Malefactors by means of Apple Pay and the stolen credit card data bought goods in Apple shops

The attackers used the data of credit cards stolen as a result of attacks on US retail stores, with the help of Apple Pay to make purchases in stores, Kommersant reports with reference to The Wall Street Journal . Eight out of every ten purchases are made at Apple's branded stores — you can resell products of this brand more than others who have joined Apple Pay.

In April 2014, unknown attackers introduced malicious code into the computer systems of Home Depot, which owns one of the world's largest networks of building materials and tools stores. The attack became known by September - by that time, hackers had received data from 56 million bank cards of customers of the store.

This data, as well as customer data from other large US retail stores, obtained as a result of hacker attacks, was used by attackers to shop in stores. Apple Pay itself was not hacked: the banks are responsible for linking the cards, and they must monitor the safety of their customers.

')

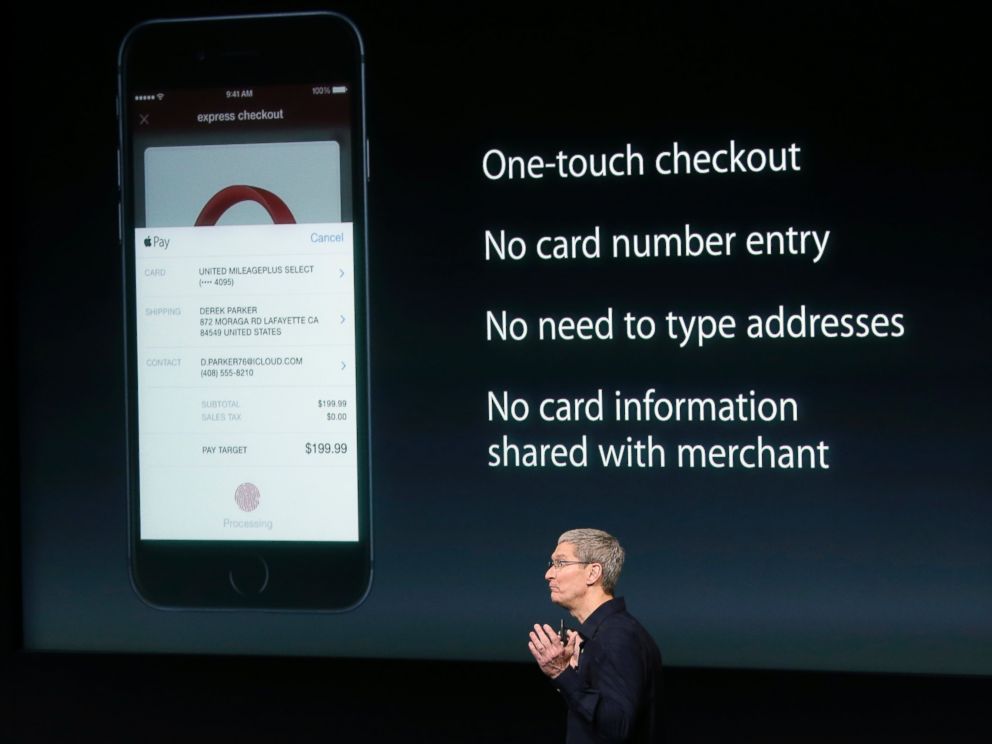

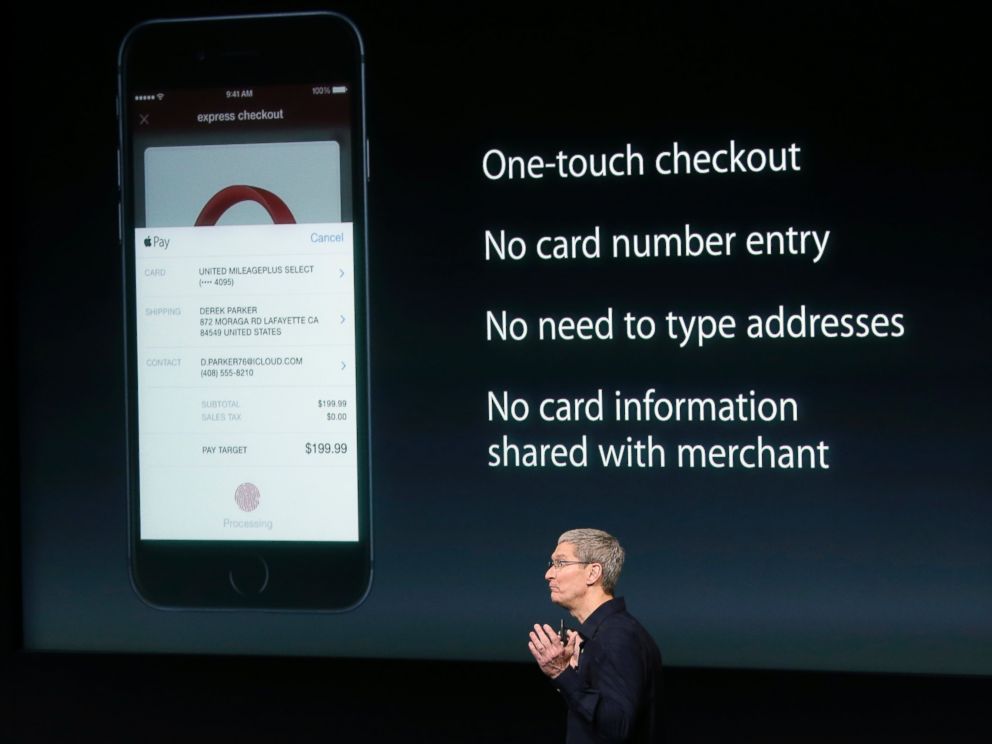

Apple Pay allows you to bind a bank card to the application and pay for goods with smartphones iPhone 6 and 6+ in terminals with NFC technology. In October 2014, Tim Cook said that 72 million cards were registered in the system 72 hours after the launch. In January 2015, two-thirds of contactless payments Visa, Mastercard and American Express passed through this system.

Some analysts point out that 6% of all Apple Pay transactions are fraudulent. This indicator for ordinary plastic cards is 0.1%.

In April 2014, unknown attackers introduced malicious code into the computer systems of Home Depot, which owns one of the world's largest networks of building materials and tools stores. The attack became known by September - by that time, hackers had received data from 56 million bank cards of customers of the store.

This data, as well as customer data from other large US retail stores, obtained as a result of hacker attacks, was used by attackers to shop in stores. Apple Pay itself was not hacked: the banks are responsible for linking the cards, and they must monitor the safety of their customers.

')

Apple Pay allows you to bind a bank card to the application and pay for goods with smartphones iPhone 6 and 6+ in terminals with NFC technology. In October 2014, Tim Cook said that 72 million cards were registered in the system 72 hours after the launch. In January 2015, two-thirds of contactless payments Visa, Mastercard and American Express passed through this system.

Some analysts point out that 6% of all Apple Pay transactions are fraudulent. This indicator for ordinary plastic cards is 0.1%.

Source: https://habr.com/ru/post/286474/

All Articles