9 secrets of online payments. Part 3: Payment Method Selection Page

Today, the number of online payment methods in RuNet has exceeded one hundred: bank cards, e-wallets, mobile accounts, terminals, Internet banking - and that’s not all. In the new edition of PayOnline , a series of 9 secrets of online payments, the company that provides services for the integration of various payment methods on websites and mobile apps will help you answer two key questions: “What?” (What payment methods do your customers need? ) and “How?” (how to help a client choose a payment instrument without complications and problems).

Today, the number of online payment methods in RuNet has exceeded one hundred: bank cards, e-wallets, mobile accounts, terminals, Internet banking - and that’s not all. In the new edition of PayOnline , a series of 9 secrets of online payments, the company that provides services for the integration of various payment methods on websites and mobile apps will help you answer two key questions: “What?” (What payment methods do your customers need? ) and “How?” (how to help a client choose a payment instrument without complications and problems). ')

Part 1. Setting up 3D Secure

Part 2. Recurring payments

Part 3. Payment selection page

Part 4. Payment Form

Part 5. Mobile payments

Part 6. Payment in one click

Part 7. Fraud monitoring system

Part 8. Returns and how to avoid them.

Part 9. Payment service settings for the type of business

To begin with, there is not and cannot be a single ideal list of payment instruments for all sites of the Runet. The list of payment methods is formed depending on several key factors:

- The size of the average check.

- Business geography.

- Products or services.

- Habits customers (buyers).

Now we consider the impact of these criteria on the formation of an optimal set of payment instruments.

Average check size

This is perhaps the most important criterion for choosing a set of payment instruments. Large payments are made online in two main ways - by credit card and via Internet banking.

For a small check, it is worth including e-wallets in your payment arsenal, payment from mobile phone bills. It is worth noting that many e-wallets today (Yandex.Money and QIWI in Runet) issue bankcards related to the wallet. This additional service turns the wallet user into a bank card holder.

Business geography

Companies that work with international or foreign client audience should pay attention to this item first. For them it is obligatory to connect receiving payments by bank cards of international payment systems not common in Russia: American Express, JCB, Diners Club, UnionPay. It will be useful to connect such a universal payment tool like PayPal (although, according to user feedback, it’s still difficult in Russia).

Products or Services

The sale of goods is critically different from the sale of services by one, but the most popular payment instrument - cash when paying. Cash goods are paid by 40% to 90% of buyers (depending on the level of trust in the store, the cost of goods, the geography of delivery). It is worth noting that in the online business commodity sector there are practically no micropayments, which means there is no noticeable need for corresponding payment instruments.

In the case of selling services, all payments go through the Internet, and here you need to provide customers with a complete, but not overloaded list of payment methods. Think about how convenient it is to pay your minimum check (possibly SMS payment) and the maximum check (what types of bank cards are needed).

Customer habits

Do not forget about shopping habits. For example, if you sell software, your customers will probably want to pay for a purchase using WebMoney. And if you are implementing a subscription to the game, do not forget to pay from the mobile account. Look at your site through the eyes of a client, draw his “portrait”, detail financial habits and create for the buyer the most comfortable conditions for parting with money in your favor.

What is more important

Depending on the average check and segment (goods or services), you can distribute payment instruments according to their level of significance for various categories of online stores and online services.

Table 1. Comparison of the relevance of payment instruments to business types

Next, we will give you some tips that will make the payment method selection page as efficient as possible. And, of course, we will analyze practical cases taken from the practice of real online stores Runet.

Council first. Do not follow the "The more the better" logic.

In most cases, the actual demand (see “Table 1”) is just a couple of payment instruments. The largest selection of payment methods is provided to its customers by coupon services, online software stores, ticket (city) offices and government services. In most cases, 99% of online payments will fall on 2-3 payment instruments. Do not forget that the majority of Russians prefer to pay large physical goods in cash upon delivery, in order to check the quality of the goods before they buy.

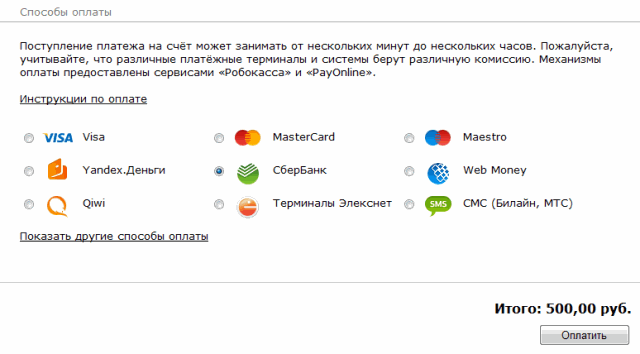

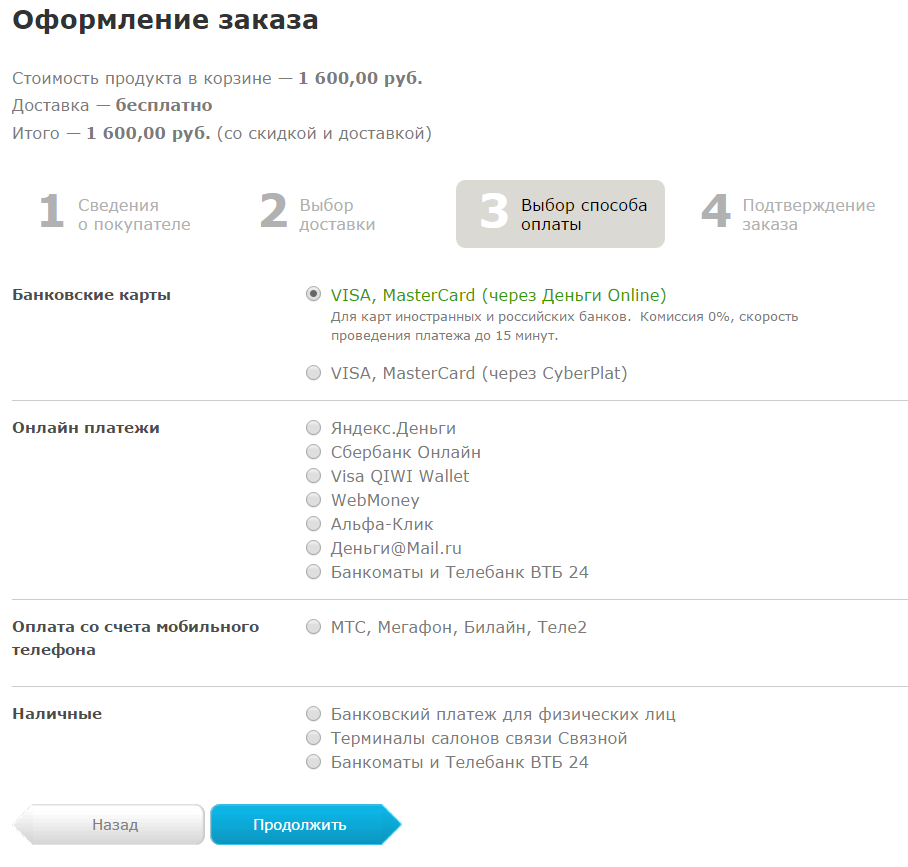

Below is an example of a redundant list of payment instruments. Despite the call “Please choose the most convenient way to pay for your order,” the convenience for the user is here and “does not smell”. The list is overloaded with payment options, additional information about the commission. Probably, the ranking of the priority of payment methods was also not carried out.

Figure 1. “An example of a surplus list of payment instruments”

To increase the convenience of the page, it is worth highlighting the priority tools, collapse homogeneous into a drop-down list (for example, “Money transfer - choose”). Additional information on the commission should be removed or converted into the final cost (without forcing the user to independently calculate the difference between the points “2-3% commission” and “1-2% commission”). The usefulness of the information about the commission is doubtful, since the indicated ranges do not add specifics, but introduce into the stupor: “commission 4-20%”, “commission 3-15%”.

Council of the second. Structure payment methods

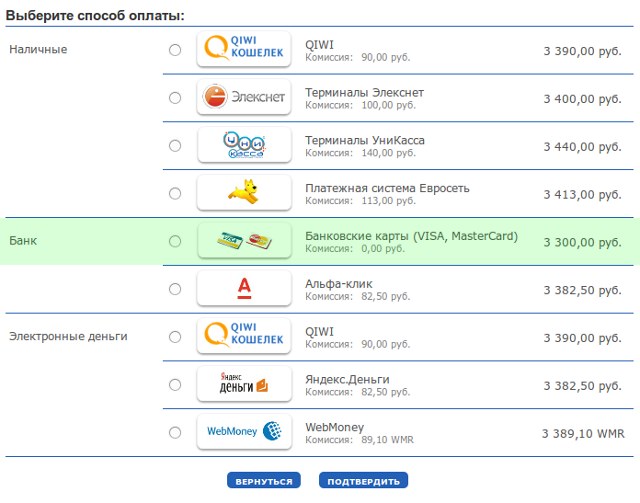

If you provide customers with a wide range of payment instruments, create a separate section for bank cards, a separate section for electronic money, and a separate section for payment through mobile operators. Visualize payment methods using icons and logos. In large volumes of text attention is scattered, sometimes it is difficult to understand how they differ. It is better to immediately recalculate all discounts and commissions into the final amount of the order (and do not forget about the rules of the IPU, which prohibit charging more money for payment with a bank card than for any other payment method). Below is an example of the incorrect structure of the payment method selection page.

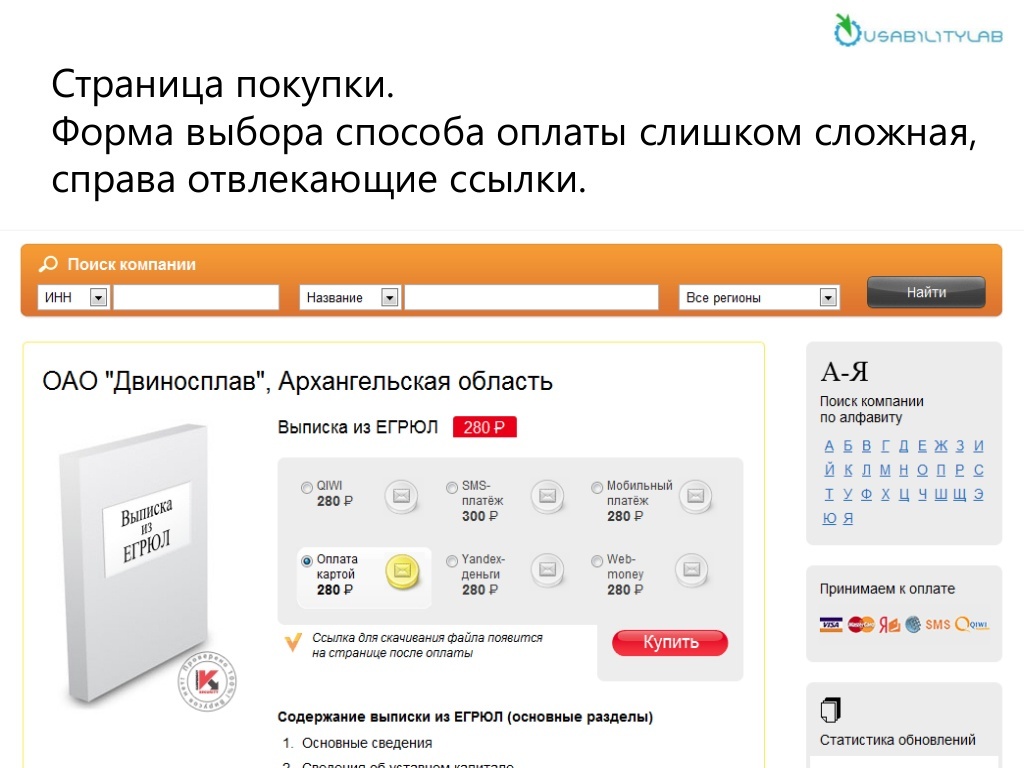

Figure 2. An example of the incorrect structure of the payment method selection page

All payment methods are dumped on one field, there is no division into types of payment methods (card, terminal, SMS, e-wallet). There is another set of payment instruments hidden under the link “Show other payment methods”. You do not need to force the client to orient himself in the variety of the presented payment methods. Provide him with a clear structure with a logical separation, as shown in Figure 3.

Figure 3. An example of the clear structure of the payment method selection page

This online store shows the buyer three simple groups of payment instruments: "Cash", "Bank", "Electronic money". Of course, the separation is not generally accepted (the term “Bank” often includes Internet banking, rather than payment by credit card), but one can clearly see the desire to make the choice of payment method as simple and convenient as possible. Another plus is the automatically calculated purchase price for each payment instrument. The buyer does not need to consider himself, and he is certainly grateful for that.

Council of the third. Do not frighten the client with terminology

Your buyer is not obliged to be familiar with the terminology common among Internet entrepreneurs. Separately, it is worth noting that even payment service providers, not to mention stores, often use completely different terms to refer to certain phenomena of "payment reality." Talk to customers in their language, and get rid of failures at the stage of choosing a payment method and at the stage of payment, additional load on the call center and other consequences of misunderstanding.

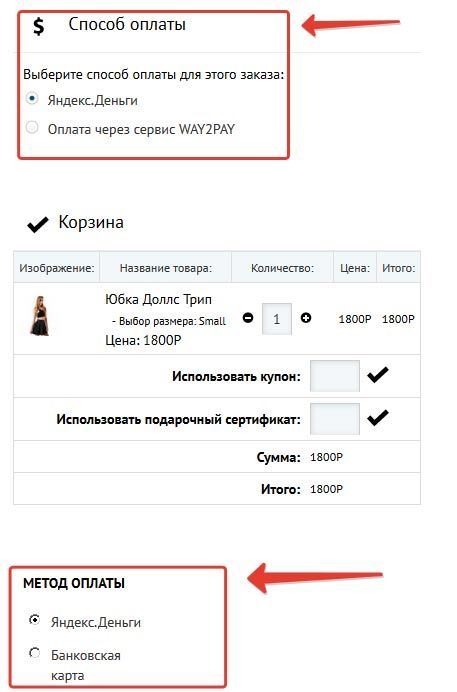

In the following example of incorrect use of terms, the buyer is given the choice of "method of payment" and "method of payment". To the user, this looks like repetition, tautology, error, and finally confusion.

Figure 4. Example of incorrect use of terms

And the online store in the first case offers the buyer (!) To choose which payment service will process his payment. And only in the second one the buyer chooses with which payment method the payment will be made: by card or from an electronic wallet.

Council of the fourth. Do not shift your work to the client

Often, online stores that accept payments through several payment services (aggregators, payment service providers, acquiring banks) offer buyers to choose “through whom to pay”. In his opinion of a typical payer, all payment services are “for one person”, and most likely, for the first time, he hears about both. In the example below (Figure 5), the payer does not understand why the second payment aggregator was offered for making payment by credit card.

Figure 5. An example of shifting the payment partner’s choice to the payer

Distribute payment traffic between the aggregators yourself. Do not force the payer to try to get "a finger to the sky." It is better to offer the client to choose a type of bank card. A more logical implementation of the choice of the processing center is shown in Figure 6, where the default is payment by Sberbank card through the acquiring bank. Since Sberbank cards account for more than 60% of payments in RuNet, this choice is justified. If the payer pays with a card of another bank, he can change the processing center. Although, again, no one has canceled the routing of payments.

Figure 6. An example of a logical presentation of the list of payment partners

Council of the fifth. Do not overload the payment page with unnecessary links.

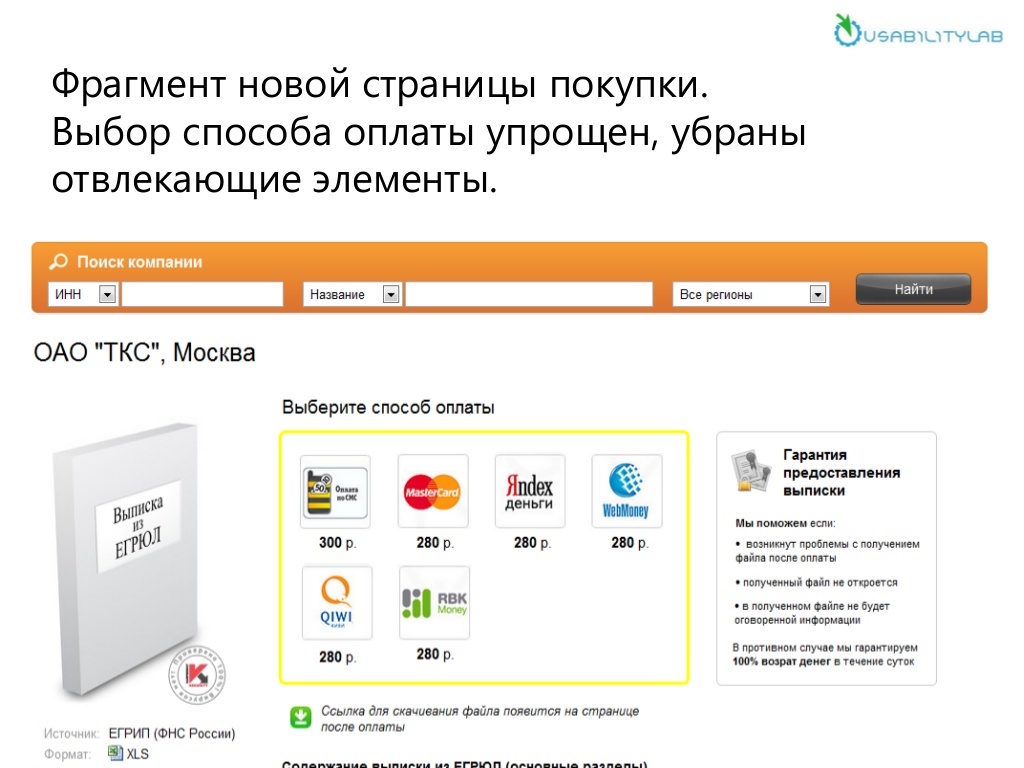

The buyer should not be distracted by the extra information and leave the page of the choice of payment instrument. This breaks the conversion chain and adversely affects the proportion of successfully paid orders. The following is a clear example of correcting such an error (Figure 7 - Figure 8).

Figure 7. Payment selection page - until corrected

Figure 8. “Payment method selection page - after correction”

That's all. In the next part of “9 secrets of online payments,” we will tell you what every owner of an online store accepting online bank card payments should pay attention to. And if you need to set up payment acceptance on the website / in the mobile application or get expert advice, please contact us , we will select the appropriate solution.

Source: https://habr.com/ru/post/279211/

All Articles