Stanford Startup School: How to attract investment? [part 1]

Stanford course CS183B: How to start a startup . Started in 2012 under the leadership of Peter Thiel. In the fall of 2014, a new series of lectures by leading entrepreneurs and Y Combinator experts took place:

Second part of the course

First part of the course

- Sam Altman and Dustin Moskovitz: How and why to create a startup?

- Sam Altman: How to form a start-up team and culture?

- Paul Graham: Illogical startup ;

- Adora Cheung: Product and Honesty Curve ;

- Adora Cheung: The rapid growth of a startup ;

- Peter Thiel: Competition - the lot of losers ;

- Peter Thiel: How to build a monopoly?

- Alex Schulz: An introduction to growth hacking [ 1 , 2 , 3 ];

- Kevin Hale: Subtleties in working with user experience [ 1 , 2 ];

- Stanley Tang and Walker Williams: Start small ;

- Justin Kahn: How to work with specialized media?

- Andressen, Conway and Conrad: What an investor needs ;

- Andressen, Conway and Conrad: Seed investment ;

- Andressen, Conway and Conrad: How to work with an investor ;

- Brian Cesky and Alfred Lin: What is the secret of company culture?

- Ben Silberman and the Collison Brothers: Nontrivial aspects of teamwork [ 1 , 2 ];

- Aaron Levy: Developing B2B Products ;

- Reed Hoffman: On Leadership and Managers ;

- Reed Hoffman: On the leaders and their qualities ;

- Keith Rabois: Project Management ;

- Keith Rabua: Startup Development ;

- Ben Horowitz: Dismissal, promotion and reassignment ;

- Ben Horowitz: Career advice, westing and options ;

- Emmett Shire: How to conduct interviews with users;

- Emmett Shire: How to talk to users in Twitch ;

- Hossein Rahman: How hardware products are designed in Jawbone;

- Hossein Rahman: The Design Process at Jawbone.

Sam Altman: For starters, I would like to ask Mark and Ron; a question that will certainly be the most important one that we are going to consider today - what makes you invest in this or that company?

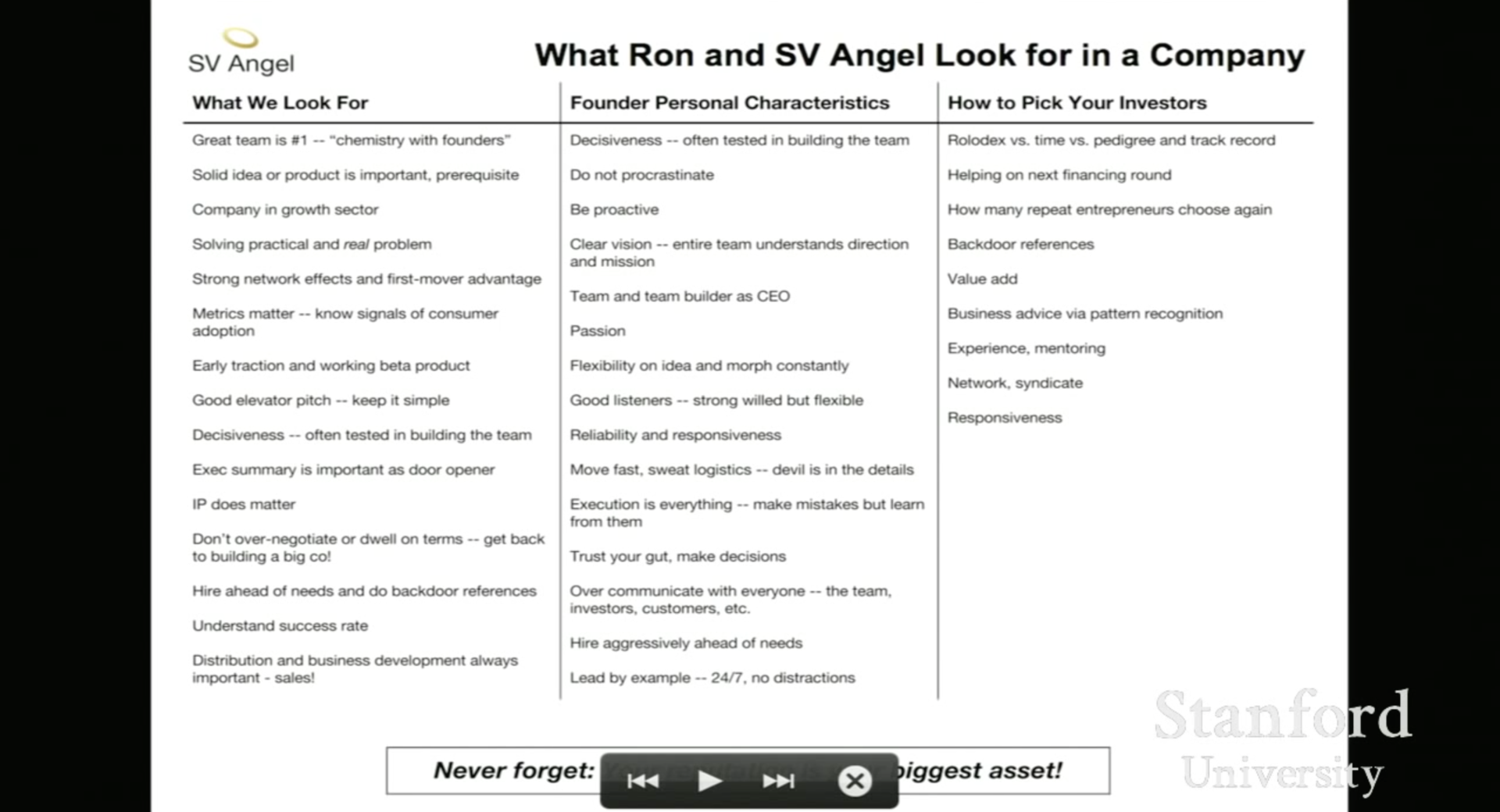

Ron Conway: We have about this slide.

Sam Altman: Mark can start while we understand [with the presentation] ...

')

[Ron asks to ask a question again and starts answering without a presentation]

Ron Conway: So, we invest in a certain company for a variety of reasons. I have been doing this since 1994, even before Mark graduated from the University of Illinois; SV Angel and its divisions have already provided investments to more than 700 companies. Investing in 700 companies means talking face-to-face with several thousand entrepreneurs; when I meet each of them, I pay attention to a lot of different moments. I will tell only about some of them.

In the first minute of our conversation, I ask myself: “Is this person a leader? Is he objective, is he focused, is he obsessed with his product? ”

The first question I usually ask is: “What inspired you to create this product?” - and I hope that the answer is related to the personal problem of the founder, and this product is the solution to this personal problem.

Then I pay attention to communication skills, because if you, if successful, are going to become a leader and recruit a team, you must be extremely sociable and demonstrate the qualities of a born leader. You may have to learn some leadership skills, but better cultivate these qualities in yourself. I'll go back to the slide, but for now the word is Mark.

Mark Andressen: Yes, I agree with everything. We can talk about a variety of details of this issue. And our activities are different from those of Ron in the sense that we invest at all stages of project development. We invest at the seed stage, the stage of venture financing, the growth stage. In addition, we invest in various business models: consumer, entrepreneurial, and many others. We can give a lot of detailed answers if you are interested in something specific.

Here are two main ideas that I would like to share: first, only those start-ups that are completely different from their competitors receive venture capital.

According to statistics, about four thousand companies in need of venture financing usually appear in a year. About two hundred of them will receive funding from the most recognized venture capital funds. About fifteen of them will ever receive a hundred million dollars in profits. And these fifteen companies this year will form about 97% of the return on investment for the entire venture capital market.

So in the case of a business venture, you get either all or nothing. You either enter these fifteen companies or not. You are either one of those two hundred or not.

And most importantly , what we pay attention to, regardless of what criteria we are talking about - these are the radical differences between your business and your competitors. This indicator is incorporated in each of our criteria for evaluating a startup.

The second point that I would like to emphasize, and which we often think about in a company: we have such a principle - invest in dignity, not in the absence of flaws. This, at first glance, seems obvious, but in fact the line is very thin.

The standard method for determining whether to invest in venture capital investments is to check on several points: a great founder, a great idea, a great product, and excellent first sales figures. If all these points are fulfilled, then it will be rational to invest money in this business. It turns out that these points are always fulfilled, but at the same time start-ups lack [for success] something that would make this project truly special and impressive. They have no outstanding characteristics that would make them unique. On the other hand, companies with such characteristics often have serious drawbacks.

One of the important lessons of the business venture: if you don’t invest in ideas with serious flaws, then you don’t invest in most of the startups that end up among the winners. You can sort through a lot of such examples: we will list almost all the major players. Therefore, we strive to invest in startups with an exceptional advantage. To a certain extent, we are ready to accept some of their shortcomings.

Ron Conway: I won’t dwell on the slide for long; at the first meeting with the investor, you should be able to tell in one convincing sentence (which should be worked out to automaticity) about what exactly your product does, so that the investor you are talking to can immediately present this product.

Probably, in 25% of cases when talking with entrepreneurs after they make the first sentence, I still do not understand what they are doing, and since I become less patient with age, I say: “Stop, I don’t even know , what are you doing". So try to bring it to perfection.

Now I want to go to the second column. You have to be decisive, the only way to succeed is to make decisions. Postponing for later is the trouble of startups. Therefore, no matter what you do, you will have to constantly move forward. Whether you want to hire or fire someone, all decisions need to be made quickly. It is important to put together a good team. When you have an idea for a good product, the main thing is to put together a good team and implement this idea.

Sam Altman: Parker, can you tell us how your round of seed investments went, and what would you do differently trying to get funding?

Parker Conrad: Of course, during the seed investment round, everything — in terms of obtaining funding — was relatively quick. But here is one of the lessons that I learned for myself: before that, I founded a company where I worked for six years, and we and another co-founder offered our idea to almost every venture company in Silicon Valley. We literally came to each of sixty different companies, and they all said no to us. We constantly tried to understand how we should build our performance? How else should we make a presentation? How do we adjust our history? Etc.

When we proposed the idea of Khosla Ventures, at some point one venture investor clarified the situation to us: he needed some specific materials that we did not have with us, and he told us: “You did not understand. Now, if you were the same as the guys from Twitter, you could come, tell something, offer, and we would invest money in you. But you are not guys from Twitter, so you need to tell us everything as clearly as possible and prepare all the materials in advance, ”and so on in the same spirit.

The lesson I learned for myself was the complete opposite of what this person wanted to convey to me - I thought that we needed to make a second Twitter, and that this is the only way to get an investment. Therefore, one of the reasons I founded the current company is one of the things that I like about Zenefits, because this company really looks like a real business. I was so upset after two years of trying to get funding from venture investors, that I decided: “To hell with this.”

You can not count on the fact that there is a venture capital for you. The business that I created seemed to be able to run without any investment at all. This option was also possible: we generated enough cash flows to feel relatively confident.

It turned out that it was in such a business that investors like to invest money, and everything came out surprisingly easy. Sam was too kind, calling me an expert in attracting investment. I do not think that I am really good at it. Perhaps I understand investments even worse than everything else. But I think that if you can run a business in which everything is moving in the right direction, if you can be like Twitter guys, then everything else is unimportant. And if you can't be like the guys from Twitter, it becomes very difficult to succeed at the expense of something else.

Ron Conway: Why did the investor advise you to be like Twitter guys when Twitter fail whale appeared on the site for two years?

Mark Andressen: Because [despite this] Twitter was successful.

Ron Conway: I also want to add: make your own way while you can. I met one of the best founders in the world of technology, a woman who is now creating a new company, and asked her: “Well, when are you going to attract investments?” She: “Maybe I won't need them”. I replied: "This is awesome." Always try to make your own way.

Mark Andressen: I actually wanted to finish this topic, but I have to continue. I think Parker said something very important that you will never hear about again. I also wanted to say this. The main advice I have ever read about and which I always tell others when discussing such topics belongs to comedian Steve Martin - I consider him a real genius.

He wrote a terrific book about the beginning of his career, which obviously was very successful. The book is called “Born standing up” [“Born as a stage comedian”], it is small, and it tells how he became the same Steve Martin. In the book, he asks a question: what is the key to success? The key to success is to be so cool that it’s impossible not to pay attention to you.

In a certain sense, this will be our entire conversation, and we will continue to talk on this topic, but now this is irrelevant. Because if you, like Parker, create a tremendously successful business, investors will throw you money. And if you come with your theory, plan, without any data, like thousands of others, it will be much more difficult to attract funding. It is absolutely possible to achieve investments, becoming so cool that they cannot ignore you. It is almost always better to make changes in your business than in your presentation.

It was a positive view of things, a negative view or a warning (it becomes difficult for me every time I talk about it, but I take a lot of drugs, so I’ll continue, and come what may): getting venture financing is the easiest thing for the founder startups have to do. Hiring developers, trading with a large company, achieving viral growth in the consumer business, and earning advertising revenue is all much more difficult. Almost everything you will ever do is harder than getting venture capital.

Therefore, Parker is absolutely right: if you are in a situation where you are unable to attract money, perhaps this is not the most difficult thing compared to what follows. It is important to always remember this. It is often said that attracting investment is not really a success, it is not a new stage in the development of a company, and I think this is true. I think this is the main motive that makes you engage in even more complex things.

Sam Altman: Let's continue the topic. What would you like the founders to change in their approach to attracting investment? In particular, Mark, did you mention the relationship between money and financing?

Mark Andressen: I think the most important thing that entrepreneurs lack (and I think it’s our fault, we don’t often discuss it), both when raising money and managing a company is understanding the relationship between risk and money. This refers to the ratio between risk and funds received, as well as the ratio between risk and money spent. I have always been a fan of what Andy Rackliff taught me many years ago; he calls it the onion risk theory. According to this theory, you assume that from the first day of its existence, a startup has all the possible risks and can make a list of them.

There is a risk that the founders will not be able to work together, that you will not create a conceived product, that you will need a technological breakthrough to achieve the goal. Will you have something that will help you realize your plans, can you do everything yourself? There will be a risk that the product launch may fail; there will be a risk of perception of the product by the market, the risk of non-receipt of profit.

There is a big risk when you have to compete with many companies that have sales professionals: can you sell a product at a price that is sufficient to cover the cost of sales? So to this list is added the risk of not covering the cost of selling a product. If you release a B2C product, there will be a risk of no virality. Therefore, at a very early stage, a startup is just a long list of these risks, your approach to managing a startup, among other things, is related to the approach to raising funds. This is reminiscent of the process of removing “risk layers” over time.

So you’ve got the seed investment to eliminate the first two or three risks: the risk of a team falling apart, the risk of not receiving the product, and possibly the risk of lack of initial oversight of what is happening. You get an investment at stage A to remove the next layer of risks associated with the product, and maybe get rid of the share of risks related to recruitment, since at this stage you have completely formed a development team.

Perhaps you get rid of a part of the risk of lack of consumers, because you have the first five customers. That is, in fact, you can imagine how the risks disappear over time; you get rid of them by reaching certain key points. And upon their achievement, you, on the one hand, make a step in the development of your business, and on the other hand, you justify the additional capital received. It is so?

Well, you come and promote your idea to someone like us. And you say that you want to receive financing at stage B. The best way to achieve this is to say: “I received seed investments and achieved such and such results. I eliminated such and such risks. Then I received an investment in round A. I achieved such and such results. I eliminated such and such risks. Now I want to get investment in round B. These are my intended goals, these are my risks, and by the time I need investments in stage C, I will be in such and such a position. ”

And then you specify how much money you received in the end, and spend it on the risks that need to be eliminated in the business. In a sense, everything seems obvious, but I am talking about this because it is a systematic approach to understanding the attraction and use of funds. You can compare it with how the founders think about it now: “Oh God, I will get as much money as possible, build a fashionable office, I will hire as many people as possible.” And after hope for the best.

Ron Conway: I will focus on tactics. Do not ask to sign a non-disclosure agreement. For some time now, we have rarely been asked about this, because many founders realized that if you ask someone to draw up a non-disclosure agreement at the beginning of your relationship, you essentially say: "I don’t trust you." The relationship between investors and founders includes a lot of trust. The biggest mistake I often encounter is that many moments are not documented.

My advice: try to ensure that the fundraising process takes place as quickly and efficiently as possible. Do not dwell on it. Often, the founders proudly consider getting an investment as their personal achievement. As Mark said, this is a tiny step in your path. This step is basic. Try to get rid of him as soon as possible.

But after someone gives you consent, you get in the car and send them a letter confirming what they promised you. Many investors have a very short memory, and they forget that they promised to provide you with financing, or they forget what opinion they have formed, or that they need to find a co-investor. You can resolve all contradictions only by presenting everything in writing, and if investors try to get away from it, simply send them a letter again and write "sorry." Fortunately, investors respond to such letters anyway, so write down everything in writing. And at the meetings, make notes and make a text summary on all important issues.

[ The second part of the 9th lecture of the startup school. ]

Source: https://habr.com/ru/post/285724/

All Articles