The most interesting and significant events of 2015 in the field of financial technologies

The post was prepared specifically for the corporate blog PayOnline , a company engaged in organizing payments on websites and in mobile applications, according to Let's Talk Payment.

Fintech's biggest disappointment

Apple pay

The situation around Apple Pay cannot be called a failure or a failure. Rather, it is a simple disappointment caused by extremely low rates of its spread. The launch of the service in autumn 2014 was marked by great news: Apple has once again demonstrated its intention to focus on improving the user experience. No less important was the scale: the company entered into partnership agreements with major financial institutions and US retailers. All this in sum was to guarantee Apple Pay success and wide popularity. The company placed great hopes on the new payment service, according to Tim Cook, its launch was to be the turning point of 2015. And yet a year later it became obvious that he did not become one.

Of course, in a sense, Apple and its partners have done a tremendous job. No other company would be able to involve such a number of large market players in the work on the project, as well as, among other things, give impetus to the use of tokenization and add support for payments using TouchID to applications. In general, the company set the bar high for competitors. However, despite all this, the situation with Apple Pay suggests that the company should pay much more attention to promoting the service, conduct more explanatory work with potential customers and, possibly, expand the functionality of the service, adding to the existing payment acceptance and electronic payment options. checks new.

')

In addition, the service needs tighter integration with assistive technologies, such as location tools and contactless authentication methods. Do not interfere with the opening of the NFC stack for general use, which would allow third-party applications and wallets to use the new solution. All these factors, according to experts, led to such a cool reception of Apple Pay by consumers.

Unexpected Breakthrough of the Year

Crediting

The IPO Lending Club in December 2014 marked the beginning of the rapid growth and development of new players in the lending market. In the forefront of this area are Prosper , SoFi , Lending Circle , Avant Credit - companies that not only benefit from a positive trend, but also themselves make a serious contribution to the development of credit through constant innovation and investment in technology development.

The practice of issuing loans exists almost as much as human civilization itself. However, today we see how the large financial institutions that have earned their reputation, which for the first century did not control this sphere of activity, managed to lose sight of a small group of players. New credit fintech companies are able to offer more suitable, affordable and technologically advanced products that better respond to the needs and desires of the new generation of mobile users. But, despite the growing number of new players, some of whom are even far from the technical sector, the market, apparently, is still far from overflowing.

Return of the year

Large banks

Large old banks are too carried away with their financial games, which young revolutionaries of Fintech took advantage of, who managed to get their market shares thanks to such connivance of banks.

However, the banking sector is far from the only field of activity that finds itself in a similar situation. We know other examples of big and proud players who, through their own fault or objectively, found themselves in the same situation. A vivid example is mobile operators. The difference between them lies in the fact that the latter did not hold out under the weight of their own ideology, while the banks, apparently, on the contrary, were able to accept reality as it is. Many of them quickly learned new techniques, and most of them met a brave new world of open innovation with open arms. This attitude has allowed many large international institutions with a serious reputation to find a way out of the situation and return to the system. The ideological industry leaders who made this happen, namely Barclays, Citi, Wells Fargo, JPMorgan Chase, Santander, BBVA and USAA, honestly deserve our approval.

The most promising direction of the year

Blockchain

Immediately make a reservation: the word "promising" in the title can be easily replaced by "rush." Yes, blockchain is a promising technology, but not yet fully understood. Last year, it was very interesting to observe how quickly and fervently large and well-known organizations supporting traditional methods adopted a communication protocol that completely denied a centralized approach to working with transactions. However, given the way of thinking of many banks and financial institutions, it is clearly not necessary to hasten the conclusions.

In 2015, we also became convinced that the blockchain has the potential to apply not only in the payment market or in the financial sector, but also beyond. People are beginning to better understand the difference between cryptocurrencies and blockchain, even despite the ironic attitude of some critics to attempts to separate these concepts. The dynamics of business activity and the level of dialogue make it easy to call this segment the most promising and to expect something really large from it, even though not everything in it now seems so obvious and understandable.

The most disastrous fintech project of the year

Softcard

Softcard (formerly known as Isis) - a joint project of AT & T, T-Mobile and Verizon, aimed at the wide distribution of NFC payments through the application of the same name. The development and launch of a payment platform that existed for almost 5 years cost the mobile operators that invested in it hundreds of millions of dollars. It all ended with a gesture of goodwill from Google, which “acquired” the failed project in the spring of 2015 for almost nothing. It should be noted that the idea of mobile operators to create a single mobile payment ecosystem, sponsored by them for the entire territory of the United States, requiring the mandatory use of NFC chips in devices, deserves all praise. Unfortunately, the end result of this ambitious undertaking was the closure of the project due to the poor results of its work.

Sigh of relief year

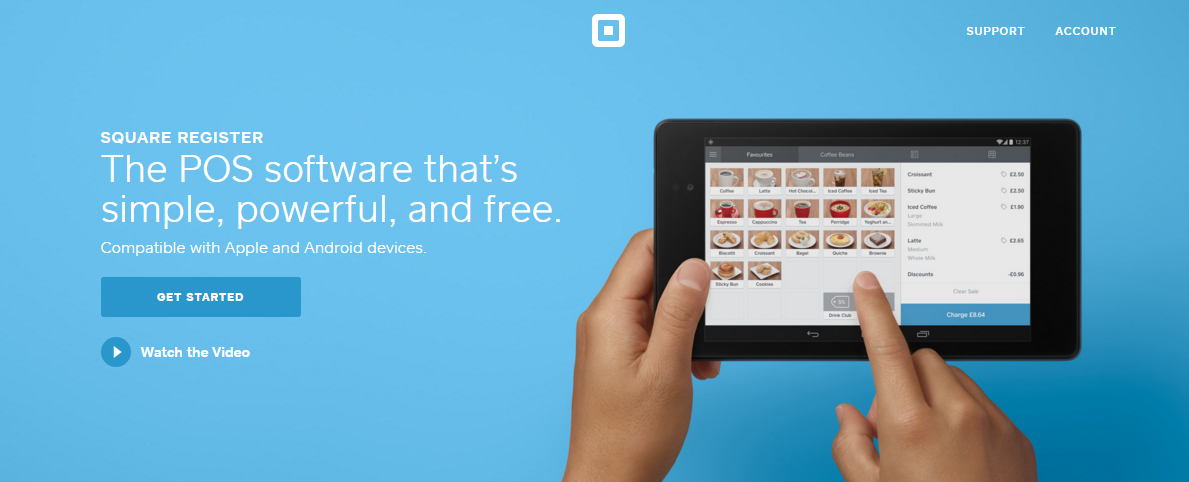

Initial public offering of Square

Square is a company that personified payment innovations and simplified acceptance of payment cards throughout the United States. The founder of this company could attract billions of dollars even without any idea. Many cautiously expected Square to become the next PayPal, while others laughed at her inability to speak the language of the industry. Square went through several lowering rounds and almost decided to change the strategy several times in all these years. All this was before the IPO, which finally occurred in 2015, and now it can give up its place on the pedestal of “Fintech-start-up, which everyone wants to be when they grow up”. Even now, when the company has been listed on the stock exchange, its fate remains uncertain. The IPO was in fact a belated recognition of the important role that Square played in accelerating innovation in the payments market. And, of course, it allowed Jack Dorsey to return to the duties of the CEO of his other company, which, not without the same sigh of relief, went through an IPO 2 years ago.

Fintech region of the year

India

Since the beginning of the year, India has experienced a boom in mobile payment companies and new e-commerce solutions, and events in this market are increasing. In the autumn of 2015, FIBAC, a conference held by the Indian Federation of Chambers of Commerce and Industry and the Association of Banks of India, was held and gathers representatives of the country's largest financial institutions. The latter, by the way, have a clear vision of the market and are working with might and main to implement their plans for cooperation with leading Indian FINTECH companies. The number of startups, their value, the amount of investment attracted in individual rounds, and other indicators suggest that this FINTECH boom in India is not just an attempt to re-implement popular ideas in the US. On the contrary, in most cases we are talking about innovative solutions tailored to the Indian market, taking into account its internal features.

Top fintech companies of the USA under one roof

Early Warning, Payfone, Authentify and clearXchange

Early Warning (EWS) is a joint venture of the largest banks in the United States, which managed, through acquisitions and investments, to collect a stunning collection of assets under the auspices of a single, well-thought-out brand. Each of these companies individually constitutes a well-established business, but this is their combination - just the case when the whole turns out to be more than just the sum of its parts.

The acquisition of Payfone gives EWS mobile authentication technology, while the purchase of Authentify is the best on the market for biometric authentication technology. The acquisition of clearXchange gives EWS the means to make direct transfers to all US banks. In addition, it should also be noted the partnership agreement that the new group of companies entered into with Fiserv, further strengthening its position.

In short, we have a wonderful example of a thoughtfully built association of FINTECH specialists, which has great potential and may even lead to the emergence of a single platform that allows you to make safe and inexpensive mobile money transfers to the accounts of any US banks.

The article has been prepared for publication by PayOnline , an international system for accepting electronic payments on the website and in mobile applications, based on the LTP portal. If you need to organize payment acceptance, feel free to contact. Also subscribe to our corporate blog, there are still many interesting posts ahead.

Source: https://habr.com/ru/post/275621/

All Articles