Now is the new bubble of startups? All pros and cons

The author of the text is Bill Maris, President and Managing Partner at Google Ventures

I heard people worry if we were in the case of startups in a bubble. Is it as bad as the dot-com bubble in 2000? Can it be worse than the old? I thought that we should look at all the available data and see if we can extract them from them more than just a personal opinion. So I asked our experts at Google Ventures to go into the question and find out that we are told by strict data. And I will share this text with you.

')

In the late 90s, venture capitalists were very excited about the Internet. A huge amount of money was poured into some companies, which then failed miserably, and many people lost a lot of money.

Fast forward again in 2015. If you read the headlines about multibillion-dollar estimates of startups like Uber (one of our portfolio companies), Airbnb, and Dropbox, it's easy to see why some people feel uneasy. Everyone is just as irrationally excited about new platforms and economic models as people were in 1999? Or is it different this time? There are arguments for and against.

Why is there no bubble

While the data suggests an increase in investment, they also show four key differences from the dot-com bubble.

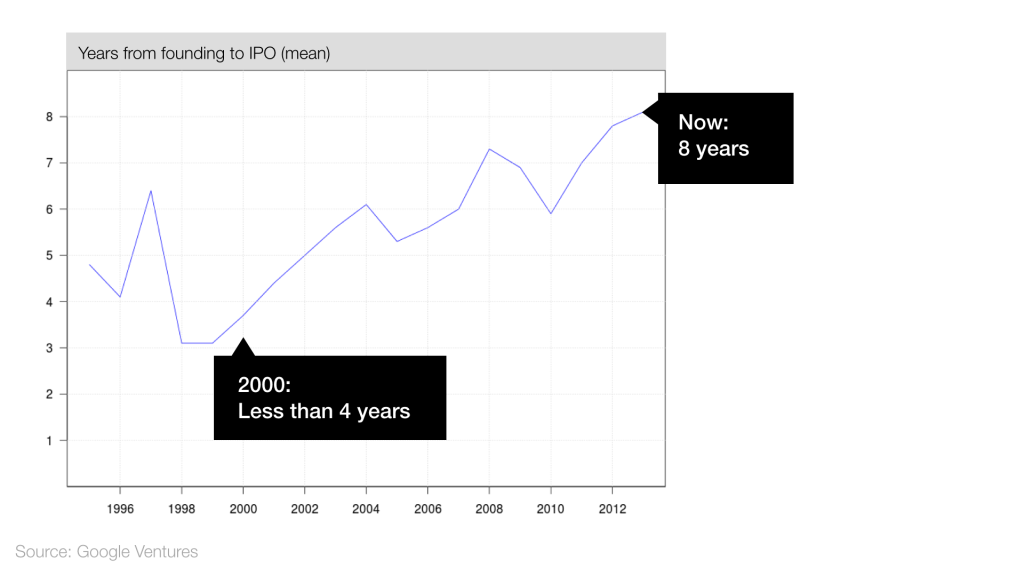

1. Companies later go public

During the bubble of 2000, many companies made an initial public offering of shares before they even received any income for the first time. Today the way of companies to IPO much longer:

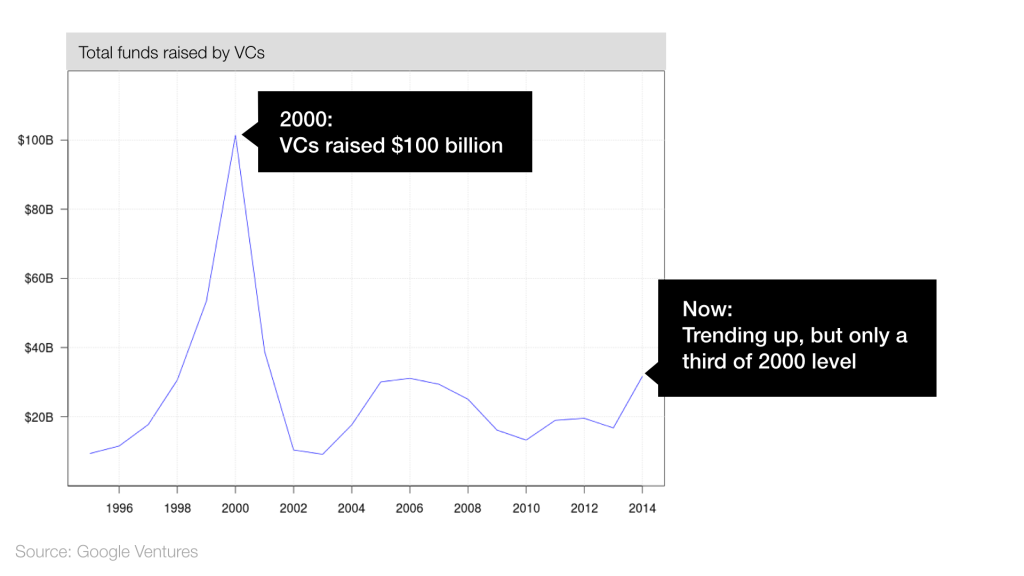

2. Venture collects less money than at the peak in 2000

In 2000, money poured into the venture flow, and as a result, financing was received even by such companies, which without it could not convince investors - which led to loud failures. Today, the flow of money to venture capital funds is growing, but it still remains far below the level of 2000:

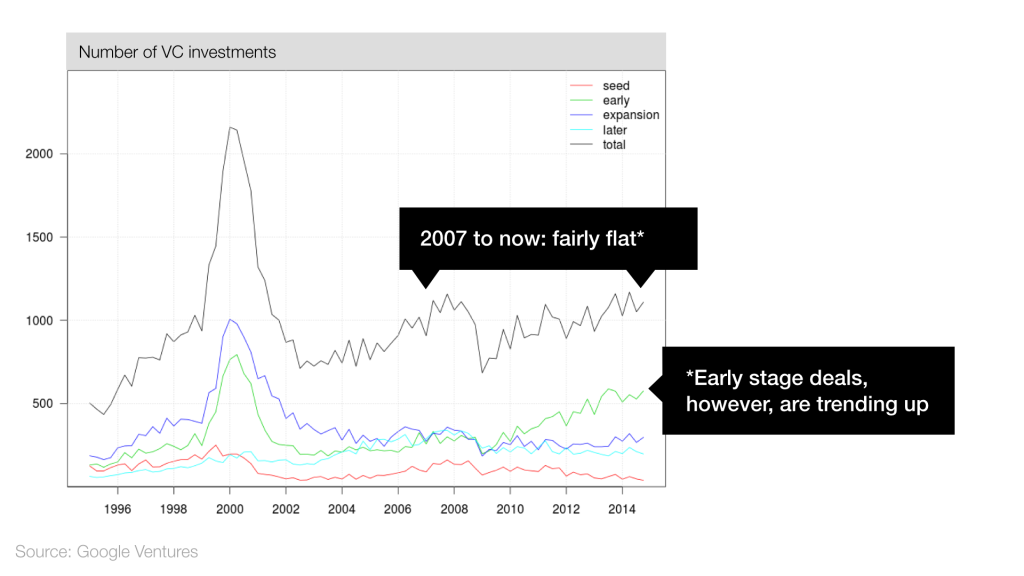

3. The total number of investments remains the same.

In 2000, venture capitalists made a record number of investments: more than 2000 per year. What's up with that now? This may seem unexpected, but the number of transactions has not changed much since 2007. This means that investors are still selective in who gets the money, and does not distribute it to everyone in a row.

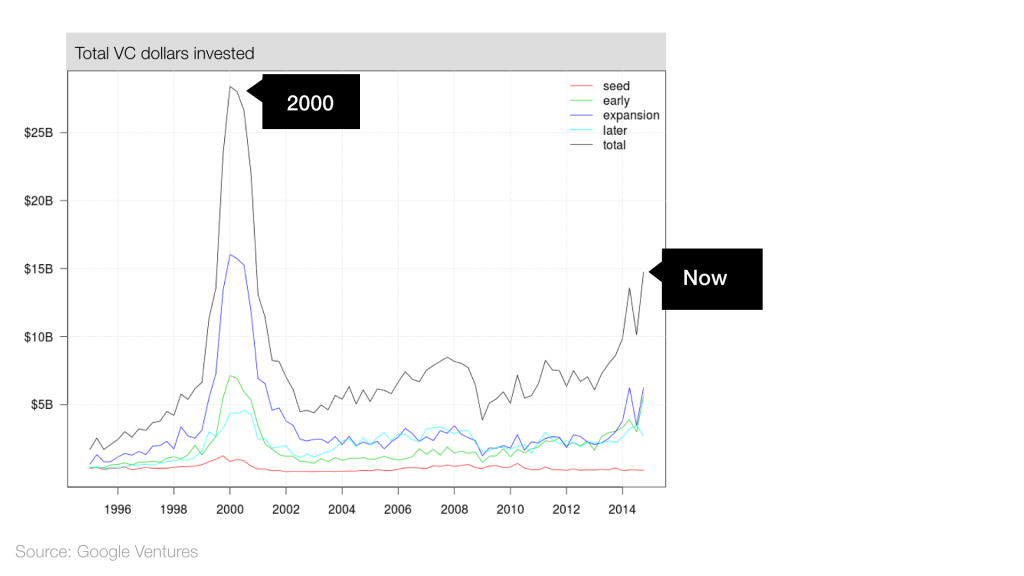

4. They began to invest more money - but still only half of the peak of 2000

Venture capital investment rose sharply in 2013 and 2014, but it still remains far below the dot-com bubble levels:

During the bubble in 2000, the increased amount of incoming money led to an increase in the number of investments. Now the volume of investments is growing, and their number remains the same. What's happening? Investors focus their money on a relatively small number of large transactions.

Why is there a bubble

Our analysis of the data was not entirely optimistic. Here are six warning signs suggesting that we can be in a new bubble.

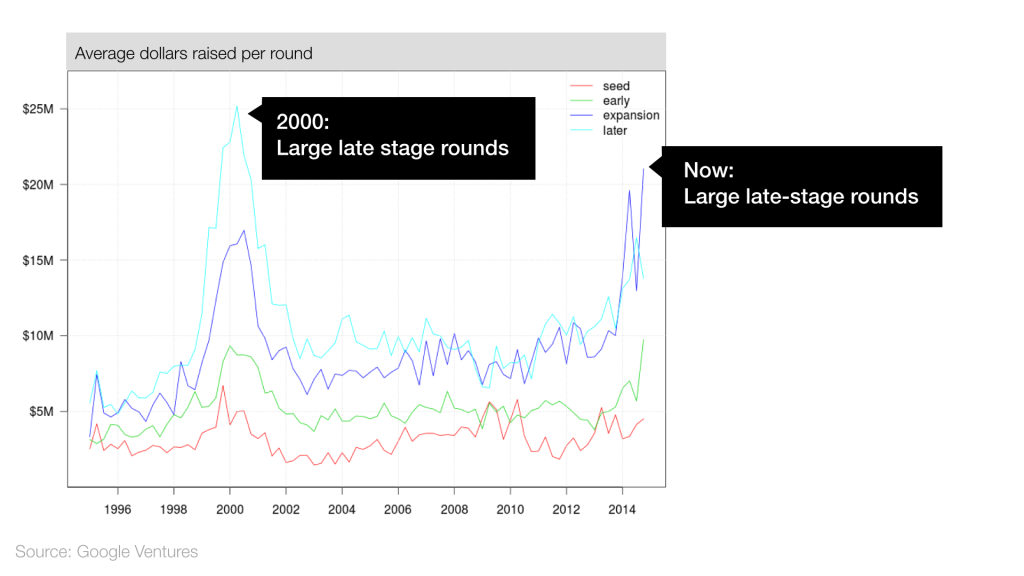

1. Investors invest more money in late rounds.

If we assume that the increased investment at a later stage replaced the IPO, this in itself does not mean a problem. However, the similarity with 2000 is obvious:

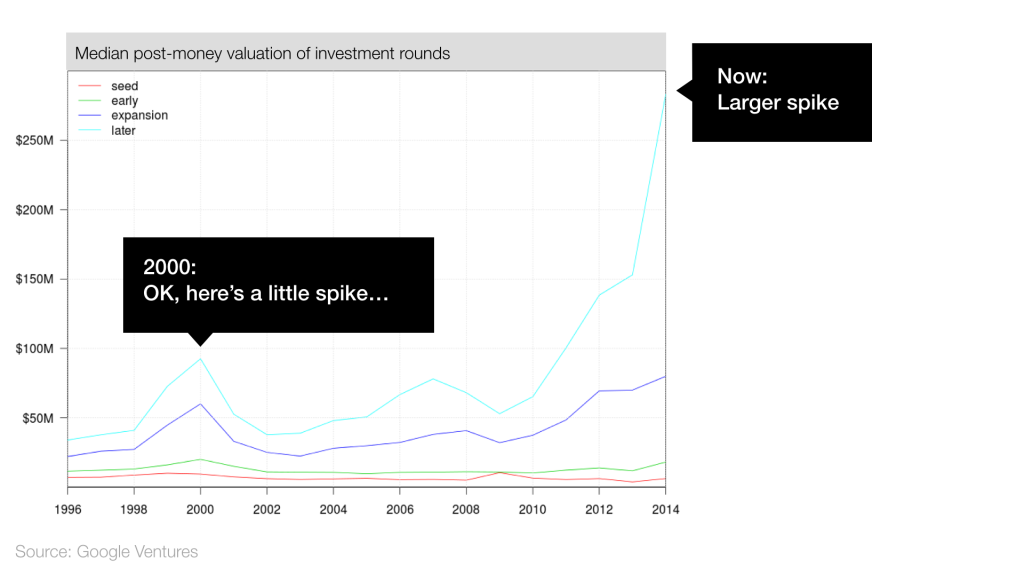

2. Estimates of companies in the private market are increasing.

Up to this point, our data showed a more favorable situation than the 2000th. However, with the estimates, the story is completely different:

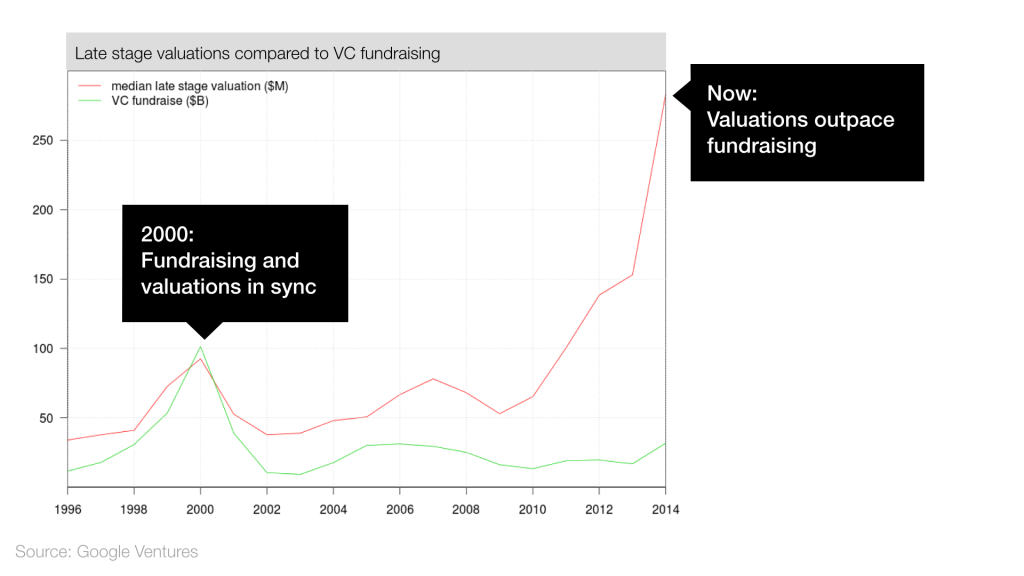

3. Estimates increase faster than venture capital funds raise

Here is another reason to be concerned:

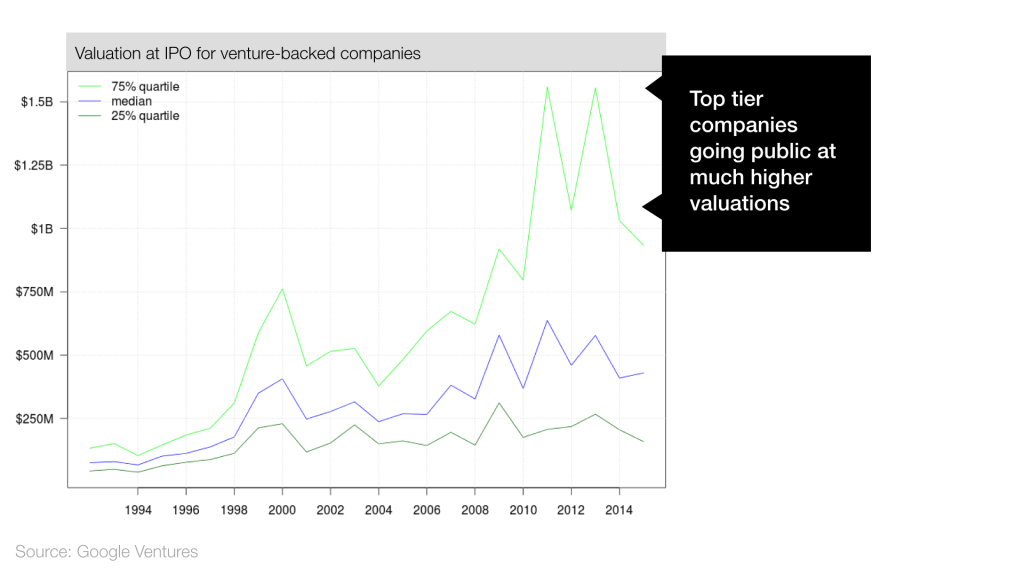

4. Evaluations on IPO increased

Estimates at the IPO increased in general, and among the most successful companies - especially strongly (well, or, perhaps, they just began to wait longer to enter the stock exchange).

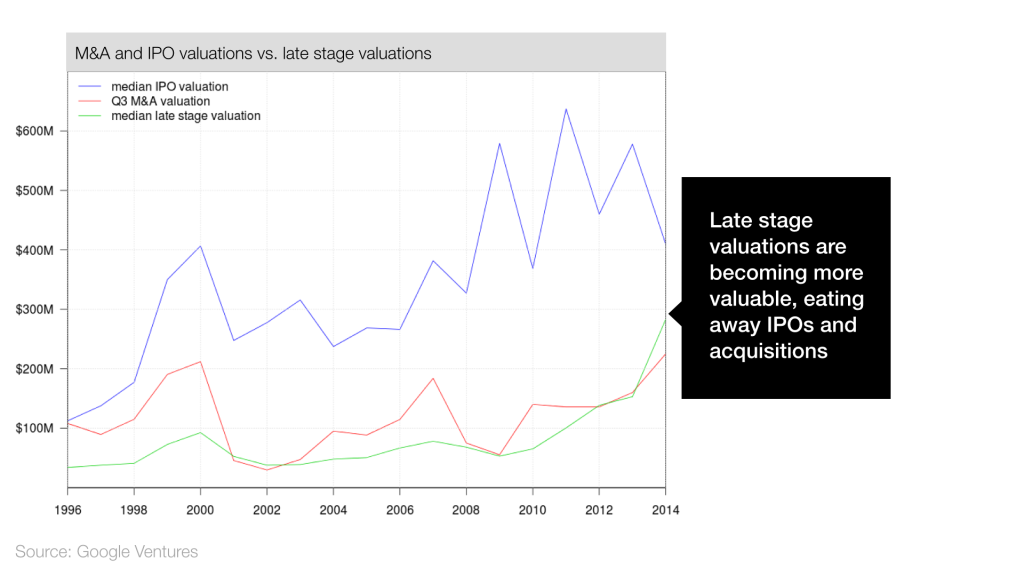

5. Later financing replaces exit

And later financing, and the purchase price of the company is growing. And last year’s IPO ratings, on the contrary, have fallen. As a result, the first two things, in fact, replace the third.

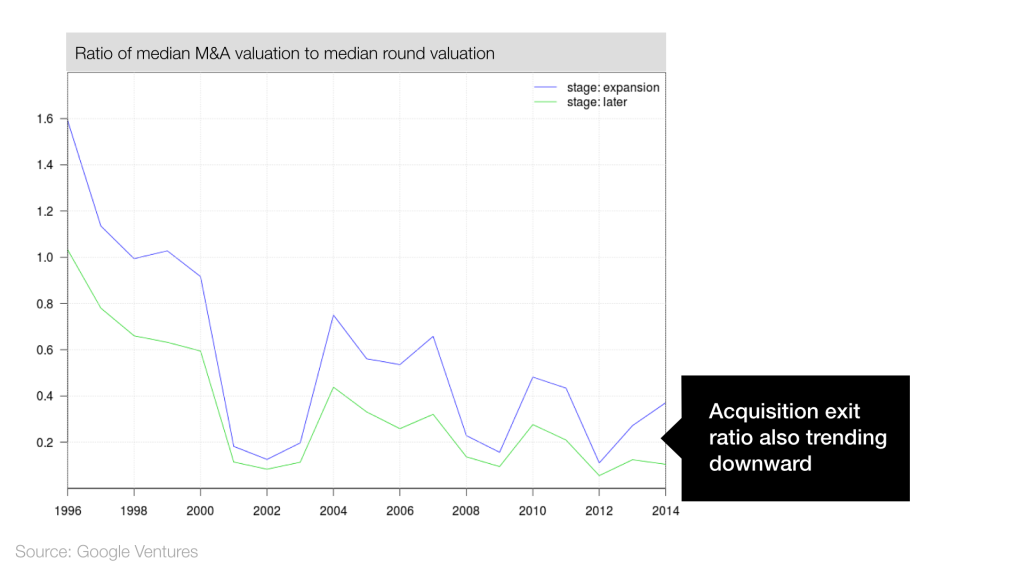

6. The ratio of the company's valuation on the IPO to the valuation with a late investment drops

This data tells us that while the IPO estimates have increased over the past few years, they do not keep up with late investment. Moreover, this process has been going on since 2009. This suggests that investors investing in the late stages will receive less from their investments than before.

Looking at this data, we can surely say only one thing: the 2015 is very different from the 2000th. At the same time, some differences are calming, and some worry.

The data clearly shows the growth of funding in the later stages, but it can be interpreted in different ways. One suggestion is that generous such financing makes companies stay in private hands longer. Another thing is that technological growth has allowed companies to grow faster, and later funding has also increased to meet the needs of these new (but already large) startups.

What is the result? If there is a bubble, then it is a completely different bubble. And this is logical, because the market and technology have changed dramatically over the past 15 years.

Of course, companies will still go bankrupt, and with today's high marks and attendant attention, these failures will look even bigger and more powerful. But this does not mean that everything will collapse soon. When one of these super companies breaks (and this is inevitable), we take a deep breath and ask ourselves if this means a trend, or only a part of the normal ratio of failures and success. Perhaps we should look at the data before panicking.

Source: https://habr.com/ru/post/287022/

All Articles