Audience segmentation when developing games

Competent user segmentation is one of the cornerstones on which the success of the game rests. In this post we will talk about how you can correctly identify the target audience of games on any platform: client, browser, mobile.

This article attempts to provide an overview of the various segmentation criteria and is aimed more at the novice audience of game developers and those interested in game design.

What are the criteria for game designers, analysts and marketers to divide the audience and which segments distinguish?

')

Each segment of the target audience can be described using different numerical characteristics. What is the size of the audience; what is the conversion rate; how easy it is for players to overcome obstacles in order to get into our project; degree of loyalty (retention); the ability to retain the audience (retention and sticky factor) - there are quite a few numerical parameters that we select for each segment. I will not delve into their description. This is already done here . In the same article I will note that the key characteristics of each segment are its ROI (return of investment), LTV (lifetime value) and the size of this segment. Anyway, they partly contain such important criteria as the average income per payer (ARPPU - average revenue per paying user), the share of paying audience in each segment (PU) and retention (audience loyalty).

In fact, the characteristics are much more, and you can select them for each segment in a variety of ways. Retention alone is calculated in dozens of different ways. For example, there is a classic retention, describing the proportion of players who entered the game on a particular day. The classic “seventh day retention” conditionally means that a user who has registered seven days ago has now logged in. There is rolling retention when a user registered a week ago logged in now or in any of the later days. Return retention - when a person registered seven days ago, and came in from the second to the seventh day. There is also a bracket dependent return retention and various scary methods for calculating this characteristic, and for each project it is usually considered in its own way. The topic of calculating retention indicators deserves a separate article.

As noted above, all these characteristics are reduced to two main indicators: lifetime value (lifetime income from the payer) and ROI (return on invested capital). We are more interested in the second parameter, because it takes into account not only the amount of money earned from the player, but also the amount of potential investments in each segment of the audience. If the audience size is very small, and LTV is gigantic, then it probably makes no sense to invest in this audience, because the return will be small simply because of the small size of the target audience. For example, you want to buy a very hardcore audience interested in black and white manga. You have placed banners on thematic sites and in shops and now you are going to start up TV advertising. In such cases, attempts to make additional investments in marketing lead only to a decrease in efficiency, because there are not so many people interested in your topic and you need to work with them more precisely.

In addition to numerical characteristics, there are those that can not be measured in numbers. For example - the amount of required content . Suppose there is some avid player in World of Warcraft, he needs a thousand dungeons, huge battlefields, arenas and much more. And there is a lover of Candy Crush Saga. He needs a thousand levels, although quite simple and similar to each other. For these two players, of course, the volume of content produced is needed completely different.

Graphic style . I will not talk about the Asian market, where they love anime girls with big eyes and breasts of the eighth size, but in different games, depending on their genre and target audience, the graphic style can also be different. And this greatly affects the cost of development. The cost of producing graphics for League of Legends, World of Warcraft and Candy Crush Saga is different. Often the setting style and the genre influence the graphic style, imposing their own requirements. Agree, Call of Duty in anime style will be aimed at a completely different audience than Call of Duty, made in the style of realism.

Gaming opportunities. There are people who with great pleasure will play any kind of "craft", that is, games where you need to create something, produce. Someone is interested in grind and sharpening - the mechanics are quite monotonous. And there are people who want to kill, destroy and dominate. We have to remember that gaming features - features - also have different development costs, and if we have defined the target audience, we should also know which features are suitable for each group.

Now let's remember the demographics . With it, everything is very simple: gender, age, region. It is curious that among the general audience of the Mail.Ru Group there are not so many people under the age of 18. Mostly dominated by more adult, more solvent audience.

Speaking about education , we first of all think about the difference in retention, solvency and preferred genres of our audience. I note that we have not found any significant differences between people with secondary, specialized secondary and incomplete higher education. In terms of profit, these are roughly equivalent groups. But the holders of higher education and schoolchildren are two different groups, both in terms of revenue, and in terms of the size and loyalty of the audience. Speaking of education, everything described in this article, I analyze in detail on the course of game design educational program Management of online gaming projects at the Graduate School of Business Informatics.

When we talk about regional affiliation, we think first of all about the market that has developed in a particular region, its economic characteristics, business conditions and cultural aspects. So, in Africa, the playing audience is small. The Middle East is also not the most interesting region for us.

Just recently, a significant event happened: the volume of the gaming industry in China exceeded the volume of the gaming industry in the USA. Let me remind you that the States were among the first to open the world to the video game industry and have held the championship for many years. ARPPU, the average income from paying, in China and in general in Asia is higher than in America, but the percentage of paying is much lower.

Previously, browser games were one of the notable segments in the revenue structure of the Chinese gaming industry. It is believed that the “iron” among the Chinese population was not powerful enough, which prompted the development of browser games, not client games. Also, legislative bans related to consoles, until recently, prevented the formation of this segment in China. But cheap Android-based mobile phones came to them quickly, so they almost immediately switched to browser games from browser games. Now it is a huge segment of the Chinese market, and it continues to grow in absolute terms.

There are a number of classifications of games by genre. Some prefer the names historically in the gaming industry. Someone uses the terminology developed by the players themselves: shooters, balls, strategies ...

It is important for us that different genres can show different numerical characteristics. The two most interesting are retention and ARPU (average income per player, usually calculated per month).

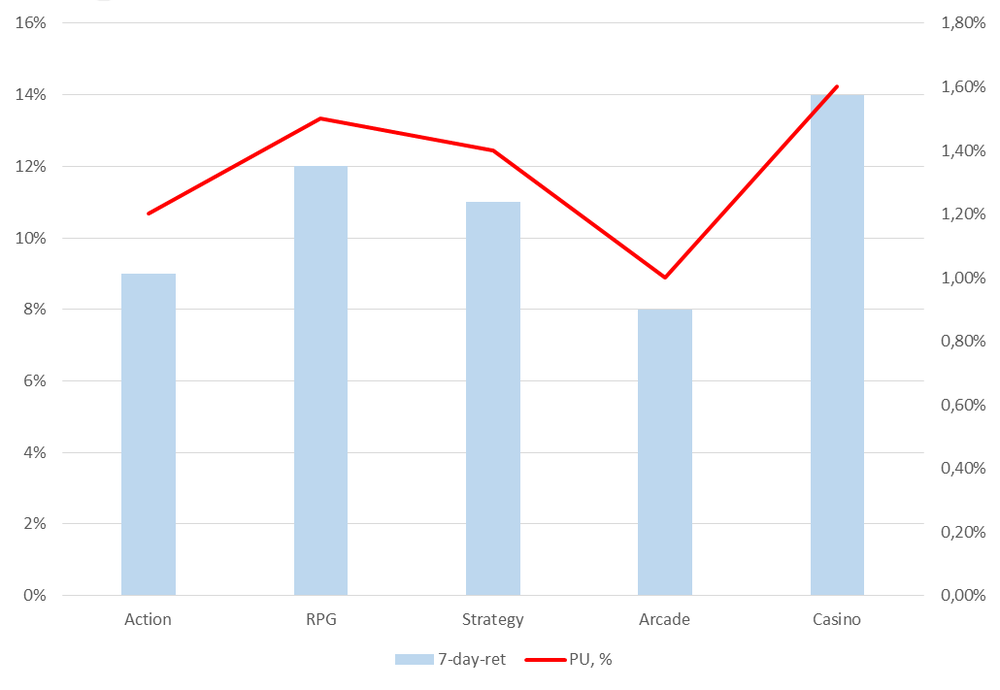

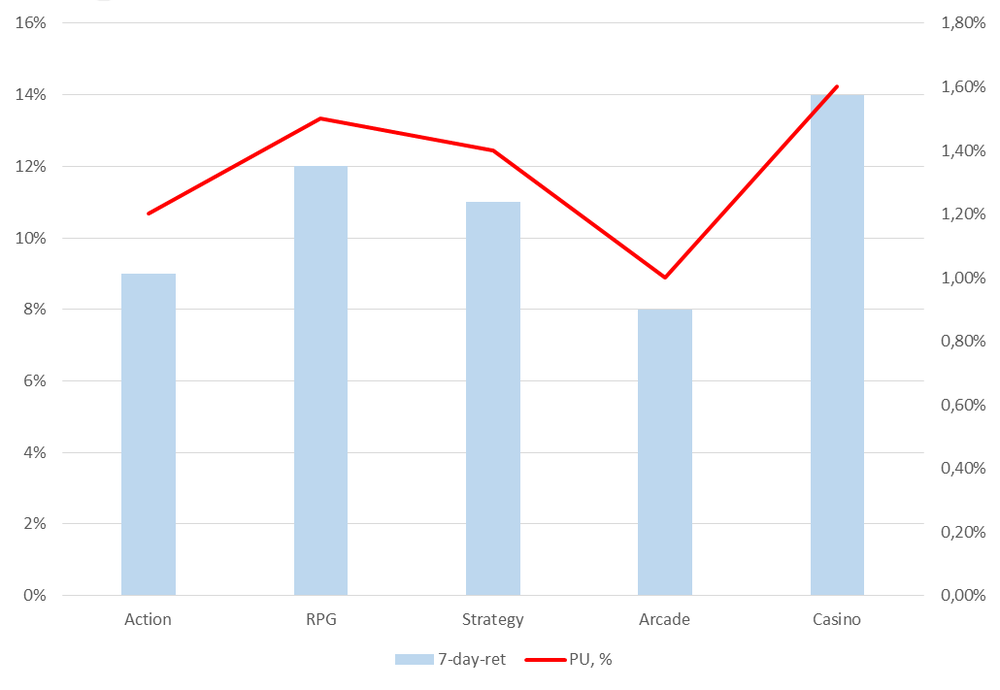

The chart reflects the situation with mobile games. In the left part there is a share, meaning “seven-day retention”, that is, how many people continue to play on the seventh day after registration. The red line refers to the right scale, it is the proportion of those who pay. As you can see, in the arcade genre, for example, minimum levels are both retention and paying. But this does not mean that the arcade is a bad or unnecessary genre for us. More people can play in them, and you can earn enough money on them.

Casino is a very profitable genre. And in social networks it is much more profitable than in the mobile segment. Now many large companies, such as BigFish or Zinga, are actively making money on social casinos, despite the stagnation of social networks as gaming platforms.

Strategy and RPG show very stable results. They have both a share of paying and retention high enough, but the competition in this niche is quite serious. The graph shows average market data, and for many Mail.Ru Group mobile games, the figures are different. For example, from this point of view “Evolution” is something between action and RPG with elements of strategy, there “the retention of the seventh day” reaches 20–25%. Almost twice as high as the market average, as is the size of the average check.

Surely many of you are familiar with Bartle segmentation . Richard Allan Bartle, a professor at the University of Essex, was the first to receive a Ph.D. in game design. For us, it sounds a little weird. He proposed a system of segmentation of players into four psycho types: killers, careerists, social workers, researchers.

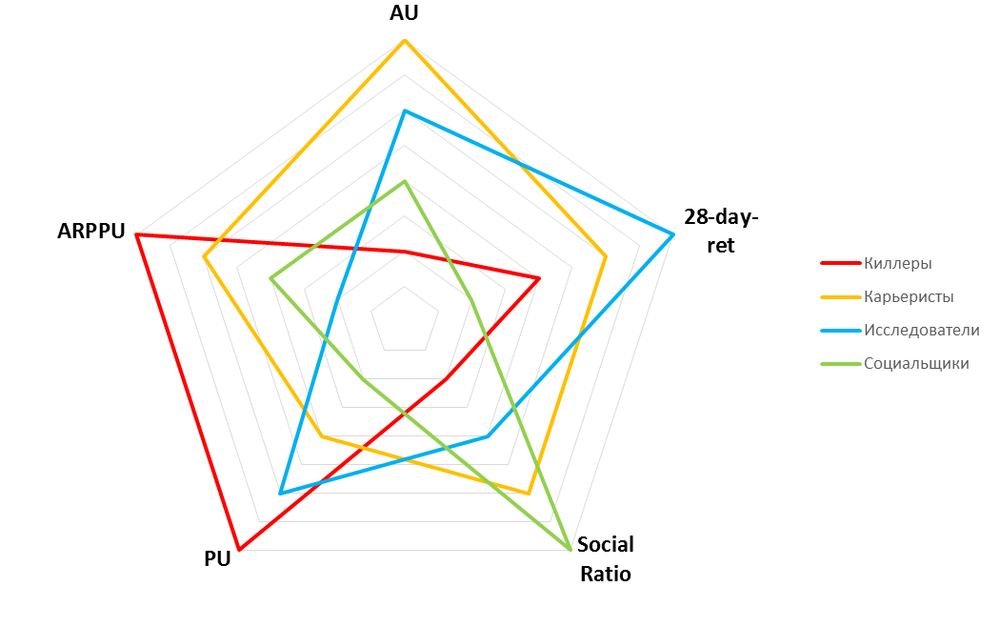

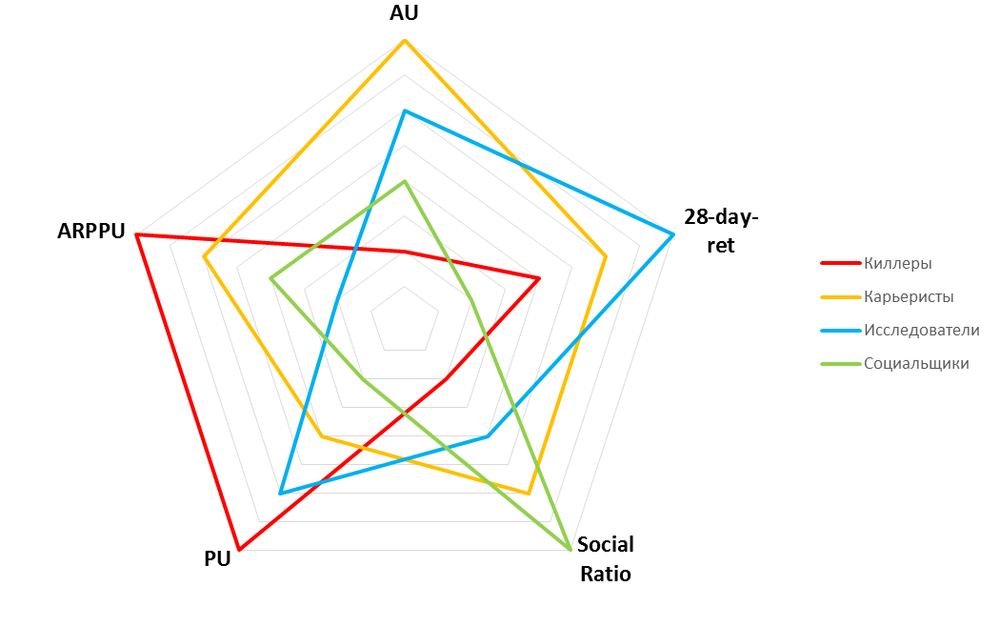

In the context of this post, we are interested primarily in the numerical difference between these psycho-types.

The diagram above shows the ratio of the various parameters of the four psycho-types. Killers are ready to invest the most money in the game. They will stop at nothing, just to buy their Sword of a Thousand Truths and slaughter all the noobs.

In second place careerists. This is a very good audience, there are no pronounced drawdowns in their graphics. They have high ARPPU, and a large audience size. On average, up to 40% of all project players are careerists. In some games, such as Perfect World, there are more than 70% of them.

The most loyal audience is researchers. They have the maximum "retention of the 28th day".

The most viral audience is social workers. They have a huge social ratio - the coefficient of attraction, which describes how actively this audience invites friends to the game. These are people who pay little, ARPPU is lower only among researchers. There are not too many of them. In general, they are not particularly distinguished, with the exception of the viral coefficient.

Virality is very important for us, because each social worker can invite several other players to the game. For example, his killer friend, who will pay us money. Therefore, when developing features, we are trying to cover the whole range of Bartle’s psycho-types.

As you know, Bartle turned out to be a kind and cheerful person: he did not stop at a model of four psycho-types. After it, he developed a system of eight psycho. He added a perpendicular axis to the so-called decision plane by the player, and three-dimensional space was obtained. To "action - interaction" and "players - the world," he added another orientation: "consciously - unconsciously."

In practice, we very rarely use this extended model, because without surveys, without tests, without laboratory research it is impossible to determine whether the player has consciously entered or unconsciously. When we want to understand whether this is a social worker or a killer, then we look at what features he uses. For example, he sits in a chat a lot - +1 point to the "social worker", killed 20 times in the arena - +1 point to the "killer". I greatly exaggerate, but the essence of this division is exactly that. In reality, heuristic models are used. And in the extended system of psycho-types, heuristics do not work.

There are many other segmentation methods, for example the BrainHex model. This model is sometimes used in Asia, it takes into account the emotions experienced by the player. Here six key psycho types are distinguished and the seventh center is a kind of “greed”, as far as they are actively developed.

How to determine with the help of numerical parameters, who is the player - casual wear or hardcore?

First of all, we evaluate the player's skill, that is, how quickly he masters the game, how much he is ready to go to more complex game levels. The hardcore has an S-shaped learning curve. Initially, he needs some overclocking to start playing a game about which he knows nothing. But then he has a high learning potential. The potential of this casual is quite low. He begins to play easily, but cannot attain excellence. Or, frankly, usually does not want.

The fundamental difference between a hardcore and casual player is how much they are willing to dive into the gameplay and “suffer” by understanding complex game mechanics.

We also distinguish the so-called midkor, an intermediate class. Worldwide, 80% of the entire audience are casuals, about 15% are midkor, and the rest are hardcore audiences.

Why are we interested in making games, including those for the remaining 5%? Because they have extremely high retention and ARPPU. There are very few such players, but they pay a lot and have a high degree of loyalty. Midkorschiki less loyal and pay less, but they are three times more. Kazualov is a huge amount, but the profits from each of them are very small, and they change the games like gloves. They can be monetized by advertising or other means.

For example, most of the audience of Clash of Clans is midkor. There is a share of hardcore players who devote a lot of time and energy to the game, and there is a share of casuals, but they don’t stay long in the game.

With Candy Crush Saga, the situation is completely different. The main share of the profits are casuals, there are a lot of them. In second place is hardcore. Candy Crush Saga has a tough hardcore audience that plays many hundreds of levels and donates good money.

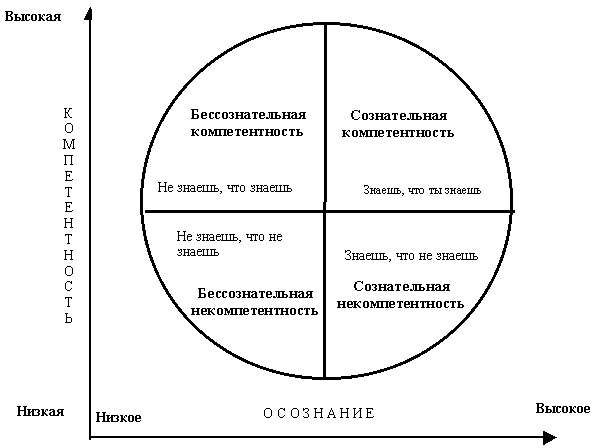

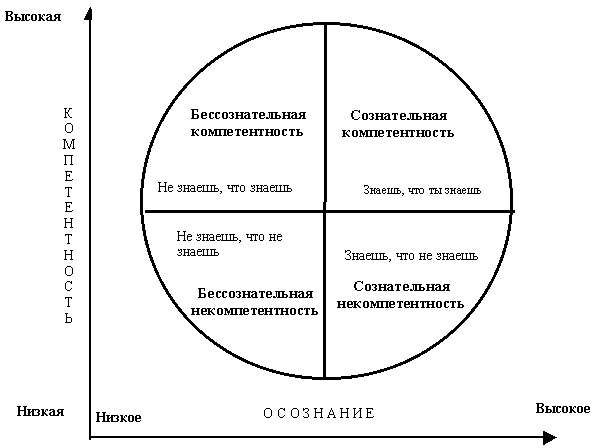

Let's look at the learning cycles. Such models were also used to train KGB officers. When a person first sees something new, in our case - new features in the game, he falls into the realm of unconscious incompetence, unconscious misunderstanding. He does not know what to do and how, he doesn’t know anything about the game at all. After a certain period of development, conscious incompetence comes to him. He understands what knowledge he lacks. This is the very moment when active learning begins. This is where the difference between casual and midcore shows appears. Casuals say: that's all, I do not know and do not intend to develop further. At this their training ends, and they actively play at their level.

Midkorschiki move on. Let's say you never played MMORPG and went to World of Warcraft. Then they realized that there are abilities, talents, factions, quests and a lot of things, but you are still too lazy to understand this, or just too much information. So you went to the second stage. If you figured it all out, learned all the features of the game, built your talent tree and feel you are a good player, then you are in the realm of conscious competence. You understand what and how to do.

Finally, when you work on all your skills to the point of automatism, you move into the area of unconscious competence, like special forces soldiers, e-sportsmen or schoolchildren in Dota. :)

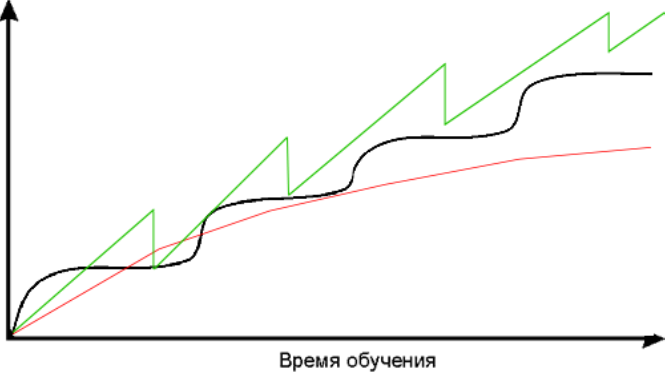

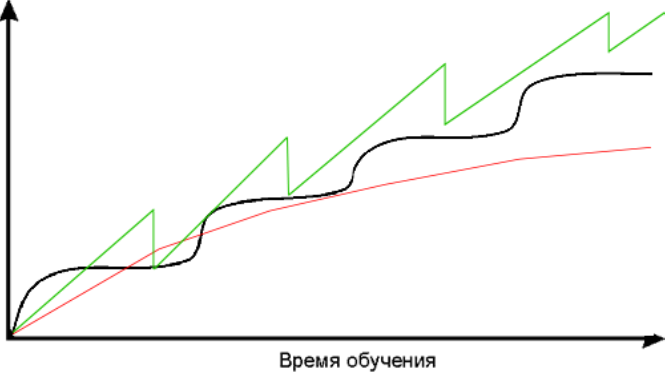

Almost the entire balance of any game in which there is development and content is built on learning curves. Initially, everyone thought that the learning curve should look like a straight line, that is, constantly increasing pressure on the player. Then the developers changed the nature of the ever-increasing pressure up to logarithmic.

How is the learning curve constructed? Roughly speaking, this is the ratio of the complexity of mastering to the time spent. And the complexity can be expressed both by the lack of resources, the duration of the achievement of the goal, and in many other ways.

The developers gradually moved away from the model of a constant increase in pressure on the player and began to simply bring him to a certain maximum level. But it turned out that people are not interested. Then a new learning curve was tested.

A person gets into one area, trains, sharpens skills, meets new complexity, and so on. But some games went even further. For example, the Candy Crush Saga uses a sawtooth curve of complexity.

Its developers believe that, besides constant learning and growth of skills, there must be a moment when the user again becomes easy and simple to play. Match-3, clickers and many other games also use this approach. How is this done in Candy Crush Saga? At the development stage, an analyst is compiled that is responsible for both the configuration of the levels and the order in which the candies fall out. This order is subject to certain laws, so opaque that the player can not distinguish it from complete randomness. . «» , , «», . « -», . : « , , … , . , , - ». , , , , . .

? - , . — . — . , . , .

- . , . - . , , . .

, . , . — retention, , , , , , . - , . .

.

, «-» « » : , .

: (), , .

— , 2,5%. , - , , . , , . :) - , — , ~13,5%. , .

Apple, , . , . , . .

, , , . iPhone — iPhone. , , , , . , , , . , — , - Nokia .

. — Candy Crush Saga Clash of Clans. Candy Crush Saga , , . . Candy Crush Saga King 200 , , . Match-3, . — « ». . Candy Crush Saga, . , .

. , 2013 King Candy Crush Saga 2,2 . : — 1,6 . 2,2 1,7 . , ? . . 2014 . . 2014 1,8 . 2015 , 1,5 . , « ». :)

— Supercell Clash of Clans. . Clash of Clans , . city builder tower defence , — Clash of Clans. Clash of Clans. , . Clash of Clans. 2015 , Clash of Clans .

, .

.

, , «». : 0,5% , 1000 . «», .

, , «», «» , . , FarmVille, , ARPPU «» — 90 . Heroes Charge — 240 .

. , , . ARPPU , .

, , . , — , — . Nothing like this. , Dota 2 — . . , . 10% , — 15–20%. . , , .

, gacha (, , ). . : , « ».

Free-to-play , — Pay-to-play. , , , World of Warcraft. Freemium, Free-to-play -. Freemium .

. , — . 4% . 18 , 12%. .

, , , — . - . , , « ».

— . , , « », « ». .

, .

This article attempts to provide an overview of the various segmentation criteria and is aimed more at the novice audience of game developers and those interested in game design.

Criteria

What are the criteria for game designers, analysts and marketers to divide the audience and which segments distinguish?

')

- The simplest is on the demographic principle . Everything is clear without explanation.

- Preferred genres . This item is typical for games, movies, for entertainment. If we are talking about users of online stores, it will be difficult to determine their genre preferences.

- Behavioral features . This refers to the so-called psycho. There are a certain number of models, according to which players are divided into psychological types.

- Casual A very popular term that contrasts "hardcore" and "casual". This is a qualitative characteristic that is difficult to express numerically.

- Adoption of innovation . The attitude of players to new features, features and gameplay types. This is important when choosing a target audience and defining gameplay.

- Solvency . As you understand, this is an important moment for any developer. :)

Numerical characteristics

Each segment of the target audience can be described using different numerical characteristics. What is the size of the audience; what is the conversion rate; how easy it is for players to overcome obstacles in order to get into our project; degree of loyalty (retention); the ability to retain the audience (retention and sticky factor) - there are quite a few numerical parameters that we select for each segment. I will not delve into their description. This is already done here . In the same article I will note that the key characteristics of each segment are its ROI (return of investment), LTV (lifetime value) and the size of this segment. Anyway, they partly contain such important criteria as the average income per payer (ARPPU - average revenue per paying user), the share of paying audience in each segment (PU) and retention (audience loyalty).

In fact, the characteristics are much more, and you can select them for each segment in a variety of ways. Retention alone is calculated in dozens of different ways. For example, there is a classic retention, describing the proportion of players who entered the game on a particular day. The classic “seventh day retention” conditionally means that a user who has registered seven days ago has now logged in. There is rolling retention when a user registered a week ago logged in now or in any of the later days. Return retention - when a person registered seven days ago, and came in from the second to the seventh day. There is also a bracket dependent return retention and various scary methods for calculating this characteristic, and for each project it is usually considered in its own way. The topic of calculating retention indicators deserves a separate article.

As noted above, all these characteristics are reduced to two main indicators: lifetime value (lifetime income from the payer) and ROI (return on invested capital). We are more interested in the second parameter, because it takes into account not only the amount of money earned from the player, but also the amount of potential investments in each segment of the audience. If the audience size is very small, and LTV is gigantic, then it probably makes no sense to invest in this audience, because the return will be small simply because of the small size of the target audience. For example, you want to buy a very hardcore audience interested in black and white manga. You have placed banners on thematic sites and in shops and now you are going to start up TV advertising. In such cases, attempts to make additional investments in marketing lead only to a decrease in efficiency, because there are not so many people interested in your topic and you need to work with them more precisely.

Qualitative characteristics

In addition to numerical characteristics, there are those that can not be measured in numbers. For example - the amount of required content . Suppose there is some avid player in World of Warcraft, he needs a thousand dungeons, huge battlefields, arenas and much more. And there is a lover of Candy Crush Saga. He needs a thousand levels, although quite simple and similar to each other. For these two players, of course, the volume of content produced is needed completely different.

Graphic style . I will not talk about the Asian market, where they love anime girls with big eyes and breasts of the eighth size, but in different games, depending on their genre and target audience, the graphic style can also be different. And this greatly affects the cost of development. The cost of producing graphics for League of Legends, World of Warcraft and Candy Crush Saga is different. Often the setting style and the genre influence the graphic style, imposing their own requirements. Agree, Call of Duty in anime style will be aimed at a completely different audience than Call of Duty, made in the style of realism.

Gaming opportunities. There are people who with great pleasure will play any kind of "craft", that is, games where you need to create something, produce. Someone is interested in grind and sharpening - the mechanics are quite monotonous. And there are people who want to kill, destroy and dominate. We have to remember that gaming features - features - also have different development costs, and if we have defined the target audience, we should also know which features are suitable for each group.

Demography

Now let's remember the demographics . With it, everything is very simple: gender, age, region. It is curious that among the general audience of the Mail.Ru Group there are not so many people under the age of 18. Mostly dominated by more adult, more solvent audience.

Speaking about education , we first of all think about the difference in retention, solvency and preferred genres of our audience. I note that we have not found any significant differences between people with secondary, specialized secondary and incomplete higher education. In terms of profit, these are roughly equivalent groups. But the holders of higher education and schoolchildren are two different groups, both in terms of revenue, and in terms of the size and loyalty of the audience. Speaking of education, everything described in this article, I analyze in detail on the course of game design educational program Management of online gaming projects at the Graduate School of Business Informatics.

When we talk about regional affiliation, we think first of all about the market that has developed in a particular region, its economic characteristics, business conditions and cultural aspects. So, in Africa, the playing audience is small. The Middle East is also not the most interesting region for us.

Just recently, a significant event happened: the volume of the gaming industry in China exceeded the volume of the gaming industry in the USA. Let me remind you that the States were among the first to open the world to the video game industry and have held the championship for many years. ARPPU, the average income from paying, in China and in general in Asia is higher than in America, but the percentage of paying is much lower.

Previously, browser games were one of the notable segments in the revenue structure of the Chinese gaming industry. It is believed that the “iron” among the Chinese population was not powerful enough, which prompted the development of browser games, not client games. Also, legislative bans related to consoles, until recently, prevented the formation of this segment in China. But cheap Android-based mobile phones came to them quickly, so they almost immediately switched to browser games from browser games. Now it is a huge segment of the Chinese market, and it continues to grow in absolute terms.

Preferred game genres

There are a number of classifications of games by genre. Some prefer the names historically in the gaming industry. Someone uses the terminology developed by the players themselves: shooters, balls, strategies ...

It is important for us that different genres can show different numerical characteristics. The two most interesting are retention and ARPU (average income per player, usually calculated per month).

The chart reflects the situation with mobile games. In the left part there is a share, meaning “seven-day retention”, that is, how many people continue to play on the seventh day after registration. The red line refers to the right scale, it is the proportion of those who pay. As you can see, in the arcade genre, for example, minimum levels are both retention and paying. But this does not mean that the arcade is a bad or unnecessary genre for us. More people can play in them, and you can earn enough money on them.

Casino is a very profitable genre. And in social networks it is much more profitable than in the mobile segment. Now many large companies, such as BigFish or Zinga, are actively making money on social casinos, despite the stagnation of social networks as gaming platforms.

Strategy and RPG show very stable results. They have both a share of paying and retention high enough, but the competition in this niche is quite serious. The graph shows average market data, and for many Mail.Ru Group mobile games, the figures are different. For example, from this point of view “Evolution” is something between action and RPG with elements of strategy, there “the retention of the seventh day” reaches 20–25%. Almost twice as high as the market average, as is the size of the average check.

Psychological types

Surely many of you are familiar with Bartle segmentation . Richard Allan Bartle, a professor at the University of Essex, was the first to receive a Ph.D. in game design. For us, it sounds a little weird. He proposed a system of segmentation of players into four psycho types: killers, careerists, social workers, researchers.

In the context of this post, we are interested primarily in the numerical difference between these psycho-types.

The diagram above shows the ratio of the various parameters of the four psycho-types. Killers are ready to invest the most money in the game. They will stop at nothing, just to buy their Sword of a Thousand Truths and slaughter all the noobs.

In second place careerists. This is a very good audience, there are no pronounced drawdowns in their graphics. They have high ARPPU, and a large audience size. On average, up to 40% of all project players are careerists. In some games, such as Perfect World, there are more than 70% of them.

The most loyal audience is researchers. They have the maximum "retention of the 28th day".

The most viral audience is social workers. They have a huge social ratio - the coefficient of attraction, which describes how actively this audience invites friends to the game. These are people who pay little, ARPPU is lower only among researchers. There are not too many of them. In general, they are not particularly distinguished, with the exception of the viral coefficient.

Virality is very important for us, because each social worker can invite several other players to the game. For example, his killer friend, who will pay us money. Therefore, when developing features, we are trying to cover the whole range of Bartle’s psycho-types.

As you know, Bartle turned out to be a kind and cheerful person: he did not stop at a model of four psycho-types. After it, he developed a system of eight psycho. He added a perpendicular axis to the so-called decision plane by the player, and three-dimensional space was obtained. To "action - interaction" and "players - the world," he added another orientation: "consciously - unconsciously."

In practice, we very rarely use this extended model, because without surveys, without tests, without laboratory research it is impossible to determine whether the player has consciously entered or unconsciously. When we want to understand whether this is a social worker or a killer, then we look at what features he uses. For example, he sits in a chat a lot - +1 point to the "social worker", killed 20 times in the arena - +1 point to the "killer". I greatly exaggerate, but the essence of this division is exactly that. In reality, heuristic models are used. And in the extended system of psycho-types, heuristics do not work.

There are many other segmentation methods, for example the BrainHex model. This model is sometimes used in Asia, it takes into account the emotions experienced by the player. Here six key psycho types are distinguished and the seventh center is a kind of “greed”, as far as they are actively developed.

Degree of causality

How to determine with the help of numerical parameters, who is the player - casual wear or hardcore?

First of all, we evaluate the player's skill, that is, how quickly he masters the game, how much he is ready to go to more complex game levels. The hardcore has an S-shaped learning curve. Initially, he needs some overclocking to start playing a game about which he knows nothing. But then he has a high learning potential. The potential of this casual is quite low. He begins to play easily, but cannot attain excellence. Or, frankly, usually does not want.

The fundamental difference between a hardcore and casual player is how much they are willing to dive into the gameplay and “suffer” by understanding complex game mechanics.

We also distinguish the so-called midkor, an intermediate class. Worldwide, 80% of the entire audience are casuals, about 15% are midkor, and the rest are hardcore audiences.

Why are we interested in making games, including those for the remaining 5%? Because they have extremely high retention and ARPPU. There are very few such players, but they pay a lot and have a high degree of loyalty. Midkorschiki less loyal and pay less, but they are three times more. Kazualov is a huge amount, but the profits from each of them are very small, and they change the games like gloves. They can be monetized by advertising or other means.

For example, most of the audience of Clash of Clans is midkor. There is a share of hardcore players who devote a lot of time and energy to the game, and there is a share of casuals, but they don’t stay long in the game.

With Candy Crush Saga, the situation is completely different. The main share of the profits are casuals, there are a lot of them. In second place is hardcore. Candy Crush Saga has a tough hardcore audience that plays many hundreds of levels and donates good money.

Training

Let's look at the learning cycles. Such models were also used to train KGB officers. When a person first sees something new, in our case - new features in the game, he falls into the realm of unconscious incompetence, unconscious misunderstanding. He does not know what to do and how, he doesn’t know anything about the game at all. After a certain period of development, conscious incompetence comes to him. He understands what knowledge he lacks. This is the very moment when active learning begins. This is where the difference between casual and midcore shows appears. Casuals say: that's all, I do not know and do not intend to develop further. At this their training ends, and they actively play at their level.

Midkorschiki move on. Let's say you never played MMORPG and went to World of Warcraft. Then they realized that there are abilities, talents, factions, quests and a lot of things, but you are still too lazy to understand this, or just too much information. So you went to the second stage. If you figured it all out, learned all the features of the game, built your talent tree and feel you are a good player, then you are in the realm of conscious competence. You understand what and how to do.

Finally, when you work on all your skills to the point of automatism, you move into the area of unconscious competence, like special forces soldiers, e-sportsmen or schoolchildren in Dota. :)

Almost the entire balance of any game in which there is development and content is built on learning curves. Initially, everyone thought that the learning curve should look like a straight line, that is, constantly increasing pressure on the player. Then the developers changed the nature of the ever-increasing pressure up to logarithmic.

How is the learning curve constructed? Roughly speaking, this is the ratio of the complexity of mastering to the time spent. And the complexity can be expressed both by the lack of resources, the duration of the achievement of the goal, and in many other ways.

The developers gradually moved away from the model of a constant increase in pressure on the player and began to simply bring him to a certain maximum level. But it turned out that people are not interested. Then a new learning curve was tested.

A person gets into one area, trains, sharpens skills, meets new complexity, and so on. But some games went even further. For example, the Candy Crush Saga uses a sawtooth curve of complexity.

Its developers believe that, besides constant learning and growth of skills, there must be a moment when the user again becomes easy and simple to play. Match-3, clickers and many other games also use this approach. How is this done in Candy Crush Saga? At the development stage, an analyst is compiled that is responsible for both the configuration of the levels and the order in which the candies fall out. This order is subject to certain laws, so opaque that the player can not distinguish it from complete randomness. . «» , , «», . « -», . : « , , … , . , , - ». , , , , . .

? - , . — . — . , . , .

- . , . - . , , . .

, . , . — retention, , , , , , . - , . .

.

- -, , / .

- -, . , . «» , , 6–7 , 3–5 . . -, -, .

, «-» « » : , .

: (), , .

— , 2,5%. , - , , . , , . :) - , — , ~13,5%. , .

Apple, , . , . , . .

, , , . iPhone — iPhone. , , , , . , , , . , — , - Nokia .

. — Candy Crush Saga Clash of Clans. Candy Crush Saga , , . . Candy Crush Saga King 200 , , . Match-3, . — « ». . Candy Crush Saga, . , .

. , 2013 King Candy Crush Saga 2,2 . : — 1,6 . 2,2 1,7 . , ? . . 2014 . . 2014 1,8 . 2015 , 1,5 . , « ». :)

— Supercell Clash of Clans. . Clash of Clans , . city builder tower defence , — Clash of Clans. Clash of Clans. , . Clash of Clans. 2015 , Clash of Clans .

, .

.

- , . . 90%, 97%.

- — , 8%. 1,5–2%. . 5% . : , «» 15% . 7–10%. , «», .

- , , — . , , «», «» «». «» -, . , 15–30% . «» , «» . , , .

, , «». : 0,5% , 1000 . «», .

, , «», «» , . , FarmVille, , ARPPU «» — 90 . Heroes Charge — 240 .

. , , . ARPPU , .

, , . , — , — . Nothing like this. , Dota 2 — . . , . 10% , — 15–20%. . , , .

, gacha (, , ). . : , « ».

Free-to-play , — Pay-to-play. , , , World of Warcraft. Freemium, Free-to-play -. Freemium .

. , — . 4% . 18 , 12%. .

, , , — . - . , , « ».

— . , , « », « ». .

, .

Source: https://habr.com/ru/post/274263/

All Articles