9 secrets of online payments. Part 5: Mobile Payments

The PayPal study showed that mobile payments are gaining popularity: 19% of users make online payments from tablets, another 32% from smartphones. In Russia, 38% of mobile devices were used to pay on the Internet, and 5% of Internet users pay online only from a smartphone or tablet. The love of mobile payments is more pronounced among the younger generation - 61% of respondents aged 18 to 34 have already paid online from their smartphones and other mobile gadgets. Mobile applications for payment are also popular - 43% of respondents installed them on their device. In the fifth part of the series “9 secrets of online payments”, containing eight years of experience of the PayOnline team, we will talk about how to interact with the mobile audience, how it has changed in Russia over recent years, and, of course, how to effectively accept payments.

The PayPal study showed that mobile payments are gaining popularity: 19% of users make online payments from tablets, another 32% from smartphones. In Russia, 38% of mobile devices were used to pay on the Internet, and 5% of Internet users pay online only from a smartphone or tablet. The love of mobile payments is more pronounced among the younger generation - 61% of respondents aged 18 to 34 have already paid online from their smartphones and other mobile gadgets. Mobile applications for payment are also popular - 43% of respondents installed them on their device. In the fifth part of the series “9 secrets of online payments”, containing eight years of experience of the PayOnline team, we will talk about how to interact with the mobile audience, how it has changed in Russia over recent years, and, of course, how to effectively accept payments. Part 1. Setting up 3D Secure

Part 2. Recurring payments

Part 3. Payment selection page

Part 4. Payment Form

Part 5. Mobile payments

Part 6. Payment in one click

Part 7. Fraud monitoring system

Part 8. Returns and how to avoid them.

Part 9. Payment service settings for the type of business

According to the PayPal survey for 2015, the growth of the audience of online payers in Russia is now at the expense of new Internet users (+ 55% per year), consumers over the age of 55 years (+ 17%) and residents of the Russian province (+ 13%). Russia has passed a critical point in the development of electronic and mobile commerce. While someone is thinking whether to develop a mobile solution for their business, buyers go further: 79% of respondents believe that in the future it will become customary to use mobile devices to pay for purchases in regular stores, 63% - that we will pay using wearable devices . According to Russians, these ideas will become a reality in Russia in the coming years.

')

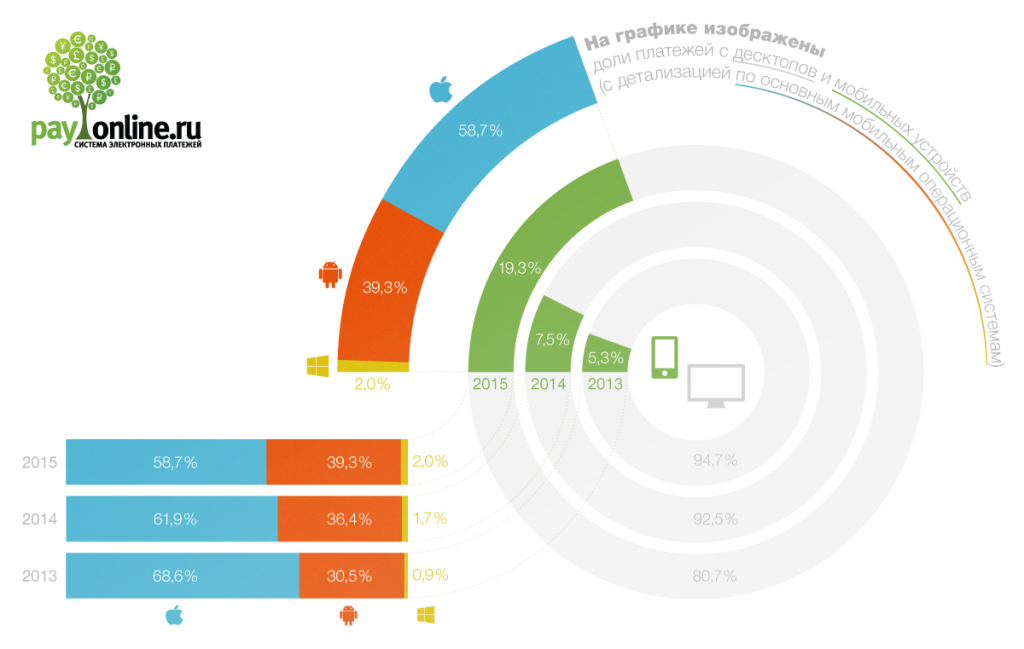

According to PayOnline, in the first quarter of 2015, already 19.3% of online payments were made from mobile devices, 59% of them from devices on the iOS platform. The share of payments from mobile devices increased in 2015 compared to 2014 by 157% and amounted to 19.3% of the total volume of payments made through the PayOnline electronic payment system.

Unfortunately, the trend of shopping through mobile devices in RuNet was caught by a few sites.

In most cases, making purchases using mobile devices on a site designed for desktops is very difficult, and sometimes impossible. Photos of products do not open properly, design elements are too small, it is difficult to get on the buttons “choose size”, “specify quantity”, and the worst is the button “pay”. After all, payment is the final and key step towards turning a site visitor into a buyer.

With a payment form that is not adapted for mobile devices, there are also many problems: the fields for entering the details do not fit on the screen of the mobile device, the page with the form loads too long, the security of the payment is questioned. It is not surprising that many potential buyers who wanted to buy something “quickly” from a smartphone refuse this idea.

What can be done to simplify the payment process for mobile users and not lose profit?

First of all, you need to give the client the opportunity to freely use the online service using a mobile device, that is, a tablet or smartphone (sometimes new generation TVs with Internet access are added to this group, but so far their share in sales is very small, although it shows high growth dynamics). This can be done using a mobile site or applications for popular mobile platforms (iOS, Android, Windows). The transition to the mobile version or to the application should be made at the moment when the user tries to access the site from a mobile device.

What to choose - a mobile version of the site or a mobile application - everyone decides for himself. Each of the options has its pros and cons: for example, applications are often more convenient, they give you the opportunity to get access to personal information of the user (contacts, photos, etc.), but to achieve installation of the application is much more difficult than attracting an audience to the mobile version site. But the application allows you to keep the attracted audience - and settle in a mobile device, “communicating” with the user using push notifications.

Here the question of payment systems arises - how will the user pay for purchases? With mobile versions, everything is obvious - when defining a mobile device, the user is automatically redirected to the mobile version of the site, and for payment - to the mobile version of the payment form. But when setting up payment acceptance, there are a number of aspects that need attention.

Choose wisely: do not overpay for accepting payments

The native payment services offered by the iOS and Android platforms charge the application owner a very high commission for processing payments: from 20% to 40%. This commission rate closes the mobile sales channel for low- and medium-margin business. Therefore, the first advice is to study the market and find a suitable payment solution.

In the Russian market, there are very few units of independent payment services (including PayOnline), offering mobile application owners a competitive fee for processing payments. Unfortunately, not everyone is aware of this possibility and they are building in a “native” platform payment system, later on facing unreasonably high tariffs.

There are many nuances regarding payment systems in applications: a lot depends on what is being sold (real goods or attributes of the game world, such as coins, armor, weapons), in which country the application is published, and what revolutions it contains. For “imaginary” artifacts and premium access, the internal currency of the mobile platform is often used exclusively and the acceptance of payments through third-party systems is prohibited. If we are talking about physical goods (clothing, air travel, movie tickets), then there are much more possibilities for integrating third-party processing with favorable rates.

More details can be found in our article , in which we talked about receiving payments from mobile devices on iOS.

The payment page should be an organic part of the application.

As for the payment page itself, it is important to adhere to a single design corresponding to the application. The easiest and safest way to integrate payment acceptance in the application is to customize the payment form for mobile devices and integrate it through the built-in browser. It is also possible to implement the payment form directly into the application, but this significantly increases the level of risk, which means it increases the commission.

The design of the payment form, customized for the other screens of the application, is positively perceived by the buyer: he is calm and knows that he is still in the same application where he placed the order.

An example is the Ural Airlines mobile application, for which PayOnline has implemented payment acceptance. As can be seen from the screenshots, the design of the payment form is designed in the same style with all the screens of the application and fits organically into the application.

It is necessary to take into account the differences between mobile devices and desktops.

The developer should understand not only the psychology, but also the buyer's physiology: when a person holds a smartphone in one hand, it should be convenient for him to operate with just one thumb.

Fields of the payment form should be reduced and simplified as much as possible, this applies to both the mobile site and the application. You only need to request the data that is really necessary for making a payment. Keep the manual set of numbers and letters to a minimum - typing on the keyboard of a mobile device is not very convenient, there is a great chance to be sealed up or suffer from autocorrector replacements. If possible, use the drop-down lists that are conveniently “scrolled” with one finger on the touch screen.

Do not overload

A large role is played by the speed of loading the page in a mobile browser. If the payment page turns out to be too “heavy”, the user may not wait for it to fully load and go to another resource.

But at the same time, the user must see the order information on the payment form. It often happens that at the time of payment of the purchase (especially expensive, such as airfare, for example), the buyer already wants to check the order details again at the payment stage. In the case of plane tickets, it can be time, airport, flight date. To reduce the number of refusals from the payment form, it is recommended to put all the important information on the payment page without overloading it.

Provide the buyer with the necessary information.

Do not forget to inform the buyer about what stage the payment processing is at, as the process of checking and authorizing a payment takes time.

So the user will not feel that his device is stuck, or “something went wrong” and the payment was not made.

In case of an error during payment, inform the buyer about its reasons, whether it is an incorrectly filled payment form, lack of funds on the card, or any other problem. In addition, it is also advisable to recommend ways to solve it - choose another payment instrument, try to pay later, contact customer support.

Safety information is important

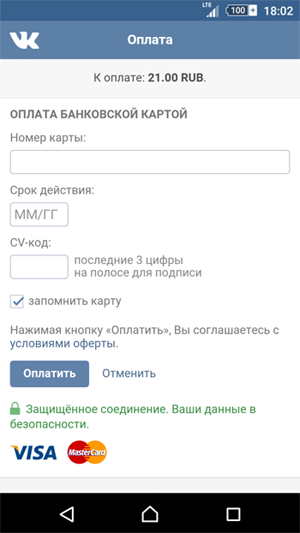

Today, almost every smartphone is a repository of vital information of its owner. All photos, contacts, messages, access to mail and social networks, billing information and confidential information - in fact, having free access to a mobile device, you can learn almost everything about a person. The owners themselves understand this, therefore they often reluctantly leave their data upon registration and payment. To convince them to protect the details of their bank cards, use the relevant information on the payment form (for example, as the Vkontakte website does, indicating “Secure connection. Your data is safe”):

If your service offers frequent purchases, you can link a user card to a device. Regular customers will thank you, because to make a purchase, it is enough to enter a minimum of data - for example, only the CVV code on the back of the card. It is about the binding of the card and the one-click payment functionality in the next article in the “9 secrets of online payments” cycle. In order not to miss the latest issues, subscribe to our blog. And if you need to organize payment acceptance on the website or in a mobile application, feel free to contact us .

Source: https://habr.com/ru/post/283248/

All Articles