3-NDFL for income sources from outside Russia

Hello to all.

This blog post is useful for those who receive income not only from their main job, but also receive money from abroad by bank transfers, which means they have to pay taxes from this income. Consider here the case of payment of taxes by an individual at a rate of 13%. The issue of the obligation to pay taxes is not considered, see the Criminal Code.

To do this correctly, you will need:

1. Program filling 3-NDFL from the tax service. You can get on the website of the Federal Tax Service, here .

')

2. Help with the main work on income for the past year, 2-NDFL.

3. Extract from the bank account to which the money was transferred. The certificate must be for the period of the last year, but not necessarily by its end: the period may end in the present. Printing a bank statement is VERY desirable, but, as I have been given to understand, is optional.

4. Photocopy of the passport of the Russian Federation, 2-3rd pages, as well as all pages with stamps on registration and withdrawal from it (5-12, excluding empty ones).

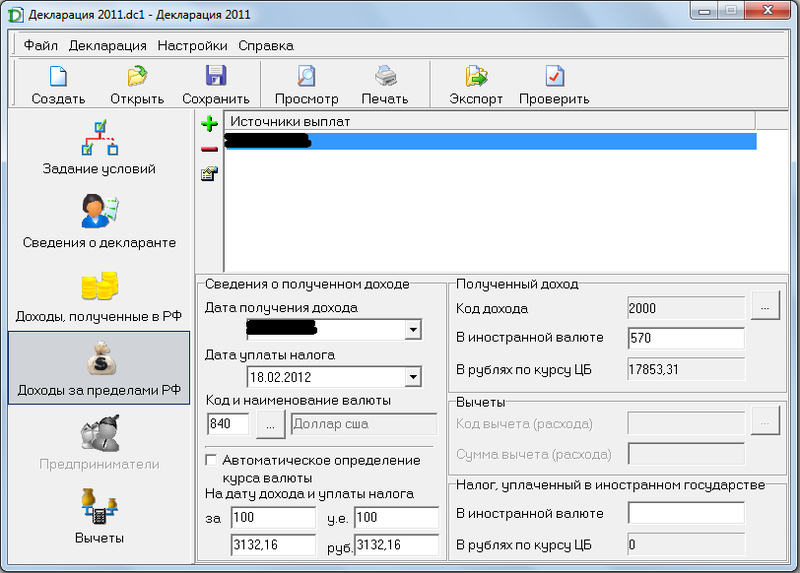

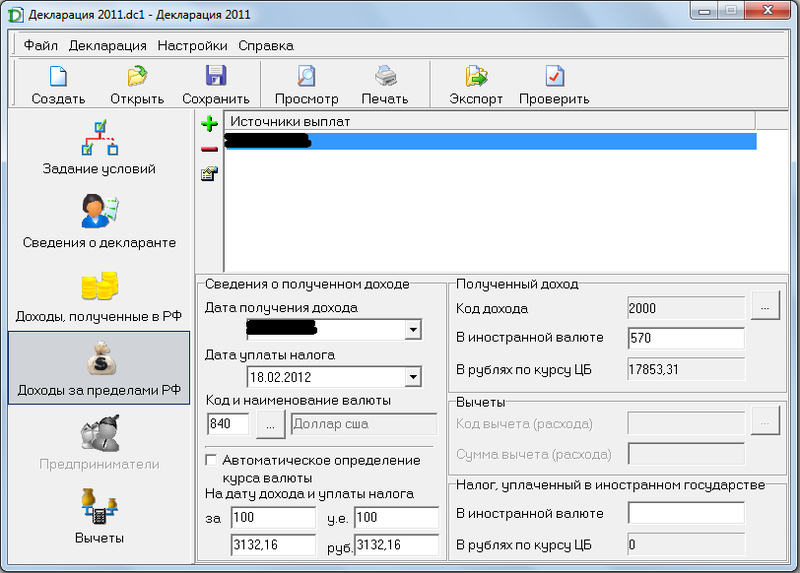

So, in the program you need to do the following:

and then the following:

After that, using the “Incomes received in the Russian Federation” button, you simply need to rewrite all the information from all the 2-NDFLs that you have, be sure to indicate the amount of tax already withheld. You do not want to pay tax a second time?

It is clear that it is also necessary to fill out the "Information about the declarant".

The program, unfortunately, is written crookedly, and therefore it works stably, but only on the Russian-language operating systems of the Windows family (in English instead of the Russian text - question marks, and when printing, an incomprehensible error occurs because of the same questions).

After filling out the questionnaire, you can print it directly from the program, but to save to something decent is not. Remember that it is impossible to make a declaration with a stapler - if you damage the bar code, the declaration will not be accepted.

As soon as the documents are in hand, we go to our tax office and submit the documents, but rather quickly. Deadline - April 30, and the closer to this date, the longer the queue. So far, there are no queues at all. Upon arrival at the tax office, you will be given a form in which you will have to write down which pieces of paper and how much you are served (photocopy of your passport, 3 pages, 2-ndfl, 1 page, etc.). Upon filing you will be told that you need to expect receipts, or simply pay by looking at the details on the tax website. You need to pay until July 15.

There are two alternatives to this adventure:

1. Sending all the same, only by mail. To the aforementioned documents, you need to make them an inventory (2 pieces) and assure by mail. The service is free!

2. Submit electronically. For this you need an account on the state portal. services. I'll tell you about it in a year if no one shares his experience, because, again, I don’t want to go to the tax office.

PS This program can add and count deductions to all this - but this is a very voluminous topic, to which I will return. I can only say that the money spent on the treatment of oneself, a spouse or children, their education, funds for the purchase of apartments and other real estate can be returned - this is called a deduction.

Calm you dreams!

This blog post is useful for those who receive income not only from their main job, but also receive money from abroad by bank transfers, which means they have to pay taxes from this income. Consider here the case of payment of taxes by an individual at a rate of 13%. The issue of the obligation to pay taxes is not considered, see the Criminal Code.

To do this correctly, you will need:

1. Program filling 3-NDFL from the tax service. You can get on the website of the Federal Tax Service, here .

')

2. Help with the main work on income for the past year, 2-NDFL.

3. Extract from the bank account to which the money was transferred. The certificate must be for the period of the last year, but not necessarily by its end: the period may end in the present. Printing a bank statement is VERY desirable, but, as I have been given to understand, is optional.

4. Photocopy of the passport of the Russian Federation, 2-3rd pages, as well as all pages with stamps on registration and withdrawal from it (5-12, excluding empty ones).

So, in the program you need to do the following:

and then the following:

After that, using the “Incomes received in the Russian Federation” button, you simply need to rewrite all the information from all the 2-NDFLs that you have, be sure to indicate the amount of tax already withheld. You do not want to pay tax a second time?

It is clear that it is also necessary to fill out the "Information about the declarant".

The program, unfortunately, is written crookedly, and therefore it works stably, but only on the Russian-language operating systems of the Windows family (in English instead of the Russian text - question marks, and when printing, an incomprehensible error occurs because of the same questions).

After filling out the questionnaire, you can print it directly from the program, but to save to something decent is not. Remember that it is impossible to make a declaration with a stapler - if you damage the bar code, the declaration will not be accepted.

As soon as the documents are in hand, we go to our tax office and submit the documents, but rather quickly. Deadline - April 30, and the closer to this date, the longer the queue. So far, there are no queues at all. Upon arrival at the tax office, you will be given a form in which you will have to write down which pieces of paper and how much you are served (photocopy of your passport, 3 pages, 2-ndfl, 1 page, etc.). Upon filing you will be told that you need to expect receipts, or simply pay by looking at the details on the tax website. You need to pay until July 15.

There are two alternatives to this adventure:

1. Sending all the same, only by mail. To the aforementioned documents, you need to make them an inventory (2 pieces) and assure by mail. The service is free!

2. Submit electronically. For this you need an account on the state portal. services. I'll tell you about it in a year if no one shares his experience, because, again, I don’t want to go to the tax office.

PS This program can add and count deductions to all this - but this is a very voluminous topic, to which I will return. I can only say that the money spent on the treatment of oneself, a spouse or children, their education, funds for the purchase of apartments and other real estate can be returned - this is called a deduction.

Calm you dreams!

Source: https://habr.com/ru/post/284696/

All Articles