Combining NXP and Freescale in terms of patenting

The announced merger of NXP and Freescale has already been discussed from the point of view of marketing, and from the point of view of management, and from the point of view of technology. I propose to look at this event from another side - in the perspective of the merger of patent assets. If the transaction is approved and the merger takes place in the second half of 2015, this will also lead to the emergence of one of the largest patent portfolios - 8,200 patents plus 1,860 patent applications in different countries.

Most patents apply to the United States. In particular, Freescale owns 6,000 US patents, and NXP owns 3,800 US patents. In turn, NXP has more Chinese and European patents. To visually illustrate their similarities and differences, Chipworks prepared a patent landscape with overlapping patent portfolios, including US patents and patent applications from these companies. Each patent document is represented by a dot, and the dots are grouped by the similarity of the texts (based on frequency analysis). For topographic heights, three terms are defined, the most common in the texts of the patent documents forming these heights and giving an idea of the technical areas (technology concepts).

The automatic patent classifier of the expert system that formed this landscape shows that most of the patents on the right side are related to the processes of crystal production and packaging. Patent documents related to circuit design dominate in the upper left, and systems engineering dominate in the lower left.

')

The illustration clearly shows that the distribution of patent documents on the technical areas of NXP and Freescale is very similar. None of the areas is not noticeable obvious dominance of any of the companies. What then can be the benefit of a merger from a patent point of view and what changes in patent policy can be predicted?

First, if you look wider - in terms of patent coverage of the final product, NXP and Freescale complement each other well.

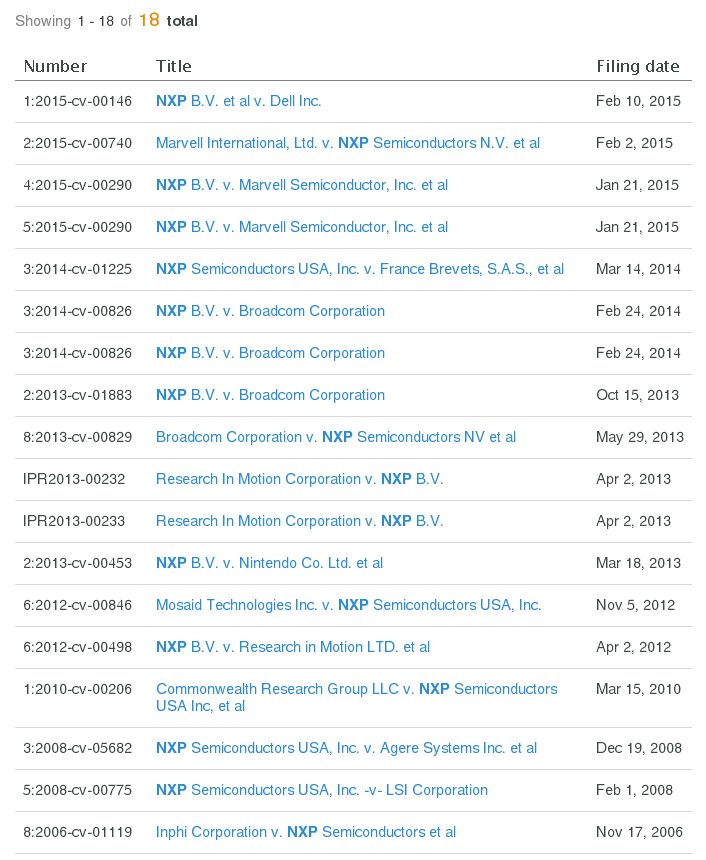

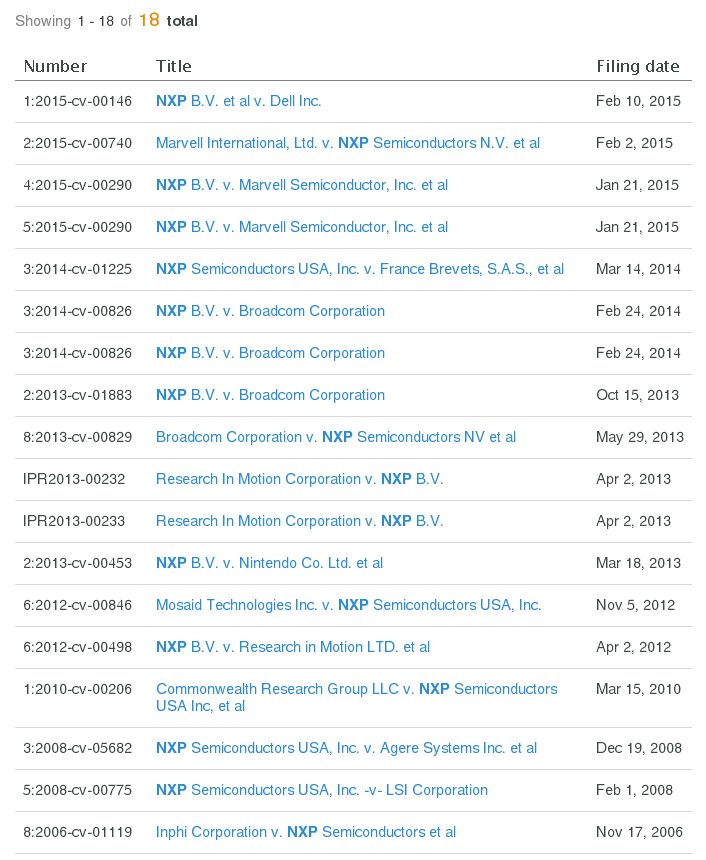

Secondly, both companies in recent years have been quite active in patent disputes, acting both as plaintiffs and as defendants. According to Patexia , in the United States alone , NXP has been listed in 18 patent disputes since 2006, 14 of which have been initiated in the last three years. Freescale was noted in 38 disputes in the United States, of which the last three years accounted for more than half.

There is no doubt that the consolidation and, most importantly, geographical diversification of the patent portfolio will help strengthen the position of the combined company in patent disputes.

Third, it can be assumed that overlapping efforts can be coordinated to free up resources for patenting priority technologies. This is indicated, in particular, by the intention of NXP, mentioned in the press, to sell its high-performance RF unit.

In general, it seems that the patent departments of Intel, Qualcomm and Texas Instruments have pretty much to worry about.

Most patents apply to the United States. In particular, Freescale owns 6,000 US patents, and NXP owns 3,800 US patents. In turn, NXP has more Chinese and European patents. To visually illustrate their similarities and differences, Chipworks prepared a patent landscape with overlapping patent portfolios, including US patents and patent applications from these companies. Each patent document is represented by a dot, and the dots are grouped by the similarity of the texts (based on frequency analysis). For topographic heights, three terms are defined, the most common in the texts of the patent documents forming these heights and giving an idea of the technical areas (technology concepts).

The automatic patent classifier of the expert system that formed this landscape shows that most of the patents on the right side are related to the processes of crystal production and packaging. Patent documents related to circuit design dominate in the upper left, and systems engineering dominate in the lower left.

')

The illustration clearly shows that the distribution of patent documents on the technical areas of NXP and Freescale is very similar. None of the areas is not noticeable obvious dominance of any of the companies. What then can be the benefit of a merger from a patent point of view and what changes in patent policy can be predicted?

First, if you look wider - in terms of patent coverage of the final product, NXP and Freescale complement each other well.

Secondly, both companies in recent years have been quite active in patent disputes, acting both as plaintiffs and as defendants. According to Patexia , in the United States alone , NXP has been listed in 18 patent disputes since 2006, 14 of which have been initiated in the last three years. Freescale was noted in 38 disputes in the United States, of which the last three years accounted for more than half.

There is no doubt that the consolidation and, most importantly, geographical diversification of the patent portfolio will help strengthen the position of the combined company in patent disputes.

Third, it can be assumed that overlapping efforts can be coordinated to free up resources for patenting priority technologies. This is indicated, in particular, by the intention of NXP, mentioned in the press, to sell its high-performance RF unit.

In general, it seems that the patent departments of Intel, Qualcomm and Texas Instruments have pretty much to worry about.

Source: https://habr.com/ru/post/288456/

All Articles