The simplest financial analysis of the company

A popular misconception about the complexity of the financial sphere for the masses leads to the fact that economic reports are turned into filkin letters for the majority. Many do not even give themselves a reason to doubt this and because of this they don’t even try to penetrate, like I don’t understand anything anyway.

A popular misconception about the complexity of the financial sphere for the masses leads to the fact that economic reports are turned into filkin letters for the majority. Many do not even give themselves a reason to doubt this and because of this they don’t even try to penetrate, like I don’t understand anything anyway.In fact, everything is not so difficult and the simplest analysis can always be carried out without having a degree in economics, of course, if you don’t get too deep into it. There you know such experienced comrades are found. In general, in order to understand this thoroughly, you need to have a good profile and good technical education, as well as not practical experience, but we are not interested in every little thing?

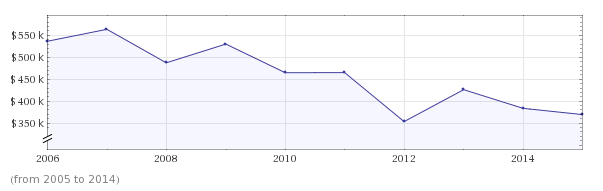

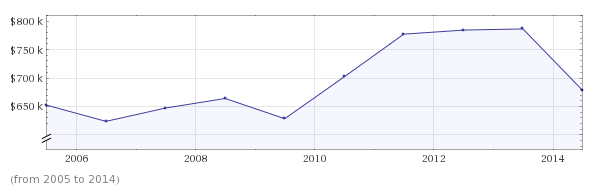

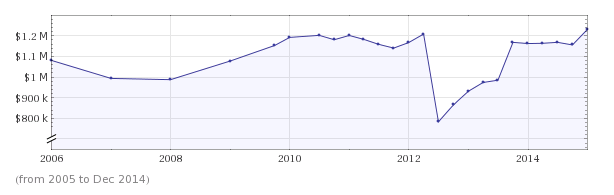

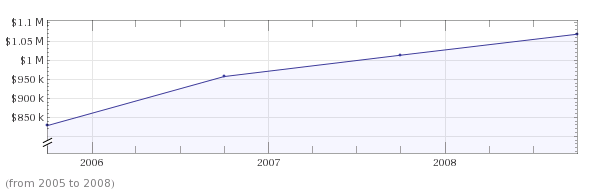

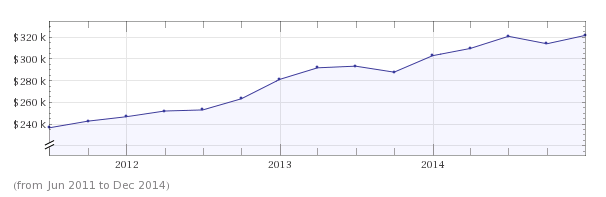

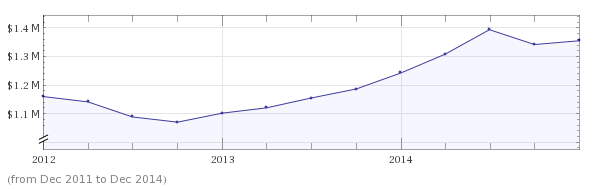

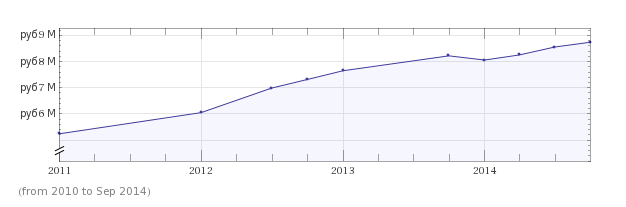

There is the simplest method of evaluating the performance of companies on the income per employee schedule. This almost instant method is quite simple and intuitive in practice.

Is the personnel policy of the enterprise relevant? How much does business growth correspond to staff size These questions are easily figured out with the help of graphs of the ratio of total revenue from sales for the period to the number of employees at the end of the period.

')

In order to obtain such information, it is not necessary to wool the financial reports of corporations and apply puzzled mathematical models. The easiest way to obtain such data is to use the Wolfram Alpha set of computational algorithms.

A simple request, a few seconds of waiting and visual data on the screen of your laptop. There is a nuance in the fact that the company should be public; accordingly, information can only be obtained for the years that have passed since the IPO.

"[company name] revenue per employee over the past [X] years"

Here are the graphics of some large techno companies:

Yahoo

Microsoft

Apple

Amazon

Yandex

Source: https://habr.com/ru/post/289456/

All Articles