How technical problems can ruin the life of a trader, or why it is important to choose a reliable broker

What problems lie in wait for those who decide to use automated trading strategies (robots) in trading? Advertising of trading robots speaks about their reliability and stability. Unfortunately, sometimes technical bugs and stupid work of a financial company can lead to significant losses of money.

I will talk about my experience of working with a Novosibirsk company that has a branch in Moscow. As a result of a combination of software bugs, poor support services, and just failures, my losses amounted to no less than 15% of the capital. To warn against errors of those who are interested in the topic of trading, I decided to tell about it. I tried to write as simple as possible, but I still need to be a bit in the topic of trading.

Who is interested to learn about my grief-experience - I ask under the cat.

Trading makes it possible to make good money on the accumulated capital, but it is always a risk. And, as a rule, the greater the risk, the more you can earn, but also lose more in case of failure. It is clear that not everyone has the time to seriously engage in trading and develop their trading strategies. Many want to find something ready. And since demand always creates supply, brokers in large quantities offer various portfolios. Many of them have been tested and have been working for many years, you can easily see the dynamics over the past 3 years: how much the initial capital has grown / fallen, what were the maximum drawdowns (losses in the worst case). Here, for example, a selection of trading robots , some of which are quite interesting.

')

Comparing the potential benefits and risks, you can find something suitable. Then it remains only to connect the tariff with auto-execution of transactions and hope that the capital will continue to grow further, as it has done in the past few years on the chart. And if the trend and the truth continues, we will earn good money. And you do not need to do anything. So or not?

It turns out not quite. For example, the trading system still needs to be monitored. If a virtual server (usually brokers themselves offer such a service) on which auto-execution of transactions works, something may not work, and you deviate from the strategy of the robot. Financial companies (at least the one that got to me) do not monitor your server themselves. If something falls - this is your problem. What, in general, is wrong, in my opinion.

What can a server crash cause? For example, you are on vacation, and your trading robot has bought shares of Sberbank (suppose you have an aggressive portfolio consisting of only this one stock). The deal was unsuccessful, the price went down, ideally the robot should have closed it with a small loss. But the server fell, and the position remained open. And then, as luck would have it, Black Monday happened (or Tuesday, or something else), and Sberbank collapsed by 20%. And the server is. Such a technical bug can lead to losses greater than choosing the most unsuccessful strategy.

This is unlikely, you say. Well, it depends on how often it will fall. My server, for example, crashed 5 times within one month due to the fact that something broke on the 1Gb partner hosting. True, SMS notifications came, although often with a delay. However, the fall of the hosting, although they themselves are outraged, never led me to any serious losses. Sometimes they can even work as a plus if you're lucky.

Well, suppose we have a very reliable server that never crashes. The selected portfolio shows good momentum. Can I sleep well? And no again. It turns out that there are things that are much worse than server crashes ...

I have been using the company for more than a year now. It was different. There were attempts to trade on his own, then the understanding came that it requires too much strength, energy, nerves. There were various ready-made portfolios, there were earnings and drawdowns. For the time being, the company's services suited me perfectly, but to be honest, there were simply no serious situations. That is, I connected the tariff, chose a portfolio, everything somehow worked. There were mentioned problems with the server, with the inoperability of installed applications. For example, once I was surprised to find that the robot does not execute the application. It turned out that the auto executor could not forward them because of some bug. Everything was fixed, the working version was installed. But again, and if I were on vacation, I didn’t notice and ... Oh well, after all, checking everything at least once a week is not that difficult.

As a result, I met the new year with an amount of about 450 thousand rubles. on the bill. In early 2015, I decided to include an aggressive portfolio of "Titan", which showed very good dynamics and was strongly promoted by the company.

For 3 plus years

Over the past few months

Before that, somewhere in six months, I used the conservative "Lira".

A source

The strategy earned a little, but it was a plus. I always try to recheck everything as much as possible, even if everything should be fine anyway. But these 3 months have eased my vigilance, and, going to the "Titan", I checked only the fact of the server operation and auto-fulfillment of applications. And he stopped checking the official schedule. And in vain.

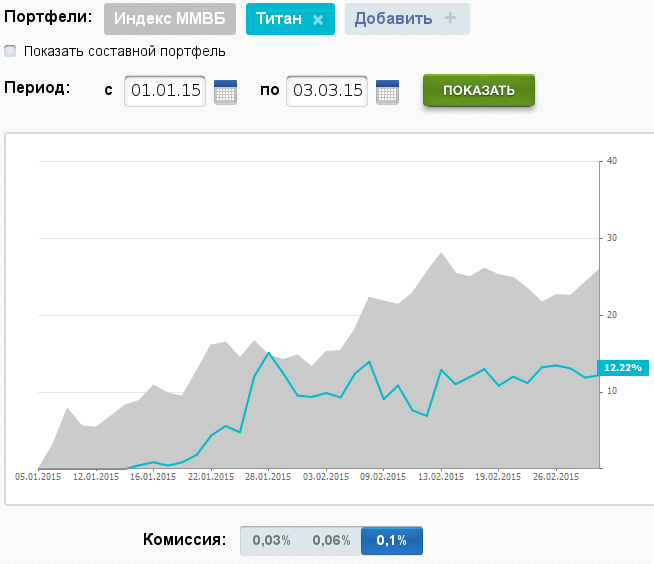

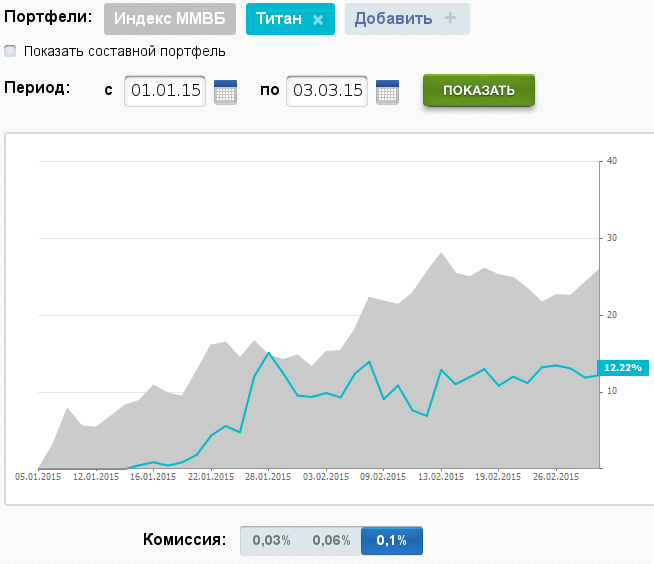

For a while there was growth, and I did not bother at all. Then it began to fall, I still did not worry, without this in trading in any way. But the fall continued. At some point, the amount on the account went into minus relative to the starting 450 thousand. Now pay attention to the Titan's schedule for this year, there are no points below zero at all, even with the largest commission.

I started to worry, checked the schedule on the site (it was the end of February). What was my surprise when, according to the schedule, I was supposed to be in positive territory by more than 10% (on the given graph, 12.22% ). I understand that there may be some technical deviations ( 1-2% ), but everything was much worse. I called the company.

I described the situation, the financial adviser said that he would try to figure it out and soon let me know everything. This was my first tomorrow. The call was made on February 24th on Tuesday. In the end, I reinstalled the program - the performer of applications (called "Autopilot"). Allegedly in her bug. In general, I will immediately say that this measure is akin to the advice “restart Windows”. The probability of solving a problem is extremely small, but you can create the appearance of solving it, perhaps the client will calm down. This is the first trick.

They also took logs for analysis, but did not say anything. By the way, the logs were then asked to send every time I called, but I never made a single conclusion on them. This is another sleeping measure in the style of "you send, and we will understand" or "have already sent? Well, send the freshest one more time. ” And the client sits and thinks: "Well, they took the logs, it means they are doing something ...". This is the second trick. As a result, during the week nobody answered me on the question.

And the problem was not worth a damn. To understand its source, it was enough to own a little school arithmetic. But first things first.

In the meantime, the money was lost. Lost every day. In itself, waiting in 3 days, when the schedule on the site successfully conquers new heights, and in fact there is a drop of 1.5% per day, pleasure, believe me, is not pleasant. Especially when you do not understand why.

As a result, it was Friday, then Monday of the next week. Since no one was going to help me, I started to figure it out myself and downloaded the file with the transaction parameters from the official site.

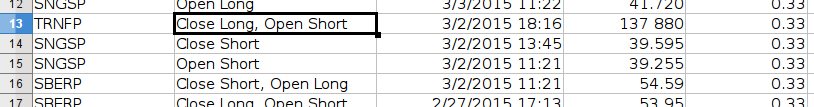

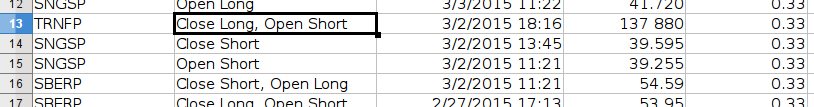

Transactions of "Titan" on March 2, 2015

Source (excel-table "Transactions" at the bottom of the page)

And checked

What happened in fact

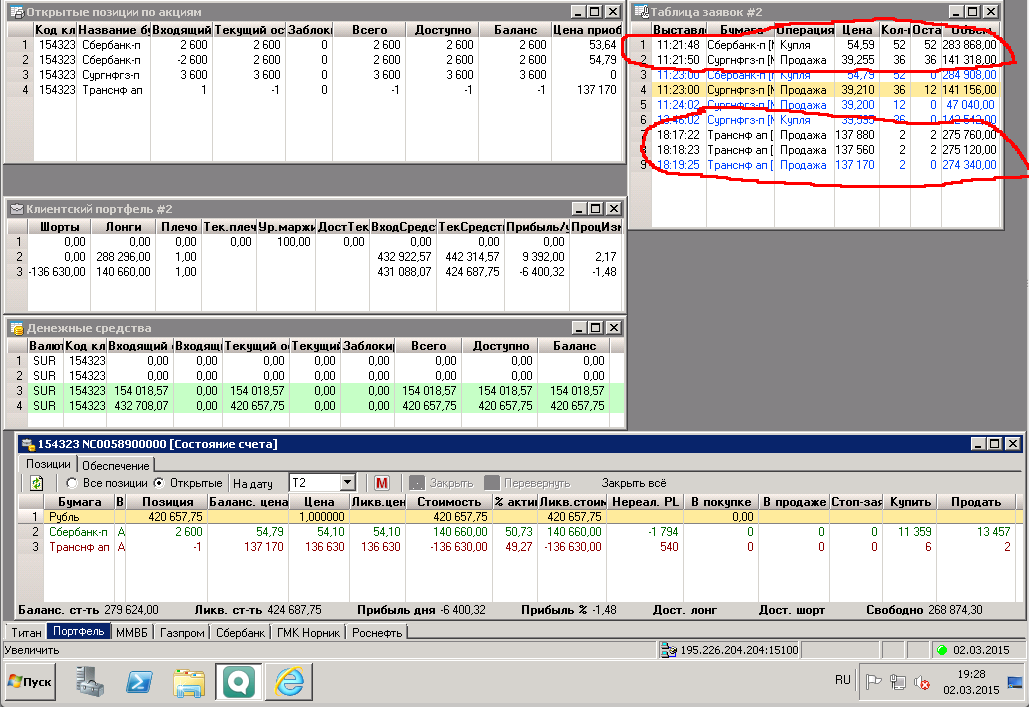

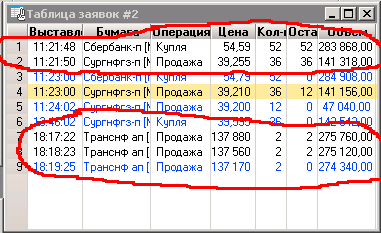

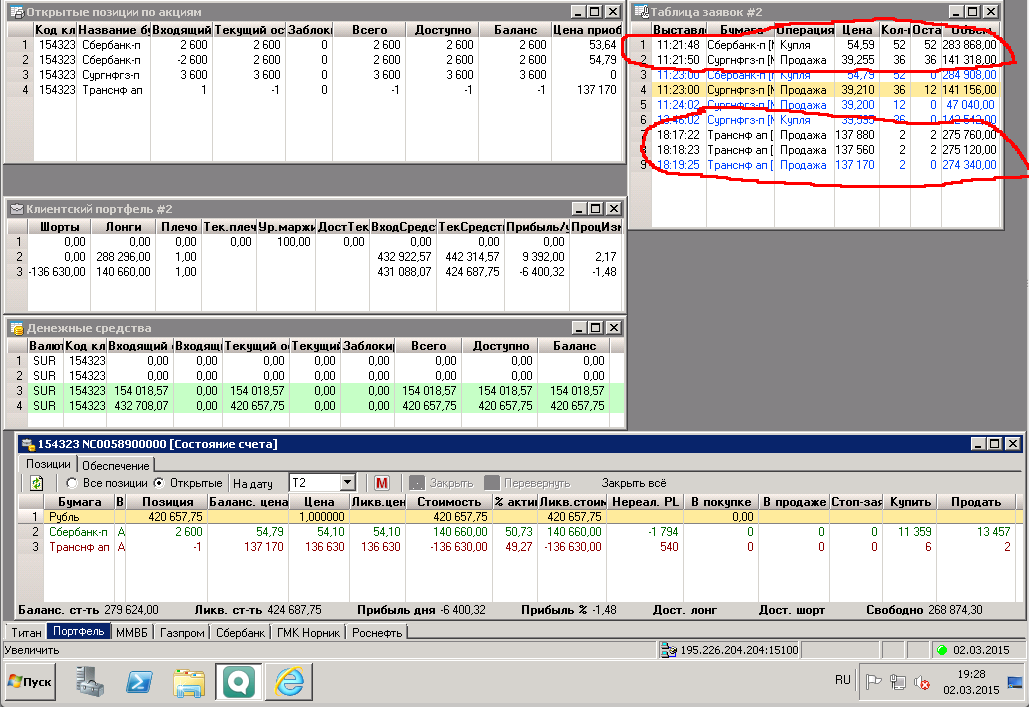

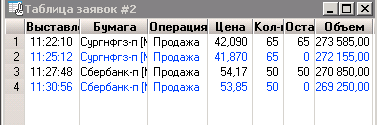

As you can see, this is also data at the end of the day on March 2, 2015. What is wrong on the screenshot? Let's look at the official dynamics:

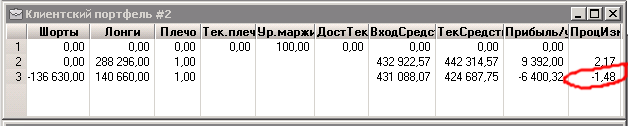

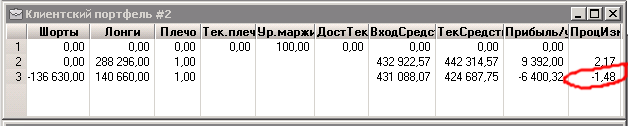

That is, in fact, on Monday we grew by 0.28% . But the real-life -1.48% :

The first line does not count, it is associated with the outdated mode T0

We calculate ourselves to know for sure. To start on the excel-table above. For March 2, only 4 deals:

We summarize, we get -0.672% , we add the commission: -0.1 * 5/3 = -0.166% , so we have about -0.838% . Where did 0.28% come from - a mystery ...

Everything is already so bad, the deception is obvious, but why did I get even less? We continue.

The table shows that applications are not always, and to be honest, they are almost never executed at the price from the “ideal” table. They were exhibited, then dropped after a minute and exhibited less profitable. For Transneft, and it is the only one who earned that day, it happened as much as 2 times. Calculate the loss on this so-called "slippage."

Total: -0.593% . In total, with the previous one, approximately -1.4% is obtained . The resulting error is related to the shares of Transneft, which I will discuss next.

It turns out that in addition to the fact that the graph is obviously false (we checked it), even in comparison with the “honest” table, there are very significant deviations. -0.593% is a lot for one trading day, the maximum tolerance should be no more than 0.1% . It is clear that if such a deviation occurs systematically, then within 20 trading days we will receive more than 10% loss only relative to the official schedule.

Total instead of a small profit in reality big losses. Guess why this happened, partly possible on the already available data, but then I will explain everything.

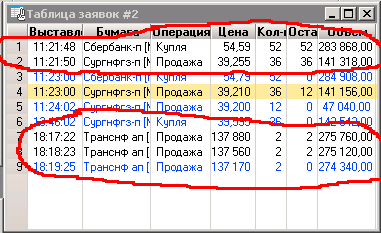

If someone thought it was an unfortunate coincidence, then here is another day.

2 "slippage" occurred in the first 2 hours of trading. Both in the negative. Friday of the previous week, the screenshots of which I have not survived, also deviated by more than 0.5% to minus. And the fact of the huge deviation from which it all began says that this happened regularly.

Having figured it all out on my own, I called the company again. Then I did not pay attention to the fundamental infidelity of the schedule on the site (by the way, this can still be checked by checking the chart and the table). But I wanted to deal with "slipping." I was extremely surprised that a serious financial company could not do such a simple arithmetic analysis for a whole week. I called, the conversation began with the fact that they started telling me a typical bike for the third time, trying to shift responsibility to me. It consists in the following.

One share of Transneft, as can be seen in the screenshots, is quite expensive. Since in the portfolio it takes only 33% , it turns out that if there is very little capital, it becomes impossible to buy it and the portfolio does not work exactly as it should. The minimum portfolio size is easy to calculate. This is somewhere 140,000 (round up the price of Transneft’s share from the table above) * 3 = 440,000 rubles . I was not very far from the critical value ( 450 thousand ), but I still had a certain margin of safety. Three times (!) The company informed me that the problems may be allegedly due to too little capital, they say, Transneft could not open. This was told to me by my financial adviser, his deputy said, the technical specialist who was reinstalling the contractor said. The guys again bet on the fact that the client does not know how or will not count. But in fact it’s just a hoax to shift responsibility.

Having heard this story for the third time, I directly asked to stop lying to me and told me about the results of my research. The financial adviser did not argue with that, said something like “yes, yes, you are right, really big slippage, we are dealing with it right now, we will tell you about the results soon”. That is, he understood the real situation. But as a result, the conversation did not lead to anything. I was told the next "we will soon understand, send logs again." Later, I left complaints about the poor performance of financial advisors Lebedev and Chernitsky, but they also remained unanswered. I think that no sanctions followed for them.

At some point, the money was less than 420 thousand , and Transneft really stopped opening. This was the last straw, to use the "Titan" further and hope that something will work out, it was already impossible. I switched to Lira again, after all, it somehow grew. An additional bonus was that the analysis of the performances of its signals allowed me to better understand the reason for slippage. Another screenshot:

What is most interesting to us here. The plate on the left above is an analogue of the table in Excel, which we have already seen. The only difference is that it contains only the last operation for a specific piece of paper. The table on the right is a real execution. What is important to notice here is the time difference between the appearance of the signal and the execution of the transaction. Calculate:

On average, we get about 7-8 seconds. on the "reflection" of the performer. What does this lead to? For example, let's look at the purchase of Raspadskaya at 11: 25-11: 30 . It is not in the signal table, but it is most revealing.

The first attempt to buy was 42.98 , in reality, bought from the fifth attempt after 4 minutes for 43.79 . We consider the difference in percent without taking into account the share in the portfolio: (42.98 - 43.79) = -1.9%

This is what trading may cost delays ... Another thing is that in such a portfolio as Lyra, they can sometimes work as a plus, which in general will bring the real picture closer to the official schedule.

My first hypothesis is that “Titan” is simply not designed for such long delays. Since the strategy is aggressive, the expectation will lead us at a loss if we delay the execution of the application. It turns out something like this:

"Titan" suddenly saw an opportunity to earn money and said: "It will grow! Come on, buy fast! ”. The performer is slow, not designed to work with a similar strategy and is waiting for something, as a result, we almost always buy or sell worse, which means we earn less, lose more.

The second hypothesis attempts to answer the question why applications that have already been submitted so often are not executed. Strange effects are applications filled in half (remember the yellow line). One application is not more than a third of the capital, and in my case it is about 150 thousand , which by the standards of trading is nothing at all. And the yellow lines appeared all the time. This is very unlikely in the normal case and therefore not explained by chance. According to my hypothesis, "Titan", standing in too many customers, simply can not buy shares on them all. As a result, someone has time, but someone does not. For those who are not lucky, the performer makes a huge step in a half-percent loss. And this can occur several times, as was shown by the example of Transneft in the screenshot. A similar situation, apparently, sometimes happens with Raspadskaya in Lira. But there it is not so critical.

Based on these arguments, those figures that are shown in the table on "Titan" on the official website, can happen with a probability tending to zero. And in real life, the deviation in the minus will always be (remember the law of large numbers from probability theory). If we take the average deviation to minus by 0.5% , and it was somewhere on the interval that I followed, we get a 2.5% deviation from the schedule for the week, 10% for the month, which will correspond to the real situation.

But in any case, in the sense of a client-financial company relationship, these hypotheses do not matter. The client should not have thought about it at all. The company advertises a portfolio, shows the schedule of its work. The client agrees: “Yes, let's, I am ready to pay for it. I want my capital to follow this schedule. ” In reality, he gets:

As a result, it turns out that in my account now should be somewhere in the 100 thousand rubles. more than it is. If I had 5 million rubles in my account, the difference would be in a million. And it would be even more significant if I did not understand the problem myself. I do not think that there are any legal levers of collecting money in such cases. Usually, under the contract, it turns out that the company can work as it pleases, and the clients themselves pay for its mistakes, if any.

Is this normal? I do not know. Maybe I was very unlucky, and maybe this is a completely normal situation in the exchange business. I would be glad if someone shares his opinion or, even better, his experience on this topic.

If someone is interested in the question of whether I tried to achieve compensation for damages, then yes, I tried. This is a very fascinating and interesting story, which I will definitely tell if it turns out that the topic is interesting.

PS: The article can have a lot of incomprehensible in the sense of terminology and conclusions, so ask, I will explain where necessary. On any other spelling and punctuation errors better in lichku.

PPS: Do not take my article as a complaint. Of course, I was very angry when it all happened, but it took a long time to calm down. I have no profit from this publication. Such companies really do not care about such articles. People who come and put 10 or 100 million rubles to them will still not read the mega brain. And clients with a capital of half a million, they do not take seriously. My main thought is that their advertising schedule is lying, though it’s lying, it is lying. And I do not know how many people are now sitting or sitting on the "Titan" with a much larger capital. And these people did not check anything. And how many more are planning to take advantage of the “wonderful” offer, admiring this continuously growing beauty ... Do not make my mistakes and be careful.

I will talk about my experience of working with a Novosibirsk company that has a branch in Moscow. As a result of a combination of software bugs, poor support services, and just failures, my losses amounted to no less than 15% of the capital. To warn against errors of those who are interested in the topic of trading, I decided to tell about it. I tried to write as simple as possible, but I still need to be a bit in the topic of trading.

Who is interested to learn about my grief-experience - I ask under the cat.

General thoughts about using robots

Trading makes it possible to make good money on the accumulated capital, but it is always a risk. And, as a rule, the greater the risk, the more you can earn, but also lose more in case of failure. It is clear that not everyone has the time to seriously engage in trading and develop their trading strategies. Many want to find something ready. And since demand always creates supply, brokers in large quantities offer various portfolios. Many of them have been tested and have been working for many years, you can easily see the dynamics over the past 3 years: how much the initial capital has grown / fallen, what were the maximum drawdowns (losses in the worst case). Here, for example, a selection of trading robots , some of which are quite interesting.

')

Comparing the potential benefits and risks, you can find something suitable. Then it remains only to connect the tariff with auto-execution of transactions and hope that the capital will continue to grow further, as it has done in the past few years on the chart. And if the trend and the truth continues, we will earn good money. And you do not need to do anything. So or not?

It turns out not quite. For example, the trading system still needs to be monitored. If a virtual server (usually brokers themselves offer such a service) on which auto-execution of transactions works, something may not work, and you deviate from the strategy of the robot. Financial companies (at least the one that got to me) do not monitor your server themselves. If something falls - this is your problem. What, in general, is wrong, in my opinion.

What can a server crash cause? For example, you are on vacation, and your trading robot has bought shares of Sberbank (suppose you have an aggressive portfolio consisting of only this one stock). The deal was unsuccessful, the price went down, ideally the robot should have closed it with a small loss. But the server fell, and the position remained open. And then, as luck would have it, Black Monday happened (or Tuesday, or something else), and Sberbank collapsed by 20%. And the server is. Such a technical bug can lead to losses greater than choosing the most unsuccessful strategy.

This is unlikely, you say. Well, it depends on how often it will fall. My server, for example, crashed 5 times within one month due to the fact that something broke on the 1Gb partner hosting. True, SMS notifications came, although often with a delay. However, the fall of the hosting, although they themselves are outraged, never led me to any serious losses. Sometimes they can even work as a plus if you're lucky.

Well, suppose we have a very reliable server that never crashes. The selected portfolio shows good momentum. Can I sleep well? And no again. It turns out that there are things that are much worse than server crashes ...

A bit of background

I have been using the company for more than a year now. It was different. There were attempts to trade on his own, then the understanding came that it requires too much strength, energy, nerves. There were various ready-made portfolios, there were earnings and drawdowns. For the time being, the company's services suited me perfectly, but to be honest, there were simply no serious situations. That is, I connected the tariff, chose a portfolio, everything somehow worked. There were mentioned problems with the server, with the inoperability of installed applications. For example, once I was surprised to find that the robot does not execute the application. It turned out that the auto executor could not forward them because of some bug. Everything was fixed, the working version was installed. But again, and if I were on vacation, I didn’t notice and ... Oh well, after all, checking everything at least once a week is not that difficult.

As a result, I met the new year with an amount of about 450 thousand rubles. on the bill. In early 2015, I decided to include an aggressive portfolio of "Titan", which showed very good dynamics and was strongly promoted by the company.

For 3 plus years

Over the past few months

Before that, somewhere in six months, I used the conservative "Lira".

A source

The strategy earned a little, but it was a plus. I always try to recheck everything as much as possible, even if everything should be fine anyway. But these 3 months have eased my vigilance, and, going to the "Titan", I checked only the fact of the server operation and auto-fulfillment of applications. And he stopped checking the official schedule. And in vain.

Collapse

For a while there was growth, and I did not bother at all. Then it began to fall, I still did not worry, without this in trading in any way. But the fall continued. At some point, the amount on the account went into minus relative to the starting 450 thousand. Now pay attention to the Titan's schedule for this year, there are no points below zero at all, even with the largest commission.

I started to worry, checked the schedule on the site (it was the end of February). What was my surprise when, according to the schedule, I was supposed to be in positive territory by more than 10% (on the given graph, 12.22% ). I understand that there may be some technical deviations ( 1-2% ), but everything was much worse. I called the company.

The importance of a financial advisor

If you ever want to work with another financial company, then carefully approach the choice of your advisor. Because of his irresponsibility, you can really suffer. Absolutely not worth working with financial advisers Lebedev and Chernitsky, with whom I had to face in solving this problem.

I described the situation, the financial adviser said that he would try to figure it out and soon let me know everything. This was my first tomorrow. The call was made on February 24th on Tuesday. In the end, I reinstalled the program - the performer of applications (called "Autopilot"). Allegedly in her bug. In general, I will immediately say that this measure is akin to the advice “restart Windows”. The probability of solving a problem is extremely small, but you can create the appearance of solving it, perhaps the client will calm down. This is the first trick.

They also took logs for analysis, but did not say anything. By the way, the logs were then asked to send every time I called, but I never made a single conclusion on them. This is another sleeping measure in the style of "you send, and we will understand" or "have already sent? Well, send the freshest one more time. ” And the client sits and thinks: "Well, they took the logs, it means they are doing something ...". This is the second trick. As a result, during the week nobody answered me on the question.

And the problem was not worth a damn. To understand its source, it was enough to own a little school arithmetic. But first things first.

Study

In the meantime, the money was lost. Lost every day. In itself, waiting in 3 days, when the schedule on the site successfully conquers new heights, and in fact there is a drop of 1.5% per day, pleasure, believe me, is not pleasant. Especially when you do not understand why.

As a result, it was Friday, then Monday of the next week. Since no one was going to help me, I started to figure it out myself and downloaded the file with the transaction parameters from the official site.

Transactions of "Titan" on March 2, 2015

Source (excel-table "Transactions" at the bottom of the page)

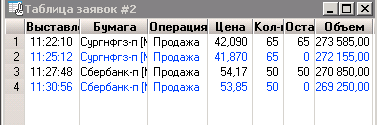

And checked

What happened in fact

As you can see, this is also data at the end of the day on March 2, 2015. What is wrong on the screenshot? Let's look at the official dynamics:

That is, in fact, on Monday we grew by 0.28% . But the real-life -1.48% :

The first line does not count, it is associated with the outdated mode T0

We calculate ourselves to know for sure. To start on the excel-table above. For March 2, only 4 deals:

- Sberbank 1 : at the time of opening, there was a sale, the price at the beginning of the day was 53.82 , bought (close short) at 54.59 , total (53.82-54.59) = - 1.43% . We divide by 3 , since the share of paper in the portfolio is 33% . Total we get: -1.43% / 3 = -0.477% . We also consider for Surgut and Transneft.

- Sberbank 2 : bought (open long) for 54.59 , price at the end of the day 54.10 , total -0.9% / 3 = -0.3%

- Surgut : sold (open short) for 39.255 , bought out (close short) for 39.595 , for a total of -0.87% / 3 = -0.29%

- Transneft 1 : at the time of discovery there was a purchase, the price at the beginning of the day was 137510 , sold (close long) at 137880 , total + 0.27 / 3 = + 0.09%

- Transneft 2 : sold for 137880 , the price at the end of the day is 136630 , total + 0.915 / 3 = + 0.305%

We summarize, we get -0.672% , we add the commission: -0.1 * 5/3 = -0.166% , so we have about -0.838% . Where did 0.28% come from - a mystery ...

Everything is already so bad, the deception is obvious, but why did I get even less? We continue.

Real Money Bugs

For those who do not understand what this table means

The blue lines mean “fulfilled” (purchased / sold), black ones - the order was submitted but later withdrawn, the yellow line - the order was partially executed (only part of the shares were bought / sold upon request).

The table shows that applications are not always, and to be honest, they are almost never executed at the price from the “ideal” table. They were exhibited, then dropped after a minute and exhibited less profitable. For Transneft, and it is the only one who earned that day, it happened as much as 2 times. Calculate the loss on this so-called "slippage."

- Sberbank : in table 54.59 , in reality 54.79 , volume 66% (closed the old + opened a new one in the amount of 33% ), total (54.59-54.79) * 2/3 = -0.244%

- Transneft : in the table 137880 , in reality 137170 , the volume is also 66% , total (137170-137880) * 2/3 = -0.345% . Note that since Transneft was a sale, a lower value will go to a minus, and a bigger one will be a plus, as opposed to a purchase.

- Surgut : in table 39.255 , in reality 39.205 (take the average of 39.210 and 39.200 for simplicity), volume 33% , total (39.205-39.255) / 3 = -0.04%

Total: -0.593% . In total, with the previous one, approximately -1.4% is obtained . The resulting error is related to the shares of Transneft, which I will discuss next.

It turns out that in addition to the fact that the graph is obviously false (we checked it), even in comparison with the “honest” table, there are very significant deviations. -0.593% is a lot for one trading day, the maximum tolerance should be no more than 0.1% . It is clear that if such a deviation occurs systematically, then within 20 trading days we will receive more than 10% loss only relative to the official schedule.

Total instead of a small profit in reality big losses. Guess why this happened, partly possible on the already available data, but then I will explain everything.

If someone thought it was an unfortunate coincidence, then here is another day.

2 "slippage" occurred in the first 2 hours of trading. Both in the negative. Friday of the previous week, the screenshots of which I have not survived, also deviated by more than 0.5% to minus. And the fact of the huge deviation from which it all began says that this happened regularly.

What happened next

Having figured it all out on my own, I called the company again. Then I did not pay attention to the fundamental infidelity of the schedule on the site (by the way, this can still be checked by checking the chart and the table). But I wanted to deal with "slipping." I was extremely surprised that a serious financial company could not do such a simple arithmetic analysis for a whole week. I called, the conversation began with the fact that they started telling me a typical bike for the third time, trying to shift responsibility to me. It consists in the following.

How to explain to the client that he himself is to blame for everything

One share of Transneft, as can be seen in the screenshots, is quite expensive. Since in the portfolio it takes only 33% , it turns out that if there is very little capital, it becomes impossible to buy it and the portfolio does not work exactly as it should. The minimum portfolio size is easy to calculate. This is somewhere 140,000 (round up the price of Transneft’s share from the table above) * 3 = 440,000 rubles . I was not very far from the critical value ( 450 thousand ), but I still had a certain margin of safety. Three times (!) The company informed me that the problems may be allegedly due to too little capital, they say, Transneft could not open. This was told to me by my financial adviser, his deputy said, the technical specialist who was reinstalling the contractor said. The guys again bet on the fact that the client does not know how or will not count. But in fact it’s just a hoax to shift responsibility.

Having heard this story for the third time, I directly asked to stop lying to me and told me about the results of my research. The financial adviser did not argue with that, said something like “yes, yes, you are right, really big slippage, we are dealing with it right now, we will tell you about the results soon”. That is, he understood the real situation. But as a result, the conversation did not lead to anything. I was told the next "we will soon understand, send logs again." Later, I left complaints about the poor performance of financial advisors Lebedev and Chernitsky, but they also remained unanswered. I think that no sanctions followed for them.

What is all over

At some point, the money was less than 420 thousand , and Transneft really stopped opening. This was the last straw, to use the "Titan" further and hope that something will work out, it was already impossible. I switched to Lira again, after all, it somehow grew. An additional bonus was that the analysis of the performances of its signals allowed me to better understand the reason for slippage. Another screenshot:

What is most interesting to us here. The plate on the left above is an analogue of the table in Excel, which we have already seen. The only difference is that it contains only the last operation for a specific piece of paper. The table on the right is a real execution. What is important to notice here is the time difference between the appearance of the signal and the execution of the transaction. Calculate:

| Stock | Signal | Execution | Difference (sec.) |

|---|---|---|---|

| SevStal | 12:07:12 | 12:07:23 | eleven |

| FGC UES | 15:27:13 | 15:27:25 | 12 |

| Gazprom | 14:50:25 | 14:50:28 | 3 |

| RusHydro | 17:46:01 | 17:46:08 | 7 |

| NLMK | 11:36:02 | 11:36:10 | eight |

| Raspadskaya | 15:08:24 | 15:08:33 | 9 |

| Sberbank | 16:55:36 | 16:55:45 | 9 |

| Sberbank-p | 17:43:13 | 17:43:23 | ten |

| Transneft | I hope now I understand why the robot can not buy it | ||

| VTB | 12:20:49 | 12:20:56 | 7 |

On average, we get about 7-8 seconds. on the "reflection" of the performer. What does this lead to? For example, let's look at the purchase of Raspadskaya at 11: 25-11: 30 . It is not in the signal table, but it is most revealing.

A little bit about Raspadskaya

For those who are not in the subject - this is one of the most volatile stocks on the Russian market, where you can both get rich very quickly and also become poorer as quickly. Since October last year, it has grown from 15 rubles. to 50. And once it cost 260 rubles.

The first attempt to buy was 42.98 , in reality, bought from the fifth attempt after 4 minutes for 43.79 . We consider the difference in percent without taking into account the share in the portfolio: (42.98 - 43.79) = -1.9%

This is what trading may cost delays ... Another thing is that in such a portfolio as Lyra, they can sometimes work as a plus, which in general will bring the real picture closer to the official schedule.

findings

My first hypothesis is that “Titan” is simply not designed for such long delays. Since the strategy is aggressive, the expectation will lead us at a loss if we delay the execution of the application. It turns out something like this:

"Titan" suddenly saw an opportunity to earn money and said: "It will grow! Come on, buy fast! ”. The performer is slow, not designed to work with a similar strategy and is waiting for something, as a result, we almost always buy or sell worse, which means we earn less, lose more.

The second hypothesis attempts to answer the question why applications that have already been submitted so often are not executed. Strange effects are applications filled in half (remember the yellow line). One application is not more than a third of the capital, and in my case it is about 150 thousand , which by the standards of trading is nothing at all. And the yellow lines appeared all the time. This is very unlikely in the normal case and therefore not explained by chance. According to my hypothesis, "Titan", standing in too many customers, simply can not buy shares on them all. As a result, someone has time, but someone does not. For those who are not lucky, the performer makes a huge step in a half-percent loss. And this can occur several times, as was shown by the example of Transneft in the screenshot. A similar situation, apparently, sometimes happens with Raspadskaya in Lira. But there it is not so critical.

Based on these arguments, those figures that are shown in the table on "Titan" on the official website, can happen with a probability tending to zero. And in real life, the deviation in the minus will always be (remember the law of large numbers from probability theory). If we take the average deviation to minus by 0.5% , and it was somewhere on the interval that I followed, we get a 2.5% deviation from the schedule for the week, 10% for the month, which will correspond to the real situation.

But in any case, in the sense of a client-financial company relationship, these hypotheses do not matter. The client should not have thought about it at all. The company advertises a portfolio, shows the schedule of its work. The client agrees: “Yes, let's, I am ready to pay for it. I want my capital to follow this schedule. ” In reality, he gets:

- Advertising schedule is completely different from what is happening in reality, and naturally for the worse.

- Even after clarifying the problem, the company does not solve it, ignores it, does not give clear answers, promises to solve it tomorrow and does not solve it.

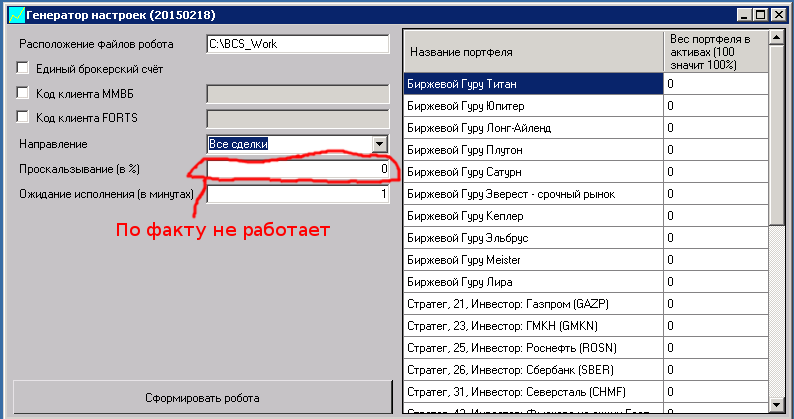

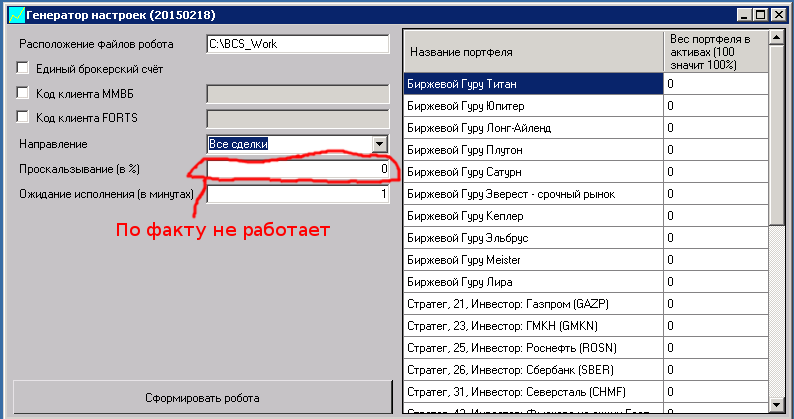

- Also, a topic not covered in the article is outdated software in which nothing can be configured. For example, remove the same time delays in 7-8 seconds. or limit slippage loss is impossible. There seems to be such a function there, but it simply did not work. I even somehow mentioned in the conversation that I can fix the code myself if I so want.

As a result, it turns out that in my account now should be somewhere in the 100 thousand rubles. more than it is. If I had 5 million rubles in my account, the difference would be in a million. And it would be even more significant if I did not understand the problem myself. I do not think that there are any legal levers of collecting money in such cases. Usually, under the contract, it turns out that the company can work as it pleases, and the clients themselves pay for its mistakes, if any.

Is this normal? I do not know. Maybe I was very unlucky, and maybe this is a completely normal situation in the exchange business. I would be glad if someone shares his opinion or, even better, his experience on this topic.

If someone is interested in the question of whether I tried to achieve compensation for damages, then yes, I tried. This is a very fascinating and interesting story, which I will definitely tell if it turns out that the topic is interesting.

A brief summary of the written

- If you use trading robots, then a beautiful chart can only be a false marketing trick, in reality, everything can be much worse.

- It is very important and necessary, especially at the beginning of the algorithm, to monitor everything, do not be lazy to read and verify, this can help you find the problem at an early stage and avoid losses.

- It is important to choose a good financial company. It is especially bad when sluggishness and total inability to solve them promptly (if at all we can talk about the ability to solve problems) are superimposed on obvious mistakes.

- It is also important to work with a good financial advisor.

- Bad financial advisors in bad companies have a number of techniques for creating the appearance of solving a problem or shifting responsibility from themselves to the client. Among those noted in the article:

- “Reinstall the software,” although it is clear that this is not the case.

- “Let's take logs for analysis,” my problem could be easily figured out without them. To send them 3 times in a row is exactly meaningless.

- “You have too little money for the portfolio to work as it should,” - take a calculator and count. Trust in this case, you can only him.

- If all else fails, again take the calculator and read. Trading sometimes seems to be something mysterious and difficult, but in reality it is enough knowledge of school arithmetic to sort out something often.

- And do not forget that even if technically everything is good, the strategy can still work at a loss, always be alert.

PS: The article can have a lot of incomprehensible in the sense of terminology and conclusions, so ask, I will explain where necessary. On any other spelling and punctuation errors better in lichku.

PPS: Do not take my article as a complaint. Of course, I was very angry when it all happened, but it took a long time to calm down. I have no profit from this publication. Such companies really do not care about such articles. People who come and put 10 or 100 million rubles to them will still not read the mega brain. And clients with a capital of half a million, they do not take seriously. My main thought is that their advertising schedule is lying, though it’s lying, it is lying. And I do not know how many people are now sitting or sitting on the "Titan" with a much larger capital. And these people did not check anything. And how many more are planning to take advantage of the “wonderful” offer, admiring this continuously growing beauty ... Do not make my mistakes and be careful.

Source: https://habr.com/ru/post/289878/

All Articles