IaaS trends brief

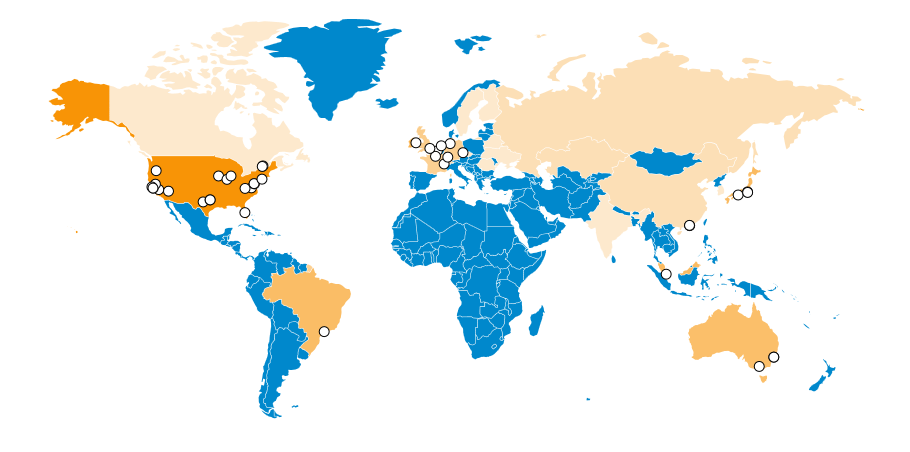

Map of geographical distribution and "density" of PaaS infrastructures. The richer the orange color, the more PaaS offers in the region

With the development of business, the number of applications that companies would like to place in the cloud is complemented by more complex systems, for example, personnel management programs, financial and accounting software. Business is guided by certain data storage requirements, which are caused not only by economic prerequisites, but also by the need to meet industry standards and new laws.

')

In this regard, companies often turn to external suppliers with the intention of placing their data in the cloud.

Cloud technologies can be divided into three service models : infrastructure as a service (IaaS), software as a service ( SaaS ), platform as a service (PaaS). In the case of SaaS, the consumer acquires the ability to use provider applications running in the cloud. Applications are available from various client devices, for example through a browser. According to Gartner, the cumulative average annual growth rate of the SaaS market in 2016 will be 19.5%, and the amount, and the cost of SaaS will reach as much as $ 32.8 billion. However, some suppliers do not offer applications, but immediately launch applications - this solution is called PaaS.

PaaS can be defined as a computing platform that allows a user to create web applications as fast as possible, since he does not need to buy and discuss the software and architecture necessary for this. For example, PaaS can be useful in the case when several developers are working on the project at once. This type of service is becoming quite popular. According to a GigaOm study , only 7% of the respondents answered that they used PaaS in 2011. In 2014, their number was already 41% and continues to increase.

Many PaaS providers use IaaS to manage their infrastructure — according to paasify.it, this number is 43%. IaaS or infrastructure as a service provides the consumer with processing, storage and other basic computing resources for deploying and running arbitrary software (including operating systems and applications). In this case, the client does not manage the underlying cloud physical infrastructure, but it can manage operating systems, storage systems, and applications.

With all these capabilities, IT professionals can quickly allocate the necessary resources, adjusting to the constantly changing needs of the business. IaaS allows you to reduce the deployment time of new applications and eliminate the need to interrupt the work of services in order to carry out equipment maintenance. We discussed specific examples of the use of IaaS for business by Russian entrepreneurs here .

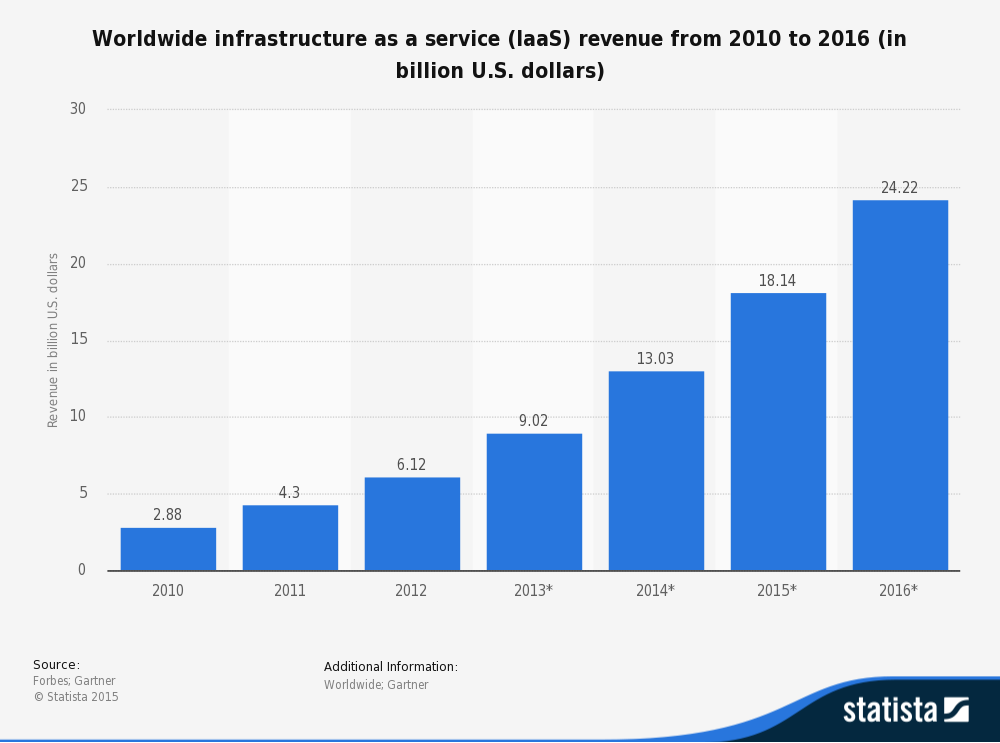

According to Statista.com, market revenues in 2015 amounted to more than $ 18 billion, which is 28% more than a year earlier. According to forecasts, revenues in 2016 will grow by about another 25%.

Revenues IaaS-market in the period from 2010 to 2016

IaaS is quite a young direction and is in a transitional phase, and therefore new competing companies will appear in this area. According to IDC, soon 75% of the proposals of IaaS providers will be revised: new solutions will be proposed or old ones will be changed. About the main trends in the work of data centers in 2016, you can read here .

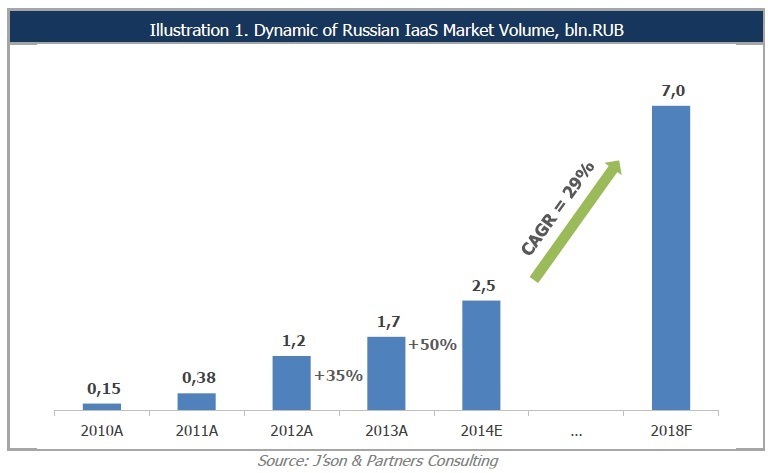

The current economic situation in the Russian Federation is forcing businesses to reduce IT costs — they have to optimize existing projects, postpone planned ones, and reconsider their decisions. It is the desire to minimize costs leads to an increase in the popularity of IT outsourcing. The growth of the currency against the ruble contributes to the fact that many companies are beginning to look for opportunities to place it in the territory of the Russian Federation. This is to some extent affected by the recently adopted Law on Personal Data. According to J'son & Partners Consulting, the volume of the Russian IaaS market will grow to 7 billion rubles by 2018, while in 2014 it was at 2.5 billion. This means that IaaS suppliers should pay special attention to "Iron" in order to keep up with the increasing demand.

Growth of the Russian IaaS market in billion rubles, according to J'son & Partners Consulting

The server hardware market is also experiencing growth. According to Gartner, in the third quarter of 2015, the number of server shipments worldwide increased by 9.2% compared to the same period in 2014. The leader in the global market for the sale of server equipment is HP, which has a market share of 27.3% (3Q 2015). Then the places were distributed as follows: Dell (17.9%), IBM (9.8%), Lenovo (7.9%), Cisco (6.6%), others (30.5%).

PS By the way, not so long ago the modular server Cisco UCS M4308 "arrived" at IT-GRAD . Its peculiarity is that it is designed in accordance with the requirements for resource density and low energy consumption, which is important for parallel and cloud computing.

The M Series uses chassis with eight cartridge slots, the connection between which is done using a third-generation VIC. The UCS M142 cartridges themselves are based on Intel Xeon E3 1275L v3 processors with 8 MB of cache and a frequency of 2.7 GHz and allow you to install up to 32 GB of RAM.

One of the main architectural solutions of the Cisco UCS M4380 server is to separate the CPU and memory blocks from other subsystems. This allows you to increase the number of cores and memory, without installing a new server with power supply, cooling systems, controllers and other components. This approach can be very convenient if the server space is limited and you need to increase capacity.

We also prepared an unboxing post for those who would like to take a look at a more detailed overview of this device.

Source: https://habr.com/ru/post/276803/

All Articles