Automation: how we, 10 people, manage an asset worth billions of dollars - IT protection from people and operational risks

In 2009, they decided to make Russia an international financial center with a strong will. Here, as with any hackathon: for it to become international, for example, you must invite a Belarusian. Actually, just in 2009, it was for securities from the Republic of Belarus that the laws were changed.

Our lawyers hackers discovered a bug and came with burning eyes with the words that we can actually directly trade in western indices. Then nobody did this. Why it is important and cool - just below. In short, after discussing with the state regulator, it turned out that this is not a bug, but a feature.

')

Then there were trips to London, Singapore, New York and Tokyo. Polite people in ties listened to us, searched for Russia on the map of financial flows (and did not find it), and then said: "Well, you understand what infrastructure is needed for this, IT support and legal support."

The hardest thing was with IT. Two data centers in London, a bundle with Russian offices, emergency deployment points, duplication of all nodes and, most importantly, integration software. Plus a lot of automation (for example, not to sign each document with hands and not to receive calls as brokers in the 30s of the last century).

It took 4 years to start.

IT operational risk protection

When you buy new ETFs (shares in stock stocks, here are the details on GT about what it is ) for 50 thousand rubles, somewhere far away in London a special robot buys real live stocks of companies from the fund index of this ETF. An index is an instruction, whose shares and in what proportions you can buy. For example, if we are talking about an ETF in a western company like Google, Apple, MS and further down the list, then this fund cannot be taken and purchased shares of Gazprom.

When you buy an ETF on the secondary market (on the exchange), you simply get ownership of these shares. One person handed them over to another, and the intervention of a robot from America (redeeming a share in the fund) is not required.

We are the first ETF provider in Russia. Our work is similar to the work of a sysadmin: we make sure that there are no problems in the process of buying and selling, but in no way interfere with the work of the foundation.

In order to make it clear how this works, first I’ll tell you about what we did to get going, and then about the process of buying a single ETF paper.

Start

It was impossible to just take and buy an ETF in Russia. Even if in America, Great Britain or Germany there was a fund that sold them, you had to work through a foreign broker. Before us.

The first task is for ETFs to be admitted to trading on the Moscow Stock Exchange. That is, they entered the list of securities sold there to a wide range of entities. Our supporting Federal Law “On the Securities Market” dated 04.22.1996 No. 39- allowed this in 2009, as I wrote above. Thanks to the new feature.

Further: a foreign security (ETF stock) must have an international identification number (ISIN) and a financial instrument classification number (CFI), which determines the type of security in accordance with Russian legislation. More information about ISIN / CFI should be published on the website of the National Settlement Depository (National Settlement Depository). In fact, all the shares traded in Russia somehow pass through it. He acts as a kind of gateway or drive.

Further: for listing in the Russian Federation (only after this the instrument becomes available to private investors) it is necessary that the instrument has previously been placed on one of the world’s foreign exchanges approved by the FSFM. The security must then be deposited with NSD. More must be met the requirements established by the Federal Financial Markets Service in the Regulations on the organization of trade in the securities market.

This is all from our side - hello to lawyers.

On the part of funds from other countries, the legal procedure itself has been polished and polished, but there are difficulties in IT. From the point of view of data storage and processing, European regulators (in our case, Central Bank of Ireland, ESMA and FCA) impose extremely severe infrastructure requirements in terms of business continuity, both at the level of the fund manager and the administrator and custodian. In particular, the requirements of the regulator provide for the duplication of all important infrastructure elements: office, data center, channels, trading platform, and so on. Despite the low cost of the error due to the long-term investment orientation of the instrument (the shares are traded at T + 2, that is, within two days - this is not about milliseconds of the exchange market), nothing should fall. Failure of any infrastructure node at any point is allowed - and the system must continue to work. KamAZ drove into the office - they turned around in another, reserve one. Refused the data center - turned around in another, backup. Road workers cut the provider cable from the office - there is a second one along a different route, and so on.

Data centers in the end required not two, but five: two "combat" in London and three recovery sites. One emergency data center in Brighton (50 kilometers from London), the second in Belham (the southern suburb of London, actually a part of the city), the third in Nydigata (25 kilometers south of London). Naturally, in the data center is optics different routes. The offices also had two Internet lines and additional telephone copper. Our main office is located in London, duplicate - in the suburbs. All our platforms work on data center servers and can easily migrate to emergency points without losing transactions (I remind you that it’s relatively simple for hours, not milliseconds, and the data centers we have are within synchronous replication - the speed of light is not introduces delays that require asynchronous replication to approximately 50–60 kilometers of the difference between points).

Accordingly, all platforms can also be accessed remotely and run remotely from laptops. This applies in particular to tools for subscription and redemption applications.

Plus, due to the fact that backoffice is built on platforms with its own data stores, information loss will not occur even in the case of simultaneous destruction of our two data centers and loss of information on local servers.

Plus, our system is designed in such a way that our provider of IT solutions and the Internet for individual workstations (Options-IT), approved by the British financial regulator (the processes fully comply with the requirements, the provider specializes in servicing financial companies) has the necessary infrastructure for setting up trading platforms and systems remotely - in other words, in the case of an unlikely situation of complete infrastructure and the need to re-configure the system, Options will be able to do its work in 24/7 mode.

Similarly, the rest of the infrastructure.

So far (knock-knock) all this is not useful.

The professional participants of the securities market in the UK, Ireland and in general in the EC regulator make much more stringent requirements in terms of the continuity of processes, which allows to completely avoid the manifestation of technical problems (even the 9/11 events did not have a significant impact on the work of financial companies whose offices were located in twin towers - continuity problems affected only those companies where most of the staff physically died).

All companies like us work on the constantly updated Business Continuity Plan (BCP): at least once a year, provided that there are no significant changes within the year.

Protection against operational risks and human factors

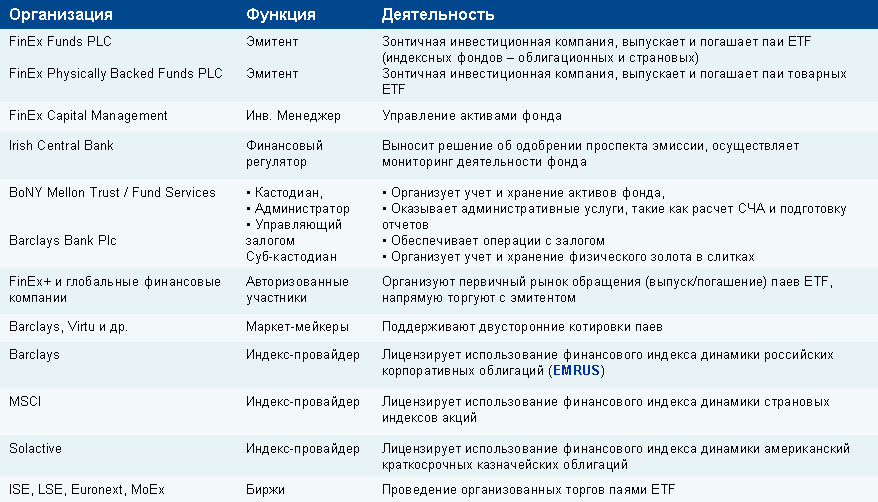

See, here is a list of companies that are involved if you click on the confirmation of an ETF purchase in the web interface or any Russian brokerage program:

- Your application does NOT actually mean for the provider a request to purchase shares in the fund. Buying ETF shares through a broker in the secondary market, you work with the seller, who previously purchased these securities. If you have invested 50 thousand rubles, in fact you cannot buy anything intelligible on them on the big market. However, you buy a share in the fund, that is, your amount is evenly distributed among index companies. A rough analogy: it is like the consumption of the computing power of a cluster, but instead of a cluster it is a depository with shares.

- If we are talking about the primary market, that is, about subscribing to new shares directly in the fund, then only authorized participants (authorized participants) can do this. Their activity is somewhat similar to the actions of vendors - they act as intermediaries between the fund and end users. To subscribe, as a rule, it is possible only in large volumes (for example, $ 2 million).

- The application flies to Ireland, where the Central Bank of Ireland is located, which monitors the activities of the fund. On the way, you will find an authorization procedure and several security checks. The final step - the bank says: "I see money, you can buy." The delivery of securities takes place on the principle of DVP - delivery against payment, this protects the client to the maximum.

- The amount of funds sent to the fund should be invested exclusively in the index - money should not go to anything other than buying shares from the list of companies of the ETF fund.

- Applications are clustered within a few hours and sent to the processing for the purchase of shares.

- The verification company (custodian) of the BoNY Mellon Trust from the United States checks that no one has ever made a mistake. It simply does not allow shares to be credited to the fund if their name or weight does not correspond to the index. In case of any error, the transaction simply cannot be carried out at the pre-control stage, and the fund - a warning. Or a strict warning (plus the BoNY Mellon Trust is obliged to “tap out” to the regulator).

- Through Euroclear (a simplified, interstate system of circulation of shares, checking all participants and the legality of the transaction) instructions are issued on the purchase of shares. In parallel, all this is checked by Computershare (the registrar of the fund, roughly speaking, is a certification center in IT concepts).

- Each of the independent parties gives its "OK", and the transaction is executed.

- Assets (stocks) come to the US custodian, ETFs are issued from there, which then are sent via Euroclear to the Russian depository.

As you can see, it is quite difficult, but it eliminates errors. I repeat: the practice for many years worked in the United States and the European Union. It is this automation and simplicity (well, compared to other tools) that makes ETFs so desirable for investors. If in a nutshell - the income is higher than on a bank deposit, but there are no problems with operational risks. The only significant risk is the market risk, if suddenly the sector of the economy where you have invested goes down.

Key infrastructure elements

With the launch of this whole business in Russia, we needed several more IT solutions.

Our first partner, Charles River Solutions, organizes a trading platform (trading), a frontend and a midland. This is a common platform for many countries, but in our case it is adapted specifically for the needs of FinEx. On the same platform, for a couple of years after us, VTB Capital partially deployed its infrastructure. The general meaning of this system is more automation of trading, less human participation. A basic algorithm has been established whereby the client on the buyer's side communicates with a broker (for example, Morgan Stanley) and makes a purchase or sale through them, in order to minimize losses. The platform is “heavy” and therefore not cheap. Only a few ETF providers around the world use CRS because of the high cost of modifying files (plus just the difficulty of moving to the platform). Due to the fact that we are relatively young in the FinEx ETF, it was possible to immediately do “as it should.” Investments in IT in the financial sector are paying off more than anywhere else.

Most often, the platform is used by managers and banks that do not have the task to complete transactions simultaneously with all assets included in the index portfolio. In our case, the manager is obliged to make transactions simultaneously with 500 or more assets, and we have spent quite a lot of time and effort to adapt the platform for these purposes in order to properly collect requests into packages and not work with individual transactions.

Plus, each of the funds operates with assets in different markets, where excellent methods of accounting, delivery and settlement of transactions with assets are adopted. Accordingly, the launch of each fund required improvements related to the accounting and servicing of asset transfers. Perhaps you know the task of organizing an information link between departments - here is about the same thing, only all the parties were interested in cooperation, so it happened in just 2 years.

Together with Charles River, a special automatic ETF Expand module was developed, which allows automatic processing of information from the administrator (BNY Mellon) regarding the structure of the subscription basket and creating trade orders, sending them to execution and checking the correctness of execution. An extremely important block, since it allows you to avoid mistakes when buying / selling securities when subscribing / redeeming ETF shares and, as a result, significantly reduce risks. Here the human factor is excluded.

The second important element of the infrastructure is our own risk management platform, already developed by us (more precisely, by a group of our developers and a London-based outsourcing company). MDX Technology was also involved in the work. As a result, the platform allows us to adequately take into account the risks associated with trading in derivatives that we use in funds with a ruble hedge (in particular, we are the only ETF provider issuing funds with hedging foreign currency assets against the ruble). As a result, Russian investors who want to invest in Eurobonds and US Treasury bonds have the opportunity to do this without the risk of a change in the exchange rate of the ruble plus an increased ruble yield. Simply put, if the ruble suddenly jumps down, your assets will go up, but you will pay a huge income tax. Moreover, the assets themselves were dug in their positions. The use of protection against ruble fluctuations and a number of other features make it possible to avoid such situations.

Total

We were able to collect and raise the entire infrastructure of the ETF provider. We achieved listing of a really interesting tool (ETF) on the Moscow Stock Exchange. We built the integration in the automatic mode throughout the buying process (it’s just space after “voice trading”).

Now you can simply call your broker or enter any application that allows you to buy shares on the Moscow Exchange - and purchase an ETF. A very big road was needed for this to work. Naturally, the big banks are trying to repeat our path now, but they will not work out quickly - you need to have very extensive experience of interaction in international markets, hacker lawyers and, most importantly, experience of fast, error-free integration by means of their IT teams.

You can read about ETF in practice and how this tool works (and what you can count on by buying it for 50,000, for example) here on Giktaimes .

Source: https://habr.com/ru/post/271449/

All Articles