How to create 40% more sales in the online store using cashback services

In 2013, the US cashback service Ebates generated $ 2.3 billion online stores, which accounted for approximately 1% of the total turnover of Internet sales in the United States. In 2014, Ebates was purchased for $ 1 billion. Japanese company Rakuten.

Many online stores solve the problem of increasing sales using additional channels. Today we will talk about the cashback channel, which allows you to increase the number of sales by 40%, and also to increase the average check in the basket.

In short, the cashback is a refund from the purchase. The customer makes purchases on the Internet and gets a percentage from it. Cashback services have been actively developing in Russia and have been working in the west for decades. In this post, kubish.ru based on research from affiliatewindow.com will help to understand some of the misconceptions that hover around cashback services, as well as prove that cashback services are drivers of additional sales that increase the average bill in the online store basket.

Additional sales

To begin with, we will define what “additional sales” are and agree that these are those sales that would not exist if the advertising campaign connected with the cashback service had not been launched. It is important to clearly understand, understanding the effectiveness of cashback services as sales drivers.

Easy integration

It is worth noting that cashback services, as a rule, are very easy to integrate into business processes. You do not need to write your own functionality, or change the business chain of the online store. Most of the time, all you have to do is accept the conditions in the affiliate network and start selling through the cashback channel.

')

Sources of sales

Analyzing the channels to attract customers to online shopping, there is a misconception that a customer goes through many sites on the way to a specific online shop. For example, he first logs on to Google, from there he gets to the Forum, from the Forum to the cashback site or coupon, from there to the online store itself. However, studies by Western colleagues suggest that 90% of transactions belong to the same source. That is, the user gets from the search engine immediately to the online store, or from the forum to the online store, or from the cashback service to the online store. This figure varies from industry to industry, for example:

- Retail - 94.83% from one source

- Sale of tickets - 96% from one source

-Travel - 95% from one source

That is just one transaction, and the buyer is in your pocket. In addition to this, it can be noted that the remaining units of percent of transactions pass through a maximum of 4-5 intermediate sites, not more. Interestingly, loyalty, reward and cashback sites usually have a minimum number of conversions.

Advertiser content

The second misconception that often occurs is the accusation of cashback services that they use the content of online stores, thereby taking away their traffic. The logo, description of the store, description of goods, coupons, links to social networks of stores are used. However, the previous analysis suggests that the majority of purchases in online stores are made through a single referral. In each case, it is different, but it is most often only one, without intermediate links. The risk of competition in the search engine with the store is removed by placing minus words in advertisements that prohibit the use of specific brand names of online stores in order to exclude intersection with them. The place where content is reused is located on the cashback service itself, where the link to the online store is located. But going there, the client knows exactly where he is and knows how the cashback service works. And if he went from there to an online store, he did it specifically with clear intentions. Therefore, the reused content of the online store does not interfere, but helps to generate additional sales, which would not exist if it were not reused.

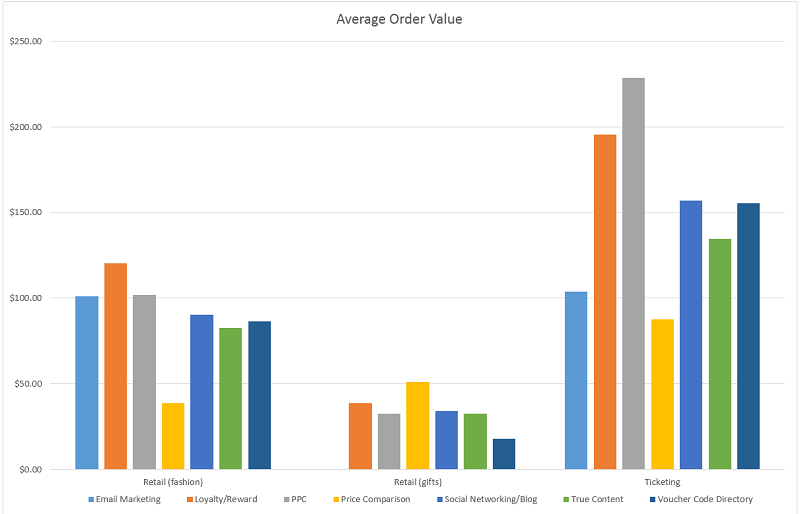

Increase average purchase check

As a rule, the check of purchase in the online store is tied to the% of the cashback that the client receives. This leads to the fact that the average purchase check of a customer who comes from a cashback channel often increases, not infrequently leaving behind other channels to attract the audience. This is because the client is motivated to get a larger cashback, and as a result, spends more. Here is a pictorial chart showing the average bill in different industries:

For an advertiser in the beauty industry, cashback sites have the largest average check (loyalty / reward) of all types of promotion. For gifts and tickets, they show impressive performance comparable to other traffic.

The diagram below also shows that the cashback sites in the travel segment generate enough sales traffic, which is second only to True Content.

Understanding which products have maximum profitability, cashback services can focus on these products, helping stores sell more. That is why a cashback channel can be a good alternative to regular online sales to generate higher checks in a shopping cart.

Repeat sales

The interested user usually becomes loyal to the cashback concept rather than the brand itself. To do this, he should only understand that cashback services are sharing with the client the advertising budget of companies without increasing the prices of goods. Therefore, cashback services can take certain actions for repeat sales. For example, promotions may be encouraged to buy more times a month for interesting product categories. A higher cashback percentage can be paid for re-purchases. This allows advertisers to increase the frequency of sales and retain buyers who could buy elsewhere. Our last report for the month also indicates that about 40% of repeated purchases occur.

To use or not to use cashback services for each business, however, many years of Western experience and the growth dynamics of our kubish.ru service on the Russian market suggest that the Western model takes root very well in Russia, which inevitably leads to an increase in the number of savvy advertisers. using cashback services to increase the average purchase check and the number of sales in general.

Source: https://habr.com/ru/post/286196/

All Articles