Bubble startups? Maybe yes, maybe not

Hello Megamind. Interested in this article , we decided to offer a translation of the material from TechCrunch, which describes the current startup boom as a possible bubble, as was the case in 2000 with the dotcoms. Written by Bill Maris , President and Managing Partner of Google Ventures. We apologize in advance if the translation is somewhat clumsy.

I heard that many people are surprised when they hear about the possibility of the existence of bubble startups. What is the probability that everything will be the same as in 2000, when the dot-com bubble was suddenly detected? Can everything be just as bad or worse? I thought that it would be advisable to look at the facts in order to find out if there is anything else besides opinions on this matter and asked our engineers at Google Ventures to provide figures. In this post I will tell everything that I learned.

')

Remember the end of the 90s? Venture capitalists came to the delight of the Internet, a lot of money was poured into Internet companies, many of which then closed, leaving a huge number of people practically impoverished.

In the yard in 2015. If you read news headlines about how Uber, Airbnb, Dropbox and others are valued at billions of dollars, it becomes clear why many people are in some kind of excitement. The current boom is an irrational arousal from new platforms and new economic models, like in 1999? Or is it something completely different? There are two points of view on this score - “For” and “Against”.

Although the numbers show that venture investment is growing, they also demonstrate the 4 main differences between current startups and the dot-com era.

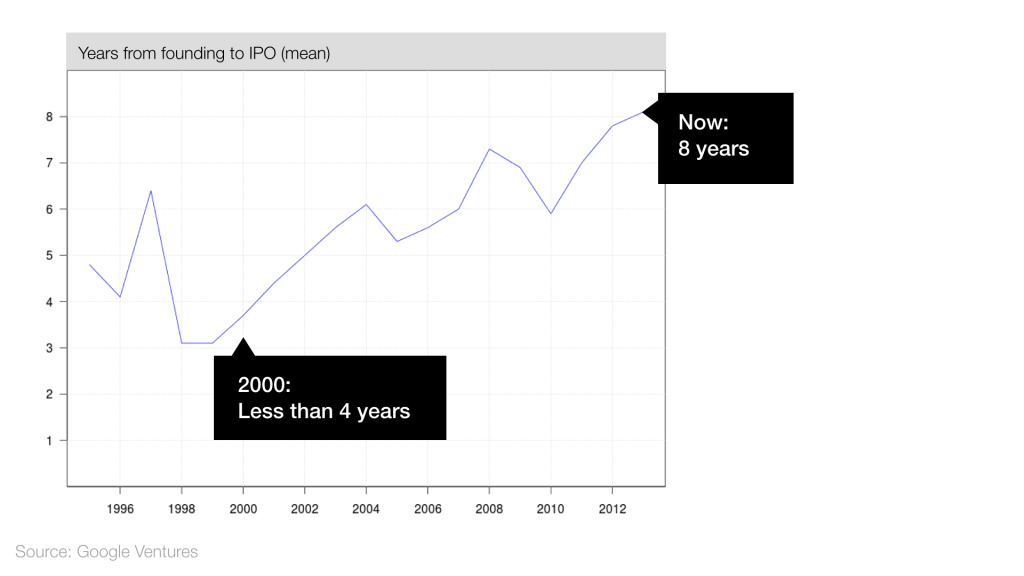

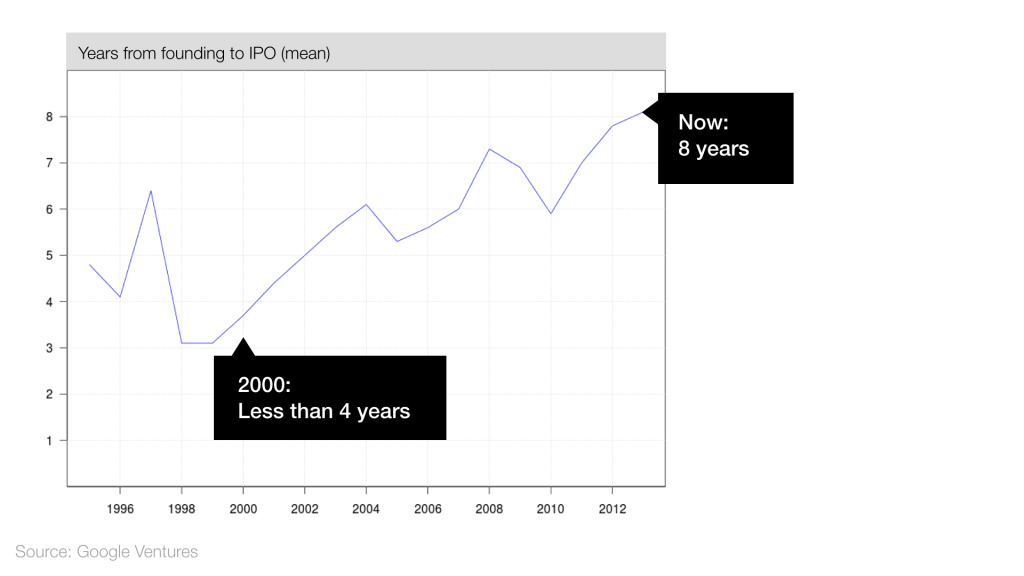

In the dot-com bubble, many companies rushed into an IPO without having any assets. Today, companies are much more attentive to the public offering of shares:

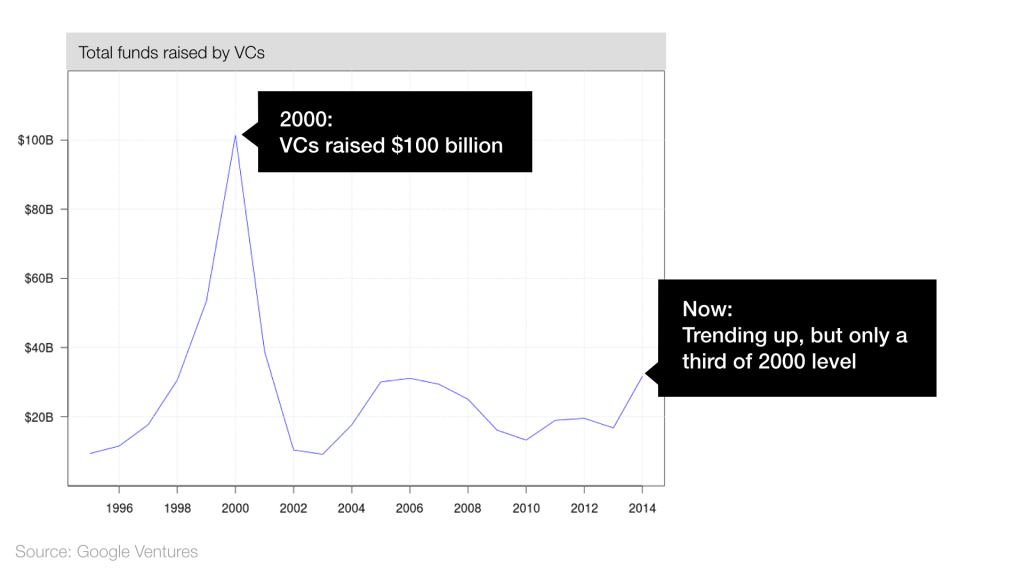

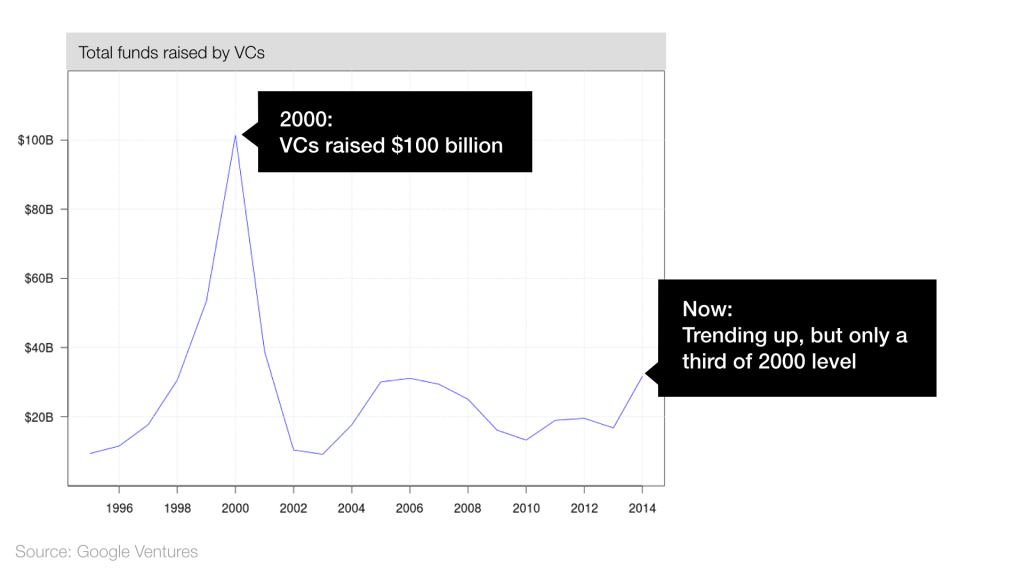

In 2000, money flooded into the venture funds, and they, in turn, poured them into companies that made their products on their knees and used bars as places for business meetings. The results were not long in coming - most of these companies failed. Today, there is a surge in venture capital fundraising, but this is still below the 2000 level:

In 2000, the venture capital made a record amount of investment - about 2000. What has changed to date? If you look at the numbers, it will become obvious that since 2007 there has been a decline. This suggests that venture capitalists began to more carefully select startups:

The amount of investment from venture capital shot in 2013 and 2014, but still far from the level of the dot-com bubble:

During the bubble of 2000, a huge amount of venture capital money led to a huge number of investments. Today, investment continues to grow, but the number of transactions is not. What is going on? As we can see, venture capitalists prefer to invest large amounts of groups, but the sample has narrowed considerably.

Data analysis showed that there are 6 alarming signs that the current startup boom may turn out to be another technological bubble.

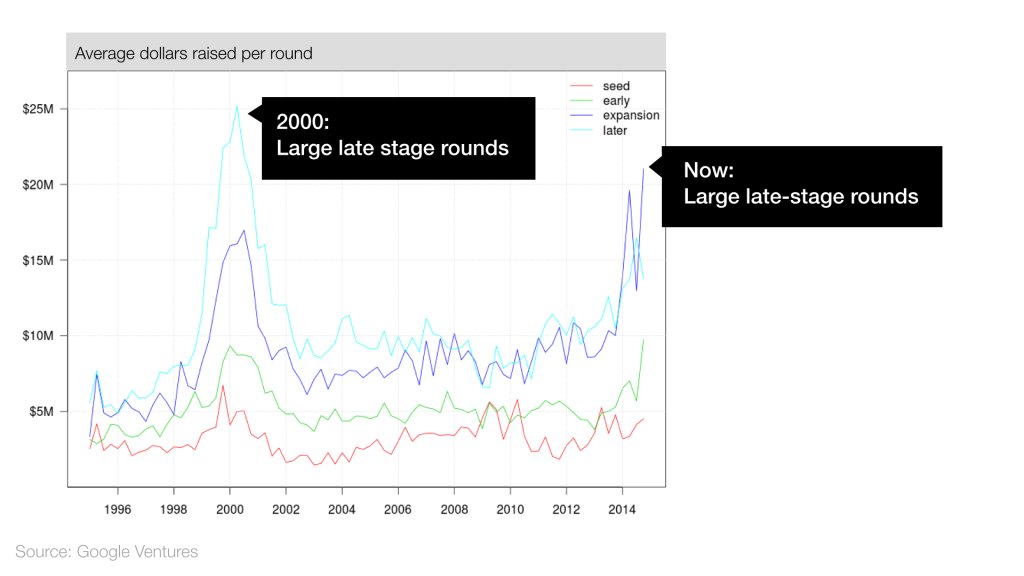

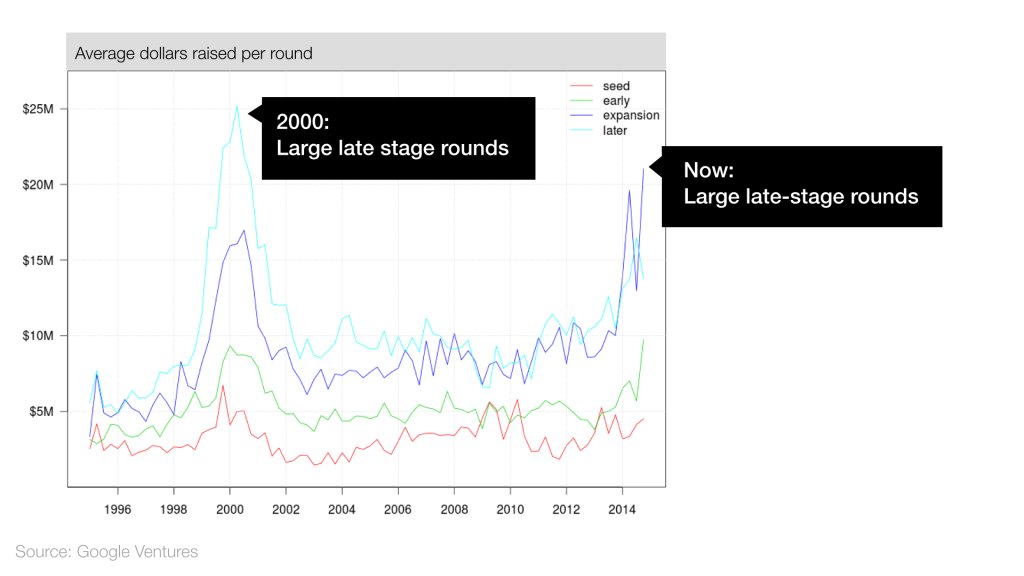

If you believe that late stage financing can be a replacement for an IPO, then this may not be a worrying sign. It is very easy to see the similarities with the year 2000:

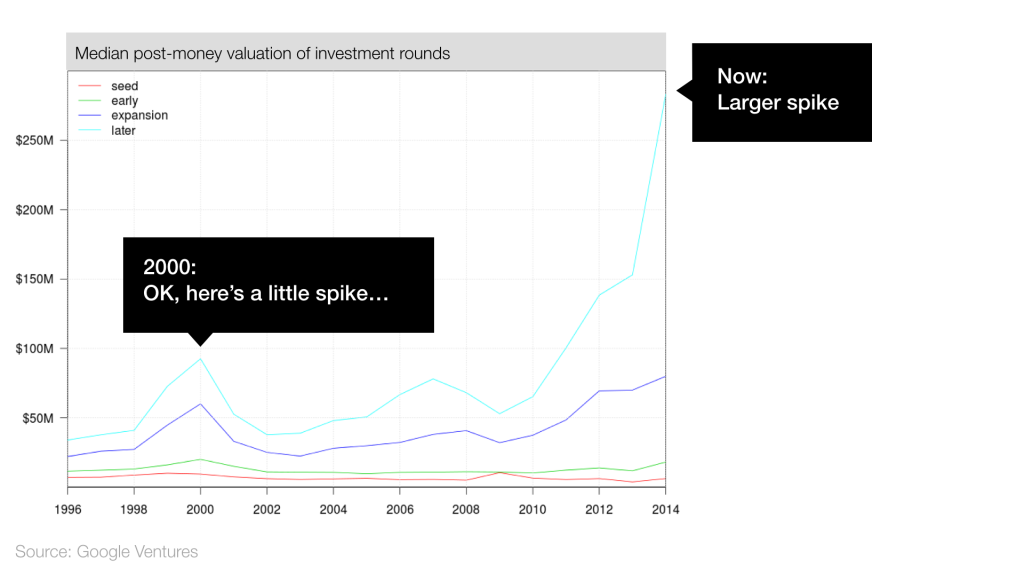

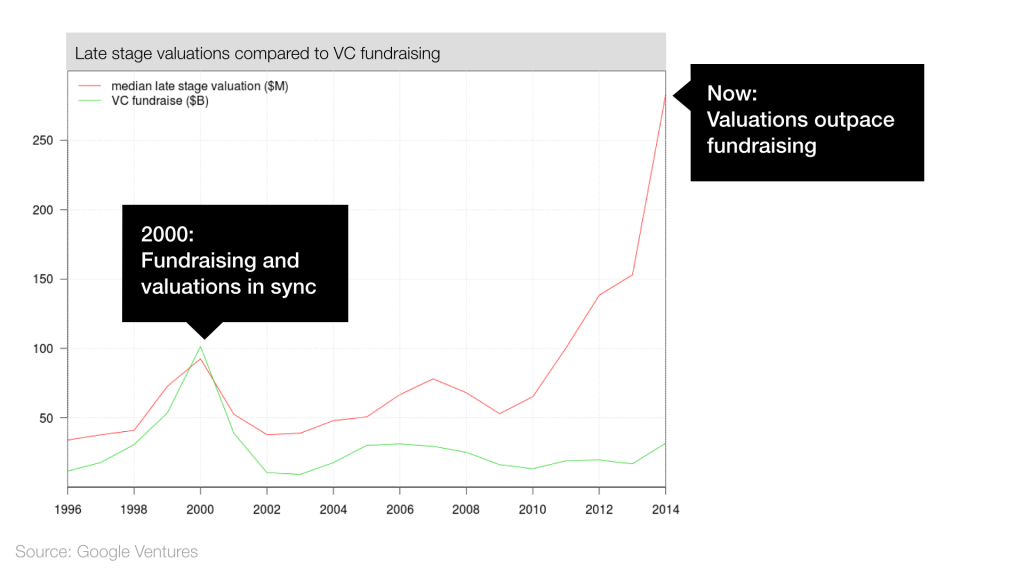

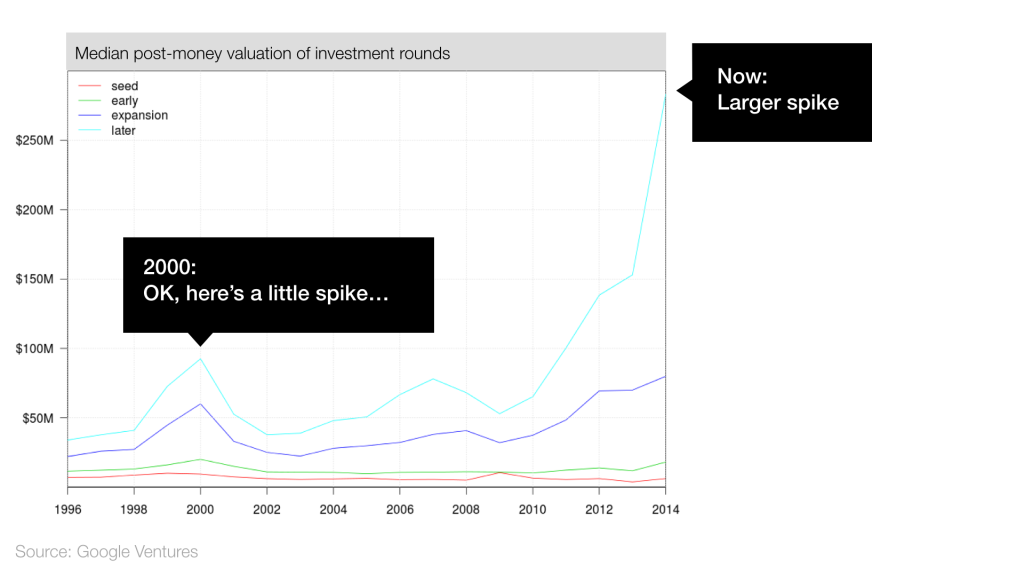

Since 2010, the valuation of closed companies has increased dramatically, and even in 2000, the mark was at a completely different level:

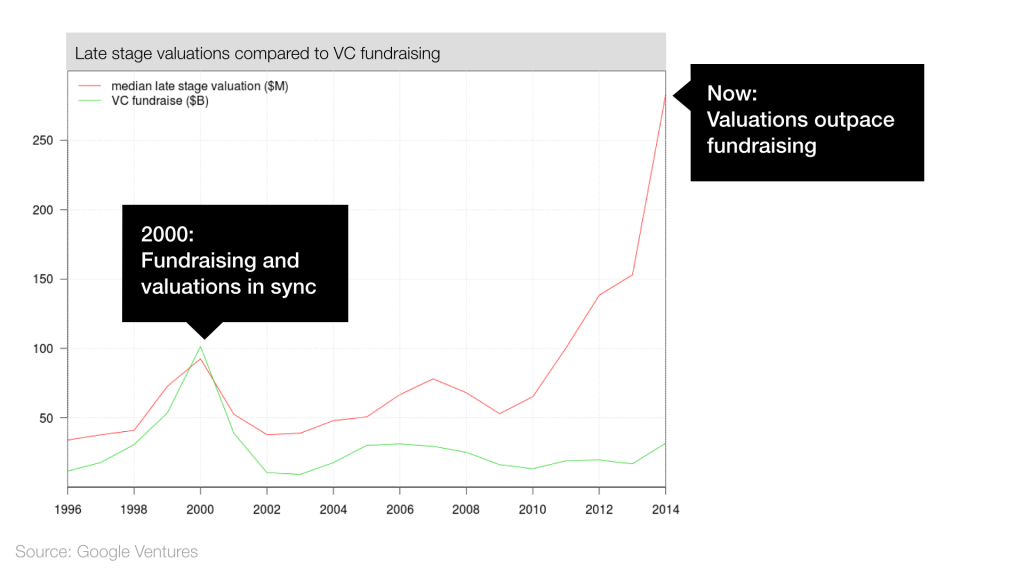

The graph clearly shows how the assessment of companies has gone far ahead:

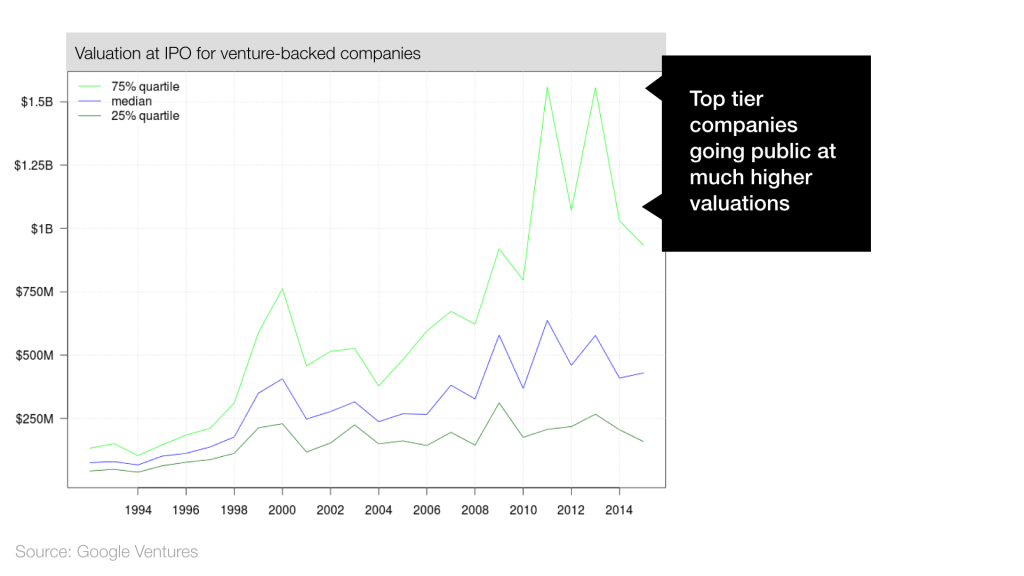

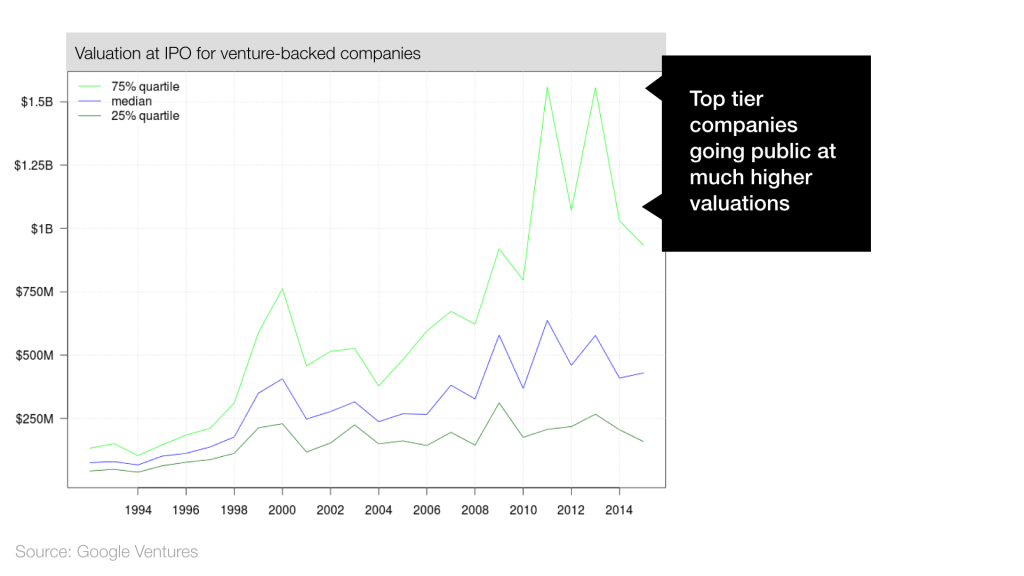

IPO scores rose across the board, but the most successful companies go public with an overly high rating (or maybe they just wait longer):

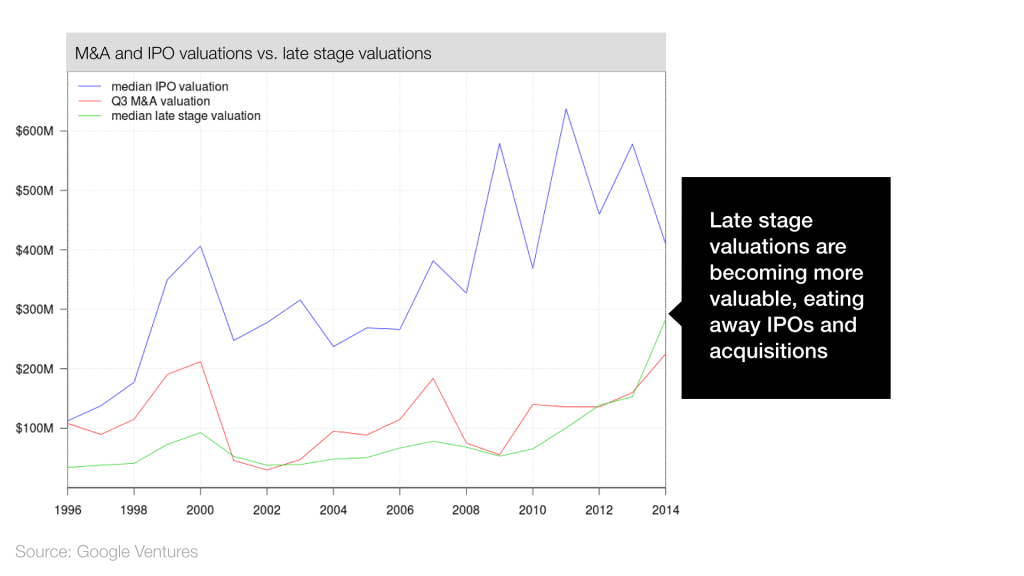

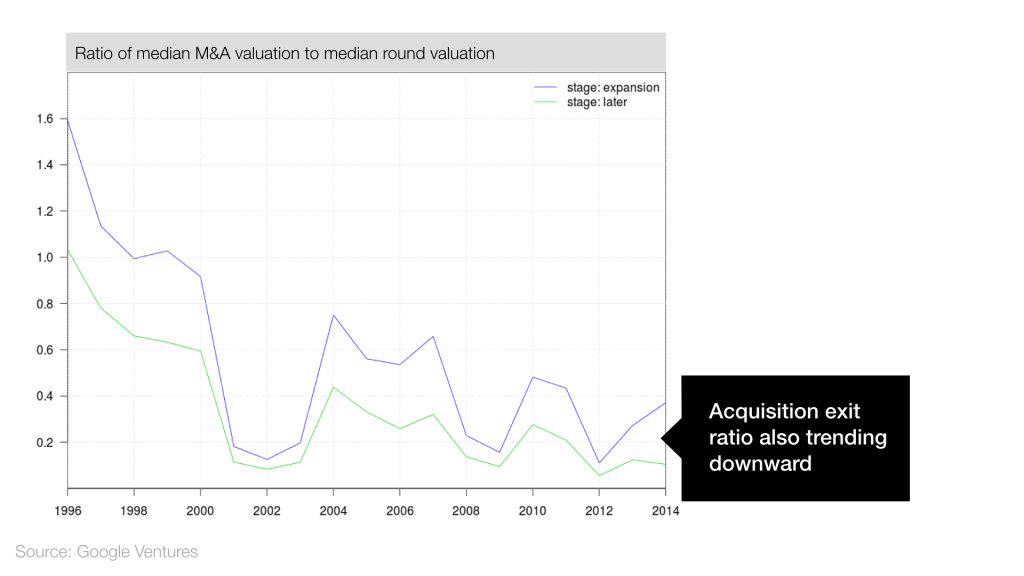

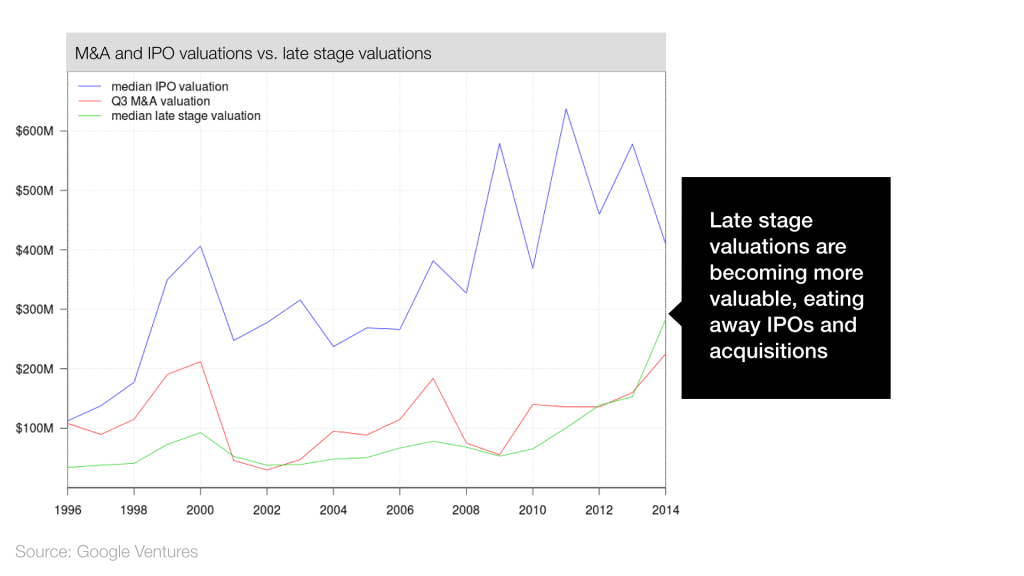

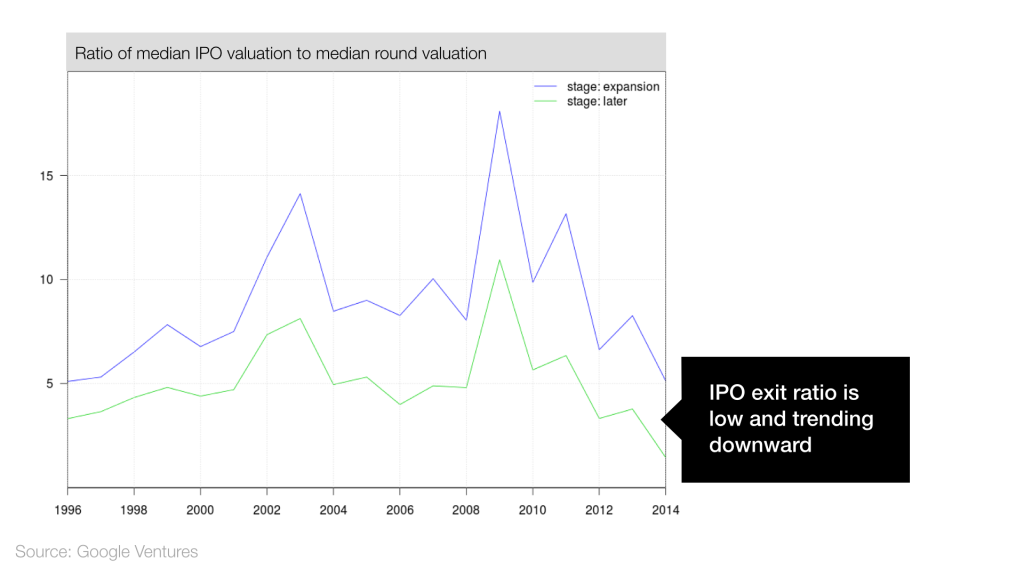

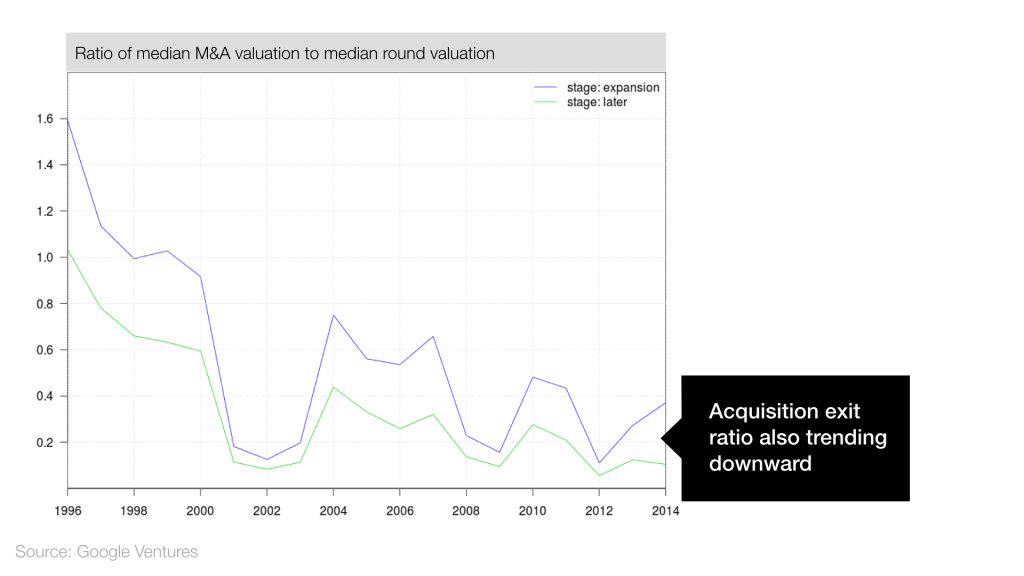

Both latency and acquisition valuation increases, while IPO valuation decreases. Late stage financing and various acquisitions, in effect, replace companies with an IPO:

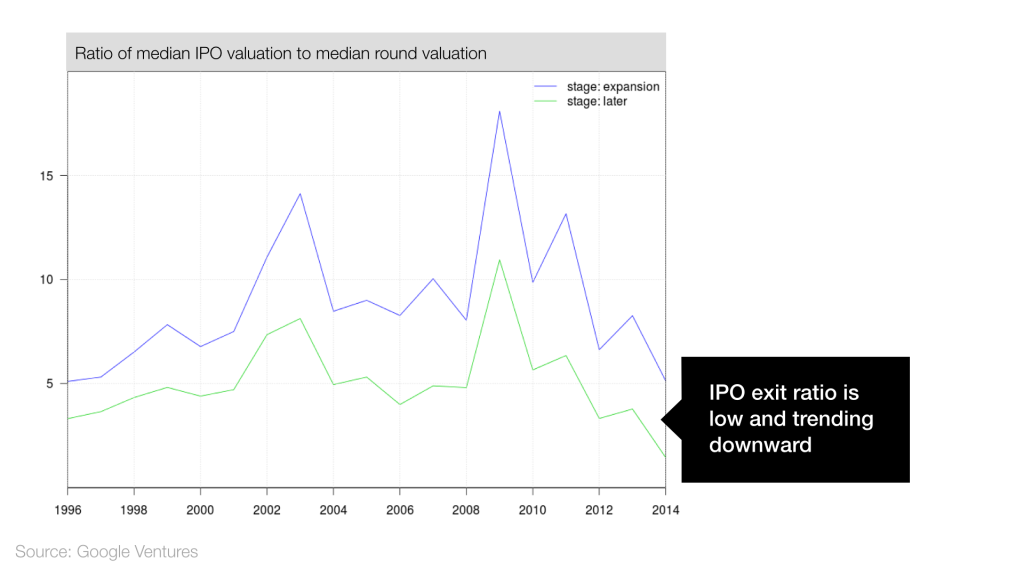

The data obtained indicate that the assessment at the IPO does not grow as fast as at the late stage of financing of closed companies. In fact, if you look at the ratio of IPO and company valuations at a late stage, you can see that this ratio has steadily decreased since 2009. This suggests that in later stages, investors can expect lower returns than they did before:

As you can see, 2015 is very different from 2000. Some differences are encouraging (for example, the total number of venture capital investments remains unchanged), while others are confusing (for example, the rapid growth of quotations and a decrease in the profitability of an IPO).

The numbers clearly demonstrate an increase in late-stage financing, but this can be interpreted differently. One hypothesis is that late-stage financing allows companies to remain “closed”, free from having to go IPO or to be acquired. It can also be said that technology allows companies to grow faster and late-stage financing is more suitable to meet the needs of these young, but already big startups, rather than placing on the stock exchange.

If what is happening now is another technological bubble, then it is a completely different bubble than the one that was in 2000. And this is logical, because in 15 years the market and conditions have changed significantly.

Of course, companies will still fail, and given the close attention to start-ups, these failures of the media will be presented as a catastrophe, but this does not mean that "the skies are crumbling."

When one of the super-rated companies fails, which, by the way, is inevitable, we need to take a breath and ask ourselves, is it something endemic or just part of normal life, where failures happen everywhere and with everyone. You may need to first look at the facts and figures before you start to panic.

Original: Tech Bubble? Maybe, Maybe Not

Translation: Rocket Callback

Photo: © TechCrunch

I heard that many people are surprised when they hear about the possibility of the existence of bubble startups. What is the probability that everything will be the same as in 2000, when the dot-com bubble was suddenly detected? Can everything be just as bad or worse? I thought that it would be advisable to look at the facts in order to find out if there is anything else besides opinions on this matter and asked our engineers at Google Ventures to provide figures. In this post I will tell everything that I learned.

')

Remember the end of the 90s? Venture capitalists came to the delight of the Internet, a lot of money was poured into Internet companies, many of which then closed, leaving a huge number of people practically impoverished.

In the yard in 2015. If you read news headlines about how Uber, Airbnb, Dropbox and others are valued at billions of dollars, it becomes clear why many people are in some kind of excitement. The current boom is an irrational arousal from new platforms and new economic models, like in 1999? Or is it something completely different? There are two points of view on this score - “For” and “Against”.

"Against" the presence of a bubble

Although the numbers show that venture investment is growing, they also demonstrate the 4 main differences between current startups and the dot-com era.

Companies do not seek to become public

In the dot-com bubble, many companies rushed into an IPO without having any assets. Today, companies are much more attentive to the public offering of shares:

Venture fundraising is significantly lower than the peak of 2000

In 2000, money flooded into the venture funds, and they, in turn, poured them into companies that made their products on their knees and used bars as places for business meetings. The results were not long in coming - most of these companies failed. Today, there is a surge in venture capital fundraising, but this is still below the 2000 level:

The total investment is rather small.

In 2000, the venture capital made a record amount of investment - about 2000. What has changed to date? If you look at the numbers, it will become obvious that since 2007 there has been a decline. This suggests that venture capitalists began to more carefully select startups:

Venture capitalists invest a lot of money - but this is only half the 2000 figure.

The amount of investment from venture capital shot in 2013 and 2014, but still far from the level of the dot-com bubble:

During the bubble of 2000, a huge amount of venture capital money led to a huge number of investments. Today, investment continues to grow, but the number of transactions is not. What is going on? As we can see, venture capitalists prefer to invest large amounts of groups, but the sample has narrowed considerably.

"FOR" the presence of a bubble

Data analysis showed that there are 6 alarming signs that the current startup boom may turn out to be another technological bubble.

Most of the investment comes in the later stages of the rounds

If you believe that late stage financing can be a replacement for an IPO, then this may not be a worrying sign. It is very easy to see the similarities with the year 2000:

Evaluation of closed non-public companies grows

Since 2010, the valuation of closed companies has increased dramatically, and even in 2000, the mark was at a completely different level:

Venture fundraising does not keep pace with the assessment of companies

The graph clearly shows how the assessment of companies has gone far ahead:

IPO scores rose sharply

IPO scores rose across the board, but the most successful companies go public with an overly high rating (or maybe they just wait longer):

Late stage funding crowds out on the exchange

Both latency and acquisition valuation increases, while IPO valuation decreases. Late stage financing and various acquisitions, in effect, replace companies with an IPO:

Coefficients at IPO fall

The data obtained indicate that the assessment at the IPO does not grow as fast as at the late stage of financing of closed companies. In fact, if you look at the ratio of IPO and company valuations at a late stage, you can see that this ratio has steadily decreased since 2009. This suggests that in later stages, investors can expect lower returns than they did before:

As you can see, 2015 is very different from 2000. Some differences are encouraging (for example, the total number of venture capital investments remains unchanged), while others are confusing (for example, the rapid growth of quotations and a decrease in the profitability of an IPO).

The numbers clearly demonstrate an increase in late-stage financing, but this can be interpreted differently. One hypothesis is that late-stage financing allows companies to remain “closed”, free from having to go IPO or to be acquired. It can also be said that technology allows companies to grow faster and late-stage financing is more suitable to meet the needs of these young, but already big startups, rather than placing on the stock exchange.

What is the result?

If what is happening now is another technological bubble, then it is a completely different bubble than the one that was in 2000. And this is logical, because in 15 years the market and conditions have changed significantly.

Of course, companies will still fail, and given the close attention to start-ups, these failures of the media will be presented as a catastrophe, but this does not mean that "the skies are crumbling."

When one of the super-rated companies fails, which, by the way, is inevitable, we need to take a breath and ask ourselves, is it something endemic or just part of normal life, where failures happen everywhere and with everyone. You may need to first look at the facts and figures before you start to panic.

Original: Tech Bubble? Maybe, Maybe Not

Translation: Rocket Callback

Photo: © TechCrunch

Source: https://habr.com/ru/post/290070/

All Articles