Russian hackers hacked Dow Jones and seized insider information

According to Bloomberg, a group of hackers (presumably Russian) carried out a successful attack on Dow Jones & Co. servers. As a result, the attackers managed to steal sensitive financial information that may be of interest to the participants of exchange trading, before its publication.

What happened

The investigation of the incident involved the FBI, the Securities Commission and the US Secret Service. As it became known to journalists, investigative actions have been going on for at least a year.

Dow Jones is a publisher of a number of financial media outlets (for example, The Wall Street Journal) and distributes financial information by subscription through its own services, such as Dow Jones Newswires.

')

A little more than a week ago, representatives of Dow Jones announced the discovery of a hacker attack, as a result of which the attackers managed to steal the payment and contact details of approximately 3,500 clients. However, according to Bloomberg, this incident is significantly less serious than the invasion that the US intelligence agencies are investigating.

At the same time, there is no evidence that these two attacks are connected. According to Bloomberg sources, hackers managed to gain access to critical financial information, including articles that have not yet been published. According to people familiar with the investigation, representatives of the special services are actively consulting with financial market participants to understand how hackers can use the stolen information. While there is no data about it. There is also no information about what exactly indicates involvement in the hacking of hackers from Russia.

Dow Jones CEO William Lewis, during an announcement of a more “petty” attack with the theft of customer information, said he considers the incident to be a “wider campaign involving other victim organizations”.

New front of the battle with insider trading

Such a serious approach to investigating the theft of information, which could potentially be used to gain a competitive advantage when trading on the stock exchange, clearly shows that cyber attacks have become an effective tool in the hands of manipulators. Hackers steal sensitive information and sell it to traders.

According to the Dow Jones annual report, one of the company's paid services called Factiva provides business information to more than 1.1 million active users. "Information from more than 4,000 sources gets to Factiva, even before it is published by these sources." Accordingly, gaining access to data that has not yet been published, but will clearly affect the alignment of forces in the market (for example, mergers and acquisitions announcements) is an attractive target for cybercriminals.

The attack on Dow Jones is not the first example of how hackers crack information services to obtain financial data. In August 2015, the US authorities carried out arrests of Russian-speaking hackers who hacked into the PRNewswire, Marketwired and Businesswire news terminal systems in order to obtain insider information for trading on the stock exchange. Allegedly, the criminal group for several years of its existence was able to earn in this way more than $ 100 million dollars.

The arrest of one of the accused Vitaly Korchevsky

In order to successfully counteract insiders and identify dishonest transactions, law enforcement officials have to work hard and come up with original methods of investigation. So one of the largest cases of insider trading was solved by compiling graphs illustrating the relationship of the defendants - we wrote about it here .

How news affects the market

Quite often, political or economic news has a serious impact on stock trading. The clearest example of such a situation is the announcement of the introduction of foreign sanctions against Russia. Then the shares of many Russian companies are seriously cheaper.

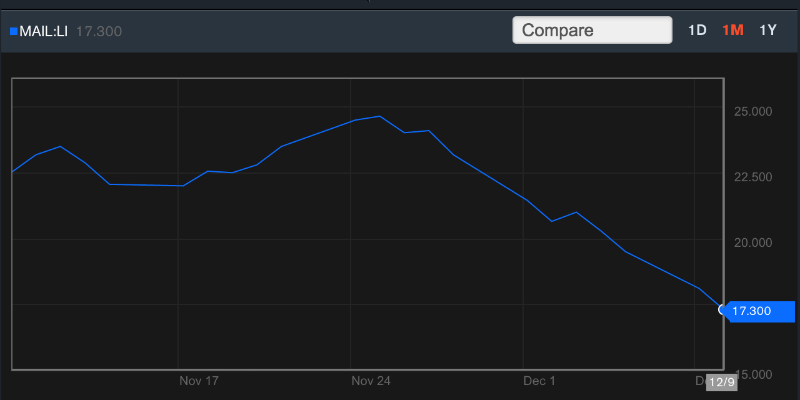

In addition, in the past, shares of Russian technology companies on foreign exchanges became cheaper during the release of news about the possible strengthening of Internet regulation in the country by the state.

At the same time, speculative trading "on the news" is not the easiest thing to do, which is not suitable for inexperienced investors. This fact illustrates the situation with Apple shares, which are far from always seriously increasing or becoming cheaper after the release of new company gadgets. This makes it a risky business to purchase shares of this company with an eye on their mandatory growth or decline after the next presentation.

How to buy shares of technology companies

Previously, it was not so easy to buy shares of technology companies on foreign stock exchanges - Russians needed to open accounts with foreign brokers who were not always eager to work with clients from our country.

At the end of November 2014, the situation improved - the St. Petersburg Stock Exchange launched trading in foreign securities. Now, Russian investors can buy shares in foreign companies that make up the number of the 50 most liquid organizations in the S & P 500 index. Technology companies such as Apple, Yahoo, Cisco Systems, Facebook, Google and Intel are among the pioneers.

You can get access to trading on the St. Petersburg Stock Exchange through ITinvest - for this you need to leave a request on the site . Also, experts of the company help to choose goals for investment.

Posts on the topic:

Source: https://habr.com/ru/post/269099/

All Articles