A bit of history: How stock technologies evolved

For modern exchange platforms, the speed of work is the most important factor in attracting investors. Traders want to buy and sell financial instruments quickly in order to avoid the possibility of price changes during the transaction execution process. It is also important the quality of market data on the basis of which the decision to buy or sell is made, as well as the overall reliability of the infrastructure.

For several hundred years, the exchanges went from publishing prices twice a week on small pieces of paper - as was the case, for example, in London, where brokers gathered at the Jonathan coffee shop, to the present technological big bang in the 80s of the last century.

')

Big bang

In October 1986, the Stock Exchange Automated Quotation (Stock Exchange Automated Quotation) was launched on the London Stock Exchange, which replaced voice trading. Now brokers could buy and sell stocks using computers without having to call up or meet in person.

In an interview with Computer Weekly, Chief Engineer of the London Stock Exchange, Robin Paine, noted that the introduction of the system brought its benefits to both private and institutional investors - the threshold for entering the stock exchange has decreased, it has become easier to trade.

All this led to an increase in trading volumes - if before the introduction of the automated system, the number of transactions on the London stock exchange was about 20,000 per day (approximately £ 700 million), then a few months after implementation, this number increased to 59,000 transactions per day, and the middle of the two thousandth reached 566 thousand a day.

Not so simple

However, the introduction of new technologies was not without difficulties. In 1987, the so-called “Black Monday” occurred - the largest decline in the history of the world stock market. October 19, 1987, the Dow Jones Industrial Average lost 22.6%.

This event also affected financial markets in other countries - by the end of October, the Australian capital market lost more than 40%, Canada - more than 22%, Great Britain - 26%.

TowerGroup analyst Bob McDowal (Bob McDowall) told Computer Weekly that, despite the fact that technology was not the cause of Black Monday, automation helped accelerate the fall in the stock market.

In those days, technologies for analyzing the situation on the market were not so developed and did not process information about factors other than the actual stock price.

The exchanges were forced to develop systems and regulations to suspend trading at times of significant or abnormally rapid price changes for a particular or several stocks.

The year 1987 was marked not only by Black Monday, but also by the first purely technological failures in the stock markets - for example, on December 9, 1987, there was a large-scale failure of the Nasdaq. Then the service of quotations of the National Association of Securities Dealers did not work for 82 minutes, the abnormal situation led to the fact that more than 20 million different stocks stopped participating in the auction.

The reason for the failure was the usual protein, which snuck into the main computer center of the exchange in Trumbull, Connecticut, and gnawed through the wiring. The animal's body was discovered by electricians of the company United Illuminating in the process of restoring power supply.

Data transfer protocols

The conversion of trade into electronic format also required the creation of appropriate data transfer protocols. In 1992, a number of financial organizations initiated the creation of the FIX protocol. Subsequently, FIX became the industry standard used by financial market participants from different countries to connect their products. More about him, we wrote in this material .

In the middle of the two thousandth, it became clear that the current version of the protocol does not cope with the increased amount of financial information generated by stock markets.

When transferring large amounts of data using FIX, there were significant delays in their processing, which caused losses to traders and made it impossible for them to develop existing trading strategies.

The classic message passing format Tag = Value, used in FIX, was too cumbersome to process it quickly. To solve this problem, a new FAST protocol was developed. The pilot project was introduced in 2005.

FAST protocol work scheme

According to the FIX protocol standard, each message has the format Tag = Value SOH, where Tag is the number of the field to be transmitted, Value is its value, and SOH is the delimiter character. An example of writing a message in the Tag = Value syntax:

35=x|268=3 (message header) 279=0|269=2|270=9462.50|271=5|48=800123|22=8 (trade) 279=0|269=0|270=9462.00|27 FIX and FAST are international standards, but besides them, local exchange platforms implement their own “native” protocols.

They are used to obtain the necessary information by both private traders and brokerage companies - such native protocols are more functional than the generally accepted standards (such as the same FIX) that attract brokers. In Russia, an example of such a development can be called the Plaza II protocol, which was created by experts of the RTS exchange. Read more about it here .

New technologies for high-speed trading

The importance of speed has become even more important with the spread of algorithmic trading. There is a huge number of systems and algorithms that use those or other inefficiencies of the stock market.

Such systems make tens and hundreds of thousands of transactions per day - and in order to make money, they need at least a microscopic fraction of a second ahead of their competitors.

Exchange platforms, seeking to attract investors, sought to do everything possible to increase the speed and reduce delays. In particular, the technology of direct access to the exchange was born (our blog contained material about it).

Direct Access (DMA) is a technology of high-speed access to stock exchanges, in which the application is placed in the exchange trading system directly, bypassing the broker trading system. All this allows to significantly reduce the time of delivery of the application to the exchange and receiving information about its status.

Colocation services also began to develop - many exchanges began to offer customers the opportunity to host their servers with trading robots in the same data center, where the core of the exchange trading system is located. Such services are on the Moscow Stock Exchange.

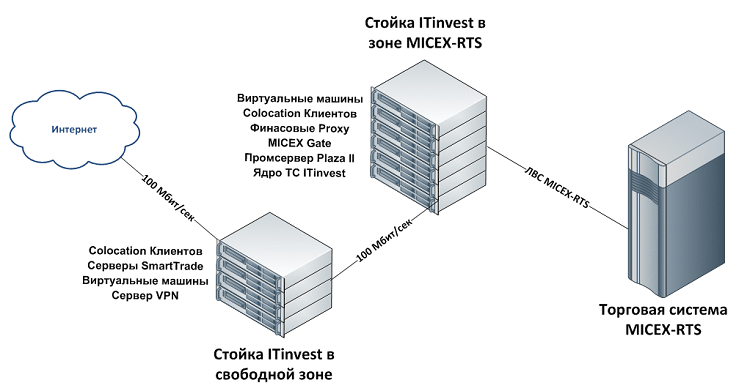

Now, the Moscow Exchange trading servers are located in data center M1. Trading robots connected to exchange servers can be located in two zones - the so-called DMA-free collocation zone and the direct collocation zone of the exchange.

Brokers have also offered to offer their collocation services (for example, ITinvest ). In the case of the Moscow Exchange, they offer the placement of servers and virtual machines in a free colocation zone. In this case, transactions are processed a little slower, but the cost of placing the trading system is reduced.

Infrastructure development

Over the past decades, stock exchanges should have been thinking about increasing reliability. Investors are discouraged by the possibility of failures, which are expressed both in the suspension of trading and in the incorrect display of information - this can lead to financial losses, since the same trading robots can continue to trade at the wrong data at a loss without understanding it.

Therefore, financial organizations worked not only to optimize the software, but also built powerful data centers where servers with the “engines” of exchanges were installed. Here, for example, looks like one of these online trading sites, the Equinix data center:

12-meter ceiling with multiple levels of cable channels

Cooling through an overhead duct system

An uninterruptible power supply (UPS) room, powered by a substation of 26 megavolt-amperes. Power equipment 30 megawatts.

More photos from Equinix data center in our material .

However, ensuring the speed of work has been and remains the main focus. If you examine the statistics of the speed of execution of orders (latency) on various stock exchanges in 2010 and compare with what was a few years later, the difference may seem enormous.

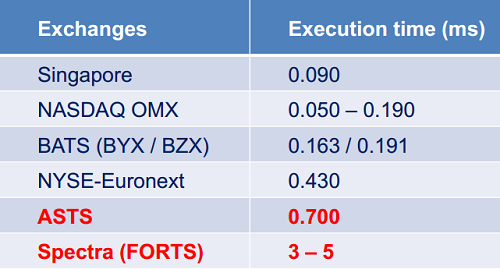

Here are the latency values of the largest stock exchanges in the world (here ASTS is the MICEX stock market, and FORTS is the RTS; later these two sites were merged into the Moscow Exchange):

Already in 2013, the situation changed quite significantly:

Later in 2013, the time for the execution of requests in the ASTS system was increased to 50 microseconds, and in the FORTS (Spectra) system it was 35 microseconds. Currently these numbers are even lower.

What else: safety

The main technological trends of the stock market are still increasing the speed of work and increasing the reliability of systems. In addition, more and more attention exchange platforms are forced to pay protection to their infrastructure from hackers.

Only in the past couple of years, several cases of cyber attacks have been recorded - for example, in 2013, unknown hackers broke into the Nasdaq system, which allowed them to penetrate into it for two years, remaining unnoticed. Already in 2015, suspicions arose that hackers from the group Anonymous or China attacked the New York Stock Exchange.

Source: https://habr.com/ru/post/267603/

All Articles