What is useful you can extract from the report on the clouds in Russia

The article will be useful to developers of cloud applications, as it contains not only bare numbers on the volumes and growth rates of individual market segments. In the Odin SMB Cloud Insights report, we asked small and medium-sized businesses (main cloud consumers) how developers can improve cloud services so that SMBs are more willing to buy them. Details of the research - under the cut.

The article will be useful to developers of cloud applications, as it contains not only bare numbers on the volumes and growth rates of individual market segments. In the Odin SMB Cloud Insights report, we asked small and medium-sized businesses (main cloud consumers) how developers can improve cloud services so that SMBs are more willing to buy them. Details of the research - under the cut.Spoiler: IaaS is in the lead, SaaS is catching up, communications are growing wildly, the web is saturated.

Briefly about the overall achievement of the market - we nevertheless waited for the very explosive growth that experts predicted 3-4 years ago, and which we have not seen since. But finally, over the past two years, the aggregate market volume has increased by more than 4 times in ruble terms and reached 88 billion rubles (or $ 1.6 billion) by now. Our market has moved into the category of services stabilizing with a share of penetration of 40-75%. This, in general, closes the answer to the question of whether the business in Russia is ready to use the clouds - not only ready, but already and quite buying.

The second important question is how far companies have ceased to fear storing data in the clouds. We noted that the heat is reduced. Only 3 years ago, the answer “we are afraid” was given by 60% of respondents (and this, by the way, was the highest figure in the world!). Today, only 42% of companies respond this way, while the share of other reasons is growing: for example, many already say that they don’t go to the clouds simply because they need to somehow use the servers they have already purchased, or that cloud services are expensive.

')

And now - some interesting results on the types of cloud services: there are exactly four of them, as in the previous study.

IaaS (infrastructure as a service)

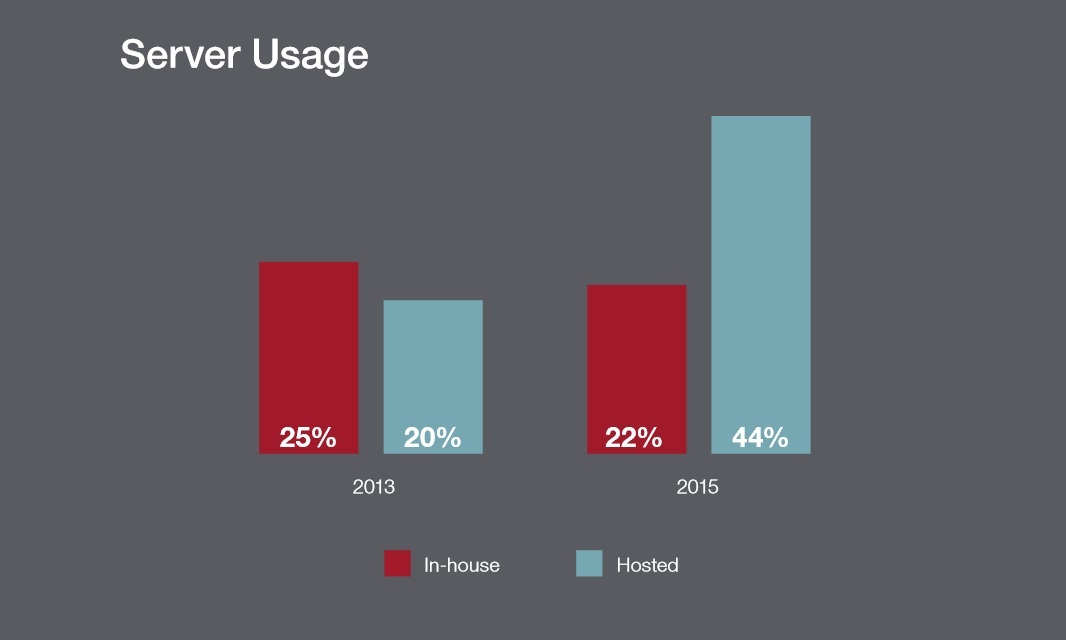

These services are still in the first place, the growth in this segment was twice as high as previously made forecasts. The share of using “personal” servers of companies is steadily decreasing, for example, in 2013, only 15% of Russian SMBs used server hosting. To date, the share of virtual hosting has more than doubled.

- The reasons why SMB companies refrain from acquiring IaaS services in Russia: 42% are worried about data security, 27% are dissatisfied with the high cost of services, 24% are forced to use already purchased equipment (or recall other technical obstacles).

- For hosting providers, it will be important to understand the reasons for choosing an IaaS service provider: 38% - at cost, 25% - ease of working with the service, 20% - security, 11% - already bought from him, 10% - as quickly as possible to conclude or expand a contract.

- 61% of SMBs are ready to pay 1000 rubles a month for higher availability of services. 52% will pay the same amount for unlimited storage.

- The most popular services that buy in addition to the main IaaS-services (as they decrease): backup (yes, do not be surprised and do not say - who needs it. As you see, it is necessary!), Control control panel, security, LAMP development platform. By 2018, backup and security services will have the largest sales growth (54%).

- Where are they looking for IaaS services for purchase: 68% are online, 21% are recommended by experts, 17% are learned from business news, 12% are discussed with local VARs (resellers), 11% are learned from their current service provider . At the same time, 41% of companies combine several methods at once.

- Where to buy: web hosts in the first place, VAR in the second, telecommunications companies in the third, telecommunications infrastructure access companies in the fourth place, and very few in retail computer stores.

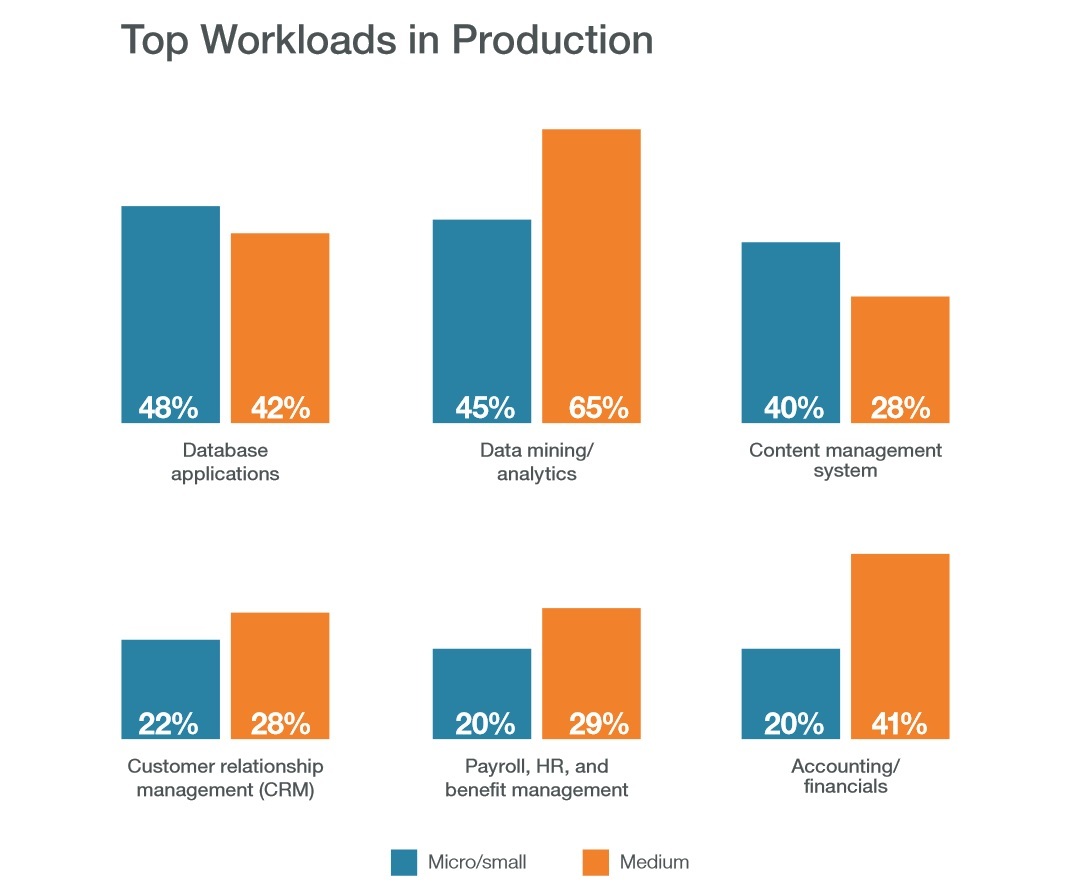

- What type of data is usually downloaded to the clouds (in descending order): databases, analytical data, content management systems, CRM, payment systems and HR systems, accounting and finance.

- 76% of small and medium businesses are satisfied with their current IaaS service provider. But they believe that it would be possible to improve the work in the following areas: productivity (speed, availability) - 43%, support - 16%, security breaches (15%), ease of use (12%), self-service capability (12%) .

- What companies do if they are not very satisfied with IaaS services: 48% change a vendor or buy additional services from it so that it is just a little easier, 34% are looking for alternative options, 16% are buying their own servers.

By 2018, these services will remain in first place in the total volume of cloud services, and the IaaS market will grow at an average annual growth rate of 20% due to new SMBs without servers that immediately connect cloud services and SMBs with servers to companies that will move to the clouds.

Cloud business applications (SaaS services)

Sure second place, despite the fact that in the past, our study, we predicted this segment first. However, the cloud business application market has grown more than 3 times over the past two years.

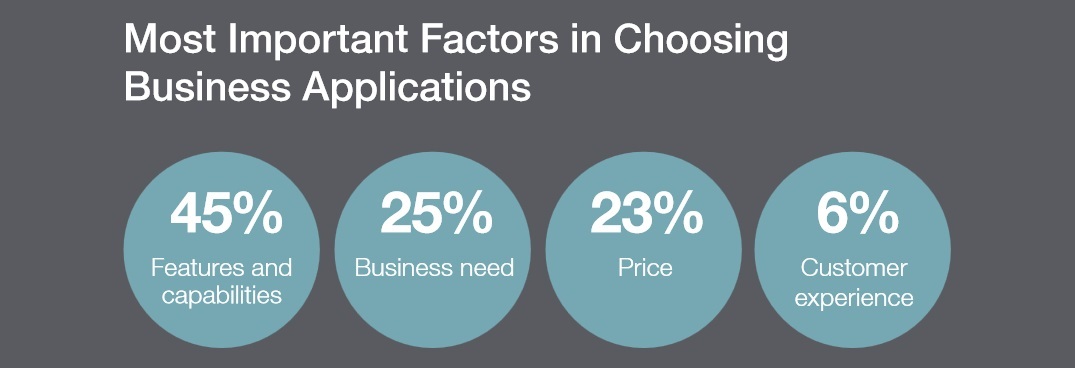

- IMPORTANT: Unlike all other types of cloud services, the cost of an application for SMB companies is a much less important factor in choosing than its capabilities. This suggests that developers need to increase functionality, and not reduce prices. In addition to having the necessary functions (45%), the choice of the application is most influenced by its compliance with business needs (25%), price (23%), and user experience (6%).

- Only 14% of companies buy the application immediately, without using its trial period, to be completely understandable, especially when it comes to complex corporate SaaS services. At the same time, 78% of applications are not purchased in the service package, but separately. This suggests that having a trial period is more important than providing bundled business applications. In order for such packages to sell well, they must have price transparency and the most popular services.

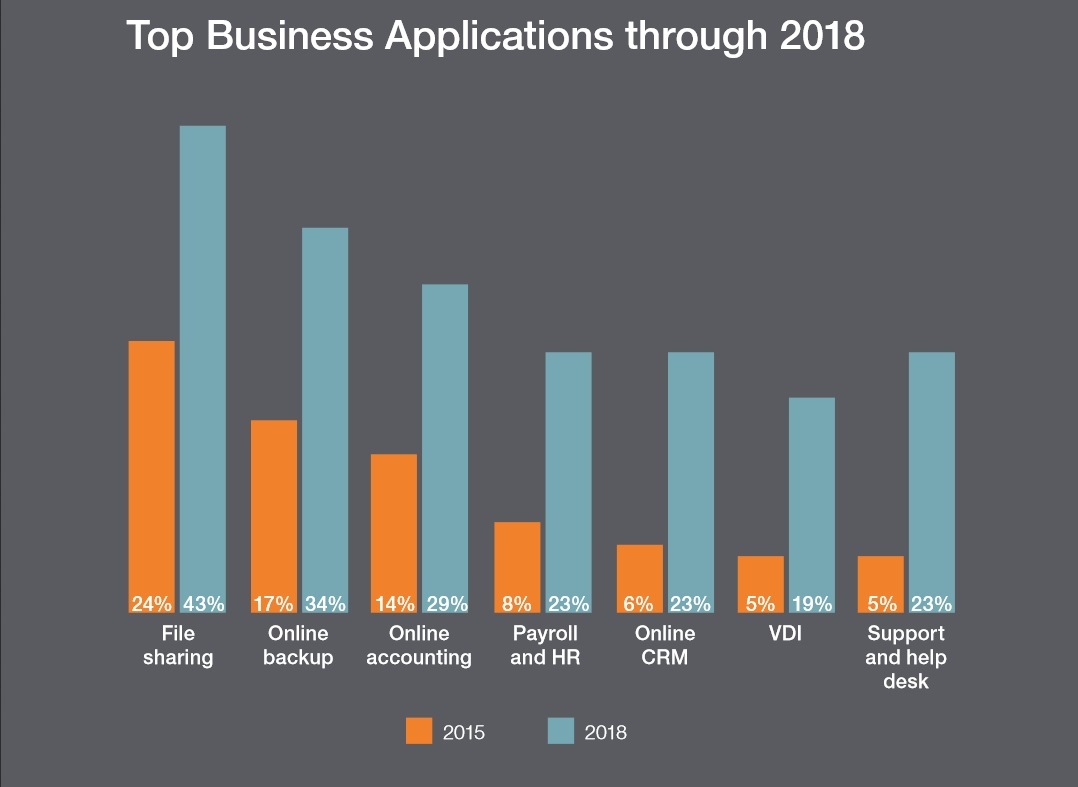

- The most popular applications (as they decrease): cloud storage and file sharing, backup, online accounting, payment systems and HR, CRM, VDI, technical support systems and HelpDesk. But what rating do we predict by 2018:

- How users find apps to purchase (as they descend): online, from industry news, from someone else's recommendation, on local IT resources, and from their current service provider.

SaaS is still one of the most promising categories of cloud services, and this market will have the fastest average annual growth rate of 26%, which will allow it to catch up with IaaS in monetary terms in 3 years. At the same time, the current leaders of the ranking, such as file storage and file sharing systems and online backup systems, will remain the best-selling services of all these 3 years.

Communication and collaboration solutions

This segment has grown almost 19 times. Here we have included such services as e-mail hosting, virtual PBX and other services for the organization of joint communications. The main thing to be taken care of by the service provider is security, as well as to teach the market the possibilities of voice services in the cloud.

Mail services:

- In this sector, like in no other, there are a lot of free alternatives - mail services, instant messaging systems and so on. What companies then explain the transition to paid solutions? 43% are concerned about security issues, 21% consider the cost acceptable, 21% want their mail to look professional and have their own domain name.

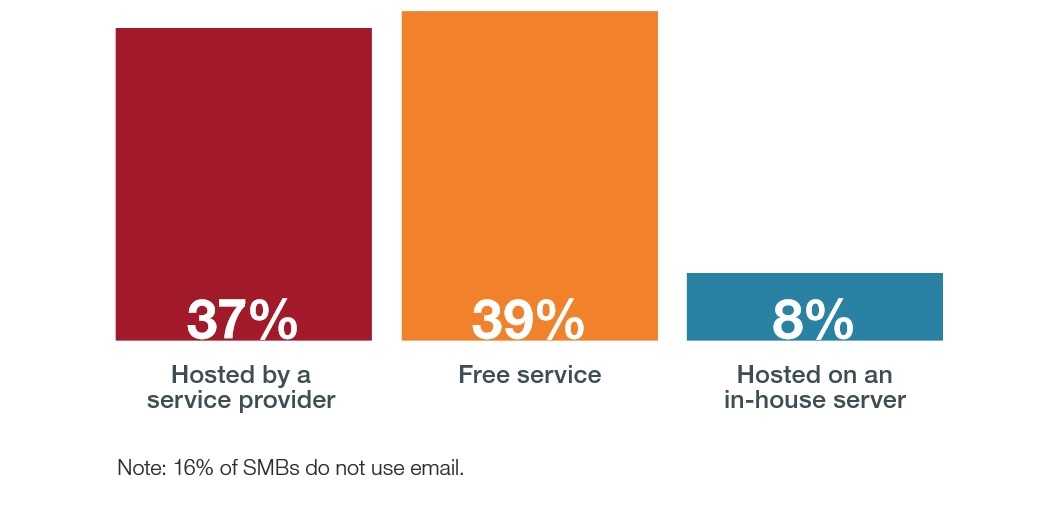

- Only 39% of respondents use the services of free mail services, 37% - the services of service providers, 8% - keep their mail server. The figure does not seem too significant until you remember that two years ago only 4% of companies in Russia had paid mail services.

- Only 49% of small and medium businesses are satisfied with their postal service provider. Why "only"? The fact is that all other services are more than 70% of respondents express satisfaction with their quality. This is what users call as areas requiring improvement: productivity (speed, availability) - 55%, ease of use (23%), professional technical support - 15%, safety - 7%.

- If the company is strongly dissatisfied with the quality of paid services, then this is how it comes: 59% buy additional services from a vendor or change it, 30% look for alternative options, 6% buy their own servers, 5% stop using mail at all (!) .

- The key mailing functions customers need are security, archiving, and calendar sharing.

Voice Services:

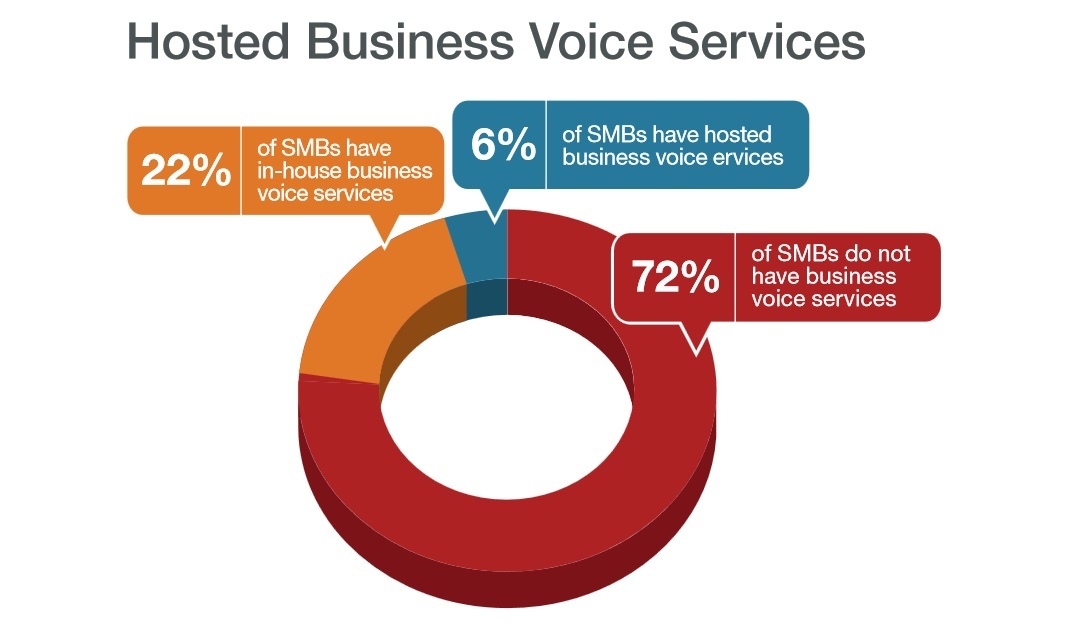

- 72% of SMBs in Russia do not use any cloud-based voice services, 22% use their PBXs, and only 6% buy such services in the cloud (2 years ago there were 3% of such users). The main barriers to the purchase of such services are, first of all, the cost (39%) and the lack of information about the possibilities of services of this kind (32%), and only then - technical limitations (24%) and concerns about data security (17%).

- The main functions necessary for business: integration with employees' mobile devices, instant messaging systems, the ability to transmit voice over Wi-Fi and access to a single number.

- Why buy such services: 30% is an acceptable price, 25% a business has grown very quickly, 20% are significant changes in a business.

- 71% of small and medium-sized businesses are satisfied with their cloud voice service provider, and among the main areas of improvement are performance (speed, availability) and the level of technical support work.

- How SMBs solve these problems: 49% buy additional services from a vendor or change it, 39% search for alternative options, 8% stop using virtual PBX systems altogether, 4% buy their own servers for this.

- The most popular additional applications in this sector are instant messaging (growth 38%, growth forecast to 2018 - 58%), web conferences (growth 9%, growth forecast - 26%), mobile device management (growth 3%, growth forecast - 22%).

The leaders among the services will remain instant communication tools such as Skype, in addition, the number of companies using virtual PBXs will grow, mainly (69%) at the expense of those who migrate to the clouds from internal servers, as well as through new market participants.

Web presence and web applications

This market has grown more than 2.5 times: in Russia now more than one million SMBs have their own website (82% of medium-sized companies, 73% of small businesses and 47% of micro-companies). Two years ago, only 54% of companies had their sites. Only 12% of today's sites are maintained on the internal servers of firms, and 19% of them plan to move to the clouds in the next three years. All other firms use the services of hosting companies, that is, more than 70% of all SMBs, which can not but rejoice.

- Key factors in choosing a web host: cost of services (69%), professional technical support and usability (37%), the ability to quickly scale resources (23%), security (19%), existing relationships (18%), brand value ( 7%).

- From whom they buy: web-hosters (more than 70%), telecommunication companies, VAR and cloud providers (their share is extremely small). 85% of services in this sector are bought online.

- A very interesting figure: the design of 67% of websites was created by the designer in the company, and 24% of them with the help of website designers.

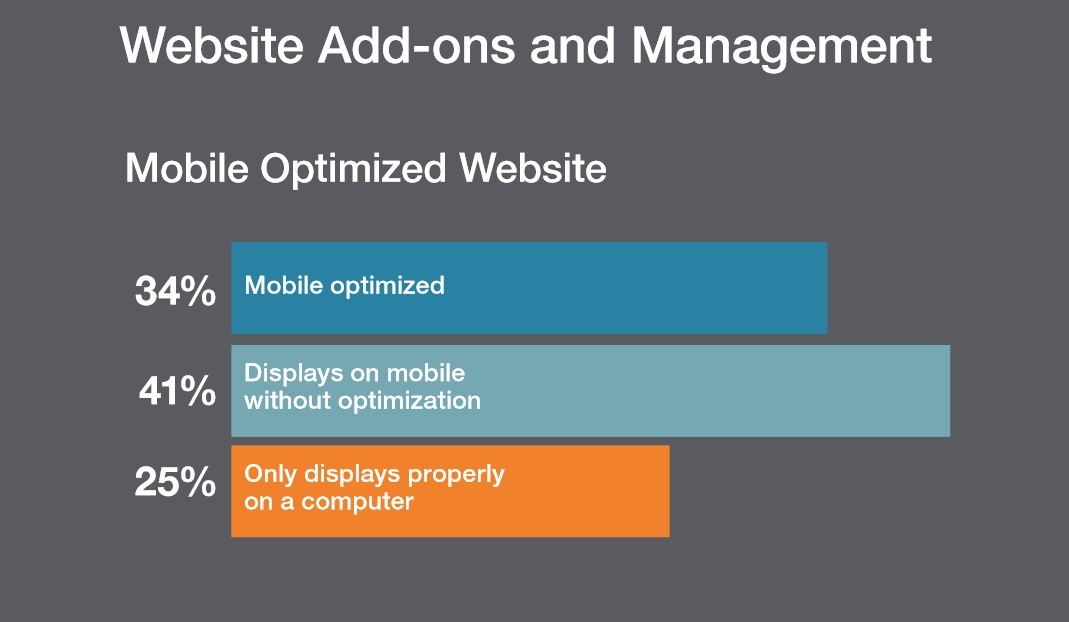

- The depressing figure: at a time when everyone is screaming about mobilization, only 34% of websites are optimized for viewing from mobile devices, which indicates a big foundation for the growth of this segment. 41% can be seen on the screen of a mobile device without optimization, and 25% of sites can only be viewed on a computer.

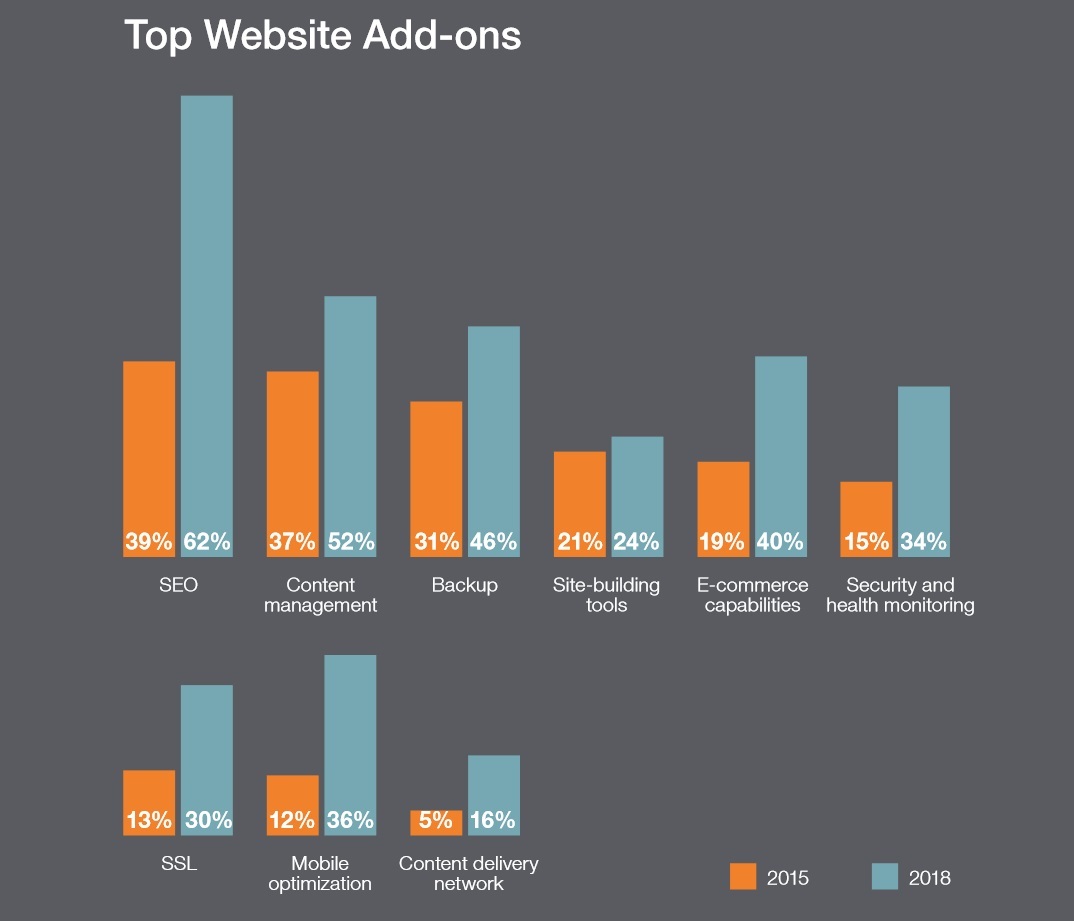

- The most popular additional services (as they decrease): SEO optimization (forecast for 2018 - an increase of 62%), content management systems (growth - 52%), backup (growth - 46%), site building tools, options for electronic commerce, monitoring and security, SSL, mobile optimization, content generation systems.

- From whom they buy additional services: 66% - from the web host (48% immediately in the package of services, 18% - after the initial purchase of the hosting), 28% - directly from the developer of the corresponding application, from another provider - 6%.

- 76% of small and medium businesses are satisfied with their current hoster. But they also mention the following areas of improvement: productivity (speed, availability) - 49%, support - 27%, ease of use (27%), security breaches (17%), self-service capability (17%).

By 2018, the double growth of the market is expected, while the most attractive niche for hosters will be mobile site optimization services. But service providers will have to take into account the main question - the question of the cost of such services.

General conclusions:

The Russian market today shows one of the highest growth rates in the global market, despite the fact that we were in a rather unstable economic situation. On the other hand, a number of stimulating laws, the transition of both global players and entire sectors of the local software market to the clouds, as well as the activation of small and medium-sized businesses resulted in a very positive result. Our general forecast: the market will continue to grow at the expense of small and medium-sized businesses that intend to migrate to the clouds in the next 3 years, as well as through the further development of small and medium business in Russia.

The main thing that we expect from the next two years is the growth and complexity of the functionality of cloud services and the reduction in their cost. From the developers of services, the market is also waiting for enhanced data security and qualified technical support for users, and from service providers - more transparent pricing in service packages.

Briefly about the study:

The Odin SMB Cloud Insight study has been conducted for the fifth year. In 2015, 400 Russian companies were surveyed to find out how their IT needs have changed over the past two years and how they use cloud services now. The companies surveyed were divided into three groups: micro companies (from 1 to 9 employees), small (10-49) and medium (50-250). The full version of the study can be downloaded here .

All questions you can ask in the comments.

Source: https://habr.com/ru/post/270557/

All Articles