Manipulating stock prices with the help of fake news: How not to fall for it

Earlier in our blog we wrote about the impact that various news can have on the stock market and the price of shares. Sometimes attackers use this and for the purpose of making money they publish fake news that affects the price of shares.

Last week another such case came to the attention of the media and the public - the Scottish trader was charged that he had, for his own benefit, caused fluctuations in the shares of companies using fake messages on Twitter.

')

Today we will understand how such frauds work, and how market participants can distinguish fake news from real ones.

How fake news destroys stock prices

According to the indictment of the US Securities Commission (SEC), 62-year-old Scotsman Alan Craig (Alan Creig) created two fake Twitter accounts that were “disguised” under the real accounts of research and analytical companies Muddy Waters Research and Citron Research.

Then he began to place in the accounts of "research companies" information on the state of affairs of companies whose shares are traded on the stock exchange, which caused fluctuations in the shares of these securities.

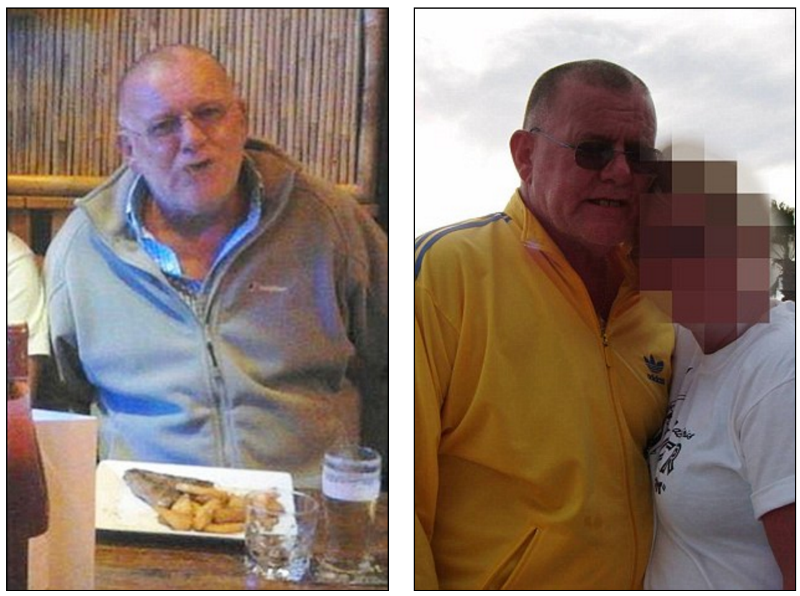

James Craig: photo dailymail.co.uk

For example, in 2013, Craig reported in a fake account that an investigation into fraud was launched against the American manufacturer Audience audio systems. This news led to a 28% drop in the company's shares for a short time, after which trading was suspended. However, by this time Craig had already managed to buy 300 shares of Audience, and after the resumption of trading the next day, he bought another 100.

Later, he used a second Twitter account to post false reports about the start of investigations against the pharmaceutical company Sarepta Therapeutics. The shares of this organization fell by 16%, and Craig bought them using his girlfriend’s brokerage account.

In this case, the manipulation did not lead to a serious trader-manipulator profit - according to the SEC, he was able to earn only $ 100. Craig missed a profitable moment for the sale of shares. Nevertheless, the losses of shareholders of companies turned out to be very significant - according to SEC estimates, they lost up to $ 1.6 million. Now, Craig faces up to 25 years in prison.

Fake messages in social networks is not the only way to misinform participants of exchange trading. So in July 2015, Twitter shares jumped in price due to the message that the microblogging service would be sold for $ 31 billion. The news was posted on a fake website that looked similar to Bloomberg.com.

After the fake news was replicated by some media , Twitter shares jumped 5% in price, and after its denial also fell sharply.

Image: Business Insider

Another way of misinformation was the release of fake press releases. In the spring of 2015, 37-year-old Bulgarian citizen Nedko Nedev distributed a press release on behalf of the non-existent company PTG Capital Partners Limited about its purchase of Avon Products.

After that, Avon's stock price rose by almost 20%, and the attacker earned $ 5,000 from this, but now he has been charged with fraud.

Why fake news affect the market

In the era of Internet development, it is very easy to manipulate public opinion. Such an opinion in a conversation with journalists Business Insider, in particular, expressed the founder of the analytical system to verify the veracity of messages in social media, James Ross.

In order to understand how true the posted information is, you need to analyze several factors. The problem is that the majority of users are not ready to spend their time on such fact-checking. Even worse is the fact that journalists do not always bother themselves with this.

James Craig manipulated stock prices with fake Twitter accounts that used real-world logos from analytic companies to give the impression that they were truly connected to these organizations. The fake website that reported buying Twitter for many billions of dollars was also very similar to the real Bloomberg.com.

Users and even some journalists could not distinguish these fake resources from the real ones and spread the news presented to them.

And then the effect of “snowball” caused by social networks came into force - media readers and subscribers who made repost users also began to share false information, as a result, the total volume of published messages about events that never happened reached enormous proportions.

In turn, traders and trading robots, who use news analysis mechanisms in their algorithms, “bought out” for a duck and began to make transactions — to buy or sell stocks. The volume of trading with specific stocks seriously grew in a short period of time, and other traders could not stand the nerves - no one wants to miss a big price movement. As a result, they also performed operations, which contributed to a further change in the share price.

How to distinguish fake news from this

Interviewed by Business Insider journalists from companies involved in analyzing the veracity of news in social media, suggest that there are several methods for identifying reliable news.

According to James Ross, the algorithms of the HedgeChatter service analyze the number of messages on a particular topic, their tonality (positive or negative), as well as the speed of their appearance.

Another, more complex method, involves comparing news from new and unverified sources with what is published in closed news feeds. Fake news and press releases, as a rule, contain errors and inconsistencies, besides, attackers rarely have time to completely copy the style of the texts and the visual style of the conditional Assosiated Press or Bloomberg, so that after a thoughtful analysis of the texts and the web -pages, you can find differences.

In addition, sometimes automatic analysis tools can take into account other factors, such as the time to create images from the text of the news and upload them to the Internet. If the time of creation of images and the time of their loading does not coincide with the time frame of the events described in the news, this may also indicate deception.

Conclusion

Sometimes even the most advanced reliability analysis algorithms and fact-checking skills cannot guarantee that robots or people will not succumb to provocation from fake news. In 2013, hackers from the Free Syrian Army hacked the real Twitter of Assosiated Press agency and reported explosions at the White House and the injury of President Barack Obama.

This news provoked a short-term panic in the markets, until all participants were denied by the presidential administration and the news agency itself.

One of the trends in the development of the stock market is the use of various self-learning algorithms during the development of trading robots, however, not only owners of automated trading systems, but also traders sitting at the terminal suffer from injecting false information. To reduce the impact of this kind of misinformation and to protect finances in case of failure in the work of exchange systems, market participants implement various risk management systems. Some of them provide their clients with brokerage companies themselves.

A similar mechanism exists in the ITinvest Matrix trading system. It protects clients from the risks arising from failures in the risk management system of the exchange - for example, a sharp increase in the guarantee security of a position that may lead to its premature closure. Also, when trading with similar instruments at various sites, the system analyzes risks and allows using assets acquired in one market as collateral for transactions in another.

That's all for today, thank you for your attention! Do not forget to subscribe to our blogs on Habré and Geektimes .

Source: https://habr.com/ru/post/270487/

All Articles