Payment conversion: 4 reasons that reduce the success of payment on your site and how to eliminate them

Friends,

Today we want to talk about the conversion of payments. What it is? What are the reasons for most failures? How to optimize the permeability of payments?

')

Different people consider conversion differently: by passability of payments (the ratio of successful payments to the total number of attempts), by the number of orders successfully paid (regardless of the number of attempts required for successful payment), and even - in especially difficult cases - by the number of transitions on the payment form. We consider the first option - for us, as for a payment gateway, the passability indicator of payments is the most important and amenable to optimization on our part.

Payment conversion is the number of successful payments from the total number of transactions. The conversion of payments can and should be analyzed, it can be optimized and, depending on the technological capabilities of the payment gateway, can be brought to maximum efficiency.

The “average for the hospital” of Russian ecommerce level of payment conversion ranges from 60 to 75%, in Payler this indicator is in the range of 85-96%. According to our statistics, failures most often occur for the following reasons:

- 3D-S authorization errors (the user did not enter the code / entered with an error, the code did not come, the 3D-S authorization page did not open). This is the most common cause of failure. It accounts for up to 42-45% of failures.

- The operation was rejected by the issuing bank / acquiring bank. The share of this error accounts for about 29-33% of failures.

- The buyer shows suspicious activity and is blocked by antifraud systems. From 18 to 25% of failures occur for this reason.

- Buyer errors. The rarest reason is only 3-4% of failures.

Most of these problems arise from insufficient flexibility / insufficient technical capacity of the payment gateway. At Payler, depending on the specifics of the business, we offer our customers the following solutions:

- Disable / vary the level of 3D-S. To reduce the percentage of failures due to 3D-S authorization errors, you can either turn off the 3D-S completely, or set more benign settings. For example, set limits on the amount and number of payments - while the user can pay without a 3D-S purchase for an amount less than the established limit (as a rule, the amount is within a few thousand rubles). You can also request 3D-S only from transactions from a specific list of countries.

- Manual anti-fraud settings. For example, to allow payments if the IP address and the country of issue of the card do not match - most payment gateways automatically reject such transactions, but the manual settings allow you to find the best balance between conversion and security.

- Routing requests. The ability of the payment gateway to conduct on-us transactions in which the issuing bank acts as an acquiring bank is practically a guarantee that the lion’s share of potentially unsuccessful payments will still be authorized.

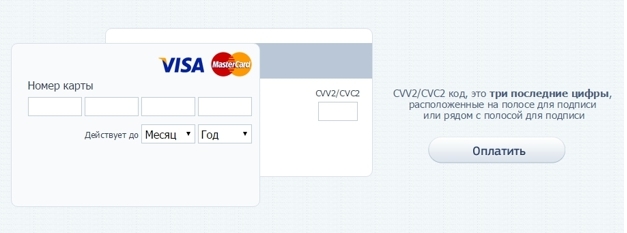

- Customization of the payment form. At this point we want to dwell. Everyone knows that the payment form should be as user-friendly as possible, but for some reason there are still such options:

And here is what a customized payment form of one of our merchants looks like:

The user is most likely to make a successful payment, if the payment form will help him in this. Breakdown of the field for entering the card number into blocks of four digits with automatic transfer of the cursor to the next block, visual simulation of a bank card, the absence of unnecessary fields (the name of the cardholder is unnecessary information, getting rid of this field affects conversion only positively) and hints at each stage payment form - these simple recommendations are suitable for almost all areas of activity.

Conversion and risks

In theory, the payment gateway can completely disable 3D-S and set up such anti-fraud settings that the conversion will strive for 100%. But you need to understand that these are risks, first of all for the merchant himself (chargeback is not a toy). Also, the payment gateway itself and the acquiring bank are subject to risks. Therefore, the main task in optimizing the patency of payments, we set finding a balance. Below we have arranged the most common categories of activity in order to reduce their riskiness:

- High-risk. Semi-legal and illegal content. Here the risks are maximal and those madmen who still decide to turn off 3D-S and the gentle setting of antifraud filters tend to compensate for their risks with overhead rates for maintenance.

- Ecommerce (physical goods). In the case of the sale of physical goods - gadgets, parts and other goods that can be quickly resold, the risks are maximum. Filters come to the rescue with restrictions on the amount / number of purchases, countries.

- Ecommerce (non-physical goods). When selling legal content, subscriptions, cloud services and other services, access to which can be limited at the first suspicion of fraud, the number of fraud requests is sharply reduced - here we can completely disable 3D-S, or connect recurrences and set the most flexible anti-fraud settings.

- Housing and public utilities, state and municipal services. Here the risks are minimal. In our practice, not a single scammer has attempted to pay utility bills or fines from a stolen card.

Any problem has its solution. The task of the payment gateway in the matter of optimizing the conversion of payments is to find an individual solution, without going beyond the threshold of acceptable risks.

We are happy to answer your questions in the comments or in the mail - hello@payler.com

With love,

your payler

Source: https://habr.com/ru/post/272091/

All Articles