certainly affect the outcome of this comparison.

Tactic 6: Mention daily payment amount

The same effect can be achieved by signing the amount of the daily payment to the current value on the price tag (for example, $ 0.87 per day).

Often this strategy, described as a system of “paying a few pennies a day” [eng. pennies-a-day pricing], affects people in such a way that the total cost seems to be less for them ( Gurvil, 1998 ).

However, regular payment is of paramount importance. It should only mention the amount of daily payment. This modest number will draw the attention of buyers to the minimum value in the price range.

Do not worry if you are unable to enter in the price tag the specific value of the daily payment. The same effect can be achieved if you compare your price with some small expenses, for example, with the cost of a cup of coffee ( Gurvil, 1999 ).

Strategy: Indicate the profitability of the purchase

In the previous strategy, it was shown how numerical values can affect how buyers perceive your price. However, the essence of the “anchor effect” is not limited to numbers alone. You can influence people's perceptions using more general principles.

For example, Oppenheimer, Lebuf, and Brewer (2007) found that people rated numbers as lower if they were asked to hold a short line (compared to those who were asked to draw a long line). If you want buyers to consider your price low, you need to link the appropriate possibilities of such a purchase with its profitability for them.

The following are ways that can help you with this.

Tactic 7: Place the cost of the goods in the lower left corner

If you want your price to be considered low, it should be placed on the left of the price tag ( Coulter, 2002 ).

It sounds strange, but I will try to explain.

According to the results of research, an indication of action in a certain direction is associated with relevant concepts. For example, the concepts denoting the meaning of the movement “upwards” are figuratively associated with positive qualities:

"... the righteous" ascend "to heaven, whereas sinners must" descend "to hell. In the media, film critics say good films are “raised” by a thumb, and bad ones are “lowered” ... those who smoke marijuana “fly in the clouds”, and when the euphoria disappears, “fall to the ground”. ( Meyer and Robinson, 2004, p. 243 )

Since the concepts of "up" and "good" are strongly related, an indication of the action in the "up" direction can cause associations meaning something "good." Meyer and Robinson (2004) found that people recognized words with a positive shade faster when they were at the top of the screen (and more easily recognized words with a negative shade when they were located at the bottom).

The same principle applies to numbers. Dehen, Bossini and Giraud (1991) found that people represent numbers on the horizontal line, and they increase from left to right.

In their study, they showed the subjects figures from 0 to 9 and asked to determine their parity (that is, the figure is either even or odd). As expected, people reacted faster to smaller numbers when they had to press a button with their left hand (and vice versa).

In other words, they reacted faster when the hand corresponded to the half of the range in which the indicated number was located.

How is this research related to pricing?

Since we imagine that smaller numbers are on the left, the location of the price on the left can cause people to feel that it has become lower, thus changing the perception of your price ( Coulter, 2002 ).

In addition, since we can imagine that the numbers are located on a vertical line (the smaller the number, the lower it is), it’s better to place your prices in the lower left corner.

Tactic 8: Use fine print

In addition to indicating the direction, the size of the label can also affect people's perceptions.

Due to the speed of the process of perception, people will consider your price low if its inscription is made in smaller type. This method will be much more efficient if you put the estimated cost in a larger font for comparison with your price ( Coulter and Coulter, 2005) .

And do not forget about kerning - the distance between the characters. Fonts with less kerning, among other things, should act in such a way that your price is perceived by the buyer as lower.

Tactic 9: If possible, remove the separators

In addition to font size and kerning, attention should be paid to punctuation. Scientists have shown that if you remove the separator (for example, $ 1,499 instead of $ 1,499), buyers can consider your price lower ( Coulter, Choi and Monroe, 2012 ).

Why is this happening? Although the length of the inscription plays a certain role, here we must take into account another principle, which we have already spoken about.

Can you guess? When you remove the separator, the number of syllables is reduced.

- $ 1,499: Thousand and four hundred and ninety nine (13 syllables)

- $ 1499: Fourteen ninety nine (10 syllables)

In combination with the ease of perception, the price after such a change will be perceived as lower.

Tactic 10: Use the right words

Be careful when choosing the words that will be written on the price tag. Certain words may distort the perception of the buyer.

For example, Coulter and Coulter (2005) distributed several different price lists for roller skates to the subjects. On some of the price tags stood out advantage in the "low coefficient of friction." Others focused on High Quality.

Despite the fact that the subjects assessed these advantages as equally important, preference was given to price tags on which “Low coefficient of friction” was written.

When choosing the words for the inscription on the price tag, try to use words that correspond to a small value (for example, "low", "small", "small").

Tactic 11: Be precise when setting high prices.

Thomas, Simon and Kadiyali (2007) analyzed 27,000 real estate transactions. What did they learn? Buyers pay more when prices are accurate (for example, $ 362,978 instead of $ 350,000).

Maybe this is related to the negotiation: when someone asks for a very accurate price, does the potential buyer lose the desire to bargain?

I thought that way. And it turned out to be wrong. Scientists have eliminated this possibility. Oddly enough, the real reason was to point out the profitability of the purchase.

Judge for yourself. When do you most often use exact values? That's right, when you are dealing with small numbers (for example, 1, 2, 3).

Because of this connection between exact numbers and small values, the use of exact numbers causes an association with small values, thus affecting customer perceptions.

Additional advice: Since the acquisition of real estate is a rational purchase, you can enhance the psychological effect using an exact non-rounded value (for example, $ 362,798.76).

Strategy: maximize estimated cost

The two previous strategies help to reduce your price in the eyes of buyers. However, the same effect can be achieved by maximizing the apparent value of the estimated cost.

In this section, there are several ways.

Tactic 12: Set High and Accurate Face Value

Due to the presence of the “anchor effect”, it is not surprising that you can earn more if you first offer a high nominal value ( Galinsky and Mussweiler, 2001 ). This great value becomes the so-called "anchor", which "drags" the final cost of the goods closer to its price range.

The established nominal value must be not only high, but also accurate. In one of their studies, Yanishevsky and Wee (2008) asked the experiment participants to evaluate the actual cost of a plasma TV based on the suggested retail price: $ 4,998, $ 5,000, or $ 5,012.

When participants were offered exact values ($ 4,998 and $ 5,012), they considered that the actual cost of the TV was closer to this price range. When the proposed price was rounded ($ 5,000), the subjects believed that the actual price should be much lower.

When the "anchor" is the exact number, we only slightly adjust our assessment. Why? Our imaginary scale is to blame for everything. As Thomas and Morwitz (2002) explain:

“If we present the adjustment in the form of movement on an imaginary scale, then the value of the amendment, among other things, may be influenced by the division value of this scale. The magnitude of the correction in X units on a scale with a small division price will be larger compared to the same number of units on a scale with a large division price ”(p. 121).

This principle works great on eBay auctions. When placing a lot at auction, you can get more revenue if you set a high reserved price - the price below which the goods cannot be sold. Higher reserved prices force people to bid from a higher price range, which in turn generates more income ( Kamins, Drize and Folks, 2004 ).

Tactic 13: Set a high "random" price

Given our propensity to compare prices with an “anchor”, can comparisons with high prices — even neutral goods — force people to choose a product whose value is in a higher price range? Will the buyer pay more for your product?

Núñez and Botright (2004) tested this hypothesis. In one of the streets of West Palm Beach, scientists were selling music CDs. Every 30 minutes, a nearby store changed the cost of the hoodies on the screen from $ 10 to $ 80 and vice versa.

Guess what happened? The price of the hoodie influenced the corresponding price range when selling discs. When the sweatshirt was selling for $ 80, buyers paid a higher price for CDs.

If you are selling something on eBay, it would not hurt you to mention other products that you want to sell (of course, more expensive).

Tactic 14: Set Any Big Number

The “anchor effect” is valid not only in the case of prices, but also for any number that is not a price.

A vivid example. Ariely, Lowenstein and Prelek (2003) showed the subjects various products (for example, a wireless keyboard, rare wine, Belgian chocolate). Then they asked the participants in the experiment if they would buy each of the goods for a dollar price equal to the last two digits of their social security number.

After the answer was received, the scientists asked the subjects to give the exact price at which they would be ready to purchase each of the goods.

Surprisingly, they found a direct correlation between the numbers on the social security card and the price at which they were ready to make a purchase. Below are the data for one of the goods - a wireless keyboard:

How can these results be applied? Do I just need to ask buyers to guess a large number? Not certainly in that way. Fortunately, your task is somewhat simpler.

The “anchor effect” works on the subconscious, so the buyer does not need to conceive a large number. Adaval and Monroe (2002) informed buyers about a large number at a subconscious level, before pointing out the price. After such an impact, people perceived the proposed price as lower.

As a result, even if potential buyers subconsciously do not perceive your numerical "anchor", you just need to make sure that they can see it.

If you have an online store, you can simply sign along with the price the total number of buyers. When people select an approximate price for themselves, this number acts as an anchor (and their approximate price will become even higher).

Tactic 15: Increase the cost of the previous version of the product

What price should you choose for the previous version of your product if you are launching a new (more expensive) version of it?

Some companies reduce the cost of an earlier version of their product in order to gradually remove it from circulation. However, this approach, oddly enough, is incorrect.

Baker, Marne and Zawada (2010) propose to increase the value of the old product. Increasing this cost, you raise the estimated price (this increases the value of the product in the eyes of the buyer). After launch, the new product will be in more favorable conditions.

, , . , - .

:

, . .

Similar articles:

- —

- , —

16:

, , ( , , 1988 . ). .

, .

(, ), . ( , 2005 . ).

, . , ( , 2009 . ).

. , ( , 2005 . ).

17: «-»

. , «-» [. decoy product].

, . « » (2008 .) Economist. - :

- : $59

- : $125

- : $125

, , . , ?

. , . . .

. ? . , .

. , , , , . ( ) , Economist 43% .

, . , .

, , . .

3:

, . .

, . : (1) «», , (2) .

Similar articles:

: « »

, - , , « » ( , 1998 . ).

, :

- (, , )

- (, , )

, , Uber, [. ride-sharing], .

. , . . , . …

Uber -. . «» . . .

– « », . .

18: [ , – . .]

« » . , ( , , 2009 . ).

But do not hurry. , «» .

, , . «» . , (, ).

19:

, . .

-, . . .

-, . , , , « ». , ( , 1998 . ).

. , ( ).

( ). .

20:

« » . , .

Similar articles:

, . , (1) (2) .

.

-, ( ), ( ). , , ( , 2006 . ), , , .

(2010 .) :

«… , , , , . , , , , » (. 18).

, , , . (2010 .) $50 $50. , , (, ) (, ).

-, . .

(2012 .) . 51% – . DVD- , 35% . .

21:

, . , – .

(2009 .) . , :

- : “ C & D's”

- : “ C & D's”

- : “ C & D's”

, , $1 $3.

: , « », . ( ).

:

« , , ( ) , , » ( , 2009 ., . 1 ).

, . , « ».

22:

What do casino chips and gift cards have in common? Both those, and others reduce "pain of payment".

If you enter a payment "intermediary" between your customers' money and making a payment, the payment process will be perceived differently. Buyers will know what they are paying, but not feel it.

Why? Scientists have found that if there is an additional payment instrument, the buyer does not want to calculate the amount of converted currency ( Núñez and Pak, 2003 ).

An interesting idea: when new customers open an account in your payment system, you can oblige them to deposit $ 10 (to pay for your service) on their accounts, which they can always return.

Once the money can be returned, customers should not offer resistance. And more importantly, the new payment instrument will change the attitude of the buyer to this money. As soon as this money is converted into another payment instrument, it ceases to be perceived as money (and the buyer has a greater desire to spend it).

In addition, this perception can be enhanced by calling this money the “Balance [of your company name]” (or any other name not associated with real money).

If you succeed in implementing this strategy, you may also want to transfer their accounts to a certain amount of interest. For example, if a client puts $ 10 on his account, you can transfer them to 10% (which would bring their account size closer to $ 11).

By transferring money in their accounts in this way, you get two benefits.

First, you encourage customers to put more money in their accounts. Given the psychological impact of additional means of payment, you should increase the attractiveness of accounts as much as possible.

Secondly, the conversion of buyers' funds into the funds in their accounts turns out to be unstable. Drize and Núñez (2004) explain that additional payment instruments become even more effective when customers have problems converting their funds:

“With an increase in its influence, as well as an increase in customer experience, converting between two or more currencies could theoretically become a habit. In this case, it is expected that prices expressed in such a combined currency may lose their effectiveness ”(p. 72).

Strategy: Use discounts wisely

If used improperly, discounts can harm your business. In fact, some [1, 2 ] suggest never to use discounts.

This advice is a bit exaggerated. Discounts can be used ... you just need to use them wisely.

Where can I go wrong? If you give them too often (or make too big discounts), people will become more price sensitive. They will be waiting for the next discount.

In addition, discounts can reduce the estimated price of the buyer, forcing him to make less purchases (as your price will seem too high).

In such a situation may reduce the frequency and magnitude of the discount. This section describes several additional methods to maintain the effectiveness of your discounts.

Similar articles:

- 3 The only way to provide discounts - Lincoln Murphy

- According to statistics, the introduction of discounts in the SaaS model reduces sales by more than 30% - Patrick Campbell

- A race in which no one can win - Tim Peter

Tactic 23: Follow Rule 100

Earlier you learned that people can estimate the same price differently depending on the factors acting on it.

Discounts are another matter.

When introducing discounts, you want to increase their apparent size so that the buyer feels that he is making a good deal.

Take a blender for $ 50. What discount should be introduced to make the deal seem to be more profitable: 20% or $ 10?

If you count, both discounts have the same cash equivalent. However, one of them has a distinct advantage over the other.

Which one to choose? Johan Berger (2013) proposes to follow the "rule 100".

- If the price is below $ 100, choose a percentage discount (for example, a 25% discount).

- If the price is above $ 100, choose a discount as an absolute value (for example, a $ 25 discount).

In both cases, you choose the discount with the highest numerical value (which will seem more in the eyes of the buyer).

Tactic 24: Explain the reason for the discount

In order to avoid the negative impact of discounts, try not to use such a word as “discount”. Otherwise, it is necessary to clearly explain why the discount.

For example, stores that use the EDLP strategy [eng. every-day-low-pricing - low prices every day], refer to supplier price reductions:

“In their promotions, stores using the EDLP strategy (for example, Wal-Mart) often inform buyers that cost reduction is due to the supplier and thus affects prices ... presumably to minimize the negative effects of an advertising campaign ...” ( Mazumdar, Raj and Sinha, 2005, p. 88 ).

Pointing to the reason for introducing the discount, you emphasize the features of the new price. And since this price is non-standard, buyers, for sure, will not take it into account when forming their approximate price.

Tactic 25: Do not use discounts with exact numbers

Earlier, I told you that you need to use exact numbers at high prices. Since people have exact numbers associated with small values, they can be influenced so that high prices seem lower for them ( Thomas, Simon and Kadiyali, 2007 ).

As for discounts, you should maximize their apparent value. Choosing exact numbers for discounts you, in fact, harm yourself. Because of these exact values, your discount will seem less.

In confirmation of this, Thomas and Morvitz (2006) cite the fact that people thought that the difference between 4.97 and 3.96 is less than the difference between 5.00 and 4.00, although in reality it is almost the same the same (1.01 and 1.00 respectively).

To increase the apparent value of your discount, use rounded values. The buyer should be able to easily estimate this value.

Step 4: Maximize Your Income

When a customer makes a purchase with you, your work does not end there. Whether you want a client to make purchases in the future or continue to use subscription services - one way or another, prosperous companies receive income from existing customers in a variety of ways.

In this section, you will be introduced to several strategies that are of great importance to your budget in the long term. You will learn, (1) how to raise the price unobtrusively, and (2) what pricing strategies can harm your reputation.

Similar articles:

- 4 ways to get shoppers to add more items to your cart - Tim Ash

- How to attract regular customers in e-commerce - Armando Roggio

- The Basics of Customer Churn Analysis - Dan Andrews

- Maximizing Your Income With Pricing - Andrew Youderian

- 3 methods of attracting more revenue from the sale of their goods and services - Joseph Putnam

Strategy: Make price increases imperceptible

In the world of inflation, an increase in prices is inevitable. Your prices will rise sooner or later.

Since the majority is familiar with such a concept as “inflation,” everyone will be condescending to price increases, right? Of course, they understand everything.

Unfortunately, it's not that simple. Despite inflation and other compelling reasons, most buyers see no justification for price increases.

Bolton and others (2003) explored the nature of this perception. They found that buyers “underestimate the effects of inflation, more often explain the difference in prices by the seller’s desire for profit and do not take into account the whole complex of factors affecting the price”. Well, very sorry.

Although you will not be able to eliminate all the negative effects of rising prices, you can make the growth of these prices less noticeable (without manipulating others).

Tactic 26: Increase prices more often (and unnoticed)

The easiest method to control price perception is to use subtle differences [eng. just noticeable difference, JND].

A subtle difference is the minimum price change that can be detected (that is, a difference that is barely noticeable).

If the price of your item is $ 11.79, increasing it to $ 14.99 will be more noticeable than increasing to $ 12.99.

This is a no brainer.

In theory, the approach itself is intuitive. Obviously, people will notice when prices rise stronger.

In practice, this principle is rather contradictory. Due to the fact that companies are afraid to raise the prices of their products, they often use this method only in extreme cases. They wait until circumstances force them to raise prices.

At the same time, when this happens, you are in a desperate situation and cannot raise the price gradually. You will have to significantly increase it.

What to do?

If you know that in the end you will have to raise the price of your product, then you should increase it more often (and unnoticed). Never wait for the moment when you have no choice.

In addition, frequent price increases will not lead to a clear indicative price. If your price remains the same for several years, people get used to the fact that it does not change. And as soon as you change it, they will surely notice it.

Tactic 27: Reduce Product Size

You can also apply the method of subtle differences to other aspects of your product.

Food market marketers know that buyers are familiar with prices, so they try not to increase prices, but to reduce the size of the products themselves (for example, packages of chips, the size of chocolate bars, etc.).

By reducing the size of products, marketers reduce their costs and increase revenue. And not least, they increase their income without raising prices (and without exposing buyers to any negative changes).

If you decide to reduce the size of your product, you should reduce the value of all three parameters - height, width and length - by the same number. Consumers are unlikely to notice changes in all three quantities ( Chendon and Ordabayeva, 2009 ).

Reducing the size of the product - the procedure is quite risky. If customers reveal your insidious plans, you may lose confidence, and sales may fall.

To maximize your income, you need to maintain and improve customer relationships. The following are strategies that can damage your reputation.

Strategy: Do not use dangerous pricing strategies

Certain pricing strategies can make a bad impression about you. In this section, you will learn which strategies you should not use.

Tactic 28: Do not use the substitution method

When I was looking for accommodation, I noticed a very interesting offer on Craigslist. I visited the apartment complex the very next day and was amazed at its luxury.

Unfortunately, my naivety did not last long. The deal was too unbelievable. The cost of housing listed in the list was a blatant lie: you had to pay $ 250 a month for the cheapest accommodation in the complex. This is how I became a victim of the substitution method.

Substitution method: marketers offer products at extremely low prices to lure people to the store. When a customer comes to the store, the product is unavailable (for example, sold out or not at all). Then marketers are trying to convince this buyer to purchase more expensive goods.

The method of substitution is not only unethical, in some cases its use is prohibited by law .

But even when its use is legal, such deception causes a negative reaction, which often reduces sales ( Allison and Allison, 2009 )

Tactic 29: Be Careful With Dynamic Pricing

Over the past ten years, more and more companies have dynamically changed their prices for various buyers. Based on many factors, their algorithm gives the price, which should lead to the greatest amount of income.

This trend is known as dynamic pricing. But however attractive it may seem, it is usually best to avoid it. Although dynamic pricing can dramatically increase sales in the short term, Dai (2010) found that it can reduce sales in the long term:

“Despite the fact that dynamic pricing seems attractive, since theoretically it maximizes the seller’s income, research results show that setting different prices for the same product can give rise to negative judgments about the truth of the proposed price, which in turn leads to negative behavioral intentions ”(p. 86).

Does dynamic pricing always bring harm? Not necessarily. Dynamic pricing can be effective in the case when the price change is based on the law of supply and demand (for example, when trying to fill in empty seats in a stadium).

It leads to negative consequences if the price change is based on the client’s readiness for payment. The introduction of different prices on the basis of the client’s previous actions, demographics or any other factor, except the law of supply and demand, should be avoided.

Similar articles:

- Five aspects of dynamic pricing that retailers need to consider - Patricio Robles

Conclusion

Have you decided to go straight to the conclusion? No problem. I suspect that you want to know only the key points and do not want to read the entire article. If so, then I offer you a 15-minute video report.

It can be viewed here for free.

Maybe you read the full article? Then you, my friend, are not timid. I can not praise you. I spent a lot of time to study all this and write an article, so I hope that it will be useful.

Before we part, I suggest we look at a number of concluding topics.

Do I need to conduct A / B testing of their prices?

My advice is often very strange, and I know it. That is why I always make references to sources.

And therefore, I recommend conducting A / B testing of my hypotheses. The theory is good. But what is true in theory is not always true in practice. If you had conducted A / B testing of images from my article on archival photos, not all tests would have been successful.

This means you need to test and use prices, right? In fact, the point is this. Pricing - the case is not quite standard. If customers see two different images, then there is nothing to worry about. But when they see two different prices ... There are problems.

It will always depend on the situation. And here is my typical advice: you should not conduct A / B testing of your prices.

You can test various price features (for example, color, size, location). But do not conduct A / B testing or other experiments on real prices.

If you are eager to test your prices, then the experiment must be very strictly controlled. Conduct a survey of your customers (ideally - decombination analysis). So you don’t actually change prices for real buyers.

Similar articles:

- Do I need to conduct online testing of their prices? - Linda Bastos

Last pricing method

Instead of remembering all the pricing strategies described, I want to talk about one more method - it is more important than everyone else on this list.

If you still have problems explaining the choice of your price to customers - even after applying the strategies from this article - then perhaps your problem is not in price. Perhaps your problem is explaining the value of your product.

Instead of setting new prices, try to offer other features of your product or service to more clearly demonstrate its value.

- What is unique about your product?

- How is he better than others?

- Why should buyers like it?

Often the price problem can be solved by more effectively describing the advantages of your product.

Given this approach — and all the other psychological pricing strategies from this article — you should be able to easily explain your price selection.

Source: https://habr.com/ru/post/291032/

All Articles