Investment Fund Life.Sreda seems to be winding up its activities in Russia

The second news of the week about the financial group "Life" reports business newspaper "Vedomosti".

Life Financial Group combines the assets of JSCB “Probusinessbank”, which includes the Bank “Express-Volga”, JSCB “VUZ-Bank”, “Gazenergobank”, CB “Let's go!”, “National savings bank”, “Probusiness-development ", CB" Solidarity ", factoring and collection company" Life ". Venture Fund Life.Sreda was founded in August 2012. The starting capital was $ 10 million. His specialization is investments in mobile and Internet projects in the financial sector.

From reliable sources, “Vedomosti” it became known that Life.Sreda put up for sale most of the projects. The proceeds will be directed to the development of the LifePay project. This is a service for accepting mobile payments using bank cards. The innovative project LifePay is designed for a wide target audience, and now it gives great promise.

But the more acute is the question of whether the second fund of the company will open, which is currently extremely short of financing. Life.Sreda suffers losses not only financially. Recently, Alexander Ivanov left them, a partner who was not the last to take place there. He refused to explain the reason for leaving. But isn't that the notorious crisis that got all the cards wrong here? Life.Sreda is now like a sinking ship from which they are fleeing. Only the captain - managing partner Vladislav Solodky - believes that he will manage to “get out of the maximum number of projects with the benefit, at least the minimum, for the foundation”.

')

The storm, which broke out on the Russian venture capital market, leads to a gradual outflow of assets from the country. According to the chairman of the Life.Sreda Foundation, Anna Yanchevskaya, 90% of the venture funds of the Russian Federation are curtailing their investments in domestic startups. At the same time, Life.Sreda is not against rejecting some foreign assets, if they can be sold profitably. Similar considerations are already under way for the Moven mobile bank and the Anthemis Group UK fund.

As Yanchevskaya declares, interest for Life.Sreda is now represented by foreign markets, in which it is possible to invest profitably. At the moment, these are the markets of Southeast Asia. But still, from Russia, as they say, do not renounce, loving. Portfolio projects are planning to merge into the ecosystem around LifePay. For all this, the fund allocated 100 million rubles.

The first Life.Sreda fund was closed in December 2014 with a volume of $ 40 million. The portfolio consists of 15 projects. The last deal is an investment in Rocketbank. The second fund does not meet expectations, as Yanchevskaya admitted. The flow of investment there is slow. The very activity of the foundation will be directed to foreign projects or to already launched domestic projects.

Alexander Galitsky, managing partner of Almaz Capital, believes that now is a time when everyone has trouble finding new investments, and Life.Sreda is no exception. Anton Inshutin, managing partner of the Fund Inventure Partners, predicts that by the end of this year, the volume of the Russian venture capital market will decrease by 5-6 times. Therefore, Life.Sreda is like a litmus test that reflects the processes taking place in the whole industry.

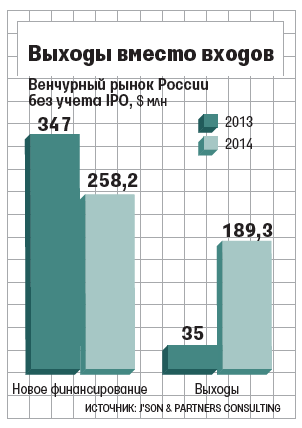

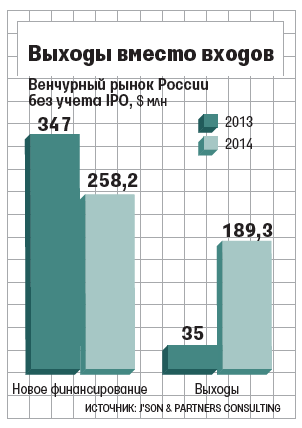

Studies by J'son & Partners Consulting show that in 2014 the volume of the domestic venture capital market reached $ 447.5 million. However, this is significantly lower compared to 2013. Also, in comparison with 2013, there is a decrease in funding by 26%.

Life Financial Group combines the assets of JSCB “Probusinessbank”, which includes the Bank “Express-Volga”, JSCB “VUZ-Bank”, “Gazenergobank”, CB “Let's go!”, “National savings bank”, “Probusiness-development ", CB" Solidarity ", factoring and collection company" Life ". Venture Fund Life.Sreda was founded in August 2012. The starting capital was $ 10 million. His specialization is investments in mobile and Internet projects in the financial sector.

From reliable sources, “Vedomosti” it became known that Life.Sreda put up for sale most of the projects. The proceeds will be directed to the development of the LifePay project. This is a service for accepting mobile payments using bank cards. The innovative project LifePay is designed for a wide target audience, and now it gives great promise.

But the more acute is the question of whether the second fund of the company will open, which is currently extremely short of financing. Life.Sreda suffers losses not only financially. Recently, Alexander Ivanov left them, a partner who was not the last to take place there. He refused to explain the reason for leaving. But isn't that the notorious crisis that got all the cards wrong here? Life.Sreda is now like a sinking ship from which they are fleeing. Only the captain - managing partner Vladislav Solodky - believes that he will manage to “get out of the maximum number of projects with the benefit, at least the minimum, for the foundation”.

')

The storm, which broke out on the Russian venture capital market, leads to a gradual outflow of assets from the country. According to the chairman of the Life.Sreda Foundation, Anna Yanchevskaya, 90% of the venture funds of the Russian Federation are curtailing their investments in domestic startups. At the same time, Life.Sreda is not against rejecting some foreign assets, if they can be sold profitably. Similar considerations are already under way for the Moven mobile bank and the Anthemis Group UK fund.

As Yanchevskaya declares, interest for Life.Sreda is now represented by foreign markets, in which it is possible to invest profitably. At the moment, these are the markets of Southeast Asia. But still, from Russia, as they say, do not renounce, loving. Portfolio projects are planning to merge into the ecosystem around LifePay. For all this, the fund allocated 100 million rubles.

The first Life.Sreda fund was closed in December 2014 with a volume of $ 40 million. The portfolio consists of 15 projects. The last deal is an investment in Rocketbank. The second fund does not meet expectations, as Yanchevskaya admitted. The flow of investment there is slow. The very activity of the foundation will be directed to foreign projects or to already launched domestic projects.

Alexander Galitsky, managing partner of Almaz Capital, believes that now is a time when everyone has trouble finding new investments, and Life.Sreda is no exception. Anton Inshutin, managing partner of the Fund Inventure Partners, predicts that by the end of this year, the volume of the Russian venture capital market will decrease by 5-6 times. Therefore, Life.Sreda is like a litmus test that reflects the processes taking place in the whole industry.

Studies by J'son & Partners Consulting show that in 2014 the volume of the domestic venture capital market reached $ 447.5 million. However, this is significantly lower compared to 2013. Also, in comparison with 2013, there is a decrease in funding by 26%.

Source: https://habr.com/ru/post/285806/

All Articles