Recent trends in the world of payments

In this post we have tried to analyze some trends of electronic payments that are happening in the world right now. Fintech is becoming one of the fastest growing industries, the volume of investments in financial and technological projects in 2014 alone amounted to almost $ 7 billion. The giants of the payment market are rapidly increasing the volume and number of transactions made. For example, PayPal for 2014 produced more than 3.5 billion transactions worth about $ 230 billion and increased its user base to 165 million people. But the main trend is payments from mobile devices. Did you know that almost 30% of the world's Internet payments are made from a smartphone or tablet?

Thanks to a report by Adyen, a global payment technology company that recently raised $ 250 million in investment, amazing insights are known:

For those who do not want to lose such a huge segment of customers and want to meet all modern market requirements, we can offer PayMobile solution, it allows you to accept payments through any device that has the ability to enter card data and access the Internet. And for platforms iOS, Android and Windows Phone developed SDK for instant integration.

')

To understand mobile payments in more detail, and also to get acquainted with infographics which illustrates what payment methods prevail in the different countries - I ask under kat.

Share of devices in mobile payments,%

The index shows that smartphones are a strong leader in terms of transaction volume. In the second quarter, their share rose to 64.1% from 61.8% in the first quarter. This happened not only due to iPhones. Android smartphones continue to increase their share in mobile transactions, which rose to 28.3%. The use of tablets, in contrast, decreased from 38.2% in the first quarter of 2015 to 35.9% in June.

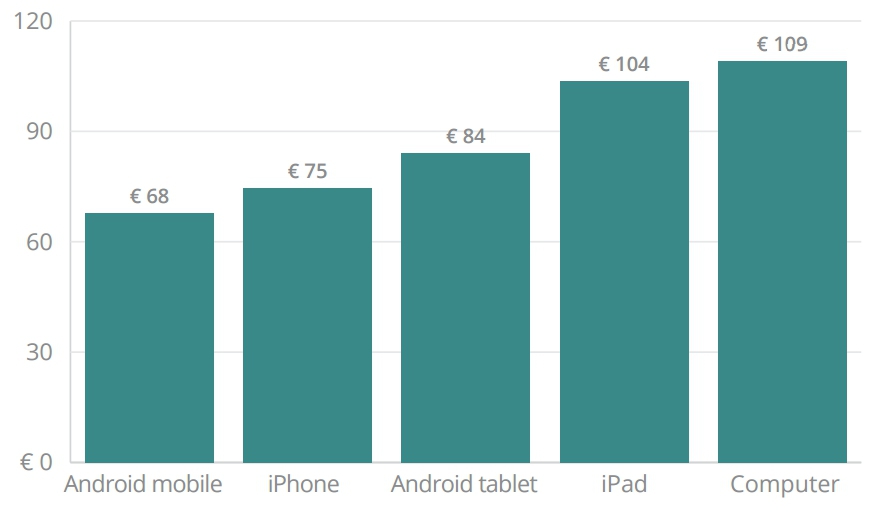

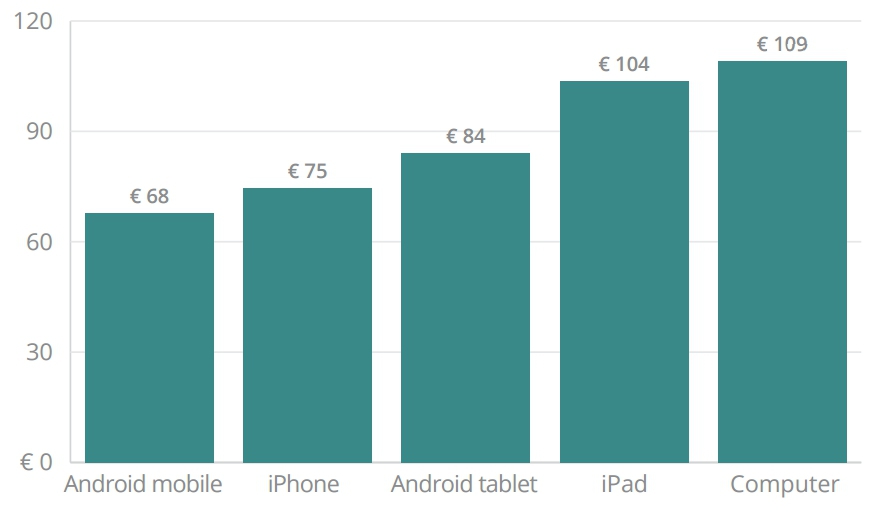

This study is the first one we met that shows the average transaction value (average transaction value, ATV) by device type. Buyers with ipads spend an average of 104 € per transaction, which is significantly more than the average transaction for users on Android tablets - 84 €. Average transactions on smartphones repeat this trend: iPhones - 75 €, Android - 68 €.

This indicates that a business that considers itself a premium brand should focus more on the iOS audience, since she is more valuable.

The average value of the transaction by type of device, April — June 2015

19% of online payments for physical goods are made from tablets and only 12% from smartphones. For digital goods (games, services, bookings and tickets) the opposite is true: 26% of online payments are made from smartphones, and only 8% from tablets.

Share of mobile payments by type of goods,%, April — June 2015

If we talk about the regions, in the second quarter Europe leads (30.4%), followed by North America (26.7%) and Asia (21.4%). In all these regions, the share of mobile payments increased by about a percentage compared to the previous quarter.

If we talk about individual countries, the UK gives a light to the whole world. In the second quarter of 2015, 44.8% of online payments in the UK were made from mobile devices, which is almost 2% higher than at the beginning of the year. If this trend continues, the UK will move over 50% of mobile transactions by mid-2016. One of the main drivers of growth is the launch of Apple Pay in the United Kingdom market last quarter.

Note: The study is based on data from global mobile online payments and does not contain information about mobile payments within applications.

In addition to the device from which the payment is made, the way money is transferred from the client’s pocket to your pocket is also important. The popularity of the payment method in the country depends on the preferences of users and the payment infrastructure. If you want to successfully trade on the Internet in different countries, it is beneficial to support as many local payment methods as possible. Site Expert Market has created a card payment methods in different countries. Here is the map of Europe:

It is noteworthy that in Germany the most popular method of online payments is ELV (shortened from Elektronisches Lastschriftverfahren) - the method of electronic direct debiting , which is supported by German banks. In the Netherlands, the local payment method iDeal is also the most popular, it is supported by almost all state banks of the country.

In the US, everything is predictable:

If you need to organize the reception of payments on the site, feel free to contact . Email us for any questions and subscribe to our corporate blog , there are still many interesting posts about payments and technologies.

Thanks to a report by Adyen, a global payment technology company that recently raised $ 250 million in investment, amazing insights are known:

- The share of online payments from mobile devices rose from 27.2% in the first quarter to 28.7% in the second. As many as 35.6% of all payments via mobile browsers are done from iPhones. This is 10.2% of all online payments in the world. At the beginning of the year, this value was at the level of 8.6%.

- IOS users spend on average per transaction more than Android users.

For those who do not want to lose such a huge segment of customers and want to meet all modern market requirements, we can offer PayMobile solution, it allows you to accept payments through any device that has the ability to enter card data and access the Internet. And for platforms iOS, Android and Windows Phone developed SDK for instant integration.

')

To understand mobile payments in more detail, and also to get acquainted with infographics which illustrates what payment methods prevail in the different countries - I ask under kat.

Share of devices in mobile payments,%

The index shows that smartphones are a strong leader in terms of transaction volume. In the second quarter, their share rose to 64.1% from 61.8% in the first quarter. This happened not only due to iPhones. Android smartphones continue to increase their share in mobile transactions, which rose to 28.3%. The use of tablets, in contrast, decreased from 38.2% in the first quarter of 2015 to 35.9% in June.

IOS users spend on average per transaction more than Android users

This study is the first one we met that shows the average transaction value (average transaction value, ATV) by device type. Buyers with ipads spend an average of 104 € per transaction, which is significantly more than the average transaction for users on Android tablets - 84 €. Average transactions on smartphones repeat this trend: iPhones - 75 €, Android - 68 €.

This indicates that a business that considers itself a premium brand should focus more on the iOS audience, since she is more valuable.

The average value of the transaction by type of device, April — June 2015

Tablets dominate physical goods, smartphones dominate digital

19% of online payments for physical goods are made from tablets and only 12% from smartphones. For digital goods (games, services, bookings and tickets) the opposite is true: 26% of online payments are made from smartphones, and only 8% from tablets.

Share of mobile payments by type of goods,%, April — June 2015

Faster than anywhere else, mobile payments are growing in Europe

If we talk about the regions, in the second quarter Europe leads (30.4%), followed by North America (26.7%) and Asia (21.4%). In all these regions, the share of mobile payments increased by about a percentage compared to the previous quarter.

If we talk about individual countries, the UK gives a light to the whole world. In the second quarter of 2015, 44.8% of online payments in the UK were made from mobile devices, which is almost 2% higher than at the beginning of the year. If this trend continues, the UK will move over 50% of mobile transactions by mid-2016. One of the main drivers of growth is the launch of Apple Pay in the United Kingdom market last quarter.

Note: The study is based on data from global mobile online payments and does not contain information about mobile payments within applications.

How to pay for online purchases in different countries

In addition to the device from which the payment is made, the way money is transferred from the client’s pocket to your pocket is also important. The popularity of the payment method in the country depends on the preferences of users and the payment infrastructure. If you want to successfully trade on the Internet in different countries, it is beneficial to support as many local payment methods as possible. Site Expert Market has created a card payment methods in different countries. Here is the map of Europe:

It is noteworthy that in Germany the most popular method of online payments is ELV (shortened from Elektronisches Lastschriftverfahren) - the method of electronic direct debiting , which is supported by German banks. In the Netherlands, the local payment method iDeal is also the most popular, it is supported by almost all state banks of the country.

In the US, everything is predictable:

If you need to organize the reception of payments on the site, feel free to contact . Email us for any questions and subscribe to our corporate blog , there are still many interesting posts about payments and technologies.

Source: https://habr.com/ru/post/266797/

All Articles