Experiment: Using Google Trends to predict stock market crashes

In our blog on Habré we have already talked about various studies aimed at creating algorithms for predicting stock prices , for example, using machine learning . Back in 2013, researchers from Warwick Business School published the results of an experiment , in which a Google search engine was used as a tool for predicting trends in the stock market.

In the Internet era, a huge amount of information generated by people is available online. And from this noise it is quite possible to isolate something useful. Researchers are convinced that information on search queries can be used to analyze stock market trends.

')

How it works

Financial markets are a collection of different data. Their analysis provides detailed information on making financial decisions on a global scale. However, the market only reflects the final decision of the investor that he buys the stock or sells it.

The data obtained using the tools of analyzing the popularity of search queries like Google Trends allows you to look at the moment when investors are still analyzing the pros and cons of a particular market decision.

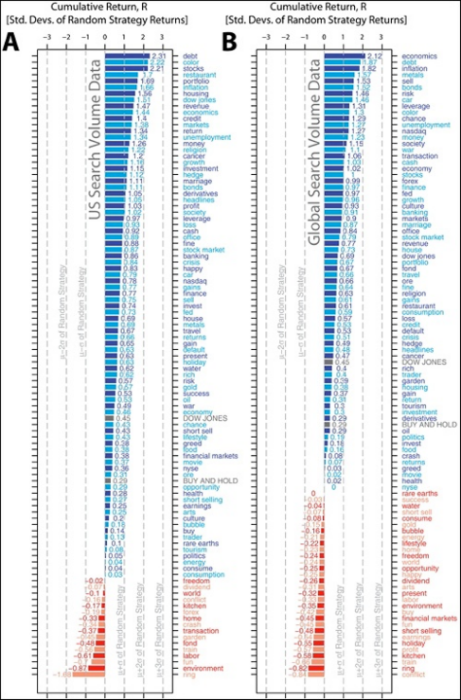

The researchers write that they were able to detect a correlation between the increase in the number of search queries associated with various political and economic topics, and the subsequent collapses of stock markets.

To detect the connection between such requests, a specially created investment game simulator was used. When the number of search requests decreased, the computer virtually “bought” stocks, and with an increase in the number of requests for “crises” and similar events, closed long positions.

The most reliable for the United States was the word "debt." By tracking markets only on it, scientists increased their hypothetical securities portfolio by 326% in just seven years. When modeling the standard trading strategy, which did not take into account the frequency of search queries, they managed to achieve an increase of only 16%.

In other words, the researchers believe that they have found a connection between what the Internet users who are interested in investing on the stock exchange were interested in, before the moment when they made the final decision to buy or sell.

In addition to Google Trends data, the experiment used, for example, Amazon Mechanical Turk service data.

Researchers suggest that a correlation is found is due to the fact that when any political or important economic events occur, people try to understand what this may mean for the market. They are not sure what will follow after the release of such news, so they begin to look for information that could suggest the right decision.

It is important to note that not the number of “direct” search queries of the form “which way the market will go” increases, but additional materials on the topic of politics or economics.

The paper provides two historical examples confirming this theory. The first is the case of the famous investor Sir James Goldsmith, who managed to sell his shares right before the collapse of 1987. He later said that at some point he simply ceased to understand the market, so he chose to “get out” of it.

The second example - back in 1929, an American businessman, John Kennedy, decided to temporarily leave the market, when a boy engaged in cleaning shoes started talking about the situation on the stock exchange. The entrepreneur reasoned that when there are too many people on the market, including those who really shouldn’t be there, then everything tends to collapse.

Similarly, a large number of searches for information that may be relevant to the situation in the stock market is a signal that the broad masses of network users are interested in them. And this interest indicates the imminent fall of the market - by the time the public “notices” the uptrend, it, as a rule, is already weakening and soon a reversal occurs. Therefore, the emergence of private investors who want to enter the market is a sign of the imminent end of its growth.

Not just the stock market

Such an analysis of the popularity of search queries helps to predict future events not only in the stock market. For example, Google back in 2013 stated that using information about search requests for trailers of outgoing films, it is possible with a probability of 94% to predict the tape's cash register in the first days of hire. Analysis of the number of search queries during the four weeks before release allows us to predict charges on the first weekend with extremely high accuracy.

In addition, the search engine has learned to use the data available to it to predict influenza epidemics . The company's specialists found a correlation between the increase in the number of search requests for symptoms of the disease and the increase in cases of the disease.

Nevertheless, it is not necessary to say that such use of big data allows obtaining guaranteed more accurate predictions - it does not matter whether it is a question of the sphere of finance, film industry or health care. For example, scientists from Harvard and Northeastern University (North Eastern University) stated that Google Trends overestimates the extent of influenza epidemics in the United States. Matt Hobbebe, his co-founder, said that he should be considered as an additional tool to help make a decision, and not as a self-sufficient means of creating forecasts, also agreed with the criticism of the service.

Source: https://habr.com/ru/post/279021/

All Articles