Speed chase: 4 ways to reduce delays when trading on the stock exchange

In the past few years, high-frequency trading has become widespread on stock exchanges around the world. Traders using this approach, apply strategies and algorithms for the success of which requires a high speed of receiving, processing and sending data to the exchange trading system.

Often, an extra millisecond can lead to the loss of a trader instead of a profit, because someone else has outpaced his trading robot. The pursuit of speed and financial results that are at stake have led to the active development of various technologies to reduce trade delays. Today we look at some of them.

')

Direct access to the exchange

For trading on the stock exchange, the investor must enter into an agreement with a broker who already provides access to trading. Usually, such companies also develop their own trading systems, in which customer requests are processed before being sent to the core of the exchange system. However, in a situation where everything can be solved within a few milliseconds, the “user-brokerage system — exchange” scheme is not for everyone.

To remove the “extra link” in the form of a brokerage system, a technology has been created for direct access to the exchange (DMA, direct market access). Its essence lies in the fact that the application is placed directly in the trading system of the exchange, bypassing the broker's infrastructure.

All this allows you to get a serious gain in time - for example, the speed of distribution of market data increases several times, which allows you to respond faster to the situation on the market. Also, when an order passes through a broker’s trading system, its processing time increases. It is still a matter of very short periods of time from the point of view of a person, but for some trading strategies such a difference can be critical and affect their overall performance.

About the direct connection in our blog was a separate material , to find out which protocols you can get such access through ITinvest, please click here .

Placement of equipment and virtual machines "near" with the exchange

Direct access to the exchange allows you to logically “bring” the trading system to the core of the exchange, but it is obvious that you can get even greater speed gains by placing it and physically closer to this end point. As a rule, exchanges provide equipment collocation service in their data centers - in this case, the trading system can be run on a server that is actually in the same rack with the servers of the exchange core.

In the case of the Moscow Exchange, this possibility is also available - dedicated servers and virtual machines can be placed in the free colocation zone (see below) and directly in the exchange collocation zone in the data center M1.

Placing in the colocation area of the exchange allows you to connect trading robots directly to the stock exchange core. Also in this area is available market data acquisition (Market Data) using the FAST protocol (we wrote about it here ). The advantage of using a free colocation zone is the fact that this option is much cheaper. But if we talk about the pursuit of speed, high-frequency traders choose the fastest option, despite the fact that it can sometimes be the most expensive.

ITinvest helps its customers organize the placement of equipment for the two scenarios described - read more about this here .

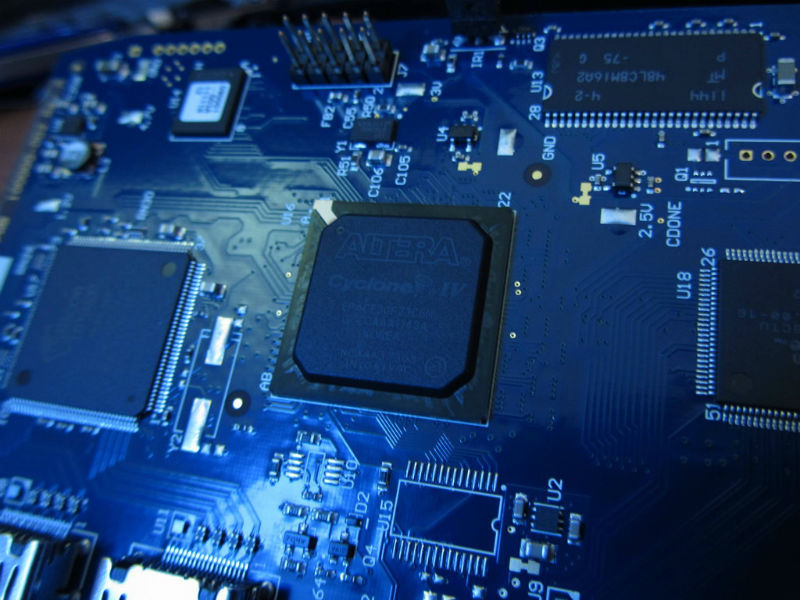

Hardware Acceleration (FPGA)

In the past few years, the use of FPGA to reduce delays in the operation of trading applications has become common among algo-traders. With the help of modern FPGA, you can implement various aspects of high-speed trading systems - for example, the processing of market data can be carried out entirely on the FPGA, without transferring them to the processor of the machine. Below are the differences in data processing between the FPGA and the conventional software platform.

The use of programmable hardware allows you to get a serious gain in processing speed and reduce delays, however, there are some difficulties. First of all, they include the complexity of developing and supporting trading applications that use FPGA - to interact with hardware, traders need to master not only high-level programming languages, but also the so-called hardware description languages. Also, do not forget about the need for additional spending on the equipment itself.

In our previous article, we discussed in detail the FPGA technology and possible implementations of libraries using it.

New data transmission technologies: microwaves and lasers

The most important component of success in high-frequency trading is the speed of data transmission. Market players are actively looking for various ways to optimize it, which leads to the development of technologies such as, for example, data transmission using microwave radiation. Despite certain drawbacks - instability to rain and fog, limited bandwidth - it allows you to send data directly. In other words, there is no need to run the fiber optic cable through the mountains, you can simply install the antennas on the towers and find the shortest distance between point A and B. Thus, applications can be transmitted through the air faster than via fiber.

Such technologies are quite expensive, but the possible financial return from their use is so great that many HFT companies invest millions in building their own microwave networks. Our blog published the story of a Belgian researcher about the location of the microwave towers of HFT companies in European cities - you can read it here (links to the first parts are located in the hacker).

However, the use of microwaves for data transmission is not the only innovation. As the Wall Street Journal wrote back in 2014, the next technological breakthrough in this area could be the creation of data networks using lasers. According to journalists, HFT companies have already agreed to create a similar network to work with the Nasdaq exchange,

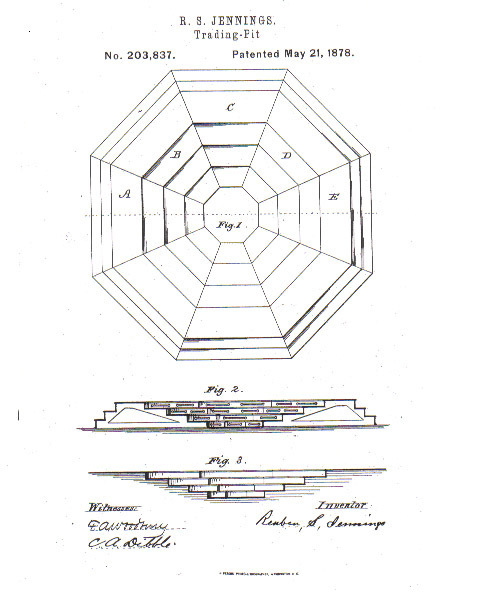

Conclusion: Circles of History

In fact, the pursuit of speed in the business of trading on the stock exchange has always existed; HFT traders are not pioneers here. In the pre-digital era, the heart of the exchange was a pit - and it was there that the posterior achievements of technology at that time were concentrated. The first exchange hole was patented by Ruben S. Jennings in 1878 - he designed the hole so that traders could see and hear other traders in the best possible way. Therefore, there were several steps in the pit, which means that the trader on the topmost level had the best overview, and also had the advantage of being able to easily see and hear colleagues. All this allowed to carry out transactions faster. Even then, the speed in the bidding played a very serious role.

Since it was necessary to be physically superior to other traders in order to gain an advantage in speed, growth began to play an important role in reducing delays. Because of this, former basketball players often became traders before: they were easier to spot. Already at the end of the twentieth century, some traders in the pits wore high heels to be taller and carry out transactions faster.

This led to problems — for example, falls due to a lack of balance. As a result, the Chicago Stock Exchange was even forced in November 2000 to decide on setting the maximum height of the heel and / or platform to two inches (a little more than 5 centimeters), and for example, on the London Metal Exchange there is still a rule , according to which transactions can be concluded only sitting.

The introduction of such standards was one of the ways to equalize the chances on the trading floor in terms of speed of work in the stock exchange hall, but in the end, there was always someone who would be ahead of the competition. Those traders who were most successful in reducing delays in trading earned the inefficiencies of the then existing system, in which, for example, growth could give a big advantage.

As a result of their work, these inefficiencies gradually leveled off - somewhere by the introduction of regulatory rules, somewhere by the very course of history - for example, the computerization of the exchanges itself made the desire to be physically above all irrelevant.

The same thing is happening today with high-frequency trading - traders using this approach find inefficiencies in the financial system, earn money by trying to outrun their own kind (which can sometimes lead to large-scale disruptions, like Black Monday ), and ultimately make the market more sustainable.

Source: https://habr.com/ru/post/272525/

All Articles